Tax-Efficient Savings Plan For Hourly Employees

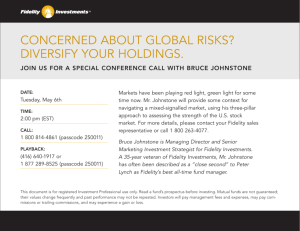

advertisement