You are the Fed Chairman Game

advertisement

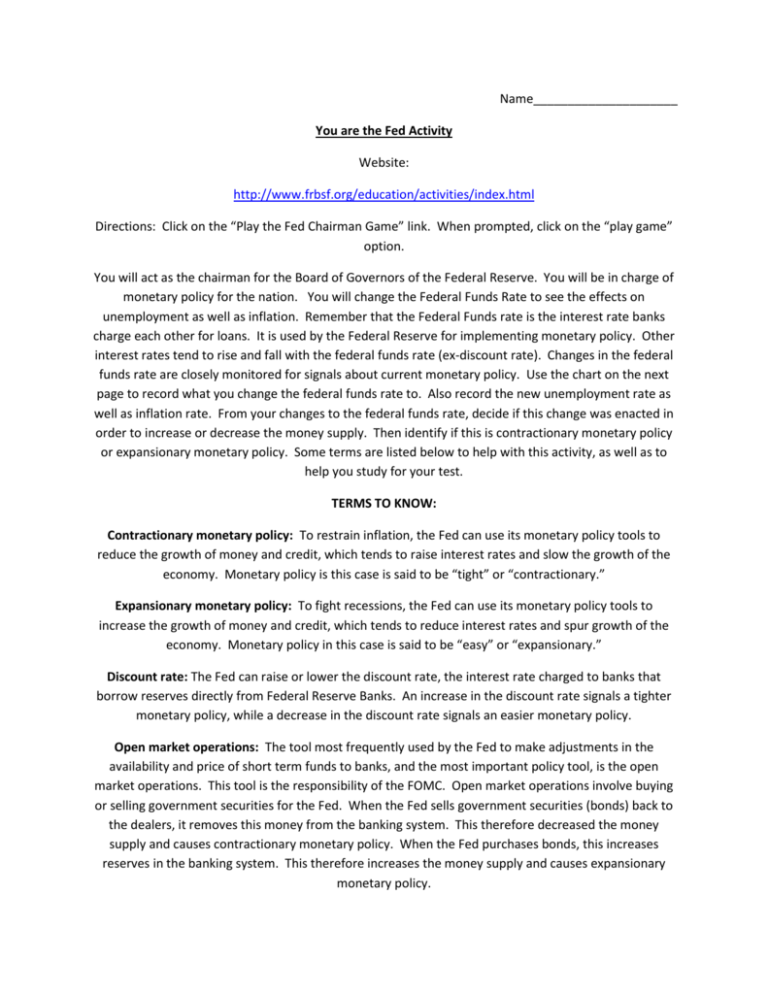

Name_____________________ You are the Fed Activity Website: http://www.frbsf.org/education/activities/index.html Directions: Click on the “Play the Fed Chairman Game” link. When prompted, click on the “play game” option. You will act as the chairman for the Board of Governors of the Federal Reserve. You will be in charge of monetary policy for the nation. You will change the Federal Funds Rate to see the effects on unemployment as well as inflation. Remember that the Federal Funds rate is the interest rate banks charge each other for loans. It is used by the Federal Reserve for implementing monetary policy. Other interest rates tend to rise and fall with the federal funds rate (ex-discount rate). Changes in the federal funds rate are closely monitored for signals about current monetary policy. Use the chart on the next page to record what you change the federal funds rate to. Also record the new unemployment rate as well as inflation rate. From your changes to the federal funds rate, decide if this change was enacted in order to increase or decrease the money supply. Then identify if this is contractionary monetary policy or expansionary monetary policy. Some terms are listed below to help with this activity, as well as to help you study for your test. TERMS TO KNOW: Contractionary monetary policy: To restrain inflation, the Fed can use its monetary policy tools to reduce the growth of money and credit, which tends to raise interest rates and slow the growth of the economy. Monetary policy is this case is said to be “tight” or “contractionary.” Expansionary monetary policy: To fight recessions, the Fed can use its monetary policy tools to increase the growth of money and credit, which tends to reduce interest rates and spur growth of the economy. Monetary policy in this case is said to be “easy” or “expansionary.” Discount rate: The Fed can raise or lower the discount rate, the interest rate charged to banks that borrow reserves directly from Federal Reserve Banks. An increase in the discount rate signals a tighter monetary policy, while a decrease in the discount rate signals an easier monetary policy. Open market operations: The tool most frequently used by the Fed to make adjustments in the availability and price of short term funds to banks, and the most important policy tool, is the open market operations. This tool is the responsibility of the FOMC. Open market operations involve buying or selling government securities for the Fed. When the Fed sells government securities (bonds) back to the dealers, it removes this money from the banking system. This therefore decreased the money supply and causes contractionary monetary policy. When the Fed purchases bonds, this increases reserves in the banking system. This therefore increases the money supply and causes expansionary monetary policy. Reserve Requirements: Another monetary policy tool involves the Fed’s ability to raise or lower banks’ reserve requirement ratio – the percentage of deposits that banks must hold as reserves. An increase in reserve requirements will reduce growth of money and credit, while a reduction in reserve requirements will increase growth of money and credit. Quarters Remaining Federal Funds Rate Unemployment Rate Inflation Rate Money Supply (Increase or decrease) Contractionary or Expansionary? 16 4.5 4.75 2.14 - - 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1