Exempt or Not Exempt? The Fair Labor

advertisement

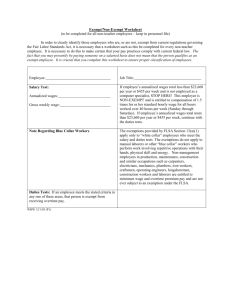

Northwestern University Office of Human Resources Exempt or Not Exempt? The Fair Labor Standards Act (FLSA) Background and Purpose The Fair Labor Standards Act (FLSA) is a U.S. Federal Law enacted in 1938 to prohibit employers from taking advantage of employees. It includes provisions which: Prohibit child labor Set minimum wage Require overtime pay Require equal pay (prohibit sex based wage differentials) Require record keeping The FLSA is an Employee Protection Act whereby employees are generally presumed not exempt and entitled to overtime pay; however there are exemptions from this law for executive, administrative, professional, and computer employees. The law requires that employees be paid for overtime hours worked at a rate of 1 ½ times their regular rate of pay (unless the employee is exempt from the provision). Overtime is defined as more than 40 hours worked in a work week. It requires significant record keeping for compliance. Employees may be exempt from this law if they meet 3 tests in regard to: 1. Salary Level 2. Salary Basis 3. Job Duties The FLSA was updated in 2004. The information below is designed to assist you in determining whether an employee is exempt from the FLSA. Test 1: Salary Level The employee must be paid at least $455 per week or $910 biweekly or $1971.66 monthly or $23,660 annually. These amounts are actual payments and salary should not be pro-rated for part-time employees. Test 2: Salary Basis Employee must receive a predetermined, fixed salary that is not subject to reduction due to variations in quality or quantity of work performed (except for some very narrow specified circumstances). Test 3: Job Duties Employee must meet all of the criteria specified in one or more of the following exemptions: Executive Administrative Education Establishments and Administrative Professional – Learned Professional – Artistic Computer-Related 1 Northwestern University Office of Human Resources The term “primary duty” is used throughout each of the exemptions. The definition of primary duty is the principal, main, major or most important duty that the employee performs. Determination of an employee’s primary duty must be based on the character of the employee’s job as a whole. Factors to consider include relative importance of the exempt duties as compared with other types of duties; amount of time spent performing exempt work (not more than 20% of an employee’s time may be spent on nonexempt work); employee’s relative freedom from direct supervision; and relationship between the employee’s salary and wages paid to other employees for the kind of nonexempt work performed by the employee. Employees who spend more than 80% of their time performing exempt work will generally satisfy the primary duty requirement. EXECUTIVE In order for an employee to be considered exempt as an executive, all of the following 3 criteria must be met: 1. Primary duty: manages enterprise, or customarily recognized (permanent status) department or subdivision. Managing includes activities such as: Interviewing, selecting, training and disciplining employees Setting and adjusting pay and work hours Planning and apportioning work among employees Maintaining production or sales records Appraising employee’ productivity and efficiency Handling employee complaints and grievances Determining the techniques to be used; the type of materials, supplies, machinery, equipment or tools to be used; or the merchandise to be bought, stocked and sold Providing for the safety and security of the employees or the property Planning and controlling the budget Monitoring or implementing legal compliance measures 2. Customarily and regularly direct the work of at least 2+ full-time employees (FTEs) 3. Hires or fires employees, or whose recommendations as to hiring, firing, advancement, promotion or any other change of status of other employees are given particular weight. Generally, an executive’s recommendations must pertain to employees whom the executive customarily and regularly directs. It does not include occasional suggestions. An employee’s recommendations may still be deemed to have “particular weight” even if a higher level manager’s recommendation has more importance and even if the employee does not have authority to make the ultimate decision as to the employee’s change in status. Additional Information A common question that arises under the executive exemption is how to classify employees who perform both exempt management duties and nonexempt duties. The regulations state that a manager who performs both exempt and nonexempt work at the same time is not automatically disqualified from the executive exemption. Generally, the exempt executives themselves make the decision regarding when to perform nonexempt duties. In contrast, the nonexempt employee generally is directed by a supervisor to perform the exempt work or performs the exempt work for defined time periods. For example, if an assistant manager’s primary duty is management, performing work such as serving customers, cooking food, stocking shelves and cleaning the establishment does not preclude the exemption. An assistant manager can supervise employees and serve customers at the same time without losing the exemption. In contrast, a relief supervisor or working supervisor whose primary duty is 2 Northwestern University Office of Human Resources performing nonexempt work on the production line in a manufacturing plant does not become exempt merely because he occasionally has some responsibility for directing the work of other nonexempt production line employees when, for example, the exempt supervisor is on vacation. ADMINISTRATIVE In order for an employee to be considered exempt as an administrative employee, both of the following 2 criteria must be met: 1. Primary duty: performs office or non-manual work directly related to management or general business operations (tax, finance, accounting, budgeting, auditing, insurance, quality control, purchasing, procurement, advertising, marketing, public &/or government relations, research, safety & health, human resources, labor relations, computer network, database administration, legal & regulatory compliance, etc. Work must be directly related to assisting with the running or servicing of the business and does not include working on a manufacturing production line or selling a product in a retail or service establishment.) of the employer or the employer’s customers. 2. Primary duty includes exercise of discretion and independent judgment with respect to matters of significance and implies that the employee has authority to make an independent choice, free from immediate direction or supervision. This involves the comparison and the evaluation of possible courses of conduct, and acting or making a decision after the various possibilities have been considered. Two or 3 of the following must apply to answer “yes” to this criteria: Authority to formulate, affect, interpret, or implement management policies or operating practices Carries out major assignments in conducting the operations of the business Performs work that affects business operations to a substantial degree Authority to commit the employer in matters that have significant financial impact Authority to waive or deviate from established policies and procedures without prior approval, and other factors set forth in the regulation Authority to negotiate and bind the company on significant matters Provides consultation or expert advice to management Involved in planning long- or short-term business objectives Investigates and resolves matters of significance on behalf of management Represents the company in handling complaints, arbitrating disputes or resolving grievances Additional Information Discretion and independent judgment does not include: Applying well-established techniques, procedures or specific standards described in manuals or other sources Clerical or secretarial work Recording or tabulating data Performing mechanical, repetitive, recurrent or routine work Employees are not exempt if they use manuals to apply well-established techniques or procedures within closely prescribed limits. “Matters of significance” refer to the level of importance or consequence of the work performed. An employee does not exercise discretion and independent judgment with respect to matters of significance merely because the employer will experience financial losses if the employee fails to perform the job properly. Similarly, an employee who operates very expensive equipment 3 Northwestern University Office of Human Resources does not exercise discretion and independent judgment with respect to matters of significance merely because improper performance of the employee’s duties may cause serious financial loss to the employer. The fact that an employee’s decisions are revised or reversed after review does not mean that the employee is not exercising discretion and independent judgment. The exercise of discretion and independent judgment must be more than the use of skill in applying well-established techniques, procedures or specific standards described in manuals or other sources. Typical Administrative Exempt Jobs: An employee who leads a team of other employees assigned to complete major projects Executive assistant or administrative assistant to a business owner or senior executive of a large business who has been delegated authority regarding matters of significance Management consultants who study the operations of a business and propose changes in organization Human resource managers who formulate, interpret or implement employment policies generally meet the administrative duties requirements Typical Administrative Nonexempt Jobs: Ordinary inspection work involving well-established techniques and procedures Examiners and graders who perform work involving comparison of products with established standards Comparison shoppers who merely report the prices at a competitor’s store Public sector inspectors or investigators Personnel clerks who “screen” applicants to obtain data regarding minimum qualifications and fitness for employment generally are not exempt administrative employees EDUCATIONAL ESTABLISHMENTS AND ADMINISTRATIVE In order for an employee to be considered exempt as an administrative employee within an educational establishment the following criteria must be met: 1. Primary duty: performs administrative functions directly related to academic instruction or training in an educational establishment. Academic administrative functions include operations directly in the field of education, and do not include jobs relating to areas outside the educational field. Additional Information Employees engaged in academic administrative functions include: Superintendent or other head of an elementary or secondary school system Any assistants responsible for administration of such matters as curriculum, quality and methods of instructing, measuring and testing the learning potential and achievement of students, establishing and maintaining academic and grading standards, and other aspects of the teaching program Principal and any vice-principals responsible for the operation of an elementary or secondary school Department heads in institutions of higher education responsible for the various subject matter departments Academic counselors and other employees with similar responsibilities Having a primary duty of performing administrative functions directly related to academic instruction or training in an educational establishment includes, by its very nature, exercising discretion and independent judgment with respect to matters of significance. 4 Northwestern University Office of Human Resources COMPUTER-RELATED In order for an employee to be considered exempt as an administrative employee, both of the following criteria must be met: 1. If compensated on an hourly basis, at a rate not less than $27.63 an hour 2. Employed as a computer systems analyst, computer programmer, software engineer or other similarly skilled worker in the computer field performing the primary duties described below: Application of systems analysis techniques and procedures, including consulting with users, to determine hardware, software or system functional specifications Design, development, documentation, analysis, creation, testing or modification of computer systems or programs, including prototypes, based on and related to user or system design specifications Design, documentation, testing, creation or modification of computer programs related to machine operating systems; or Combination of aforementioned duties, performance of which requires the same level of skills Typical Computer-Related Nonexempt Jobs: The computer employee exemption does not include employees engaged in the manufacture or repair of computer hardware and related equipment. Employees whose work is highly dependent upon, or facilitated by, the use of computers and computer software programs (e.g., engineers, drafters and others skilled in computer-aided design software), but who are not primarily engaged in computer systems analysis and programming or other similarly skilled computer-related occupations identified in the primary duties test described above, are also not exempt under the computer employee exemption. PROFESSIONAL - LEARNED In order for an employee to be considered exempt as an administrative employee, all of the following 3 criteria must be met: 1. Primary duty: performs work requiring advanced knowledge: Predominantly intellectual in character Includes work requiring the consistent exercise of discretion and judgment The advanced knowledge is generally used to analyze, interpret or make deductions from varying facts or circumstances Not work involving routine mental, manual, mechanical, or physical work Cannot be attained at the high school level 2. Knowledge must be in field of science or learning (Accounting, Actuarial Computation, Architecture, Biological Sciences, Chemical Sciences, Engineering, Law, Medicine, Pharmacy, Physical Sciences, Teaching, Theology) 3. Knowledge customarily acquired by a prolonged course of specialized intellectual instruction. Specialized academic training is a prerequisite for entering the profession with the best evidence that an employee meets this requirement is possession of the appropriate academic degree. Additional Information The learned professional exemption is not available for occupations that may be performed with: Only the general knowledge acquired by an academic degree in any field 5 Northwestern University Office of Human Resources Knowledge acquired through an apprenticeship Training in the performance of routine mental, manual, mechanical or physical processes The exemption also does not apply to occupations in which most employees acquire skill by experience. Exemption is also available to employees in learned professions who: Have substantially the same knowledge level and Perform substantially the same work as the degreed professionals, But attained the advanced knowledge through a combination of work experience and intellectual instruction Examples: Lawyer who did not attend law school Chemist who does not have a chemistry degree Typical Learned Professional Exempt Jobs: Lawyers Teachers Accountants Pharmacists Engineers Actuaries Chefs Athletic trainers Licensed funeral directors or embalmers Typical Learned Professional Nonexempt Jobs: Accounting clerks and bookkeepers who normally perform a great deal of routine work Cooks who perform predominantly routine mental, manual, mechanical or physical work Paralegals and legal assistants Engineering technicians PROFESSIONAL – ARTISTIC In order for an employee to be considered exempt as Professional – Artistic, the following criteria must be met: 1. Primary duty: performs work requiring invention, imagination, originality or talent in a recognized field (music, writing, acting, graphic arts) of artistic or creative endeavor. Typical Creative Professional Exempt Jobs: Actors Composers Certain painters Cartoonists Novelists Musicians Soloists Writers Essayists 6 Northwestern University Office of Human Resources FLSA WORKSHEET JOB TITLE: _____________________________________________________________ Date of Test: ________ Please answer yes or no (Y/N) to the statements below. Any no (N) answer makes the job non-exempt. TEST 1: SALARY LEVEL Employee’s salary greater than $455/week or $910 biweekly or $1971.66 monthly or $23,660 annually? Y/N TEST 2: SALARY BASIS Employee receives a predetermined, fixed salary that is not subject to reduction due to variations in quality or quantity of work performed? Y/N TEST 3: JOB DUTIES (must meet all criteria in at least 1 category below) Y/N Executive – All of the following 3 criteria must be met: 1. *Primary duty: manages enterprise, or customarily recognized department or subdivision 2. Customarily and regularly direct the work of at least 2+ full-time employees (FTEs) 3. Hires or fires employees, or whose recommendations are given particular weight Administrative – Both of the following 2 criteria must be met: 1. *Primary duty: performs office or non-manual work directly related to management or general business operations (e.g.: tax, finance, accounting, budgeting, auditing, insurance, quality control, purchasing, procurement, advertising, marketing, public &/or government relations, research, safety & health, personnel management, benefits, human resources, labor relations, computer network, Internet and database administration, legal & regulatory compliance, etc.) of the employer or the employer’s customers 2. *Primary duty includes exercise of discretion and independent judgment (authority to formulate, affect, interpret, or implement management policies or operating practices; carries out major assignments in conducting the operations of the business; performs work that affects business operations to a substantial degree) with respect to matters of significance. Educational Establishments and Administrative 1. *Primary duty: performs administrative functions (administration of such matters as curriculum, quality and methods of instructing, measuring and testing the learning potential and achievement of students, establishing and maintaining academic and grading standards, and other aspects of the teaching program OR department heads in institutions of higher education responsible for the various subject matter departments OR academic counselors and other employees with similar responsibilities) directly related to academic instruction or training in an educational establishment. Professional – All of the following 3 criteria must be met: 1. *Primary duty: performs work requiring advanced knowledge 2. Knowledge must be in field of science or learning (Accounting, Law, Teaching, Engineering, Biological, Chemical or Physical Sciences) 3. Knowledge customarily acquired by a prolonged course of specialized intellectual instruction Computer-Related – Both of the criteria listed below must be met: 1. If compensated on an hourly basis, at a rate not less than $27.63 an hour 2. Employed as a computer systems analyst, computer programmer, software engineer or other similarly skilled worker in the computer field performing the primary duties described below: Application of systems analysis techniques and procedures, including consulting with users, to determine hardware, software or system functional specifications Design, development, documentation, analysis, creation, testing or modification of computer systems or programs, including prototypes, based on and related to user or system design specifications Design, documentation, testing, creation or modification of computer programs related to machine operating systems; or Combination of aforementioned duties, performance of which requires the same level of skills *Primary duty: looking at the job as a whole - principal, main, major or most important reason that the job exists. Non-exempt work can be no more than 20% of the job.

![[DATE] Mary Ziegler Director Division of Regulations, Legislation](http://s3.studylib.net/store/data/007212021_1-b96b03cd98cadfc74a22865c0247494d-300x300.png)