Basic Earnings Per Share

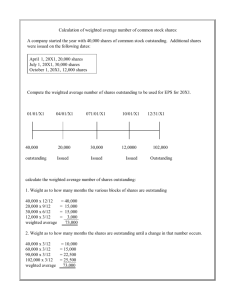

advertisement

Chapter 19 Share Based Compansation and Earnings Per Share BASIC EARNING PER SHARE Earnings per share must be reported on the face of the income statement. It reflects the current earnings available for each share of common stock. In addition, when the income statement contains irregular items (items net of tax below the income from operations line) EPS should be reported for each item. Earnings per Share-Simple Capital Structure In a simple capital structure the corporation has no securities that have a conversion option. Preferred Stock Dividends: If the corporation has both preferred and common stock typically preferred dividends must be subtracted from net income to derive income available to common stockholders. If the preferred stock is cumulative, dividends are subtracted whether declared or not. If the preferred stock in non-cumulative the dividends must be declared. The formula for calculating basic earnings per share is as follows: Basic EPS = Net Income less Preferred Dividends Weighted Average Number of Common Shares Outstanding Issuance of New Shares Current year preferred dividends are subtracted from net income to derive the net income available to common stockholders. The weighted average of the number of shares of common stock outstanding provides the basis for calculating the per share amount. We account for any shares issued or repurchased during the period. This is accomplished by calculating the fraction of the period that they are outstanding and adding this to the beginning balance of shares outstanding. Example: On January 1, 2003 Spencer Company had 500,000 shares of common stock outstanding. On May 1, 2003 the company issued an additional 84,000 shares and on September 1 the company repurchased 42,000 shares (treasury stock). On November 1 the company resold 36,000 shares of the treasury stock. The weighted average of common stock outstanding for the year is calculated as follows: Weighted-Average Common Shares for Fiscal Year of 2003 Fraction Weighted Description Dates Shares of Year Average Beginning balance 1/1/03 500,000 4/12 166,667 Issued shares 5/1/03 84,000 Adjusted balance 584,000 4/12 194,667 Repurchased shares 9/1/03 (42,000) Adjusted balance 542,000 2/12 90,333 Issued shares 11/1/03 36,000 Adjusted balance 578,000 2/12 96,333 Weighted average number of shares outstanding F:\course\ACCT3322\200720\module4\c19\tnotes\c19b.doc 11/10/2006 548,000 1 Chapter 19 Share Based Compansation and Earnings Per Share Stock Dividends and Stock Splits The above is fairly straight forward in that there are not complicating issues like stock dividends and stock splits. If there is a stock dividend or stock split we must restate the number of shares outstanding prior to the date of dividend or split. Let’s assume that Spencer Company declared a stock dividend of 40% on October 1, 2003. The calculation of the weighted average of common shares outstanding for the year would be as follows: Weighted-Average Common Shares for Fiscal Year of 2003 Restated Fraction Weighted Description Dates Shares Restate Shares of Year Average Beginning balance 1/1/03 500,000 1.40 700,000 4/12 233,333 Issued shares 5/1/02 84,000 Adjusted balance 584,000 1.40 817,600 4/12 272,533 Repurchased shares 9/1/02 (42,000) Adjusted balance 542,000 1.40 758,800 1/12 63,233 40% stock dividend 10/1/02 216,800 Adjusted balance 758,800 758,800 1/12 63,233 Issued shares 11/1/02 36,000 Adjusted balance 794,800 794,800 2/12 132,467 Weighted average number of shares outstanding 764,800 If in the above example Spencer Company had the following items in the calculation of net income, the related basic EPS would be presented on the income statement as follows. Income before extraordinary item Extraoridinary loss, net of tax Net income $400,000 (100,000) $300,000 Earnings per share: Income before extraordinary item Extraordinary item, net of tax Net income $0.52 (0.13) $0.39 Each item in the income statement is divided by the weighted average number of shares outstanding, which are 764,800 in this example. Answer the following questions regarding earnings per share with a simple capital structure. Question 1 With respect to the computation of earnings per share, which of the following would be most indicative of a simple capital structure? F:\course\ACCT3322\200720\module4\c19\tnotes\c19b.doc 11/10/2006 2 Chapter 19 Share Based Compansation and Earnings Per Share a. Common stock, preferred stock, and convertible securities outstanding in lots of even thousands b. Earnings derived from one primary line of business c. Ownership interest consisting solely of common stock d. None of these Answer c. Ownership interest consisting solely of common stock Question 2 In computing earnings per share for a simple capital structure, if the preferred stock is cumulative, the amount that should be deducted as an adjustment to the numerator (earnings) is the a. preferred dividends in arrears. b. preferred dividends in arrears times (one minus the income tax rate). c. annual preferred dividend times (one minus the income tax rate). d. annual preferred dividend. Answer d. annual preferred dividend. F:\course\ACCT3322\200720\module4\c19\tnotes\c19b.doc 11/10/2006 3