Fast Casual Restaurants: Lessons learnt from Chipotle and Boston

advertisement

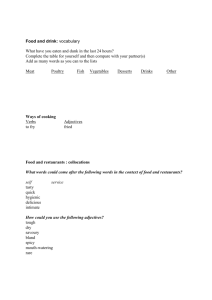

Fast Casual Restaurants Lessons learnt from Chipotle and Boston Market and applying them to Indian fast-casual restaurants EIS Project, Fall 2012, Section 1 Jay Beckstoffer Andres Bilbao Nishant Daruka Liqiong He (Jasmine) Prof. Ron Adner EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) Background The restaurant industry has traditionally been divided in four main sectors: fast-food, fast-casual, casual dining and upscale/fine dining. Over the last decade we have seen the explosion of the fast-casual segment highlighted by the success of Chipotle. The fast-casual segment grew at a 5.2% CAGR through the great recession (2007 – 2011), the best of any restaurant segment (actually the only segment that grew at all). As an example chipotle currently has a P/E ratio of 41x, an EBITDA margin of 20% and a net income margin of 10%, all well above restaurant industry averages. At the time of Chipotle’s IPO in January 2006 it owned and operated 480 stores, today that number is close to 1,400. Fast-casual restaurants blend the operational efficiencies of fast-food restaurants and the perceived quality and nutritional value of casual dining restaurants. By being uniquely positioned between these two segments their cost structure more closely resembles a fast-food restaurant while the prices they charge are closer to casual dining restaurants. And, as more consumers look for a healthier option to fast-food, the fast-casual restaurant sector is forecasted to grow at ~7% CAGR over the next 5 years. The fast-casual restaurant category is gaining significant momentum in the US. Not only is the fast-casual segment the fastest growing restaurant segment, also EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) 73% of American consumers reported visiting one in the last month, up from 55% in 2011. 1 US Fast Casual Restaurant Industry Sales ($US millions) $40,000 $35,000 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 $0 2006 2007 Source: Mintel market data 2008 2009 2010 2011 (est.) 2012 (fore.) 2013 (fore.) 2014 (fore.) 2015 (fore.) With substantial growth came increased competition and numerous new entrants. Chipotle now faces multiple, head-on, competitors such as Qdoba and Moe’s Southwestern Grill. The U.S. fast-casual landscape has grown to include American concepts like Panera Bread, French Bistro concepts like Cosi and Pret a Manger (McDonald’s newest investment) and Southeast Asian concepts like Pei Wei. While Asian-inspired cuisine has been the hottest segment of the fast-casual sector (e.g. Chipotle and P.F. Chang’s both started their own Asian concepts) a 1 Mintel Research Report: Fast Casual Restaurants - US - October 2012 2016 (fore.) EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) national Indian-inspired concept has yet to arise. We have discovered many regional Indian-inspired concepts but none that we believe will become broadly adopted across the U.S. Additionally, data and actions of existing fast-casual restaurants (e.g. Boloco adding Indian-inspired options to its menu) suggest consumers’ desire for an Indian fast casual option. Why, then, is there no national Indian-inspired fast casual option in today’s restaurant market? To answer this question we will examine the histories of Chipotle and Boston Market. The Boston Market and Chipotle were both benefactors of large investments from McDonalds but while Chipotle became the preeminent fast-casual concept, Boston Market experienced multiple contractions. Once the fast-casual restaurant ecosystem has been exposed we will apply our findings to Indian-inspired fastcasual restaurants in the U.S. Industry Dynamics and Analysis Chipotle operated 16 locations in 1998 when McDonald’s became an investor. By 2006, Chipotle had grown to over 480 locations and today has ~1,400 locations. Boston Market peaked in the late 1990’s at 1,143 stores. McDonald’s purchased Boston Market in 2000 and sold the chain to a Private Equity Firm in 2007. At the time of sale, Boston Market operated 530 stores by 2012 the number dropped to 474 stores. What were the reasons for Chipotle’s success and Boston Market’s lackluster performance? EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) Both success stories such as Chipotle’s and failure stories such as Boston Market’s have several drivers for their ultimate outcome. By the time that McDonald’s invested in these companies, they were both doing phenomenally well, and we believe that their success at the time was driven by the following: Obesity and health concerns Over the last 25 years the prevalence of obesity in the US population has skyrocketed. Exhibit 1 shows how the percentage of the population that is obese (BMI > 30) grew from less than 15% in 1990 to an average well above 22% in 2006 and has continued to grow. This trend is not a novelty, but the fact that the general population is well aware of the perils it represents, has sparked the desire to eat healthier. General population’s desire to eat healthy As a reaction to the increase in obesity health concerns associated with it, the general population grew more concerned about not only exercise, but also the caloric intake and quality of food they were ingesting. One data point that helps illustrate this shift in behavior is the most recent ‘Top 10 food trends’ published by the IFT. Half of the trends highlighted in this survey publication are somehow associated to better eating habits. Granted this data speaks to the current attitudes of grocery shoppers as opposed to the particular trends in the 90s, but it was in that EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) time that both fat-free/diet snacks reached mass markets, and the organic food market gained traction with the passing of the Trade Act of 1990 (Farm Bill). Against this backdrop, Chipotle and Boston Market built their success, providing consumers high quality ingredients, a pleasurable eating experience, and an affordable price. In the case of Chipotle, some of the drivers of success included: Innovation in value proposition: Although in hindsight it seems almost obvious that the concept of a Fast Casual restaurant was a great idea bound to succeed, but it was only until Chipotle’s appearance that this segment came to be. In a nutshell, Chipotle was delicious and healthy, but fast! The stores were nice enough that you could bring your date, but inexpensive enough that you could go eat there often. The management team made some difficult choices to make this value proposition possible, and they proved to be innovations in the restaurant delivery service. Simplicity: Instead of providing a huge assortment of various Mexican dishes, Chipotle decided to reduce its offering by focusing on predominantly one dish, the Mexican Burrito. This allowed them to provide a flavor that was Mexican enough that people would associate with a regional dish, but simple enough that it could be ‘manufactured’ quickly and inexpensively. Chipotle’s operations benefited significantly from this choice. EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) Personalization: Although the burrito is just one dish, people can configure it many different ways, which provides the variety that allures customers to come back. This ‘Build your own burrito’ approach started to tap into the emerging trend of ‘foodies’, people who feel are knowledgeable about food and mixing the ingredients they like. Consistency and Freshness: Although many people may argue that consistency is nothing new to the fast food industry, it was hard to come by in many chain restaurants. Where Chipotle excelled was in its determination to have fresh ingredients in every store. There are no refrigerators in any of the regular stores, which constraints the full supply chain and employees to have fast turnaround cycles and maintain freshness in their products. It takes only trying the guacamole at Subway after having it at Chipotle to realize the difference this strategic decision has on the product. Convenience: For any restaurant that can be associated with fast food, convenience is a big part of the value proposition. Chipotle’s approach blew the competition with flying colors. Their solution was to provide an ambience that was unique and deliver high quality food that customers could enjoy at the restaurant or bring back home. EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) Consumer preference for the product As Steven Ellis, Chipotle’s co-CEO put it in a 2012 CNBC interview ‘…people just love what we offer’. But several ingredients come into play for this winning recipe. By the time Chipotle started, the US had enjoyed several years of fast growing Mexican immigrant population that had introduced Americans to typical Mexican flavors. This familiarity with the flavors, combined with the ability to build your own burrito (see Exhibit 5), provided Chipotle with a proposition that customers were not only willing to try, but then happily returned to enjoy. When compared with other fast/casual restaurants, Chipotle provided a quick way to build your own burrito, of a higher quality, fast, and with a perception of being not only more fresh but significantly more healthy than the typical fast food restaurant. We conducted some informal conversations with our classmates to learn their perception of Chipotle and many referred to it as ‘great quality and taste’ and ‘healthier than fast food’. This leads us to believe that given today’s customers’ preferences in fast casual restaurants (see Exhibit 7), Chipotle hit quality and taste right on target, but then built a strong differentiation through the perception of a healthier option. These two defining characteristics could be attributed to SUBWAY, a privately owned sandwich company that has also seen tremendous growth (in total number of stores) via a franchise model, a positioning around healthy eating, and providing EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) customers the opportunity to build their own meals quickly using ‘fresh’ 2 ingredients. Strong Management Team and People Culture Chipotle characterized itself for being an organization with a fantastic management team that motivated its workforce and never compromised the quality of their product. When referring to Chipotle, Larry Zwain, a 1980 Tuck MBA, who served as CEO of Boston Market in 1997 and was McDonald’s US Marketing Senior VP at the time when they invested in Chipotle, referred to the management team as “very bright team that somehow ensured that all its employees knew Chipotle’s mission and could articulate it”. In regards to its people culture, it is worth highlighting that Chipotle hires from within, and 97% of their managers started rolling burritos on the front line, and there is a clear career path to grow to a role of restaurateur, who acts as leader of his/ her own restaurant and helps coach up to 3 more leads. Managers at Chipotle help build the people culture, and spend a significant amount of time on the front line, a behavior that was engineered by the decision to not build manager offices within Chipotle stores. Operational Excellence Chipotle has embraced technology to improve its operational efficiency and produce high quality, homogeneous burritos. An example of this strength is its adoption of We do not refer to Subway’s ingredients as fresh given that Andres Bilbao spent a summer working in one of its stores in Florida and emphatically refuses to do so when referring to the meats, lettuce, pickles, olives, to name a few. 2 EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) the sous-vide cooking technique adopted for preparing carnitas (pork). This technique, regularly employed by haute cuisine chefs enables cooking at lower temperatures in a very homogeneous fashion, allowing for consumers to enjoy a high quality consistent meal every time. The organization is rigorous in regards to its investments. It’s marketing strategy, for instance, although very creative and insightful (Examples 1, 2, 3, 4, 5), is not mainly focused on TV commercials that have fuzzy return rates. Finally, the fact that all of its stores are company-owned allows for great quality control and execution. Strategic relationships and financing Chipotle was very strategic in selecting the partners that would allow them to exist, and further strengthen their growth projections, and found in McDonald’s and ideal partner. After significant growth in Boston, having opened 16 stores, Chipotle approached McDonald’s, which invested in the company. This was a great move that allowed Chipotle to maintain high quality control by not having to deal with franchisees and allowing it to leverage McDonald’s fast-food know-how and capital to manage a highly profitable growth. Chipotle went from having 14 locations in Denver in 1998 to 37 in 1999 and over 500 stores in 2006 when McDonalds divested the business. Chipotle’s CEO was always the guiding visionary for his organization. EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) The fall down of Boston Market The ecosystem of Boston Market is as shown below. It is not as complicated and innovative as many other ecosystems. However, it has gone from being a very successful company to a shrinking business. The following reasons have contributed to the fall down: Adoption chain risk: expanded too aggressively to pursue the first mover’s advantage It is very easy for a successful business to become too aggressive in expansion. Boston Market made this common mistake by raising too much debt to finance its expansion. The rapid expansion allowed the company to create a steady stream of revenue from one-time development fees and increasing royalties, but also higher interest rates on its development loans. EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) Boston Market basically underwrote the debt from banks and investors and lent it to franchises to open more stores to support the quick expansion. It carried too much of the financial risks, while relying on the franchises success to enable its success, it became vulnerable to the progress and performance of the adopters of the value chain. While the ecosystem was favorable in that the population was increasingly health cautious, Boston Market misjudged the first mover’s advantage as a casual fast food chain. The two essential conditions to support the first mover advantage are “efficiently sized” and “simple product”. In the casual fast food ecosystem, it is too big a market to support “winner-take-all”, also, there is such a wide variety of options for food that the “simple product” condition also does not stand. Even if Boston Market expanded successfully to capture a bigger market size, it does not bring the network effect to magnify the return of the huge investment, thus it did not justify the big risk associated with the fast expansion. Execution Risk: dilution of tradition and misleading marketing message The Boston Market stores specialized in rotisserie chicken and a variety of side dishes, but in February 1995, the chain expanded its menu to include turkey, meatloaf, ham, and sandwiches, and changed the name to Boston Market. The company continued to add new products to the menu, such as Beef Brisket, Baked EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) white fish, haddock or cod, the variety of products have diluted the image of its traditional focus on chicken related products. The traditional rotisserie chicken is considered an occasional dish for most people, in the sense that customers can only enjoy it once a while. At the beginning, customers tended to enjoy the product as dinner, without fully appreciating the nature of their product, Boston Market began to promote lunch consumption, which triggered the shift of customers from more expensive dinner to less expensive lunch. Without quickly growing the customer base, the shift of dining time greatly reduced the revenue and profit. What is more, Boston Market falsely increased the size of their stores from 3000 square feet to 5000 square feet without strong justification of the change. The bigger sizes required more capital investment, diluted the initial cozy atmosphere of small store and failed to attract enough customer in-flow to sustain the business. The new marketing campaign called the "Boston Marathon" was totally a wrong step by relating to overeating. The competition involved eating 3 whole chickens, 2 pot pies, 8 pieces of cornbread, 6 sides and 2 desserts of choice in under an hour with no help. It went against the increasing health awareness of the population. Also the government is issuing regulations on sizes of beverages and food to handle obesity. It is not a smart idea for Boston Market to send a market signal about over eating. EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) Co-innovation risk: inappropriately reached to adjacent business A selection of Boston Market-branded items has been available since April 1999 in many supermarkets across the U.S. Frozen meals and side dishes are sold nationally under the Boston Market brand name. In April 2004, Boston Market introduced chilled menu items to be sold at supermarkets. In December 2005, these chilled menu items were available in 700 supermarkets. The company entered catering business as well to support events and parties, etc. Let’s have a look whose reach make sense. As shown in the table below, Boston Market chose to reach in the quadrant with the greatest potential damage. The company was doing great in the casual fast food market by offering food in stores; however, they decided to develop other channels such as super markets to distribute their products and to offer catering service customized per customers’ request. Although they can leverage the supply chain of the ingredients, the customer service location and model are totally different, thus the business reach to those areas bring no synergy to the core business. Disrupted element of core business model Context Core Boston Market Attractive Unattractive Existing Business Prospects EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) Applying the lessons learnt to Indian Fast-casual restaurants As we mentioned earlier, there are no national Indian fast-casual restaurants in the United States, despite a growing Indian population and an increasing familiarity of Americans with Indian flavors. Our research shows that there are a few reasons why this is true – 1. Indian restaurants are traditionally owned by first-generation immigrants and operated as typical mom-and-pop stores. These immigrants did not have the vision to build their restaurant as a national chain, nor did they have the operational know-how to make their food consistent. 2. Indian restaurants have not adapted to the changing American tastes. Their food tastes the same as it did 50 years ago and the menu is as complicated as ever. 3. They never applied the lessons learnt from the success of Chipotle and the failure of some other fast-casual restaurants like Boston Market to develop a winning strategy, despite the growing popularity of Indian food. Boloco has recently introduced an Indian sub-menu owing to the demand from customers. As per John Pepper, the founder of Boloco, -- “Indian flavors were long overdue. An obvious trend and our guests were asking for it.” EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) The newly introduced Boloco Indian Menu Based on our analysis of Chipotle and Boston Market, we believe that the following lessons should be applied to Indian fast-casual restaurants to ensure their success – 1. Keep the menu simple: Chipotle was successful because it kept the menu simple and easy to understand. There was a limited learning curve for customers and the restaurant was consistent in its vision. We understand EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) now how Boston Market failed trying to be everything to everyone. The menu should be designed in a simple and easy to understand manner and customers should not be inundated by ethnic names that drive them away. 2. Keep it fresh: The growing trend of consumers towards health warrants an Indian fast casual restaurant to appeal to this customer group. Not having freezers and managing the supply chain just like Chipotle did are essential to success. 3. Make it personalized: Having customization options to appeal to the section of customers who are more knowledgeable and picky in the food they eat, is also essential. Currently, very limited Indian restaurants offer this value proposition. EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) EXHIBIT 1 World War II The generation born in 1932 or before. In 2011, members of this generation are aged 79 or older. Swing Generation The generation born between 1933 and 1945. In 2011, members of the Swing Generation are between the ages of 66 and 78. Baby Boomers The generation born between 1946 and 1964. In 2011, Baby Boomers are between the ages of 47 and 65. Generation X The generation born between 1965 and 1976. In 2011, Generation Xers are between the ages of 35 and 46. Millennials* The generation born between 1977 and 1994. In 2011, Millennials are between the ages of 17 and 34. Matrix Generation** The generation born from 1995 to present. In 2011, Matrices are aged 16 or younger. EXHIBIT 2 Casual dining Full-service restaurant chains with average checks of $8-20 per entrée. Restaurants frequently carry liquor licenses. With an appetizer, beverage, and dessert, checks frequently come to $20 per person, though lunch specials priced at less than $10 for an entire meal are also common. Examples of chains included in this segment are Chili’s, Applebee’s, and Red Lobster. Chain Chains are multi-unit foodservice concepts operating under a single brand name, such as McDonald’s or Pizza Hut. A restaurant chain consists of two or more restaurants owned by one person or company. Usually, all restaurants in a chain have similar décor and serve the same food. Consumer unit A consumer unit is defined as either 1. All members of a particular household who are related by blood, marriage, adoption, or other legal arrangements; 2. a person living alone or sharing a household with others or living as a roomer in a private home or lodging house or in permanent living quarters in a hotel or motel, but who is financially independent; or 3. two or more persons living together who pool their income and make joint expenditure decisions. Financial independence is determined by the three major expense categories: housing, food, and other living expenses. To be considered financially independent, a respondent must provide at least two of the three major expense categories. Full-service restaurant Full-service restaurants are, by definition, establishments that provide table service. Food is ordered at the table and is paid for at the end of the meal. The segment is comprised of several sub-segments, differentiated primarily by check size. These include family/mid-scale restaurants and casual dining restaurants. Family/mid-scale Full-service restaurants with checks frequently less than $15 per person. Often, these restaurants have specialized meal options for children and do not sell alcohol. Examples include EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) restaurants International House of Pancakes, Cracker Barrel and Denny’s. Fast casual The fast casual segment is a hybrid of fast food and casual dining, combining the convenience of limited service with the ambience and quality of full service. Defining features include check averages of $6-9; décor that is more sophisticated than QSR; and food prepared to order, with customization of ingredients by patron being the norm. Fast food Used interchangeably with QSR. Fine/upscale/ gourmet dining Restaurants that exceed $20 per check, typically serve alcoholic beverages, and seat patrons at their own tables. Foodservice All places that prepare food outside the home are included as part of the foodservice industry, including food operations in supermarkets, schools, hospitals, factories, and prisons. Restaurants make up the largest part of the foodservice industry. Franchise In most franchise agreements, a restaurant owner grants another person or company the right to use the name of his or her restaurant. This right also includes the use of the original owner’s patented products, building designs and trademarks. In return, the original owner receives a fee. In addition, the franchisee usually pays a percentage of the restaurant’s income to the original owner. Independent A single restaurant that is not part of a chain. Quick-service restaurant (QSR) For the purposes of this report, QSR consists of all restaurants without table service, excluding pizza, coffee, smoothie, snack, ice cream, and fast casual shops. Systemwide sales Systemwide sales include a chain’s sales from company-owned stores, franchised stores and affiliates. It excludes moneys derived from non-restaurant revenue streams (e.g., interest). Units The number of stores operated within a chain. EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) EXHIBIT 3 EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) EXHIBIT 4 EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) EXHIBIT 5: CHIPOTLE COUNTER EXHIBIT 6: SUBWAY COUNTER EIS Project, Fall 2012: Jay Beckstoffer, Andres Bilbao, Nishant Daruka, Liqiong He (Jasmine) EXHIBIT 7 Important attributes for fast casual restaurants Mintel 2012