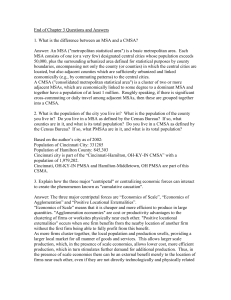

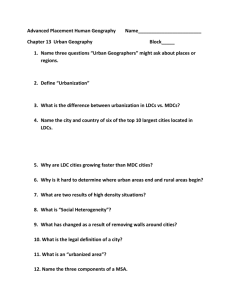

Louisiana Economic Outlook 2015-2016

advertisement