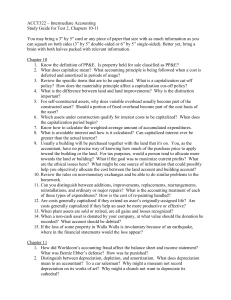

Measurement and Tax Depreciation Policy: The Case of Short

advertisement