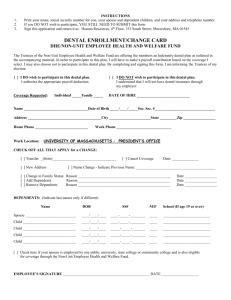

Dental Plan Summary Description

advertisement