A special accounting treatment for special industries.

advertisement

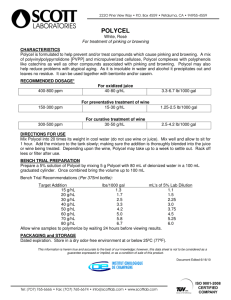

"A special accounting treatment for special industries. Evidence from Port Wine Industry accounting practices." Rui Couto Viana University of Porto Faculty of Economics Lúcia Lima Rodrigues University of Minho School of Management and Economics February 2004 Second draft – please do not quote without the authors’ permission Contact Author Rui Couto Viana University of Porto Faculty of Economics Rua Dr. Roberto Frias 4200-264 Porto Portugal Telef.: 351 22 5571100; Fax: 351 22 5505050; e-mail: coutoviana@fep.up.pt Acknowledges: The authors would like to express acknowledge to Professor Stefano Zambon for his helpful comments on an early version of this paper as a discussant in a Doctoral Colloquium of the IPA Conference 2003. It also acknowledged the comments of António Filipe from Symington Family Port Wine Companies. It is also gratefully acknowledged the financial support from Faculdade de Economia do Porto (Portugal) and PRODEP. Abstract Some industries face difficulties to fit in with the traditional accounting framework. This is the case of the Port Wine industry that is characterized for its high quality product and long-lived inventories. Accounting in the wine industry developed greatly in recent years. The premium wine was the starting point for that development. We began by analyzing the accounting standards of Spain and Australia and found that there are several accounting ways of dealing with wine accounting problems that do not fit the traditional accounting framework and general standards. Our research hypothesis is that Port Wine companies face the same problems that others wine companies in the world. In other words, due to the industry and product characteristics, Port wine industry need, in order to present useful financial statements, the same special accounting treatment that is found in other countries: a specific standard or flexibility in adopting the general accounting plan. The research method used was a questionnaire survey regarding wine accounting policy and practice. The questionnaire design was based on the wine accounting problems identified on the literature. We found that some of these problems were not felt in the industry and that Port Wine companies have its own accounting practices - like a unique cost formula. Our work aims to be a contribute to the development of wine accounting. We advocate that Port wine industry only need flexibility in the accounting treatment of their longlived inventories. 2 I. Introduction Accounting in the wine industry has developed greatly in recent years. The premium wine (higher quality wine that usually stays in cellar for a period of 5 to 10 years) was the starting point for that development. As Blake et al. (1998) stated the application of a traditional accounting framework to the wine industry has a negative effect on premium wine as compared to low-quality wine. So, in order to promote quality production in the wine industry major amendments to financial accounting and management accounting are needed. Our work intends to be a contribute to the development of wine accounting. Many academic researchers and institutions are dedicating a lot of their time to these issues. Amat and Anzizu (1996), Amat and Blake (1995), Amat et al (1998), Blake et al (1998), Castrillo and Marcos (2000), Hill and Juchau (2000), Juchau (1996), Juchau (2001), Lee and Jacobs (1993), Rodriguez and Ocejo (2002), Booth and Walker (2003), Asociación Espanõla de Contabilidad y Administración de Empresas - AECA (1999) or Instituto de Contabilidad de Madrid (2002) are good examples. Furthermore, in 2001, the Spanish standard setter issued a special accounting sectoral plan for the wine industry. Due to the long-term specification of this industry's goods, accounting recognition of some wines was changed and became different from the traditional accounting framework. In Australia, there is no specific accounting standard regarding the winemaking industry. Nevertheless, there is flexibility in applying the general standards, for example, borrowing cost are capitalized to the cost of the maturing wine or reporting maturing wine in non-current assets account. In Portugal there is no specific accounting treatment regarding Port Wine industry. Although, Port Wine industry has a specific accounting cost formula that is acceptable for the auditors and industry regulator. In our study, we show that the traditional accounting framework is not a suitable framework regarding long-lived quality Port wine inventories and some special accounting treatment is needed. 3 In this study, we analyzed the Port Wine accounting practices and try to know if the industry needs a specific standard, some flexibility in the rules of the general accounting plan or no special accounting treatment at all. The Port wine sector is a very regulated one1. There are two main rules that a company must follow: first, the company can only operate after having stocked a minimum level of goods; second, the company is allowed to sell at any time only one third of its inventories. These rules, which aim to produce high quality wine, determine decisively the type of inventories in this industry. We advocate that Port wine industry only need flexibility in the accounting treatment, regarding recognition, measurement and disclosure, of their long-lived inventories. II. Literature Review Many academic researchers and institutions are dedicating a lot of their time to wine accounting. Amat and Anzizu (1996), Amat and Blake (1995), Amat et al. (1998), Blake et al. (1998), Hill and Juchau (2000), Juchau (1996), Juchau (2001), Lee and Jacobs (1993), Rodriguez and Ocejo (2002), Booth and Walker (2003), AECA (1999) or Instituto de Contabilidad de Madrid (2002), are good examples. 1 "The Port Wine Institute (IVP), a public entity created in 1933, is responsible for controlling the quality of the several types of Port Wine and for defending and promoting these wines. The Port Wine Institute is the entity that is responsible for supervising and certifying wines bearing the Porto denomination of origin, by controlling the quality and quantity of the wines that are eligible for this denomination of origin based on regulations that govern the way it is produced and strict quality control and technical examinations. The IVP is also responsible for safeguarding the Denomination of Origin and supporting the expansion of the Port Wine trade to markets worldwide through the generic promotion of this wine. Once a wine has been approved by the Port Wine Institute, it acquires the right to call itself Port, to bear the Seal of Guarantee and to a Certificate of Denomination of Origin, both of which are issued by the IVP. Together with the entities responsible for producing and selling Port Wine, with which it shared the responsibility for supervising the sector, the IVP was and continues to be "a higher entity, supported by and subject to the Government", mandated to "guide the production and sale of Port Wine and act as a higher supervisory body", as stated in the Preamble to Decree number 22461 dated 10 April 1933." in site www.ivp.pt/uk/IVP/. 4 Some authors, like Castrillo and Marcos (2000) and Walker (2003), have been studying the agricultural perspective of the wine industry - the grape production. In this paper, we focus on the industrial perspective of the winemaking activity. The wine industry has its own characteristics that contribute to be a special industry. One fact deals with existence of a short time cellar wine industry (usually associated with low quality wine2) and a long time cellar wine industry - the premium wine industry. Usually, a premium wine stays in cellar up to 10 years but in the Port wine industry the special categories can be in cellar up to 40 years. These long-time inventories impose lots of difficulties when a company adopts the traditional accounting framework that is appropriate to high inventories rotation companies. Several problems were identified in the literature regarding wine companies: time related problems (long-lived goods in inventories, inflation), tax related problems (barrels depreciation, plantation residual value, equity in taxation - related to historical cost and replacement cost)3, grape valuation and imputed interests in inventories. Time related problems Some authors question the historical cost in the winemaking industry when we face long-lived wines. Rodriguez and Ocejo (2002) stated that, when we are dealing with wines that are in cellar for a long time, historical cost should be corrected. They suggest the use of monetary coefficients, replacement cost or other solutions such as the use of LIFO4 or monetary revaluations. Juchau (1996) studied the asset reporting practice in Australian wine companies and found that companies were disclosing wine inventories in both current and non-current assets. In order to valuing wine inventories, the companies treated maturing wine separately from bottled wine. Juchau stated (p.35) "The valuation and movement of 2 There are exceptions like the Portuguese Vinho Verde. Even in Port Wine, the Vintage is bottled after maturing two years in wood barrels. 3 Our study deals only with the winemaking industry but in many companies agricultural and industrial operations are joined. Some wine accounting problems associated with the agricultural operations - like grape valuation - have a new accounting treatment due to the fact that several accounting standards setters issued standards regarding agriculture. 4 Nowadays, not allowed by IAS nº2 - Inventories. 5 inventories is critical for wine companies given that inventories is a significant portion of their asset portfolio". The AECA's Management Accounting Principles Commission (AECA, 1999) thinks that the long-lived maturing wine should be accounted in the tangible fixed assets. Although, the Spanish standard setter, when issued the wine accounting plan, didn't follow AECA's position and instead splited the Inventories accounts into current and non-current5. Paragraph 59 of IAS 1, do not allow inventories to be accounted in the non-current balance sheet account if they belong to normal operational cycle. This rule produces a reporting problem to all industry who have different inventories goods - short and long operational cycle goods: all inventories (including those who have a long operational cycle) have to be reported in the same balance sheet account. Due to its low levels, inflation is not, nowadays, seen as an accounting problem for the vast majority of the companies. Although, it is a problem for wine companies that produce quality wine because, as we already stated, these wine stays in cellar for long periods of time. With a simple example Amat et al. (1998) demonstrate inflation as an accounting problem (see Appendix 1). In the example, with an income tax rate of 35%, the tax paid would be 35. But, as usually considered, companies are going concern entities and must replace their inventories. Adopting this perspective, the real income is 77,2 resulting in a real income tax rate of 45% ((35/77,2)*100)). There are several accounting solutions for the inflation problem and they are the same suggested for the long-lived goods in inventories. Amat et al. (1998) also suggest that these long-lived inventories should be recognized in the tangible fixed assets accounts. When Amat and Blake (1995) studied the implementation of ABC in a medium-sized family-owned wine company, they suggested, the restatement of all stocks to replacement cost, due to inflation. 5 In the special case of the Sherry wine - Xerez, Manzanilla and Fino - some products regarding the production in the Solera method can be accounted in the tangible-fixed assets account. 6 Tax related problems In the premium wine making process, the cost of the wood barrels has a high relative weight in the overall cost of the wine. Usually, in countries like Spain and Portugal, this wood barrel depreciate in seven years for tax purpose but its economic life is lower - 2 or 3 years is the period that wood barrels add flavor to wine. Due to the tax rule, companies usually depreciate their barrel for financial and management accounting in the same seven year period. The problem of non-realistic depreciation period is not felt in low quality wine. Rodriguez and Ocejo (2002) described this problem too, just like Amat et al. (1998) regarding the accounting practice of New Zealand and Californian wine companies. In most cases the residual value, after depreciation, of a wine plantation is negative. This happens because the value that companies receive from the sale of the old vine is lower than the value paid for the soil decontamination and the vine withdraw. The moment to recognizing this negative value is a wine accounting problem. Some authors or standards setters like the Spanish split the negative value in an equal way through the life of the vine adopting an accounting provision. Rodriguez and Ocejo (2002) described this problem too. According to Juchau (1996), some Australian companies revaluate their vineyards at three-yearly intervals based on fair market value for existing use. Vineyards are normally subject to depreciation or amortization charges over their economic life. Due to accounting specifications, quality wine producers are penalized against low quality wine or short cellar wines. As we saw, the producer of long cellar wine is tax penalized due to the inflation accounting treatment and the historical cost, resulting in a non-equity taxation comparing low quality to high quality wine companies. 7 Grape Valuation Nowadays grape valuation can be made according with its historical cost or with its fair value. This happens in countries like Spain or Australia and in companies that adopt IASB standards6. If a company adopts fair value in grape valuation the company must split its operational income regarding the grape production (agriculture) and the wine production (industry). Because of this many companies are splitting their activities in agriculture and industrial in order to recognize earlier its grape production income. Amat et al. (1998, p.535) state that, in management accounting, "both methods - fair value and historical cost - have some practical difficulties". When a company uses fair value for high quality grape valuation, they argue that the company should have a refined cost system. Imputed interests in Inventories Rodriguez and Ocejo (2002, p. 210), states that "it seems obvious that interest should be capitalized in wine production until it is sold". This is so when we are facing high quality wine; the same conclusion doesn't apply to low quality wine (short periods in cellars). Amat et al. (1998) have the same opinion and they establish a parallel with tangible fixed assets. These authors propose this imputation for both financial and management accounting purposes because this treatment would allow time matching between interest supported and sales. Other problems regarding small family-owned companies Problems like non-paid work from family workers, utilization of the owner's facilities and land without accounting for the costs and non-paid interest regarding owners' funds are other problems faced by some wine companies. We think that most of these problems are related to all small firms. These problems were identified in AECA (1999) book. 6 These alternatives accounting treatments are allowed by IAS 41 - Agriculture. 8 III. Wine Accounting Standards in Portugal, Spain and Australia We did not intend to do an exhaustive analysis of all wine accounting standards. We selected these three countries based on different arguments. First, Portugal because our prime intend is to study Port Wine accounting practices. Second, Spain because it has a sectoral accounting plan dedicated to the wine industry and has an accounting standardization background like the Portuguese one. Last, Australia because, although its important winemaking industry, Australian companies do not have a specific accounting standard. Portugal There is no special accounting treatment for the Port Wine industry except the cost formula called “the tradition one”. This cost formula is a tax rule7, issued by the tax authorities, that is accepted as an accounting rule in the Port wine industry. All Port Wine companies are legally authorized, for tax purpose, to adopt this specific cost formula if they want to. Since this cost formula is very old and prior to Portuguese accounting standards, it has been accepted by auditors and the industry regulator. Each year the company calculates its average purchasing cost. With this, it has only one accounting entry per year. But when this “traditional cost formula” started, as a legal tax rule, in 1980, all pre-1980’s entries were merge in only one entry, calculated by average cost. After compute the accounting entries, the cost of sales are computed in the same way as LIFO, except the fact that the last accounting entry is not considered. For example, a company that uses this kind of LIFO in 2000 has 22 entries (maximum) in its inventory (see Appendix 2). The Port Wine industry is facing a new challenge due to 2005 harmonization process the lost of its traditional inventory cost formula, once it is not allowed under the IAS 2 Inventories because of the way the Portuguese Standards setters are managing the process of harmonization locally, this industry will be forced to use a close adaptation 7 Portuguese Tax Secretary of State decision (5/7/1991). 9 of the IAS 2 and face a general standard, that was built to listed companies who face financial markets. In the Portuguese general accounting plan, companies are allowed to adopt as a cost formula: specific cost, weighted average cost, FIFO, LIFO and standard cost. Under IAS 2 - Inventories, LIFO is not allowed as an alternative cost formula, where FIFO and weighted average cost are the benchmark cost formulas if the specific cost is not determinable. There are at least one reason why Port wine companies do not adopt LIFO under Portuguese accounting rules: the report value of the inventories, special in companies with old inventories, would be so low (due to the physical age of the goods8) that the report value would be meaningless. Spain In 2001, the Spanish standard setter issued a special accounting sectoral plan for the wine industry (O.M., 2001). This sectoral plan was issued due to the operational specifications of the winemaking industry and due to the importance of this industry in the Spanish economy. Like stated by Rodriguez and Ocejo (2002), this plan was an industry demand for a long time. The Spanish sectoral plan is justified, according to the Spanish standard setters, by the specific characteristics of the winemaking industry: • lack of an accounting standard regarding the agricultural process in winemaking; • specific investments in maturing wines; • time need to mature wines and its effects on companies' financial structure and the effect of inflation; • low use of some equipment (once a year after the harvesting); 8 For example, Port with an Indication of Age: 10 years old; 20 years old; 30 years old; 40 years old are superior quality wines, obtained by blending wines from different years in order to obtain complementary organoleptic characteristics. Aged in wood for varying periods of time, the age that is indicated on the label corresponds to the approximate average age of the different wines in the blend. From that age, one obtains an indication of the characteristics the wine acquired as it aged in wood. 10 • importance to the Spanish economy. The plan is divided in five parts: Accounting principles, Accounts, Definitions and Accounting relations, Financial Statements and Measurement criteria. Regarding the accounting principles there is no difference facing the general accounting plan. The Accounts are a guideline for companies, in terms of denomination and number; they are not mandatory. The third part (Definitions and Accounting relations) is not mandatory except when we are facing measurement criteria or its interpretation. Companies are required to adopt the Financial Statements framework including models of the Balance sheet, the Statement of Income and the Notes to the financial Statements. The last part, Measurement criteria, is mandatory and these rules deal with operations measurement and recognition and with their economic effects. Because of the long-term specification of this industry's goods, accounting recognition rules are different from the traditional accounting framework. The Spanish wine companies recognize long-lived inventories and current inventories. Although they have different maturing duration, an asset can only be account in the tangible fixed assets account if it will be used to produce another asset. This other asset must be sold during the normal operational cycle of the company. A long-lived wine is available for sale in the normal operational cycle of the company, so it should be account in the inventories Australia Australia does not have a sectoral accounting plan for the winemaking industry like Spain but there are some general standards that affect the wine industry in a different way regarding other countries. Australia Accounting Standard Board AASB 1040 According with this standard, wine companies must report their inventories in current assets account. Booth and Walker (2003) found out that only two of the Australian five9 biggest companies reported their inventories as current assets account. They analyzed 9 Orlando Wyndham, Fosters, Southcorp, BRL Hardy and McGuigans 11 their accounts for the years ended 31 December 2000, 30 June 2001 and 31 December 2001. Australia Accounting Standard Board AASB 1041 The accounting standard for revaluation of non-current assets applies to a company owned grape vines. The values of the vineyards are determined at independent valuation based on the discounted net present value of expected future cashflows. The net market value of grape vine is determined as the difference between the vineyard values and the values of land and other vineyard improvements thereon. In determining the net market value certain assumptions have to be made about the yields and market prices of grape in future vintages, the cost of running the vineyards and quality of the grapes grown. Australia Accounting Standard Board AASB 1037 The accounting standard for self-generating and regenerating assets (SGARAs) applies to a company owned vineyards. The standard requires to value the vines on the companies' own vineyard at market value and effect any change in the value over the year through the Profit and Loss statement. The standard also requires to book any difference between the market value and the production costs of grape harvested from the companies' own vineyards through the Profit and Loss statement. Booth and Walker (2003, pp. 59) believe that the application of AASB 1037 "results in false or misleading statements and a reduction in the presentation of relevant financial information". Other reporting practices Australian wine companies recognized their maturing wine in the non-current assets account. All inventories recognize in the current assets account are assets to be realized within one year. So, we can find inventories in the current assets account in the balance sheet (realized within one year) or in the non-current assets account (maturing wine). Borrowing costs are capitalized to the cost of the maturing wine. Where funds are borrowed specifically to a qualifying asset, the amount of borrowing costs capitalized is 12 those incurred in relation to that borrowing, net of any interest earned on those borrowings. Where funds are borrowed generally, borrowing cost are capitalized using a weight average capitalization rate. Keep away from accounting standards It is possible under the Portuguese general accounting plan that, under exceptional cases, a companies will not comply with some rules of the accounting plan. That is the case when standard rules give no true and fair view of the companies' assets, liabilities or profits (Note 1 of the Portuguese General Accounting Plan). There is also some flexibility in the International Accounting Standards regarding accounting policies. The paragraph 22 of IAS 1 opens the possibility, in the lack of a specific IAS or interpretation, to the management to adopt other accounting policy in order to achieve useful information to the financial statements users. So, in Portuguese accounting standards or in International Accounting Standards, seems to be an opportunity to adopt other non-standardized accounting rules where the general one don not give useful information about the financial statements. Non-financial information Booth and Walker (2003) believe that wine companies should disclose some nonfinancial information. For example, companies should disclose their volume of wine held in inventories. IV. Port Wine Industry Until 1986 all Port Wine had to be traded from Vila Nova de Gaia. The legislation which came into force on June 26th of that same year opened the way for trading from the demarcated region. Some wine-growers then began marketing their production directly, thus enhancing the concept of "Produzido e Engarrafado na Origem" (Douro region bottled). In 1996, even though there were about 30 bottler-producers - nine of 13 which were co-operatives - registered at the Port Wine Institute, their share of Port Wine sales was nor greater than 1%10. Thus, almost all of the trade is still in the hands of the exporting companies based in Vila Nova de Gaia. It is true that Port Wine does not hold the same share in the Portuguese economy as it once did, but its importance is still manifest. Firstly, for what it represents for the economy of a vast region of the country. Secondly, for the relative importance of its revenue: more than two thirds of wine exports and about one fifth of all exports of agricultural food products. IV. Research Method and Data To our best knowledge this study is the first to address Wine Accounting problems in Portugal11. The primary aim of this survey was to determine the accounting practices and problems in the Port Wine industry. The research hypothesis is that Port Wine companies face the same problems that others wine companies in the world. In other words, due to the industry and product characteristics, Port wine industry need some special accounting treatment, like a specific standard, in order to present useful financial statements. Research Method The research method used was a questionnaire survey regarding wine accounting policy and practice. The postal questionnaire survey was chosen because of its advantages over other data collection methods. The main advantage of this method is that large number of companies can be easily (in a cost effective way). 10 in www.ivp.pt/uk/IVP/ The only known exception is a 1987 questionnaire survey by the Port Shippers Association to its members, but it only addressed valuation issues and suffers from a number of methodological shortcomings. 11 14 In order to design the questionnaire, we studied the wine accounting problems in the literature: Long-lived goods in inventories, inflation, grape valuation, imputed interests in inventories, wood barrels depreciation, plantation residual value, equity in taxation and other problems regarding specially small companies (see literature review). At the same time, we interviewed several chief financial or accounting officers in order to complement the literature analysis by capturing other accounting problems and practices in the Port Wine industry. Survey population We started to analyze the companies that are legally authorized by the industry regulator to operate in the Port Wine industry. The industry regulator has a public database of all Port Wine companies available in its website. Because of the small number of companies they were all selected for the survey. Henceforth, there was not any sampling procedure. So, companies had to fulfill only one criteria before they were included in the survey population: they were legally registered with the industry regulator - I.V.P. In the beginning of 2003 there were 107 Port Wine companies, which could be divided in two groups: Shippers (Comerciantes), and Producers/Bottlers (ProdutoresEngarrafadores). The questionnaire was send to the Shippers and Producers/Bottlers with the collaboration of the respective Associations (Associação de Empresas de Vinho do Porto - Port Wine Shipper's Association, and Associação dos Engarrafadores Viticultores de Vinho do Porto e Douro - Douro and Port Wine Producers and Bottlers Association). There were some companies that did not belong to any of these associations, in which case the questionnaires were sent directly by the authors. 15 Shippers Producers/Bottlers Location Gaia Douro Region Number 38 15 54 107 The questionnaire design12 To determine the accounting problems and practices of the Port Wine industry, a fourpage questionnaire was designed, pretested, revised, and then mailed to the chief financial or accounting officers of all legally Port Wine companies. The questionnaire design was based on the methodological approach suggested by Salant and Dillman's (1994). Due to the small size of the population, the reliability of the results depended on obtaining a very high response rate. Three procedures were used to enhance credibility. First, the questionnaire included an official letter from Faculdade de Economia do Porto, signed by the dean of the school, requiring collaboration in the study. Second, the logos of the school were included in the cover page of the questionnaire. Third, institutional support was negotiated and received from the Port Wine Shipper's Association and the Port Wine Producer and Bottlers Association. The questionnaire used clear instructions and guidelines and good printing quality. The respondents were assured of total confidentially and offered anonymity as a choice. The final questionnaire was printed in April 2003 and was sent out to companies in early May. Before, however, the questionnaire was tested with three chief accountants, and one auditor who works with several Port Wine companies and is a member of the board of auditors of the Port Wine Institute. 12 The authors gratefully acknowledges the technical and methodological support received from the Social Sciences faculty department. 16 The questionnaire contained 19 questions grouped into two parts: one group of questions is dedicated to accounting problems of the wine sector in general that were present in the wine accounting literature; the other group of questions is dedicated to the accounting problems of the Port Wine industry regarding their inventories. Regarding our hypothesis, the most important questions were Questions 1 to 9. The others were included mainly in order to deal with Port wine management accounting valuation practices. Question 19 is an open question in order to the respondents state what they think the Port Wine accounting problems are. Usable questionnaires were received from 32 respondents, resulting in a 29,9 percent response rate. V. Research findings In this section, we present the main results of the postal questionnaire survey to the Port wines companies. We are going to present an analysis of the collected information based on descriptive statistics. From this preliminary analysis, we can ascertain, in Port wine industry, existence or nonexistence of the wine accounting problems present in the literature. The results are based on 32 respondents, which represent 65% of the market share. Eleven respondents are Bottle-producer and 21 are Port Wine Shippers. From the 29 respondents that informed about the total of sales in 2002, the shippers had an average sale of 12.747.000 euros and the bottle-producers of 7.287.000 euros. Only 3 bottleproducers did not inform about their sales in 2002. The first question aims to know how old the Port Wine inventories of the respondents were. The results were according with our expectations: in 12 companies inventories with 5 or more years long represent more than 37,5% of the overall stock. According with these answers we think that the Port wine industry is different from the general company that desires a high rotation of its inventory and so expects current inventories. 17 Table 1. Wine in cellar for more than 5 Years (% of the overall inventory) Valid <10% >=10%-<20% >=20%-<30% >=30%-<40% >=40% Total Frequency 5 6 3 6 12 32 Percent 15,6 18,8 9,4 18,8 37,5 100,0 Regarding the way inventories are valued, 29 of the respondents use historical cost and 3 use fair value. This last result is surprising because fair value accounting is not allowed in Portugal in terms of inventory valuation. Table 2. How are the inventories valued? Valid Historical Cost Fair Value Total Frequency 29 3 32 Percent 90,6 9,4 100,0 Not surprising is the fact that 18 companies want to change from historical cost inventory valuation to fair value13 valuation. The fact is that almost 60 percent of the respondents think that the inventories should be valued with fair value. Table 3. How should the inventories be valued? Valid NR Historical cost Fair Value Other Total Frequency 1 11 19 1 32 Percent 3,1 34,4 59,4 3,1 100,0 As we have already stated in the above pages, in the Spanish sectoral plan for the wine industry, the majority of the maturing wines are reported in the inventory account of the standardized balance sheet; the Australian wine companies report their maturing wines 13 The respondents were informed in the questionnaire that Fair value could be reached trough market value or general acceptable theoretical model. 18 in the non-current assets account of the balance sheet. Almost 80 percent of the respondents think that the long-lived inventories should be reported in the current inventory account of the balance sheet. Table 4. Where should the inventories be reported? Valid Current Non-current Fix Assets Both Total Frequency 25 3 4 32 Percent 78,1 9,4 12,5 100,0 Twenty-seven companies agree with the revaluations of the inventories in the same way of the tangible fixed assets. In Portugal, the tangible fixed assets can be revaluated in two ways: according with the monetary devaluation and its effect is accounted for tax purposes; according with an independent valuation but its effect is not acceptable for tax purposes. Companies in Australia can revaluate their non-current assets in the same way of other non-current assets. In Spain, it is not allowed to revaluate long-lived inventories. Table 5. Should the inventories be revalued in the same way of the tangible fixed assets? Valid No Yes Total Frequency 5 27 32 Percent 15,6 84,4 100,0 Three reasons were given to the respondents to justify the revaluation: (1) a way of signaling to the accounting users; (2) to allow better credit risk analysis and (3) another one. They were given the possibility to choose several. Seventeen companies want to revaluate the inventories for signaling the users of the financial statements and 14 to permit better credit risk analysis. 19 Table 6. Dou you want to sign to the accounting users? Valid Yes No NA Total Frequency 17 10 5 32 Percent 53,1 31,3 15,6 100,0 Table 7. Do you want to allow a better risk credit analysis? Valid Yes No NA Total Frequency 14 13 5 32 Percent 43,8 40,6 15,6 100,0 Although the low levels of the inflation rate in Portugal in the last 5 years, 25 companies agree with the fact that this rate affects the reported value of the inventories. Regarding the reasons for that fact, twelve say that inflation affects the cost computation and other twelve justify the answer with the fact that inflation distorted the reported value. Table 8. Do you believe that inflation affects your reported inventory value? Valid No Yes Total Frequency 7 25 32 Percent 21,9 78,1 100,0 Table 9. Reasons for the influence of inflation on the reported inventory value Valid Affects the cost computation Distorce reported values Other NA Total Frequency 12 12 1 7 32 Percent 37,5 37,5 3,1 21,9 100,0 When asked for possible solutions for the inflation problem, surprisingly, 15 companies don't believe in any solution purposed in the wine accounting literature. From the purposed solutions, a specific cost formula like LIFO is chosen by 16 percent of the respondents. 20 Table 10. What is the main solution for the inflation problem? Valid Monetary coeficients Fair value Specific cost formula None NA Total Frequency 3 2 5 15 7 32 Percent 9,4 6,3 15,6 46,9 21,9 100,0 Another surprising result came from the question regarding the imputation of interests into the inventories. In Spain and in Australia, this practice is allowed for financial and management accounting purposes. We asked the Port wine companies if they imputed interests into the inventories for financial and management accounting purposes. No company adopts this practice for either purpose. As we have already stated, in Portugal, the imputation of interests to the tangible assets is allowed under certain conditions. Ninety percent of the respondents (29 companies) use wood barrels in their companies and 22 companies agree with the barrel depreciation rule (seven years like the tax rule). This result is not surprising because, in Port Wine, wood barrels (if not old) can damage, by adding flavor, the wine. Companies usually buy old wood barrels and so barrels depreciation in seven years (tax rule adopted by accounting officers) is not considered as a problem. Table 11. Does your company have wood barrels? Valid No Yes Total Frequency 3 29 32 Percent 9,4 90,6 100,0 Table 12. Do you agree with the wood barrel depreciation accounting rule? Valid NR No Yes NA Total Frequency 1 7 22 2 32 Percent 3,1 21,9 68,8 6,3 100,0 21 Two thirds of the respondent companies have its own wine plantation. Only one company refers that the residual value of the plantation after the period of depreciation is negative. The Spanish sectoral plan deals with this problem through an accounting provision. This provision aims to compensate the costs of recovering the land's capacity because companies are not allowed to depreciate the plantations. Table 13. Does your company have its own wine plantation? Valid Yes No Total Frequency 21 11 32 Percent 65,6 34,4 100,0 Table 14. Plantation residual value Valid NR Positive Negative Null NA Total Frequency 2 5 1 13 11 32 Percent 6,3 15,6 3,1 40,6 34,4 100,0 After a group of questions regarding the general wine accounting problems present in the literature, we focus now on Port wine accounting specificities: its traditional cost formula. Regarding Port Wine industry cost formula, 17 companies use this traditional Port Wine cost formula. Table 15. What is your cost formula? Valid NR Average weight cost LIFO Traditional cost formula FIFO Specific cost formula Other Total Frequency 2 9 1 17 1 1 1 32 Percent 6,3 28,1 3,1 53,1 3,1 3,1 3,1 100,0 22 Very few companies state problems regarding the small firms. Only one very small Bottle-producer states that he uses non-paid family work in his firm; three companies use the owner's properties and land without paying; and only three companies state nonpaid interest regarding owner's funds or loans. It is hard to comment these questions due to its delicate nature, even when we give confidentially as an option. Table 16. Is there non-paid work in your firm? (related with family members p.e.) Valid NR Yes No Total Frequency 2 1 29 32 Percent 6,3 3,1 90,6 100,0 Table 17. Does your firm use owner's facilities and land without accounting for the costs? Valid NR Yes No Total Frequency 2 3 27 32 Percent 6,3 9,4 84,4 100,0 Table 18. Does your company have non-paid interest regarding owner's funds? Valid NR Yes No Total Frequency 2 3 27 32 Percent 6,3 9,4 84,4 100,0 The last question (an open one), the companies were asked to point out the accounting problems they face. Six companies state that the different date of the financial statements regarding the winemaking cycle is a problem. Three companies believe that the non-existence of accounting software with inventories valuation purposes is a problem. And three firms think that the difficulty of finding workers who want to comply with tax rules is the major accounting problem. 23 Association between variables During our work with interviewed several chief financial officers of Port Wine Companies who suggested to us that the traditional cost formula was adopted by big shippers. Small and medium size companies, mostly bottle-producers, would adopt GAAP cost formulas. The hypotheses and the independent variables Based on theoretical considerations, on previous empirical research, and on the characteristics of the information by the sample companies, we developed the hypotheses described below in order to explain the use of the traditional cost formula. All hypotheses are stated in alternative form indicating the expected sign of the relationship. Size There are several arguments that can be used to link size to compliance with GAAP. As Watts and Zimmerman (1990) argue, political costs are higher in larger companies. So, larger firms are more likely to comply with GAAP since it improves confidence and reduces political costs. Secondly, larger firms are supposed to have superior information systems. Consequently, additional disclosure is supposedly less costly in larger firms than in smaller ones. Moreover, proprietary costs related to competitive disadvantages of additional disclosure (Verrecchia, 1983) a smaller as firm size increases. Activity The relationship between industry and compliance can be explained by the political costs theory. Watts and Zimmerman, argue that industry membership (being related to size) is related to political costs. Additionally, companies in the same industry have interest in producing the same level of disclosure of the other companies in the same industry in order to avoid being negatively appreciated by the market (competitive pressures). This argument is in line with the signaling theory. 24 In the Port Wine industry there are, has we had already stated, two regulated activities: Shippers and Bottle-producers. The Logistic Regression Model In order to find out some association between firm-specific characteristics - size and activity - and the traditional accounting cost formula, we used binominal logit regressions. This approach suggested by Sharma - "In short, the preceding analysis suggest that a 2x2 contingency table can be analyzed using logistic regression. In fact, one can use logistic regression to analyze a 2xj table. (p. 328, 1996)" - was chosen due to the difficulty, based on the small number of observations and in the fact that we were dealing with nominal variables, to test the association with nonparametric test like Quisquare test. To test the association between variables we assume that there is only one independent variable in the logistic regression model: ln p = βo + β 1 X 1− p This equation models a linear function of the independent variables, and is equivalent to a regression equation with log of the odds ratio as the dependent variable. Since the log of the odds is also referred to as logit, this equation is commonly referred as a logistic regression. The equation can be rewritten as: p= 1 1 + e −( βo + β 1 X ) 25 The software used to test our hypotheses was SPSS 11.0 for Windows and our hypotheses were: H1: There is no relationship between Cost formula (Traditional or GAAP) and Size (Big or small, medium size) Model Summary Step 1 -2 Log likelihood 36,450 Cox & Snell R Square ,038 Nagelkerke R Square ,051 Classification Tablea Predicted Step 1 Observed Cost Formula GAAP Traditional Cost Formula GAAP Traditional 3 8 2 15 Overall Percentage Percentage Correct 27,3 88,2 64,3 a. The cut value is ,500 Variables in the Equation: Independent - Size; Depedent: Cost Formula Step a 1 SIZE Constant B 1,034 -,405 S.E. 1,012 ,913 Wald 1,043 ,197 df 1 1 Sig. ,307 ,657 Exp(B) 2,812 ,667 a. Variable(s) entered on step 1: SIZE. Our result suggests that there is no relation between traditional cost formula and size. This is according with the agency cost theory (reduces the political cost): in our study, Port wine big companies adopt the GAAP cost formula. H2: There is no relationship between Activity (shipper or producer) and Size (Big or Small, medium size) 26 Model Summary Step 1 -2 Log likelihood 31,294 Cox & Snell R Square ,026 Nagelkerke R Square ,039 Classification Tablea Predicted Step 1 Observed Activity Bottle-producer Shipper Activity Bottle-producer Shipper 0 7 0 22 Percentage Correct ,0 100,0 Overall Percentage 75,9 a. The cut value is ,500 Variables in the Equation: Independent - Size; Dependent: Activity Step a 1 SIZE Constant B ,930 ,405 S.E. 1,042 ,913 Wald ,796 ,197 df 1 1 Sig. ,372 ,657 Exp(B) 2,533 1,500 a. Variable(s) entered on step 1: SIZE. Due to historical facts14 there is an idea that the Port Wine Shippers are the big companies and the Bottle-producers the small, medium size companies. Our observations did not confirm this idea. In fact, our test suggests there is no relation between activity and size. H3: There is no relationship between Activity (Shipper or bottle-producer) and Cost formula (Traditional or GAAP) Model Summary Step 1 14 -2 Log likelihood 30,260 Cox & Snell R Square ,140 Nagelkerke R Square ,204 Until 1996, only the Port Wine Shippers were allowed to export Port Wine. 27 Classification Tablea Predicted Step 1 Observed Activity Bottle-producer Shipper Activity Bottle-producer Shipper 0 8 0 22 Percentage Correct ,0 100,0 Overall Percentage 73,3 a. The cut value is ,500 Variables in the Equation: Independent - Cost Formula; Dependent: Activity Step a 1 Cost Formula Constant B S.E. Wald df Sig. Exp(B) 1,861 ,936 3,952 1 ,047 6,429 ,154 ,556 ,077 1 ,782 1,167 a. Variable(s) entered on step 1: COST FORMULA. This result is in the line of the signaling theory. Companies in the same activity have interest in producing the same level of disclosure of the other companies in the same activity in order to avoid being negatively appreciated by the market. The results were not surprising to us due to the fact that was the Shippers Association who lobbied the tax authorities in order that the traditional cost formula would be acceptable for tax purposes. Other firm characteristics In our questionnaire survey we gave confidentially as an option. So, it is very difficult to test other firm characteristics - like profitability - because we were dealing with nonlisted companies whose financial statements are not available15. 15 Some companies are not legally obliged to publish their financial statements. 28 VI. Discussion and conclusion The following is a summary of the main results of the analysis of the background variables in the survey: • Some wine accounting problems identified in literature such as barrels and plantation depreciation are not felt in the Port Wine industry. As we have already stated, the winemaking process itself justifies the wood barrels depreciation rate. We think that the plantation residual value problem is not felt because the industry is in an investment phase. • Low levels of inflation are felt as one accounting problem. • Some of respondents' management accounting system is not a sophisticated one because several companies express the need for computer software to help them in the inventories valuation. • Fair value accounting in inventories is welcome by the majority of the respondents. Table 19. Wine accounting problems present in the literature and in the Port wine companies16 Time related Tax related Imputed interested in inventories Wood barrels depreciation rate Plantations residual value Grape valuation Literature Our research 17 Our work aims to be a contribute to the development of winemaking accounting. Our results found that the traditional accounting framework, which is the base of the framework of the Portuguese accounting standards, is not adequate regarding long-lived Port wine inventories. The majority of the respondents think that there is no adequate standardized accounting treatment regarding their long-lived inventories. The fact that fifty-six percent of the companies would like to change from historical cost inventory valuation to fair value valuation illustrates this. Besides, almost 60 percent of the 16 Based on the majority of the respondents Regarding this problem, Port wine companies, according with the Portuguese Accounting Directive nº18, are able to adopt IASB standards and by doing this, the problem would disappear. 17 29 respondents think that the inventories should be valued at fair value and eighty-five percent of the respondent companies agree with the revaluations of the inventories in the same way of the tangible fixed assets. The Port Wine companies have been demanding a sectoral plan to their industry for a long time. Like in Spain, where there is a standardized accounting plan for the winemaking industry, or in other premium wine industries, we feel that Port Wine companies face different accounting problems compared with a general company. Their problems have their roots basically on the long-lived inventories. Our questionnaire survey show that the Port wine industry demands different ways of measuring and recognize their inventories. The current accounting framework is based on current inventories; Port wine industry has long-lived inventories. And the live of these inventories is even longer than other premium wines; this is the reason why the majority of the respondents think that none of the solutions purposed by the wine accounting literature suits the industry. We think that this fact is one reason why the majority of the respondent companies use the traditional cost formula of Port Wine industry. Our work suggest to us that Port wine companies face only "one" wine accounting problem: their long-lived inventories. In this study, we analyzed the Port Wine accounting practices and tried to know if the industry needs a specific standard, some flexibility in the rules of the general accounting plan or no special accounting treatment at all. We advocate that Port wine industry only need flexibility in the accounting treatment regarding recognition, measurement and disclosure, of their long-lived inventories. 30 References AECA (1999) "Contabilidad de gestión en las empresas vitivinícolas", Madrid; Amat, Oriol, and Anzizu José M, (1996) "El caso bodegas Torres", Barcelona Management Review, Jan, pp. 82-92; Amat, Oriol, and Blake, John (1995) “Learning ABC in Spain… With no sour grapes”, Management Accounting: Magazine for CMA, Vol. 73, nº9, pp. 36-39; Amat, Oriol, Moya, Soledad, Blake, John and Dows, Jack (1998)"Problematica contable del sector vitivinicola", Tecnica Contable, July, pp. 527-536; Australian Accounting Standard Board, (1998), AASB 1037 - Self-Generating and Regenerating Assets; Australian Accounting Standard Board, (2001), AASB 1041 - Revaluation of Noncurrent Assets; Blake, John, Amat, Oriol and Dowds, Jack (1998) "The drive for quality: the impact on accounting in the wine industry" Journal of wine research, Vol. 9, nº2, pp. 75-86; Booth, Brian and Walker, R.G. (2003), "Valuation of SGARAs in the Wine industry: Time for sober reflection", Australian Accounting Review, November, Vol. 13, nº3, pp. 52-60. Castrillo, L, Marcos, N (2000), "Normas Internacionales de contabilidad para la Actividad agrícola: aplicación del valor razonable", Revista de Contabilidad y tributation, October, nº 211, pp.339-356; Comissão de Normalização Contabilística, (1997), Portuguese Accounting Directive nº18 - "Objectivos das Demonstrações Financeiras e princípios contabilísticos geralmente aceites"; Grupo de Trabajo del Instituto de Contabilidad de Madrid (2002), "Contabilidad de Empresas Vitivinícolas", Editorial Instituto de Contabilidad de Madrid, Madrid; Hervás Oliver, J.L. (2002), "El camino internacional hacia el valor razonable" Partida Doble, Noviembre, nº 138, pp. 68-73; Hill G.P. and Juchau, R (eds) (2000) Agricultural Accounting: Perspectives and Issues, Whitstable: The Oyster Press, pp193; 31 International Accounting Standards Committee, International Accounting Standards nº 1 – Presentation of Financial Statements; International Accounting Standards Committee, International Accounting Standards nº 2 – Inventories; International Accounting Standards Committee, International Accounting Standards nº 41 – Agriculture; Juchau, Roger (1996) "Australian Wine Companies: Asset Reporting Practices", Australian Accountant, February, pp: 32-36; Juchau, Roger (2001), "Right on the bottle", Australian CPA, February, pp. 60-62; Lee, John Y., Jacobs, Brian Gray (1993) "Kunde Estate Winery", CMA Magazine, April, Vol. 67, Issue 3, pp.15-19; Normas de Adaptation del Plan General de Contabilidad a las empresas del sector vitivinícola - O.M. 11/05/2001; Portuguese General Accounting Plan (POC); Portuguese Tax Secretary of State decision (5/7/1991); Rodriguez Rodriguez, Mª Paz and Sáez Ocejo, José (2002) "Aspectos del plan general contable de las empresas del sector vitivinícola", Técnica Contable, Março, pp.197220; Watts, Ross and Zimmerman, J.L. (1990), "Positive Accounting Theory: A ten year perspective", Accounting Review, January, Vol.65, Issue 1, pp131-156; Salant, P. and Dillman, D.A. (1994), "How to conduct your own survey", New York, John Wiley & Sons; Sharma, Subhash (1996), "Applied Multivariate Techniques", New York, John Wiley & Sons; Verrecchia, Robert E. (1983), "Discretionary disclosure", Journal of Accounting & Economics, Dec. 83, Vol.5, Issue 3, pp. 179-195; 32 Appendix I – Example of Inflation as an accounting problem Suppose a wine company that has production cost of 200 per bottle. After the first year, the stocking cost is 10 per bottle a year. The Inflation rate is 2% per year. In the beginning of the seventh year the wine is sold at 350 per bottle. Costs Discount Factor Present Cost Year 1 200 1,104 220,8 Year 2 10 1,082 10,8 Year 3 10 1,061 10,6 Year 4 10 1,04 10,4 Year 5 10 1,02 10,2 Year 6 10 1 10 250 272,8 Income Present Income Sales 350 350 Cost of Sales 250 277,8 Income 100 77,2 Source: Amat et al (1998, p. 530) 33 Appendix II – Example of Traditional cost formula Suppose a Port Wine company that has wine in wine inventories since 1975. Each year the company has two or three inventories entries at different prices and no sales. In the first day of 2001, the company sold 100 bottles of Port Wine. The company has been adopting the traditional cost formula since in 1980. Year Entries Cost Year Entries Cost 1975 10 1 1988 11 1 15 1,1 15 1,2 10 1 19 1,1 16 1,2 16 1,3 19 1,1 19 1,2 10 1,3 13 1 15 1,2 15 1,2 11 1 11 1 14 1,2 14 1,5 16 1,4 16 1,1 10 1,5 14 1,3 15 1,3 15 1,2 10 1,1 10 1 16 1,4 15 1,5 19 1 11 1,1 20 1,5 14 1,4 18 1,1 16 1,2 14 1,3 10 1,4 16 1,2 15 1,5 17 1 10 1,4 10 1,5 16 1,5 11 1,3 19 1 19 1,1 20 1,2 20 1,4 18 1,3 15 1,5 14 1,5 17 1 16 1,2 18 1,2 17 1,4 12 1,3 10 1,3 18 1,5 11 1,5 14 1,2 19 1,3 12 1,4 20 1,1 10 1,3 11 1,4 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 34 After computing the accounting entries with the traditional cost formula, we can restate the accounting entries like this: Year Entries Cost Year Entries Cost pre-1980 161 1,1944 1990 47 1,1446 1980 45 1,1644 1991 25 1,28 1981 38 1,3105 1992 45 1,1955 1982 47 1,1574 1993 25 1,3 1983 21 1,3952 1994 41 1,2414 1984 54 1,3222 1995 25 1,46 1985 35 1,1028 1996 45 1,2666 1986 44 1,35 1997 38 1,2473 1987 22 1,3545 1998 47 1,3617 1988 26 1,1153 1999 21 1,4047 1989 35 1,1914 2000 50 1,242 So, after computing the accounting entries, the cost of sales would be: (21*1,4047)+(47*1,3617)+(32*1,2473). The last accounting entry is not accounted for (in this example the year 2000) and the others are computed in the Last In, First Out (LIFO) way. 35