Efficiency and Equality in Economic Analysis of Law

advertisement

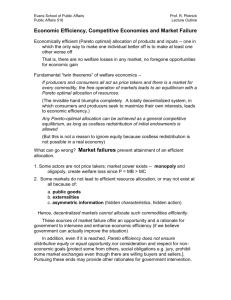

Economic Analysis of Law and the Value of Efficiency forthcoming in Aristides N. Hatzis ed. Economic Analysis of Law: A European Perspective (Cheltenham, U.K.: Elgar 2005) Bruce Chapman Faculty of Law, University of Toronto bruce.chapman@utoronto.ca Economic analysis of law can usefully be divided into three types (Trebilcock 1997). Two of these are positive forms of analysis, and the third is normative. The positive analyses purport to use economics either to describe how things are, or to predict how things will be, but they do not seek either to assess or prescribe how things should be. Thus, in the first form of positive analysis, positive theories of legal doctrine, the claim is that economics offers a very useful way (perhaps even the most useful way) to understand legal doctrines as they are, and to comprehend why the law might make the distinctions that it does. For example, the rules of negligence liability are best understood, the argument might go, as incentives to shape the behaviour of parties so that the costs of accidents are either efficiently avoided or distributed (Landes and Posner 1997). But no claim is made that these rules, understood in this way, are the best rules, or that values other than economic efficiency might not be worthy of pursuit. Likewise, in the second form of positive analysis, legal impact analysis, where the gaze shifts from an understanding of legal doctrine as developed by judges and other law makers to the prediction of how economic actors will respond to various legal rules, the claim, again, is that these are only predictions about behaviour. The economist as positivist makes no claim that these predictions about the impact of legal rules have any special implications for what the law should be. Thus, for example, when the economist predicts that individuals might take less care driving their cars if there is a legal 2 obligation to wear a seatbelt, because the wearing of a seatbelt lowers the cost of an accident to the driver when it occurs, the point stops there (Peltzman 1975). The idea is not to suggest, as a normative matter, that we should question the propriety of having any such legal obligation to wear our seatbelts. However, in the third type of economic analysis, the agenda is overtly normative. Social values are explicitly advanced as attractive ones for society to adopt in the making of legal rules. In economics the primary value is Kaldor-Hicks efficiency (named after the two prominent British economists who first articulated it) or wealth maximization, a value, we shall see, that the economist has sought to derive from the closely related values of Pareto superiority and Pareto optimality. Thus, in normative economic analysis of law, the claim is that legal rules should be shaped so as to promote Kaldor-Hicks efficiency, and it is grounds for criticizing a legal rule if it ignores this consideration (Zerbe 2001). Thus, for example, if a rule of strict liability can be shown to provide better incentives for the efficient avoidance and distribution of accident costs than the currently prevailing negligence rule (a claim that will likely also make use of legal impact analysis), then, all else equal (for example, the costs of litigation), that will count as a reason for the law to adopt the strict liability rule. In this essay, I shall try to explain in some greater detail what is entailed by a normative prescription for law based on Kaldor-Hicks efficiency or wealth maximization, and offer some reasons for being cautious about being guided by it. In the course of my analysis I will have reason to emphasize the difference between wealth and welfare, and show how a single-minded pursuit of the former can frustrate our enhancement of the 3 latter. Indeed, I will demonstrate that the systematic pursuit of wealth maximization can make us all worse off. My analysis will also borrow from social choice theory and suggest an economic interpretation of the relevance that a common social consensus or community morality might have for the enhancement of individual welfare under legal rules. In the final analysis, this essay will show that the value of Kaldor-Hicks efficiency provides a much less secure basis for assessing and prescribing law than the economist thinks, and that it needs to be heavily supplemented by a concern for a common social consensus if the law is achieve anything of real value in terms of human welfare. I will finish by raising some more fundamental concerns about the single-minded pursuit of welfare and argue that there may even be some reason to doubt that we should share the economist’s allegiance to the principle of Pareto efficiency from which the principle of Kaldor-Hicks efficiency is derived. I. Kaldor-Hicks Efficiency and its Paretian Pedigree Suppose two individuals form a market contract to their mutual satisfaction, and that the contract has no external effects, that is, that the contract for the exchange or reallocation of certain goods does not affect anyone else in any way. If the two individuals feel better off in virtue of the contract (and why else would they choose to make the contract?), and no one else feels any worse off (as no one else is affected), then the contract has brought about what economists call a Pareto superior state of affairs: at least one person is better off than she was, and no one is worse off. We can also say that the 4 contract has increased total welfare (or satisfaction); if welfare has increased for each of the two contractors, and not been decreased for anyone else, then the total amount of welfare must be up overall. Note also what we cannot say. First, we cannot say that total welfare is maximized because of the contract; we can only say that it has increased. This could be because there are even more contracts that could be made, which further increase total welfare. Economists refer to the state of affairs from which no further Pareto superior reallocations can be made as a state of Pareto optimality. Thus, Pareto superiority refers to a comparison (or a move) between two states of affairs, and Pareto optimality is an attribute of a given state of affairs (Coleman 1988). Second, we also cannot say that the goods or services have been transferred by contract to someone who values them more highly (in terms of welfare) than the person who originally had them (Posner 1980). That would require us to compare the welfare gains and losses of different individuals for the goods being transferred. But the source of the social gain in a contract is not to be found in any such interpersonal comparison, at least if we restrict ourselves to the economist’s idea of Pareto superiority. Rather, the social gain in a contract is to be found in intrapersonal comparisons only, namely, in the idea that no one person (given contractual compensation) is worse off in terms of his or her own welfare or satisfaction after the exchange than that person was before it, and at least one person (willing to pay the compensation) is better off. These intrapersonal comparisons are quite consistent with the possibility that, if an interpersonal comparison were made, one of the goods or services exchanged was actually going from someone who valued it more highly in welfare terms to someone who valued it less highly. To see 5 the point vividly, imagine someone who is both cold and hungry, and who, in exchange for some much needed food, gives up her warm jacket to another person who is neither cold nor hungry. One can easily appreciate that this might be a Pareto superior exchange in which each party is better off, but that, nevertheless, the jacket was more highly valued in an interpersonal sense by the person who was cold. This is a significant point for understanding the value of Kaldor-Hicks efficiency and we will have reason to reconsider it below. Of course, contracts are not the only way in which Pareto superior re-allocations can be made, and Pareto efficiency achieved. In theory some legal authority could simply mandate some new state of affairs in which some one was better off and no one was worse off, perhaps because financial compensation was required to be paid to the latter. Thus, the voluntarism that is present in market contracting, and which might be attractive to a libertarian concerned about rights, is not strictly necessary for the achievement of Pareto superior re-allocations of goods. But economists do tend to prefer the use of contracts where possible, since the information needed to assess how a proposed reallocation might affect the welfare or satisfaction of individuals is often difficult for third parties to obtain. On the other hand, if all individuals agree to some re-allocation, the general view amongst economists is that this must be because, in their own best judgement, each individual considers himself or herself better off after the re-allocation than before it or, at least, not any worse off. Nevertheless, it will sometimes be difficult for the parties to contract so as to achieve the Pareto superior state of affairs. This will typically be because there are transactions costs, namely, information costs, negotiation costs, and enforcement costs in 6 the contracting process. Suppose, for example, that downstream users have a right to receive clean stream water from upstream users, but that an upstream polluting factory would rather, because it is cheaper than cleaning up the stream, pay the downstream users to use an alternative supply of bottled water. Suppose too that the downstream users would be quite happy with this solution to their clean water needs. Nevertheless, it may be difficult for the firm to identify all the different downstream users (an information cost), to bargain with each and every one (a negotiation cost), and to strike a bargain that has terms that are both easy for the parties to observe for compliance and to verify to a court (the costs of enforcement). Thus, the Pareto superior bottled water solution might not arise by contract. In such circumstances it might be better to have the same reallocation of resources achieved in some other way that avoids the costs of contracting, perhaps by regulation, or by a court injunction providing for some new entitlement. (Of course, these other methods of resource allocation will have their own sorts of transactions costs to be considered.) A court could mandate that the downstream users use bottled water, for example, or, more likely, simply not enjoin the firm from polluting the stream, leaving the downstream users to buy bottled water on their own as the next best alternative to having it paid for by the firm. In this way, the court appears to mimic the market outcome (Coleman 1988). The same allocation of resources that the parties would have achieved by way of contract (had the costs of contracting not been prohibitive), namely, the use of bottled water by the downstream users, is achieved by way of a court decision. The court simply gives to the polluting firm the right to pollute, a right that the firm would have bought from the downstream users (by financially 7 compensating the downstream users for the costs of bottled water) had the costs of contracting been less. Of course, there is a crucial difference between achieving this outcome by way of a mandatory order and achieving it by contractual agreement with the downstream users. One has only to ask the downstream users! In the contract, the polluting firm has to make a payment to the downstream users to use the bottled water, something it was prepared to do and they were prepared to accept. Thus, in the contractual solution, there is a truly Pareto superior move. No one is worse off, and someone is better off. However, in the court’s solution, the downstream users are given a dirty stream and left to pay for the substitute bottled water on their own. They are clearly worse off than they were before the court’s mandatory order. The economist often describes the mandated solution as involving Kaldor-Hicks efficiency, or potential Pareto superiority rather than actual Pareto superiority (Posner 1980). After all, but for the costs of actual contracting, the parties could have voluntarily bargained to the result where bottled water was used and the stream was allowed to become dirty. Under the court’s mandated solution, the argument goes, we have achieved the same result in the allocation of resources, or the same amount of wealth. The only difference is that the downstream users have not actually been financially compensated by the polluter for the costs of substituting bottled water for stream water, although they could have been. This points to the difference between potential Pareto, or Kaldor-Hicks, superiority and actual Pareto superiority. 8 II. Wealth versus Welfare Now, it is tempting for the economist to dismiss this difference between an actual Pareto superior gain and a potential Pareto superior gain as merely involving a question of distribution. After all, given the same resulting allocation of resources, it seems that there must be the same total social gain. The difference, it might be thought, is only that, when the new allocation is mandated, and the downstream users are not contractually compensated, they do not share in the social gain in the way that they would if there was a contract. However, it is wrong to think that this is the only difference between a Pareto superior reallocation and a Kaldor-Hicks or potential Pareto superior one. In fact, if the courts only mimic the market in a Kaldor-Hicks superior way, and do not insist on the actual Pareto superiority that is achieved when financial compensation is paid, it is possible that there may be no social gain in welfare at all. This must surely make us wonder about what is achieved by way of Kaldor-Hicks efficiency. To see the problem, one needs to remember the earlier point that a Pareto superior contractual exchange is quite consistent with there being a re-allocation of some good from a person who values the good more highly to a person who values the good less highly in terms of human welfare. This point is often obscured when the economist speaks about the Kaldor-Hicks re-allocation as generating sufficient gains for the beneficiaries of the re-allocation such that, hypothetically, the beneficiaries could (by contract) compensate the losers from the re-allocation so as to render them indifferent to it and still have some gains left over for themselves. While not, strictly speaking, 9 inaccurate, this way of characterizing the social gain suggests that the welfare gain to the beneficiaries of securing the good is larger than the welfare loss to the losers of losing it, an interpersonal comparison. After all, the argument goes, the beneficiaries could compensate the losers for their losses and still have some of their own gains left over. But, as already argued, the source of the social gain in a Pareto superior exchange is to be found in intrapersonal, not interpersonal, comparisons of welfare. It might be that the person giving up the good valued that good more highly than did the person receiving it, but that this social loss was more than made up for in the contract by the fact that the person giving the good up nevertheless valued the financial compensation that she was to receive in the contract (or, more specifically, what that money would buy for her elsewhere) even more than she did the good transferred. However, in a Kaldor-Hicks superior re-allocation, where only the good or entitlement is exchanged, but financial compensation is not actually provided, we have lost the assurance that any possible loss in the transfer of the good to someone who values it less highly has been properly offset for that person by the welfare gain she receives in having money to spend on other goods she prefers. Thus, it is possible that all we have accomplished is the transfer of a good from someone who values it more highly to someone who values it less highly and, therefore, a loss of total welfare overall. The prospect of a loss of total utility overall within a given re-allocation raises an even more serious question. Could not a series (or a system) of such Kaldor-Hicks reallocations lead to an outcome in which everyone is worse off than when they started, that is, to a Pareto inferior state of affairs? If this could be shown to be possible and, further, possible given some plausible assumptions, then we should surely begin to wonder if the 10 notion of Kaldor-Hicks efficiency has not taken us too far from what was originally so attractive about Pareto superiority and Pareto optimality. III. Kaldor-Hicks Efficiency and Pareto Inferiority The easiest way to see the possibilities is by recognizing, first, that competitive market contracting is a kind of Kaldor-Hicks superior allocation. Competitive contracting is contracting between two parties that does affect a third party. Specifically, the third party is less well off than she was before the contract because she has lost the business that she previously had with one of the parties. In economic terminology, she is the victim of a pecuniary externality, the stuff of market competition. However, economists are not inclined to worry about this sort of externality (as opposed to a technological externality like pollution) because the external effect is priced in the market and the good is allocated according to willingness to pay (Posner 1980). The loser in the competition lost the benefit of the contract because she had a lesser willingness to pay (or, perhaps, a lesser willingness to reduce prices) than the competitor who secured the contract. Again, this will be because she had better uses for her money elsewhere, another sort of intrapersonal comparison. It is not because, in some interpersonal sense, the good available in the contract was more valuable to her competitor than it was to her. The competition is Kaldor-Hicks efficient because the winner in the competition was obviously prepared to pay more for the contract than the loser was and, therefore, more than what the loser would have needed to be compensated for choosing her next best alternative. 11 Let us denote the state of affairs before this new contract (contract #1) as z. This is the state of affairs that prevailed before our competitive loser, call her C, lost her prior business with A to her new competitor B. Denote the new post-contractual state of affairs as y. Obviously, both A and B, the contractors, prefer y to z; C, the competitive loser, prefers z to y. Or, equivalently, they are better off in terms of their preferences and she is worse off in terms of hers. Thus, while this process of contracting does result in a KaldorHicks superior re-allocation, it does not bring about one that is Pareto superior. Now, once in state of affairs y, suppose, in a fully analogous way, that individuals A and C sign their own Kaldor-Hicks contract (contract #2) to their mutual advantage, bringing about state of affairs x, which is disadvantageous to B. Finally, imagine further that in state of affairs x, B and C sign a Kaldor-Hicks efficient contract (contract #3) to their mutual advantage, which is to the disadvantage of A, producing state of affairs w as the final social outcome. Thus, in a series of three different Kaldor-Hicks efficient contracts, we have moved through the different states of affairs from z to y to x to w. The impact of these three different contracts on the preferences of the three individuals, together with what we can surmise about these preferences given an assumption that individual preferences are transitive, is summarized in Table 1. Table 1 Preferences as Revealed by Three Kaldor-Hicks Efficient Contracts Assume three Kaldor-Hicks efficient contracts from state of affairs z to y, from y to x, and from x to w: Contract #1 Contract #2 Contract #3 By transitivity Individual A y preferred to z x preferred to y x preferred to w x preferred to z Individual B y preferred to z y preferred to x w preferred to x Individual C z preferred to y x preferred to y w preferred to x w preferred to y 12 The important thing to note about these preferences is that for each and every individual the preference ranking between state of affairs z, where the whole contractual sequence started, and state of affairs w, where it finished, is so far undetermined. We are now ready to pose the question: Could it be that this sequence of Kaldor-Hicks efficient contracts has only resulted in a Pareto-inferior state of affairs, that is, one in which each individual is worse off than when the sequence started, and over which all individuals prefer the original state of affairs z? To see that such a result is not inconsistent with the preferences implied by the three Kaldor-Hicks efficient contracts, it is enough if we can explicitly introduce this possibility (that is, the possibility that, for all individuals, z is preferred to w) into the preferences shown in Table 1 without producing a contradiction (Chapman 1994). Table 2 shows the result, a result that allows for a complete and fully transitive determination of each individual’s preference ordering over all four of the possible states of affairs (now ordered by preference for each individual from top to bottom in one of the three columns). 13 Table 2 Kaldor-Hicks Contracting and Pareto Inferior Outcomes Assume the preferences in Table 1 and, additionally, that all individuals prefer state of affairs z to state of affairs w: Individual A Individual B Individual C x y z y z w z w x w x y Thus, given these individual preference orderings over the four states of affairs, the three Kaldor Hicks efficient contracts can take these individuals from z to y, from y to x, and from x to w, and generate a Pareto inferior outcome, or an outcome (w) in which every individual is worse off than when he or she started (in outcome z).1 Now it might be thought that these must be particularly odd preference orderings, and that this sort of perverse Kaldor-Hicks sequence should not generally be expected. In fact, there is something special about the profile of individual preferences shown in Table 2, although in the context in which this preference profile is usually discussed it is not thought to be particularly odd. The preferences that these three individuals have over the alternative states of affairs w, x, y, and z, are the sort of preferences that generate the majority voting paradox, a problem commonly discussed in public and social choice theory (Mueller 1989). One can see the problem if one imagines that, instead of the three individuals choosing by contract to move between the various states of affairs, they do so 14 by majority vote. By inspection of Table 2, we can see that a majority of the voters, considering the various states of affairs in pairs (so as to ensure a majority), would choose y over z, x over y, w over x, and (if they could reconsider a previously rejected alternative) z over w (unanimously). Thus, every alternative has another alternative that is preferred to it by a majority, and it would be impossible for a majority of these individuals to choose anything but a minority preferred alternative. That is the paradox of majority voting. Of course, if the group adopted the rule that they would not reconsider or revisit an alternative that had previously been rejected by a majority (perhaps doing so because they did not want to cycle endlessly from one alternative to another that was majority preferred to it), then they might well end up choosing a Pareto inferior outcome. Indeed, that is exactly what they would do if they followed the same sequence as our earlier Kaldor-Hicks contractors, going by majority vote from z to y, from y to x, and from x to w. In state of affairs w, everyone is worse off than they were in state of affairs z where the sequence began. Thus, the Table 2 preference profile, which has been shown here to be problematic for Kaldor-Hicks superior re-allocations (in that a series of such contractual re-allocations can produce a Pareto inferior outcome), is the same profile that is commonly discussed, and accepted, as problematic for majority voting. Thus, the literature in public and social choice theory that has analyzed this preference profile in some detail is relevant not only to voting mechanisms, where decisive majorities move groups of individuals between states of affairs (often at the expense of minorities), but also to Kaldor-Hicks efficient contracting, where the same moves are accomplished by decisive pairs of contracting partners (often at the expense of competitors). (This should 15 not be surprising, of course, given the general nature of the impossibility results in social choice theory; see Arrow (1963).) It is worth considering, therefore, what else this literature can tell us about the value of pursuing Kaldor-Hicks efficiency. IV. Value-Restricted Preferences and the Need for Social Consensus The first insight that this literature provides is that the Table 2 preference profile is problematic because of the pattern of preferences that it reveals across all the individuals taken together rather than because of the particular preference ordering that any one individual might have. Specifically, the difficulty is that the preference profile of the three individuals in Table 2 fails to manifest the very particular kind of social consensus that is required if social choice problems, like the Kaldor-Hicks and majority voting paradoxes, are generally to be avoided. Public choice economists, when they discuss this problem in a voting context, emphasize the idea that the problem in Table 2 is that the individual preferences there are not single peaked (Mueller 1989). When preferences are single peaked, this means that all the individuals agree that, for every set of three alternatives, (1) there is a single attribute with respect to which all three alternatives for choice can be decisively ranked, and (2) one of the three alternatives has an intermediate amount of that decisive attribute. If both of these conditions are satisfied, then the intermediately placed alternative will be either best (for those moderates who most prefer an intermediate amount of the decisive attribute) or in between (for those extremists who most prefer either a lot, or a little, of the decisive attribute). But the intermediately placed alternative will never be a worst 16 alternative of the three for any of the individuals, that is, one with two more preferred alternatives (or two peaks) on either side. (If the intermediate alternative was a worst alternative for some individual, such that the individual preferred either extreme to it, then that individual would be revealing either that the dimension was not decisive for him after all, or that this alternative was not, in his view, the intermediate one on that decisive dimension; how else could one explain him ranking both of the extreme alternatives ahead of the intermediate one?) For this reason, the single peaked preference requirement is also sometimes called not-worst value restriction. If this form of value restriction is satisfied, the arguments show, paradoxes of social choice, like the majority voting paradox or the Kaldor-Hicks contracting paradox, cannot occur. As it happens, and as might be suggested by a process of reasoning analogous to that which generates this result on not-worst value restriction, it can also be proved that these paradoxes will not occur if all the individuals agree, for every set of three alternatives, that some one alternative of the three is either not-best, or not-between the other two. In other words, for the paradoxes to occur, it must be that, for at least one set of three alternatives, each of the three alternatives appears as best, as between, and as worst in the preference ordering of at least one of the individuals. When this occurs, it is sometimes said that the preference orderings over those three alternatives form a Latin square (Sugden 1981). In Table 2, one can see that there is a Latin square for the set of three alternatives (x, y, z). Put in this conjunctive way, it might seem that the paradoxes will be of theoretical interest only, since they appear to depend too much on a very specific and unlikely sort of preference profile. However, as the social choice literature shows, this is mere wishful 17 thinking. In multidimensional choice problems, if individuals’ preference orderings satisfy some very plausible requirements (for example, that individuals prefer alternatives according to how “close” they are to their ideal point), then if the space of available alternatives is sufficiently “rich” (or dense), it is almost certain that a problematic Latin square will appear somewhere over some set of three alternatives (McKelvey 1976). Only if the individuals’ ideal points all lie on the same line through the multi-dimensional space will the problem be avoided. However, this effectively reduces the multidimensional problem to a single dimension or attribute (represented by the equation of that line), and avoids the social choice problems herein described by reverting to a kind of not-worst value (or single peaked preference) restriction on that dimension. It seems much more likely that in a multi-dimensional choice problem (and how many problems can be reduced to one dimension?) the ideal points of the different individuals will not lie along the same one line and, therefore, the problematic preference profile, or Latin square, will be present. The problems inherent to a multi-dimensional choice problem and, more particularly, the idea that such a choice problem may generate the special diversity of views that we see in a Latin square, might be obscured for an economist who equates Kaldor-Hicks efficiency with the idea of wealth maximization. After all, the goal of wealth maximization appears to be uni-dimensional. At most it would seem that there would only be disagreements about a particular wealth maximizing move which imposed some short term loss on some particular party. But what individual would not want to maximize wealth over the long run, or over a sequence of such wealth enhancing reallocations, especially if there was a real prospect of sharing in this overall long run gain 18 in social wealth? However, what Table 2 shows is that wealth enhancing re-allocations, as measured by the greater willingness to pay of the beneficiaries as compared to those burdened by the re-allocation, are quite consistent with the diversity of views that is characteristic of, and problematic for, multi-dimensional social choice. Thus, wealth need not be some one thing that all individuals want more of. Rather, it can be a diversity of different things, all somewhat misleadingly grouped under this singular word “wealth”. In the final analysis, what Table 2 shows that it is possible that a series of Kaldor-Hicks or wealth enhancing re-allocations can add up to an outcome in which we are all worse off. This possibility suggests that the economic theorist of legal decision-making should be interested in finding ways to prevent legal decisions being responsive to the particular profile of preferences that are represented in Table 2 even if this means denying some Kaldor-Hicks efficient re-allocations. To the extent that a concern for the existence of a restricted preference profile is akin to a concern for whether or not shared values are informing our legally privileged choices, then we are asking the economist to show more interest in the relationship that should exist between law and social morality. This, of course, has been the stuff of longstanding debate in legal theory (Hart 1963; Devlin 1965), and the thought that economic analysis might make some sort of contribution to that debate should not be entirely unwelcome (Chapman 1979). From the analysis presented here, we can see that one important contribution is already at hand. With the help of social choice theory, economics can tell us precisely what sort of social consensus or social morality is required to exist if society is to consistently achieve its goal of enhancing the welfare (and not just the wealth) of its 19 members. Specifically, for every set of three alternatives for choice, every individual should agree that one of the alternatives is either not worst, or not best, or not-between the other two. However, we have seen that it is unlikely that this sort of social consensus will arise as a matter of brute fact, and it would be interesting, therefore, if this analysis could suggest some institutional requirements for the legal reinforcement of the required social morality. For this the public choice literature should be useful. For example, it has been shown that by restricting variations between alternatives for choice to one dimension at a time, majority voting can avoid some of the difficulties that it would otherwise confront in a multidimensional choice problem if changes on all dimensions can be proposed simultaneously (Strom 1990). (Under such a method of choice the alternative finally chosen is that one that is at the intersection of all the different median voters’ most preferred amounts on each dimension.) Further, in the context of corporate law, it has been argued that if managers’ and directors’ fiduciary obligations are interpreted as being owed to stakeholders more broadly, and not just to shareholders alone, then certain Kaldor-Hicks contractual coalitions, which might otherwise threaten the corporation with Pareto inferior outcomes, are less likely to form (Chapman 1993). The problem is particularly acute in so-called “end games”, where shareholders seek the cooperation of the firm’s managers in the sale of their shares to an opportunistic acquirer. This last argument, of course, focuses the analysis more on the benefits that a firm might gain from recognizing its own corporate culture, and is less about the advantage that society might gain from reinforcing a common social morality. But the lesson for these different sorts of collectivity is 20 essentially the same. Without some restrictions on the opportunities that are made available to decisive coalitions, be they voting majorities or contracting parties in pursuit of Kaldor-Hicks efficiency, there is a real danger that the cumulative effect of otherwise uncoordinated decisions will be a Pareto-inferior state of affairs, that is, one in which everyone is worse off than they otherwise might be. V. Questioning the Very Idea of Pareto-Superiority To this point the argument has essentially been that legal rules designed to advance Kaldor-Hicks efficiency or, equivalently, the maximization of wealth, will only provide the illusion of advancing human welfare unless certain restrictions on individual preferences are also accounted for in the law. While this argument might mean that our enthusiasm for Kaldor-Hicks efficiency and wealth maximization has to be somewhat qualified, we can still be grateful that the tools of economic analysis have been useful in informing, in a very precise way, an age-old debate about the relevance of social consensus and morality for law. Given a sufficiently rich diversity of individual preferences, the rights to form certain decisive coalitions, be they majority voting coalitions or Kaldor-Hicks efficient contractual coalitions, may have to be restricted if losses in human welfare, and Pareto-inferior states of affairs, are to be avoided. This last way of putting the point may suggest that there is a normative trade-off between, on the one hand, respecting certain individual rights and freedoms and, on the other hand, securing certain gains in overall human welfare, even (Pareto superior) gains in which everyone has some sort of share. That there is this tradeoff is easy enough to 21 demonstrate. The following example is a variation on one offered by Amartya Sen (Sen 1970). It illustrates, in the context of certain preferences, the possibility of an incompatibility between a very minimal conception of individual rights and the satisfaction of the principle of Pareto superiority. Suppose that there are multiple copies of some controversial book at some public library. The book is controversial because of its content. Some would like to see the book banned from the shelves or, at least, kept away from impressionable readers. Others, who think the book is a truly great piece of literature, would like to see it much more widely read. (If it helps to have an example of such a controversy, one might think of the book Lolita by Vladimir Nabokov; Sen’s original example, Lady Chatterley’s Lover, now seems somewhat dated.) Everyone has the right to read the book, or not, as he or she chooses. Consider two individuals, Patrick and Herbert, each of whom is representative of one side of the controversy. Patrick, who objects to the book, would prefer most that no one read it (state of affairs n), but, failing that, would prefer that only he read it (state of affairs p) rather than that the younger, more impressionable, Herbert read it (state of affairs h). Patrick’s least preferred state of affairs, predictably, is that everyone would read the book (state of affairs e). Herbert, on the other hand, would prefer most that everyone would read the book, and considers the state of affairs in which no one reads it to be worst of all. But, if only one sort of person should go to the library and read the copies that are there, Herbert thinks that it would be better that people like Patrick should go. He thinks that they have so much more to learn from reading the book than do more liberal people like Herbert. Thus, where Patrick ranks the four states of affairs in the order (from left to right) n, p, h, e, Herbert ranks them in the order e, p, h, n. 22 What would happen if these individuals simply exercised their rights of choice to read the book or not? Although we are interested, ultimately, in the possibility of a normative tension between rights and welfare, the strategic aspects of the situation are easily represented as a prisoner’s dilemma (in Table 3), and with predictable results. Patrick (and everyone else like him) prefers row 2 to row 1, regardless of what column Herbert chooses (we say, therefore, that row 2 is dominant for Patrick); thus, he chooses not to read the book. Herbert (and everyone else like him) prefers column 2 to column 1, regardless of what row Patrick chooses (column 2 is dominant for Herbert), and so Herbert chooses to read the book. The result is the intersection of row 2 and column 2, or outcome h, the state of affairs in which only Herbert (and others like him) read the book. Note, however, that everyone, including Patrick and Herbert (and everyone like them), considers this outcome to be inferior to outcome p, the state of affairs in which only people like Patrick read the book. Thus, the exercise of individual rights by all those involved has resulted in a Pareto-inferior state of affairs. Table 3 Individual Rights and Pareto Inferiority Patrick 1. Reads the book 2. Does not read the book Herbert 1. Does not read the book 2. Reads the book p e n h 23 Some legal authority could, of course, mandate that only people like Patrick read the book and, therefore, make everyone better off in terms of their own preferences. However, there are obvious practical difficulties. Every Patrick has an incentive to misrepresent himself as a Herbert so that he is not required to read the book. And every Herbert has an analogous incentive to misrepresent himself as a Patrick so that he is permitted to read the book. Each of these non-cooperative strategies makes sense for each of the individuals as it tends to move the individual either towards his most preferred outcome (if no other individual is adopting this non-cooperative strategy) or away from his least preferred outcome (if all the other individuals are likewise adopting the noncooperative strategy). In other words, the prisoner’s dilemma structure of the problem continues to undermine any such mandatory solution. Similarly, any solution to this problem based on contract (Kaplow and Shavell 2001), where the various Herberts and Patricks have the additional right to contract with one another to achieve the Pareto superior state of affairs (where only the Patricks, and not the Herberts, read the book), is going to be subject to this difficulty. After all, if there is a good to be achieved here in having Patrick and others like him read the book, then it is a public good (that is, one for which the benefits of consumption cannot be made available only to those who contributed to the costs of its provision) and, therefore, one that is susceptible in the usual way to individuals free riding on the cooperative behaviour (contractual commitments) of others. Of course, if everyone chooses to free ride, then the public good is not provided and everyone is worse off, a Pareto inferior state of affairs. But the real point of the example is not to spell out a familiar strategic problem, but rather to suggest that the principle of Pareto superiority may not be so sacred after all. 24 If we believe that there is some normative value in allowing people to choose, as a matter of individual right, to read the books they want, then the possibility that everyone might be worse off than they would be if they did not have such rights might well be an acceptable outcome. Of course, this would mean that the normative foundation for such legal rights is grounded in something other than welfare. However, this may not be much of a surprise to anyone but the most avid and single-minded proponent of economic efficiency as a normative foundation for law. 25 BIBLIOGRAPHY Arrow, Kenneth J. (1963), Social Choice and Individual Values, New Haven and London: Yale university Press Chapman, Bruce (1979), ‘Law, morality, and the logic of choice: an economist’s view’, University of Toronto Law Journal, 29 (2), 114-137. ------------------- (1993), ‘Trust, economic rationality, and the corporate fiduciary obligation’, University of Toronto Law Journal, 43 (3), 547-588. -------------------- (1994), ‘The rational and the reasonable: social choice theory and adjudication’, University of Chicago Law Review, 61 (1), 41-122. Coleman, Jules L. (1988), Markets, Morals and the Law, Cambridge and New York: Cambridge University Press. Devlin, Patrick (1965), The Enforcement of Morals, Oxford and New York: Oxford University Press. Hart, H.L.A. (1963), Law, Liberty and Morality, Oxford and New York: Oxford University Press. 26 Kaplow, L. and Shavell, S. (2001), ‘Fairness versus welfare’, Harvard Law Review 114, 961- . Landes, William A. and Posner, Richard A. (1987), The Economic Structure of Tort Law, Cambridge, Mass. and London: Harvard University Press. McKelvey, R.D. (1976), ‘Intransitivities in multidimensional voting models and some implications for agenda control’, Journal of Economic Theory, 12, 472 - 482. Mueller, Dennis C. (1989), Public Choice II, Cambridge and New York: Cambridge University Press. Peltzman, Sam (1975), ‘The effects of automobile safety regulation’, Journal of Political Economy, 83, 677 - . Posner, Richard A. (1980), ‘The ethical and political basis of the efficiency norm in common law adjudication’, Hofstra Law Review, 8, 487 – 507. Sen, Amartya (1970), ‘The impossibility of a Paretian liberal’, Journal of Political Economy, 78, 152 – 157. Strom, Gerald S. (1990), The Logic of Law Making, Baltimore and London: Johns Hopkins Press. 27 Sugden, Robert (1981), The Political Economy of Public Choice, Oxford: Martin Robertson & Co. Trebilcock, Michael J. (1997), ‘An introduction to law and economics’, Monash University Law Review, 23 (1), 123 – 158. Zerbe, Richard O. (2001), Economic Efficiency in Law and Economics, Cheltenham, UK and Northhamptom, Mass.: Edward Elgar. 1 Two points are worth emphasizing at this point to avoid confusion. First, the individuals might not be content to stop at outcome w if it makes them all worse off. They might prefer to return to outcome z. But this is only to say that the problem might manifest itself as a cycle rather than as a choice sequence leading to (and ending in) a Pareto-inferior state of affairs. This alternative scenario is familiar enough to those who study the fully analogous problem in voting theory, namely, the majority voting paradox. On this last point, see the paragraph to follow in the text. Second, it might be thought impossible to distribute wealth, as measured by willingness to pay, over the three transactions (from z to y, from y to x, and from x to w), so that everyone is made worse off than when they started. However, the possibility is real, and it turns on taking the “ability to pay” constraint seriously. Having “paid” for some beneficial transactions, one runs out of the wealth needed to resist the (most) harmful transaction when it appears in the transactional sequence. Of course, one does not actually pay in Kaldor-Hicks efficient transactions, but if willingness to pay is going to mean anything, one has to take the idea of a budget constraint seriously. So, in the table below (which reproduces Table 2 from the text with the following additions), let the willingness to pay of the different individuals for the different transactions be represented by the letters in bold immediately to the right of that individual’s preference ordering. (For ease of exposition, and without loss of generality, the willingness to pay of each individual for z over w has been assumed to be the same, namely, c; c > 0 if z is Pareto-superior to w.) Individual A x Individual B y a y b c w c w c w z d z z Individual C f x e x g y Thus, for example, individual A and individual B would pay b and d respectively for the transaction from state of affairs z to y, and individual C would pay all she can, or c + f + g, to avoid that transaction (the worse possible for her in this scenario). So, if this transaction goes through on Kaldor-Hicks grounds, it must be that: 28 (1) b+d > c+ f + g Analogously, the Kaldor-Hicks approved transaction from y to x implies that the willingness to pay of individual A and individual C for this transaction, or a and g respectively, is larger in aggregate than what individual B is willing (and able) to pay to avoid this transaction, taking into account (or subtracting) that individual B has already spent d in the earlier z to y transaction. In symbols, we have: (2) a+ g > d+ c+ e-d Finally, the Kaldor-Hicks approved transaction from x to w implies analogously (taking into account that individual A has already spent a and b in the earlier transactions) that: (3) e + f > a + b + c – (a + b) Gathering terms on each side of these inequalities implies that: (4) b + d + a > 3c Now, obviously, if the final outcome state of affairs w is Pareto-inferior to the original state of affairs z, then the term on the right hand side is positive (since c > 0). Thus, a Kaldor-Hicks approved sequence of transactions can lead to a Pareto-inferior state if and only if the terms on the left of the inequality are positive and larger than the terms on the right. But there is no reason to think that this is a problematic requirement. Imagine only that c, while positive, is small. Then almost any willingness to pay by individuals A and B for the move from z to y, or any amount that A might pay for the move from y to x, would be sufficient for the result. Of course, this does suggest that A and B are slightly myopic (in that the choice sequence they undertake will end up making them worse off), but that is consistent with the usual demonstration of a majority voting paradox that leads a politically decisive majority to choose a Paretoinferior outcome; on this, see again the next paragraph in the text.