tort liability for intentional acts of family members

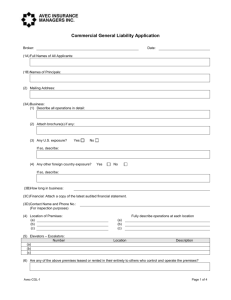

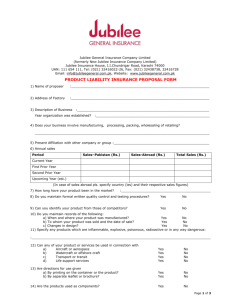

advertisement