Corporate performance - lecture 10102007

advertisement

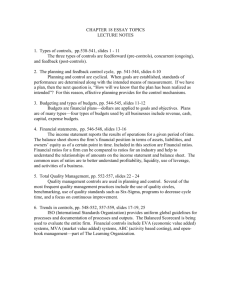

Corporate performance analysis Financial ratio analysis and rating Helena Sůvová Guest lecture for the Czech University of Agriculture Course: Financial Economics October, 2007 1 Content of the lecture Sources of financial ratios (indicators), users of corporate performance analysis Objectives and caveats Basic groups of financial ratios Comprehensive systems of financial ratios, default prediction models Credit rating – external, internal Summary of the lecture Assignments for the tutorial 2 Sources of financial ratios Financial statements: balance sheet, income statement, statement of cash flows, statement of retained earnings ! Important: accounting /reporting standards • • • GAAP IFRS or IFRS European version CAS Accounting units registered on a regulated securities market in a EU Member State must report in IFRS – EU adjusted Accrual accounting – recognizes timing X cash inflow – otflow: differences caused by: accrual principle, depreciation, taxes 3 Sources of financial ratios, users Other sources: web pages of individual firms, internet databases, paid databases – Magnus, Ariadna Users of corporate performance analysis: stockholders, managers, employees, business partners (customers, suppliers), journalists, students, public generally 4 Objectives, caveats Financial ratio = mathematical relationship among several variables (numbers), stated in %, times, days Financial ratios are used to analyze firm´s financial performace, however do not provide all answers Ratios are not standardized Ratios should not be analyzed in isolation to judge overall performance of a firm (x just specific aspect) Accounting standards affect the ratios Financial statements: annual, quarterly, monthly 5 Objectives, caveats Comparisons: • cross sectional - industry norms, key competitors, • time series, trends – comparisons with previous periods Comparability: • use the same ratio formulas • preferably use audited (annual) statements based on the same accounting standards • be aware of valuation of assets 6 Objectives, caveats Example of cross-sectional and time-series analysis 7 Basic groups of financial ratios 5 basic groups: • • • • • liquidity ratios debt management ratios (leverage ratios) asset management ratios (activity ratios) profitability ratios market value (valuation) ratios 1) Liquidity ratios firm´s ability to pay its obligations in the short term • • • • current ratio = current assets/current liabilities (1,5) quick ratio = (current assets – inventory)/current liabilities (1) cash ratio = (cash + near-cash)/current liabilities (0,25) net working cap. to total assets = (curr.assets – curr. liab.)/total assets 8 Basic groups of financial ratios 2) Debt management ratios characterize relative mix of debt and equity financing and measures the long term debt paying ability of the firm • debt ratio = total liabilities (total debt)/total assets (0,5) • financial leverage = total assets/equity • long term debt ratio = long term debt/ total assets • interest coverage ratio (times interest earned) = EBIT/interest expense (5) • fixed payment coverage = (EBIT + lease payments)/(interest + lease payments + 1/(1-T) * (principal payments + preferred stock dividends)) 9 Basic groups of financial ratios 3) Asset managemet ratios = asset utilization/efficiency turnover is measured in sales or costs • accounts receivable turnover = net credit sales/avrg accounts receivable (60) • receivable collection period = 365/accounts receivable turnover (60) • inventory turnover = cost of goods sold/ avrg inventory • inventory collection period (avrg age of invetory) = 365/inventory turnover ratio (60) • fixed assets turnover = sales/ (net) fixed assets • avrg payment period = accounts payable/avrg purchases per day 10 Basic groups of financial ratios 4) Profitability ratios final answer about the effectivness of business • profit margin on sales (net profit margin) = net income/ sales ( or EACS/sales) • gross profit margin = (sales-costs of goods sold)/sales • return on (total) assets ROA = EBIT/ total assets • …… but also ROA = EACS/total assets • return on equity ROE = net income/ equity • …. or EACS/equity EACS = earnings available for common stockholders 11 Basic groups of financial ratios – ROE in different Czech industries 2004, 2005 12 Basic groups of financial ratios 5) Market value ratios most comprehensive measures of performance • • • P/E ratio = price of share/earnings per share market to book ratio (M/B ratio) = market value/book value EPS = EACS/total assets 13 Comprehensive systems of financial ratios, default prediction models Financial analysis may become a part of other corporate performance analyses Example = credit analysis, rating Questions of credit manager: How much money can I lend? How much risk am I exposed? Credit analysis – long time relied on financial analysis 1968 – first statistical methods used in financial ratio analysis: Z – Score model by Altman, based on discriminant analysis 14 Comprehensive systems of financial ratios, default prediction models 1977 – updated Zeta model 1980 – KMV Corporation using modern portfolio theory → model Credit Monitor – default risk for publicly traded companies in North America and Europe models like this are called „Merton“ models 1997 - J.P. Morgan developed Credit Metrics 1999 - Moody´s introduced Risk Calc 2002 - Kamakura Corporation credit risk models appeared – Merton type of models, reduced form models (similar to Z-Score), hybrid combining both methodologies 15 Comprehensive systems of financial ratios, default prediction models Z – Score: discriminates between firms that default (fail) and those that do not Z = 1,2 X1 + 1,4 X2 + 3,3 X3 + 0,6 X4 + 0,999 X5 X1 = working capital/total assets X2 = retained earnings/total assets X3 = EBIT/total assets X4 = market value of equity/book value of total liabilities X5 = sales/total assets Decision-making criteria: Z < 1,81 …. fail Z Є (1,81; 2,99) …. grey zone Z > 2,99 ….. on going 16 Comprehensive systems of financial ratios, default prediction models Czech index for assessment of the financial situation – IN index (index of Czech enterprise creditworthiness) Comprehensive financial analysis – using organized system of financial ratios, e.g. Du Pont system or pyramid analysis 17 : Example of more complex pyramid system 18 Credit rating – external, internal Credit rating = opinion of the general creditworthiness of an obligor. It represents the relative level of default risk. Rating scale – from AAA to D • investment grades: AAA, AA, A, BBB • speculative grades: BB, B, CCC, CC, C • default: D Global rating agencies: S&P, Moody´s, Fitch Rating by rating agencies are external (are published) Rating methodology – • long –term, through-the-cycle • stress on sustainability of cash flows 19 Credit rating – external, internal This is an ideal through-the-cycle rating: 20 Credit rating – external, internal Types of rating: • • • issue-specific X issuer rating long-term X short-term rating international (foreign currency) X local rating Rating methodology usually includes the assessment of: • 1) Business risk – – – – – – – – – Country risk Industry characteristics Company position Product portfolio/Marketing Technology Cost efficiency Strategic and operational management competence Profitability/Peer group comparisons 21 Credit rating – external, internal • 2) Financial risk – Accounting – – – – – Corporate governance/Risk tolerance/Financial policies Cash-flow adequacy Capital Structure/Asset Protection Liquidity/Short-term factors Ratings widely accepted by the financial markets. Rating is an example of comprehensive assessment: financial factors (including ratio analysis) must be completed by non-financial factors + expert judgement 22 Credit rating – external, internal Basic ratios used in rating methodology: • • • • • growth of EBITDA growth of profit margin debt ratio interest coverage ratio liquidity Interpretation of ratios is never straightforward „Rating is as much art as it is a science.“ 23 Credit rating – external, internal Internal rating systems – used for internal purposes of financial institutions similar basis as external rating by rating agencies, but tailor-made for internal portfolio and needs methodology based on model, completed by expert judgement usage: credit approvals, limit setting, pricing, internal reporting, setting strategy for homogenous portfolios (e.g. retail loans) – scoring systems (automatic assessment) 24 Summary of the lecture Financial statements are basic source of financial analysis which is based on financial ratios. Interpretation of ratios is not straigtforward, for comprehensive view must be be completed by nonfinancial information and expert judgement. Financial analysis makes part of other analyses – credit analysis, credit rating, default prediction – used by certain users for pre-determined purposes. 25 Assignments for the tutorial What are some important caveats to remember when analyzing financial ratios? For which business is inventory turnover important? 1. 2. • • • • 3. 4. 5. manufacturing (production) company wholesaler retailer service sector How can a firm have a high current ratio and still be unable to pay its bills? (Q 8.6.) „The higher the rates of return on assets, the better the firm´s managament“. Is this true? (Q 8.7.) What factors would you examine if a firm´s ROA was too low? (Q8.8) 26 Assignments for the tutorial 6. 7. What does a credit rating mean? Web case: – – – 8. 9. 10. GO TO www. hoovers. com In the search box at the top of the page, enter UAL, select "by ticker" from the dropdown list, then click GO. Who are the top competitors to United Airlines? Who is the CEO of United Airlines? Springfield Medical Devices, Inc., has a current assets valued at $15 million, inventory at $12 million, and current liabilities valued at $6 million. The cost of goods sold was $60 million. Based on this information, its current ratio is: a) 2.5 b) 0.25 c)0.5 d) 3.0. P2-20 on page 93 of Gitman textbook : Zach Industries Look at the financial statemets of ČEZ and make simple Du Pont analysis by using ROA, ROE and financial leverage in 2004/5. 27