Kohls Annual Report 05

advertisement

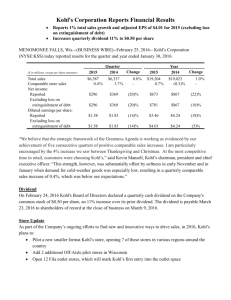

A N N U A L R E P O RT 2 0 0 5 N56 W17000 Ridgewood Drive Menomonee Falls, WI 53051-5660 www.kohls.com Financial Highlights 2004(1) 2005 Net Sales up 14.5% (In millions of dollars) $ 13,402 $11,701 $ 1,416 $ 1,193 Operating Income (In millions of dollars) up 18.7% Percent of Sales Net Income up 19.7% $ (In millions of dollars) Net Sales 9% G CA 12000 703 (In millions of dollars) (2) 1000 R 16. $ 842 Net Income(1) (In millions of dollars) 15000 10.2% 10.6% $13,402 (2) R AG $842 C .7% $11,701 19 $10,282 $9,120 800 $703 $601 $546 9000 600 $7,489 $458 $6,152 $343 6000 400 OUR PROFILE 3000 Kohl’s mission is to be the leading family-focused, value-oriented specialty department 200 store offering quality exclusive and national brand merchandise to the customer in an environment that is convenient, friendly and exciting. 0 Kohl’s operates from coast to coast. At the end of fiscal 2005, we served customers in 41 states through 732 stores and Kohls.com. In 2006, we plan to open approximately 80 to 85 stores. 00 01 02 03 04 05 00 01 02 03 04 (1) Results for 2000-2004 fiscal years have been restated to reflect expensing of stock options. (2) Compounded annual growth rate. 05 0 LETTER TO SHAREHOLDERS SHARE REPURCHASE PROGRAM “In 2005, we made significant strides in bringing expect great things to life.” The Board of Directors has authorized a $2 billion share repurchase program. The program is expected to be completed over the next two to three years. Pictured: Arlene Meier, Larry Montgomery and Kevin Mansell. Dear Shareholder, and our own private brands further broaden the mix and set us on how to create their own look. These initiatives not only make Our customers will continue to receive the same great credit card In our letter to you last year, we introduced our new positioning apart in the market. it easier to shop our stores, but also more exciting. benefits. We will continue to handle all customer service functions strides in bringing expect great things to life. In 2006, we will build on our 2005 success and launch even more Expansion: A Leading National Retailer to our credit card customers. In return, we will receive ongoing new brands. We will add Chaps in women’s, boys’ and footwear, In 2005, we continued to bring Kohl’s into new markets and payments related to the profitability of the program. We differentiated ourselves even further in the marketplace and Tony Hawk in men’s and boys’ and West End and AB Studio expand our presence in existing markets. We opened 95 stores, in women’s. In addition, Stamp 10 by Liz Claiborne will be introduced operating 732 stores in 41 states at the end of the year. The new In anticipation of the sale of the credit accounts receivable, the in 300 stores in both women’s and men’s. We are also extending store openings were split between new and existing markets. Board of Directors has authorized a $2 billion share repurchase our contemporary private brands including Candie’s, daisy fuentes New markets included Buffalo, New York, and our entry into program. The program is expected to be completed over the and apt. 9 into other areas of the store. We will complete the Florida with stores in Orlando and Jacksonville. next two to three years. Looking ahead, we plan to open approximately 500 stores over We expect to use the initial proceeds from the credit card statement: expect great things. In 2005, we made significant provided our customer with a better-than-ever shopping experience. We added exciting new brands and opened 95 stores in both new and existing markets. These initiatives focused on one goal - growing the company profitably. Strong Financial Performance 2005 was a record year for Kohl’s. Net sales increased 14.5% to a record $13.4 billion, while comparable store sales rose 3.4%. Net income increased 19.7% to a record $842 million or $2.43 per diluted share. Our balance sheet remains strong and we continue to generate significant cash flow from operations. In February 2006, we repaid $100 million of our long-term debt. and will be responsible for all advertising and marketing related repositioning of our biggest private brands, Croft & Barrow, Sonoma, and apt. 9, to appeal to three different lifestyles: classic, updated and contemporary. Our marketing strategies go hand-in-hand with our merchandise content and are designed to raise our visibility among both loyal, long-term customers and first-time shoppers who want to see what all the excitement is about. A successful combination of integrated fashion-focused advertising and the continued use of Company Initiatives our newspaper inserts helped to drive increases in transactions We made excellent progress on our 2005 initiatives. These initiatives per store in 2005. Our advertising continually reminds our focused on merchandise content, marketing, inventory management customers that they can expect great things at Kohl’s. and the in-store shopping experience. In 2005, better inventory management, along with continually From a merchandise perspective, we broadened our customer introducing fresh and exciting new content into our stores, reach by introducing new brands and categories into the contributed to our sales increases and helped to improve merchandise mix. We focused on our customer’s lifestyles to gross margin. We continue to focus on consistently buying the next five years. This growth will come from a strategic blend of new stores in both new and existing markets, along with capitalizing on real estate opportunities that may arise as the industry continues to consolidate. In fiscal 2006, we plan to open approximately 80 to 85 stores. We will enter the Northwest with stores in Portland and Seattle that will be a combination of new builds and the takeover of former store locations. Some of our new stores opening in October will incorporate new design features both on the interior and exterior. By the end of fiscal 2010, we plan to operate over 1,200 stores all across the country. Our approach to expansion is very disciplined, ensuring the consistent execution of our growth strategy. As part of this strategy, we will continue to update our existing stores to help drive meaningful gains in market share. provide an assortment that satisfies her needs – whether she is the right number of units, improving allocation accuracy, shopping for herself, her family or her home. streamlining the seasonal transition across our various Capital Structure geographic locations and ensuring that colors and sizes In March, we entered into a strategic alliance with JPMorgan Chase are in stock by store. to enhance our credit operations. Chase will purchase Kohl’s private Of course, Kohl’s means brands and this is where we continue to excel. Kohl’s was built on the concept of emphasizing national transaction to repurchase Kohl’s stock, fund our store expansion and for general corporate purposes. Our Vision We are well positioned to continue to execute our growth strategies. We have a strong and growing base of stores in many key markets across the country, but there are many more markets where we can expand. We are leveraging our core concept of brands, value and convenience to satisfy existing customer needs, broaden our customer base and improve our customer’s shopping experience. We have a track record of strong financial performance. Most importantly, we have a team of over 107,000 Associates who are dedicated to serving our customers, as well as an experienced Board of Directors and senior management team that are committed to long-term profitable growth. To our shareholders, customers, partners and most of all, our Associates, thank you for another record year. We look forward to building on this momentum in 2006 and beyond. label credit card accounts and the outstanding balances associated brands that project quality and value and have wide customer The shopping experience is where everything we do comes with the accounts under a multi-year program agreement. The total appeal. National brands such as Levi’s, Columbia, Nike and many together. We’ve organized departments by lifestyle for ease of purchase price, which will be equal to the receivables balances others across the store are the foundation of our merchandise shopping, differentiated special sizes, added graphics that highlight at the closing date, will be paid in cash and is expected to be offerings. Exclusive national brands, available “Only at Kohl’s,” key trends and presented merchandise to give customers ideas approximately $1.5 billion. Larry Montgomery Chairman and Chief Executive Officer Kevin Mansell President Arlene Meier Chief Operating Officer 1,232 Stores by the End of 2010 1,232 Continuing Growth from Coast to Coast In 2005, we continued to bring the Kohl’s brand into new markets and to expand (projected) in existing markets. We added 95 stores in 2005 and entered Florida for the first time with stores in Orlando and Jacksonville. In 2006, we will expand into the E X PA N D I N G O U R P R E S E N C E Northwest with new stores in Portland and Seattle. The story of Kohl’s is a story of profitable expansion. We plan to open approximately 500 stores over the next five years, operating more than 1,200 stores by the end of 2010. New States in 2006 Seattle Portland 732 320 Jacksonville Over the last 10 years, we’ve grown from 128 stores Our merchandising strategies, which are designed to to 732, moving from our Midwest base to become a maximize our existing customer base and attract new leading national retailer. We will continue to build on customers, will also help us to successfully capture a this momentum through a well-defined expansion solid share of the retail market across the country. And strategy that includes both new builds and takeovers with our distribution network, we have the infrastructure New in 2006 Mid-Atlantic Region (77 stores) of existing retail sites. With our three store formats – to support our continued growth. Midwest Region (243 stores) Southeast Region (85 stores) Kohl’s will grow from 128 stores in suburban, small and urban – we have the flexibility to SouthCentral Region (93 stores) Southwest Region (117 stores) 1995 to an estimated 1,232 stores add stores in markets of all sizes. Northeast Region (117 stores) We remain committed to long-term profitable growth, Orlando New State in 2005 128 1995 2000 2010 2005 by the end of 2010. which provides continuing opportunities for our Associates. A Leading National Retailer Number of Stores by Region 3% 1% 1% 5% 12% 16% These charts show Kohl’s evolution 51% 12% over the past 10 years from our Midwestern base to a coast-to-coast 10% 95% 3% national retailer. At the end of 2005, 13% 33% 13% 16% 16% Kohl’s operated in all regions of the country except the Northwest. We will 1995 2000 2005 expand into the Northwest in 2006, Midwest Region Northeast Region Southeast Region beginning in Portland and Seattle. SouthCentral Region Mid-Atlantic Region Southwest Region INSPIRING OUR CUSTOMERS BUILDING OUR BRANDS Kohl’s is the source of inspiration, guidance and style at great value that lets our customer transform the way she looks, lives and feels in the many roles she plays. Our collection of national brands is strategically evolving to meet the desires of our customers and the “Only at Kohl’s” exclusive brand portfolio continues to grow. Kohl’s appeals to a broadening customer base. Regardless of her lifestyle, our customer is a smart Our brands appeal to different customer lifestyles. fashion-forward contemporary look, we offer daisy Our customer can be a busy mom shopping for shopper who knows there is more to value than She may want to be “classic” during the day and fuentes and apt. 9. We also balance our assortment herself, her family and her home. She can also price. She finds what she wants in a single trip “updated” or “contemporary” at night. That’s why of basics and wardrobe fundamentals with fresh be a single woman looking for updated and where compelling merchandise and in-store we’ve focused on those lifestyles in our merchandise styles, exciting silhouettes, new fabrics, trendy colors contemporary fashions or a working woman graphics help her put together the look she wants mix. For a classic look, she can find the traditional and unexpected pieces that surprise her. without children. The styles and looks she wants in a short amount of time. styling she wants in Chaps for her, designed by and needs are constantly changing and Kohl’s is in tune with those changes. Our strategy is to encourage our customer to Polo Ralph Lauren exclusively for Kohl’s, or our In 2006, we will launch Tony Hawk in young men’s private Croft & Barrow brand. and boys’ and West End and AB Studio in women’s. shop more frequently and attract new customers In addition, Stamp 10 by Liz Claiborne will be to our stores by giving her great, new fashion in The updated customer’s roots are in traditional introduced in 300 stores in both women’s and an exciting, easy-to-shop environment. styling, but with modern fabrics and a more men’s. Candie’s and apt. 9 will extend to home and body-conscious fit. National brands such as axcess we will launch the popular Yankee Candle brand. and Nine & Company in women’s and axcess and We will complete the repositioning of our biggest Axist in men’s satisfy this customer. Our private private brands, Croft & Barrow, Sonoma, and apt. 9, brand, Sonoma, provides value for both our to appeal to three different lifestyles: classic, updated women’s and men’s updated customer. For a and contemporary. THE KOHL’S BRAND PORTFOLIO Kohl’s has the exciting styles that appeal to the lifestyles of our classic, updated and contemporary customers. Our portfolio of national and exclusive brands continues to grow with the names our customers know and trust. National Brands adidas Aerosoles Arrow axcess Axist Bali Briggs Calphalon Carter’s Champion Chaps Cuisinart Dockers Dyson Gloria Vanderbilt Haggar Jockey KitchenAid Krups Laura Ashley Lifestyles Lee l.e.i. Levi’s Mudd New Balance Nike Nine & Company Norton McNaughton OSHKOSH Reebok Requirements ROYAL VELVET Russell Athletic Sag Harbor Speedo Unionbay Vanity Fair Villager Warner’s ZeroXposur Exclusive Brands American Beauty Candie’s daisy fuentes FLIRT! good skin grassroots Oh Baby! by Motherhood Stamp 10 Tony Hawk Private Brands apt. 9 Croft & Barrow SO... Sonoma Tek Gear Urban Pipeline TRANSFORMING OUR STORES Finding everything she needs to fit her lifestyle and having a great in-store experience keep customers coming back to Kohl’s. For the Kohl’s customer, exciting shopping means classic, updated and contemporary merchandise to finding a well-edited selection of brands in an inspiring guide her to the section of the store that best reflects and hassle-free environment. In 2005, we organized her lifestyle. our stores to reflect the way our customer naturally shops. Throughout the store, we added colorful, Brands, value and convenience are compelling reasons back-wall graphics that highlight trends and brands to shop at Kohl’s. But what makes the Kohl’s shopping and make departments easier to find. Strategically experience really special is our friendly, knowledgeable placed mannequins differentiate departments and Associates. They are well trained to meet customer show her how to put outfits together. expectations and to provide friendly, helpful customer service. Our customers indicated their satisfaction In spring 2006, we reorganized the floor layout in with the Kohl’s experience by giving us a #1 ranking misses’ by lifestyle. Many of her items mix and match in customer satisfaction for the fourth consecutive – taking her from day to night – from the office to a year on the American Customer Satisfaction Index movie. Our new misses’ department will separate prepared by the American Society for Quality. This Kohl’s A Team worked side by side with neighbors to construct the first of five new Chicago playgrounds built to the latest Consumer Products Safety Council standards. The playgrounds are part of the Kohl’s Cares for Kids® Safety Network program. PA RT N E R I N G W I T H O U R C O M M U N I T I E S Every day across the country, Kohl’s is putting time, effort and funding toward health and educational opportunities for children. Kohl’s is a strong partner in our communities through programs through the Kohl’s A Team. Associates volunteer their involving our company and our Associates. In 2005, we time and talent to support youth-serving organizations and donated more than $22 million to support our communities Kohl’s supports their efforts with corporate grants. The nationwide. Kohl’s Fundraising Card program is a simple, effective way for schools and other youth-serving nonprofit organizations Kohl’s Cares for Kids is not just a program. It’s a to raise money to purchase supplies and equipment. In 2005, promise of hope for a brighter, healthier future for kids in Kohl’s supported more than 3,000 nonprofit organizations. ® our communities. Throughout the year, Kohl’s sells special Financial Summary Fiscal Year 2004(a) 2005 2003(a) 2002(a) 2001(a) 2000(a) Summary of Operations (In millions) Net sales Gross margin Selling, general & administrative expenses Preopening expenses Depreciation and amortization Operating income Interest expense, net Income before income taxes Net income $13,402 4,763 2,964 44 339 1,416 70 1,346 842 $11,701 4,114 2,584 49 288 1,193 63 1,130 703 $10,282 3,395 2,158 47 239 951 73 878 546 $ 9,120 3,139 1,884 41 193 1,021 56 965 601 $ 7,489 2,565 1,583 33 159 790 50 740 458 $ 6,152 2,096 1,328 36 128 604 46 558 343 Diluted Earnings Per Share $ $ $ 1.59 $ 1.75 $ 1.35 $ 1.02 (b) $ 1,902 3,316 6,691 1,076 4,212 14.1% $ 1,776 2,734 6,311 1,059 3,532 19.0% $ 1,584 2,196 4,927 1,095 2,803 18.3% $ 1,199 1,725 3,853 803 2,217 17.6% 2.43 2.04 Financial Position Data (Dollars in millions) Working capital Property and equipment, net Total assets Long-term debt Shareholders’ equity Return on average shareholders’ equity $ 2,520 4,544 9,153 1,046 5,957 15.3% $ 2,187 3,988 7,979 1,103 5,034 15.2% Other Data Comparable store sales growth Net sales per selling square foot Stores open at year end Total square feet of selling space (In thousands) 3.4% 252 732 56,625 $ $ 0.3% 255 637 49,201 $ (1.6)% 268 542 41,447 5.3% 284 457 34,507 $ 6.8% 283 382 28,576 $ 9.0% 281 320 23,610 $ (a) Results for the 2000-2004 fiscal years have been restated to reflect expensing of stock options. (b) Adjusted for stock split. R E P O RT O F M A N A G E M E N T The management of Kohl’s Corporation is responsible for the integrity and objectivity of the financial and operating information contained in this Annual Report, including the consolidated financial statements covered by the Report of the Independent Registered Public Accounting Firm. These statements were prepared in conformity with generally accepted accounting principles and include amounts that are based on the best estimates and judgments of management. merchandise in our stores with 100% of the net profit In the fall of 2005, Kohl’s and our Associates rallied to The consolidated financial statements and related notes have been audited by Ernst & Young LLP, independent registered public accounting firm, whose report benefiting health and educational opportunities for children support the victims of Hurricane Katrina. Kohl’s matched is based on audits conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States). As part of its audit, the nationwide. In 2005, we partnered with 75 children’s hospitals the contributions of Associates to the National Red Cross in 41 states to fulfill the health element of our Kohl’s dollar-for-dollar, for a combined contribution of more Cares for Kids mission. than $500,000. ® firm performed a review of the Company’s system of internal controls and conducted such tests and employed such procedures as considered necessary to render its opinion on the consolidated financial statements. The Company’s consolidated financial statements including the Report of the Independent Registered Public Accounting Firm are included in the Company’s Form 10-K for the year ended January 28, 2006. The Audit Committee of the Board of Directors is composed of three independent Directors. The Committee is responsible for assisting the Board in its oversight of Kohl’s financial accounting and reporting practices. The Audit Committee is directly responsible for the compensation, appointment and oversight of the Our annual Kohl’s Kids Who Care® scholarship program Kohl’s is also taking a leadership role in supporting a is an opportunity for us to recognize and reward youth who healthy, active lifestyle for kids as the official department volunteer in their communities. In 2005, we honored more store of U.S. Youth Soccer. In 2005, the Kohl’s than 1,000 young volunteers. Also in 2005, Kohl’s American Cup soccer tournament visited 36 states Associates volunteered more than 20,000 hours of service and welcomed over 40,000 youth participants. Company’s independent registered public accounting firm. The Audit Committee meets periodically with the independent registered public accounting firm, as well as with management, to review accounting, auditing, internal accounting control and financial reporting matters. The independent registered public accounting firm has unrestricted access to the Audit Committee. Larry Montgomery Wesley S. McDonald Chairman and Chief Executive Officer Executive Vice President - Chief Financial Officer Executive Committee Back row: Donald A. Brennan, Executive Vice President – General Merchandise Manager, Men’s and Children’s; Jon Nordeen, Executive Vice President – Planning & Allocation; Gary Vasques, Executive Vice President – Marketing; Kenneth Bonning, Executive Vice President – Logistics; John Worthington, Executive Vice President – Director of Stores; Telvin Jeffries, Executive Vice President – Human Resources; Chris Capuano, Executive Vice President – General Merchandise Manager, Home and Footwear; Richard D. Schepp, Executive Vice President – General Counsel, Secretary. Bottom row: Peggy Eskenasi, Executive Vice President – Product Development; Jack Boyle, Executive Vice President – General Merchandise Manager, Women’s Apparel and Accessories; Wesley McDonald, Executive Vice President – Chief Financial Officer; John J. Lesko, Executive Vice President – Administration. (Larry Montgomery, Kevin Mansell and Arlene Meier also serve on the Executive Committee). Corporate Headquarters Directors Kohl’s Corporation N56 W17000 Ridgewood Drive Menomonee Falls, WI 53051-5660 (262) 703-7000 Web site: www.kohls.com Jay H. Baker Kevin Mansell Retired President, Kohl’s Corporation (b) (c) President, Kohl’s Corporation Steven A. Burd Arlene Meier Chairman, President and Chief Executive Officer, Safeway Inc. (b) (c) Chief Operating Officer, Kohl’s Corporation Wayne Embry Chairman and Chief Executive Officer, Kohl’s Corporation Transfer Agent and Registrar The Bank of New York Shareholder Relations Dept. 11-E P.O. Box 11258 Church Street Station New York, New York 10286 (800) 524-4458 Web site: www.stockbny.com Annual Meeting The Kohl’s 2006 Annual Meeting of Shareholders will be held on Wednesday, April 26, 2006 at 10:00 a.m. at the Midwest Airlines Center, Milwaukee, Wisconsin. Investor Information/ Quarterly Reports For quarterly earnings reports and other investor information, please visit our Web site at www.kohls.com or direct your inquiries to the company, Attention: Investor Relations. Form 10-K Parts I-III of Kohl’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, are included with this report for all shareholders. Senior Advisor to the General Manager of the Toronto Raptors (a) (c)* James D. Ericson R. Lawrence Montgomery Frank V. Sica President, Menemsha Capital Partners, Ltd. (b) (c) Retired Chairman, President and Chief Executive Officer, Northwestern Mutual Life Insurance Company (b)* (c) Peter M. Sommerhauser Shareholder in the law firm of Godfrey & Kahn, S.C. Stephen E. Watson Retired President and CEO, Gander Mountain, L.L.C. (a) (c) John F. Herma Retired Chief Operating Officer, Kohl’s Corporation (a) (c) R. Elton White Retired President, NCR Corporation (a)* (c) William S. Kellogg Retired Chief Executive Officer, Kohl’s Corporation (a) 2005 Audit Committee (b) 2005 Compensation and Stock Option Committee (c) 2005 Governance and Nominating Committee * Denotes Chair Common Stock Price Range Fiscal 2005 First Quarter Second Quarter Third Quarter Fourth Quarter High $53.86 58.90 57.44 50.96 Low $45.26 46.50 43.63 42.78 Fiscal 2004 First Quarter Second Quarter Third Quarter Fourth Quarter High $54.10 48.83 52.86 53.24 Low $39.59 40.10 43.70 45.40 F O R WA R D - L O O K I N G S TAT E M E N T S Certain statements made within this report are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements reflect management’s current views of future events and financial performance. These statements are subject to certain risks and uncertainties which could cause Kohl’s actual results Stock Listing/Shareholders Kohl’s common stock is listed on the New York Stock Exchange under the symbol KSS. As of March 1, 2006, there were 5,973 holders of record of Kohl’s common stock. to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, those described in Exhibit 99.1 to Kohl’s annual report on Form 10-K and other factors as may periodically be described in Kohl’s filings with the SEC.