tort liability for intentional acts of family members

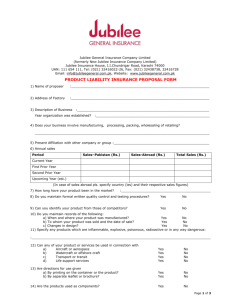

advertisement