Doing business in Tunisia

advertisement

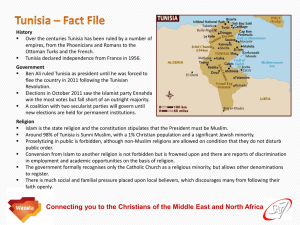

Doing business in Tunisia UK Trade & Investment Doing business in Tunisia Are you a member of a UK company wishing to export overseas? Interested in entering or expanding your activity in the Tunisian market? Then this guide is for you! The main objective of this Doing Business Guide is to provide you with basic knowledge about Tunisia; an overview of its economy, business culture, potential opportunities and an introduction to other relevant issues. Novice exporters, in particular will find it a useful starting point. Further assistance is available from the UKTI team in Tunisia. Full contact details are available at the end of this guide. Important Information - Sanctions and Embargoes Some countries maybe subject to export restrictions due to sanctions and embargoes placed on them by the UN or EU. Exporting companies are responsible for checking that their goods can be exported and that they are using the correct licences. Further information is available on the Department for Business, Innovation & Skills (BIS) The purpose of the Doing Business guides, prepared by UK Trade & Investment (UKTI) is to provide information to help recipients form their own judgments about making business decisions as to whether to invest or operate in a particular country. The Report’s contents were believed (at the time that the Report was prepared) to be reliable, but no representations or warranties, express or implied, are made or given by UKTI or its parent Departments (the Foreign and Commonwealth Office (FCO) and the Department for Business, Innovation and Skills (BIS)) as to the accuracy of the Report, its completeness or its suitability for any purpose. In particular, none of the Report’s contents should be construed as advice or solicitation to purchase or sell securities, commodities or any other form of financial instrument. No liability is accepted by UKTI, the FCO or BIS for any loss or damage (whether consequential or otherwise) which may arise out of or in connection with the Report. UK Trade & Investment Doing business in Tunisia Content Introduction 4 Preparing to Export to Tunisia 12 How to do business in Tunisia 13 Business Etiquette, Language and Culture 20 What are the challenges? 21 How to Invest in Tunisia 22 Contacts 23 Resources/Useful Links 24 UK Trade & Investment Doing business in Tunisia Introduction Tunisia is the smallest country in North Africa. It is one of the most politically stable countries in Africa and the Middle East. Tunisia has friendly relations with its immediate neighbours, Algeria and Libya. It has the most diversified economy in the region and one of the highest standards of living in Africa. Tunisia has modest reserves of oil and gas but exploration is leading to new, if smaller, discoveries, with 45 foreign and local firms exploring for oil and gas on 50 licences. BG Tunisia, the largest single foreign investor in Tunisia, has invested £335 million to extend the life of its Miskar gas field and another £868 million for developing the Hasdrubal gas field and building a new gas processing plant. The Hasdrubal project was developed in equal partnership between BG and the Tunisian national oil and gas operator ETAP. Other important growth markets are the manufacturing sector (textiles, leather, mechanical and electrical equipment, food processing and chemical industry are the leading sectors of growth), tourism, agriculture and services (in particular financial and ICT). Strengths of the market The most important strengths of the Tunisian economy are its stability, the quality of its human resources, location and economic diversification. As an indicator of the country’s stability, the Tunisian economy has maintained an average growth rate of around 5.4% per annum since 2004, with average annual income per capita £2,690. Despite the global economic crisis, GDP growth was 2-3% in 2009 and is expected to increase to 3% or possibly 4% in 2010. Inflation has varied from 3-5% in recent years (4.5% in 2006, 3.1% in 2007, 5.1% in 2008). The quality of human resources comes from the considerable investment in public education that Tunisia has made since independence. In fact, one-third of the government’s budget was spent on education during the first years of independence. This has helped to achieve a 74% literacy rate, which one of the highest in the region. Tunisia has a strong record on women's education with 99% of girls completing primary education, and women accounting for more than half of the university students. Tunisia is well positioned in the Mediterranean to bridge Europe, Africa and Asia. Tunisia is an Arab Muslim country with links to the wider Arab world, but also part of Africa and strongly connected to Europe. Europe accounts for over 80% of Tunisia's exports and over 75% of its imports. In 2008 Tunisia achieved full trade liberalisation with the EU for industrial goods. The Tunisian economy withstood a number of serious shocks due its economic diversification. For the last decade the agriculture, tourism and manufacturing industries have contributed equally to the growth of the economy. The services sector has continued to grow as the Tunisian economy makes a transition to more knowledge-based and value-added economy. Opportunities in Tunisia Despite its size, the Tunisian market offers opportunities in various sectors. Manufacturing Industries Once primarily based on phosphates and agriculture, the economy has diversified over the past two decades. Manufacturing industries, producing largely for exports, are at the core of Tunisia’s economic growth and a major source of foreign currency earnings, accounting for nearly 70% of all exports. There are five main sectors: UK Trade & Investment Doing business in Tunisia textiles and leather, mechanical and electrical industries (which include automotive, aircraft materials, cablings and electronics), food processing, construction materials (especially cement and ceramics) and chemicals. Tourism Tourism accounts for over 5% of GDP and 11-12% of foreign exchange earnings. It provides about 75,000 jobs directly and 220,000 indirectly. 90% of tourists come from Europe. Receipts were about £1.7 billion in 2009, but tourist arrivals down 2.1% to 6.9 million. Tunisia plans to achieve 10 million tourist entries per year by 2014, including 300,000 medical tourists annually. There are also plans to increase the value of tourism (e.g. golf) and move away from the massmarket seaside holidays that mean Tunisia currently has the lowest revenue per tourist night (£53) in the Mediterranean. Agriculture and Food Processing Industry Agriculture accounts for 11–15% of GDP. Combined agricultural and food processing sectors account for 9–14% of exports (depending on harvests). This sector employs about 16% of the Tunisian workforce. The main exports are olive oil (about 3% of all exports), seafood, dates and citrus fruit. ICT In 2009, the Tunisian government sold a third 2G/3G fixed line to the French operator Orange. The Tunisian government considers as the move as essential to enhancing the telecoms infrastructure in the country to support economic growth and social development. The new operator called Divona-Orange is expected to offer its services very soon. Transport The rail network is currently being upgraded, with important investments in line electrification and new rolling stock. Greater Tunis light metro system is also being extended. A number of high-speed rail links between central Tunis and its suburbs are being built. The tenders for the civil engineering works for the first part of the new rapid railways networks called RFR (Réseau Ferrovier Rapide) were issued end of 2009. The RFR will relieve the light rail routes of their longer-distance traffic, add much-needed extra capacity and improve journey times to the outer suburbs. Construction of the RFR network is expected to take around 15 years, beginning with a first phase costing £800 million. This covers the inner sections of each of the four new routes, adding up to 29 route-km in total, plus an initial build of rolling stock, stabling depot and maintenance workshops. Line C would be built as far as Bir Kassaa, Line D to Goubaa, Line E to Zahrouni station in Ezzouhour, and Line F as far as Borjel. In its five-year budget for 2007-11, the government expects to award contracts totalling £475 million, which will result in contract payments of around £300 million. The government set up a separate state-owned company called TRANSFER to oversee the detailed planning of the RFR network and undertake project management during the construction phase. The government took an equity stake of £120 million in the company, and will invite proposals for other sources of external funding. The studies for the RFR project were prepared by a consortium of four companies: SESTRA from France, SCET and STUDI from Tunisia and PCA from Japan. Roads UK Trade & Investment Doing business in Tunisia The 20,000 km road network has been receiving substantial investments over the years but is increasingly congested, in particular in cities. A number of bridges, new roads, roundabouts and under/overpasses have been built during 2007-08 to try to ease the traffic congestion in the Greater Tunis area. Tunisia has a modern motorway runs over 400 km from Bizerte in the north to Sfax in the south. The building of the extension to Gabes will start soon ( see construction below). Tunisia and Libya plan a 533 km highway between Sfax and Tripoli. The number of vehicles has been steadily growing by 6-7% per year, reaching about 1.5 million in 2007. Half of these vehicles are concentrated in greater Tunis. Ports The construction of a £1.06 billion deepwater port near the industrial zone of Enfidha is expected to begin in 2010. The port will be located in what will become Enfidha transport hub, including a new international airport and development and upgrading of roads. Airports The Turkish operator TAV has a 40-year concession for the new international airport at Enfidha, some 100 km south of Tunis and close to the resorts in the Gulf of Hammamet. The airport is scheduled to start operating with the beginning of the 2010 summer tourist season. The starting capacity of this new airport is 5-7 million passengers per year with a long-term capacity of up to 25-30 million. Energy and Mining The sector is essentially dominated by the production of oil, gas and phosphates. Phosphate reserves are significant. They form the basis of the domestic chemicals industry dominated by public group Phosphates de Gafsa/Groupe Chimique. Tunisia has been producing oil and gas since the early 1960s, with a peak in production to 120,000 barrels per day in the early 1980s. Since then, production has declined gradually turning Tunisia into a net importer in 2000. The global energy crisis led to a surge in oil and gas exploration activities. In 2007, oil and condensates production increased by 40% to a total of 4.6 million tonnes, with Oudhna oil field (owned by Tunisian ETAP and Swedish Lundin) becoming fully operational and producing some additional 24,000 barrels/day. Tunisia oil production increased from 70,000 barrels/day in 2007 to an average of 90,000 barrels/day during 2008, with a government objective to reach and maintain a daily production of 100,000 barrels/day in 2009. Investments in exploration substantially increased following the increase in oil prices, reaching £230 million in 2007. In 2007, some 20 new wells were drilled, (against 9 in 2006). The energy authorities aim for a minimum of 15 exploration wells per year. A change in the statute of national oil and gas operator ETAP in 2007 meant that it is now a full partner of foreign operators and can also invest in exploration. In 2008 it created a foreign branch, ETAP International, to operate overseas. An extensive gas exploration programme in 2008 confirmed promising new gas reserves. The energy authorities are confident that gas production will exceed domestic demand from the beginning of 2010. ETAP is setting up a new joint venture with Eni, OMV, Pioneer and Talisman Energy called South Tunisia Gas Project (STGP) to produce the gas. ETAP is currently assessing natural gas export opportunities. Since 1990 BG Tunisia has been the largest single foreign investor in Tunisia. The company focuses on the development and production of natural gas. Its Miskar gas field has been in UK Trade & Investment Doing business in Tunisia operation for about 15 years. BG Tunisia continues to invest heavily to maintain high production levels through to 2014. This includes the drilling of six new producing wells in addition to the existing 13 wells in production on the Miskar platform. BG Tunisia’s second important investment, Hasdrubal, is a joint venture with ETAP. The £868 million project is one of the largest industrial investments ever undertaken in Tunisia. It includes both development of the offshore gas field of Hasdrubal in the Gulf of Gabes and an onshore processing facility in Sfax. The installation started in the beginning of 2010 producing significant new volumes of natural gas, oil, butane and propane. BG Tunisia continues to look for more gas opportunities in the Gulf of Gabes. Other large UK companies operating in the energy sector are Shell, Petrofac and Cairn with several SMEs signing for oil exploration licenses in 2008. Other areas with considerable growth potential over the next two decades are: independent power generation, electricity grid upgrading, natural gas transport network extension, cogeneration, renewable energy (in particular wind, solar, solar thermal, biomass), energy efficiency, CDM projects, civil nuclear power in around 2020. Renewables Tunisia wants to boost power production through solar energy with 40 projects worth £1.8 billion between now and 2016. Most of the finance is being sought from the private sector and with the public electricity and gas monopoly STEG contributing £272 million. This strategy was announced in December 2009. It contains plans for 3 Concentrated Solar Power (CSP) plants with funding from the World Bank. CSP converts solar radiation to thermal energy then to power (and which is different from photovoltaic power). The European Investment Bank is expected to contribute to micro-generation, such as solar roof panels for 7,000 homes, 1,000 buildings, 300 farms and 100 service stations. There are plans to link this to a larger regional plan to use solar power to generate electricity and create a two-way electrical connection between the EU and North Africa through a £363 billion solar energy plan due to be implemented in stages across the region and due to be completed in 2050. Under the Union for the Mediterranean (UFM) Mediterranean Solar Plan, Tunisia plans to launch pilot projects in 2009-11 for 1.5 MW photovoltaic, 14 MW wind power and 70 MW CSP. There is good potential for wind and solar power in the MENA region. Spanish wind company Gamesa is involved in projects in Tunisia, Morocco and Egypt. In Tunisia it has 3 wind farms: 35 MW Megawatt (MW) capacity at Metline, 35MW at Kechbate and 25MW at Ben Aouf. These projects are worth £193 million. In the region, Tunisia is well behind Egypt (planning 7,200 MW by 2020) and Morocco (planning 340 MW) but ahead of Libya (planning 25MW). Tunisia has 100,000 square metres of solar collectors installed mostly on homes (including some on the Embassy estate). Construction Despite the economic downturn, the Tunisian construction sector continues to grow. The size of some of the planned Emirati investments was reviewed and other projects were cancelled. Tunisian developers have continued building commercial and residential property with some support of the Tunisian banks that have been largely decoupled from the global economic crisis (though they have difficulties of their own and lending can be strict). UK Trade & Investment Doing business in Tunisia In order to boost the economy, the government gave the go ahead to a large number of construction projects such as the 150 km highway to Gabes and the improvement of a large number of roads in the capital and elsewhere (see Roads above). Financial Sector A UKTI Financial services specialist visited Tunisia in October 2009 and identified opportunities in for UK financial institutions in Tunisia. These opportunities are in the areas Tunisian wants to reform in order to develop into a regional financial hub. Banking Tunisia is often criticised for having too many banks and a weak banking sector. The Presidential election programme for 2009-2014 term promised consolidation of the banking sector. The Tunisian Central Bank (BCT) is planning to implement this through the merger of three stateowned banks. The BCT may also raise the capital requirement for the Tunisian banks to provoke mergers among the Tunisian private banks. Capital Markets The Tunisian stock exchange was one of the best performing markets in the world in 2009. This level of performance has enabled Tunisian to reach the “Frontier” market status in capital markets with the hope of reaching the “Emerging” market status in the near future with the increasing market capitalisation. Tunisian authorities remain interested in opening up the financial sector and changing the regulation to enable new financial products to emerge. Accordingly a new law has been passed to promote the securities industry through the regulation of financial services’ provision to nonresidents. This law has discarded highly sophisticated, and thus highly risky, financial instruments (for instance derivatives of financial derivatives). Instead the law provides for a variety of financial products such as options, swaps, futures and all other futures relating to financial instruments, commodities, currencies and interest rates. In addition to the above-mentioned law, all these newly introduced financial instruments must be traded on a regulated market subject to the oversight of a regulatory authority The regulator is member of the International Organisation of Securities Commissions. Aid Funded Business Since 2003 the temporary headquarters of the African Development Bank (AfDB) has been located in Tunis. This presents huge opportunities that are not very well exploited by British companies. The main opportunities lay in consultancy services, but other opportunities also exist in the following areas: infrastructure, which includes power supply, water, sanitation, transport and communication, governance, focusing on strengthening transparency and accountability in public resources management, private sector initiatives, such as supporting private enterprise, strengthening financial systems, building competitive infrastructure, promoting regional integration and trade, improving the investment climate, and higher education and technology, for upgrading and rehabilitating existing facilities, improving conditions for scientific and technological innovations, bridging major gaps in ICT across the continent. For more information see African Development Bank below and for the opportunities at the AFDB contact www.afdb.org/en/home/ UK Trade & Investment Doing business in Tunisia Trade between the UK and Tunisia UK total imports from Tunisia £408 million - slightly increased on 2008(£406 million) UK total exports to Tunisia £153 million - 30% compared to 2008 (£218 million) Market Share – Tunisia is now the UK’s 78th largest export market worldwide. Main UK investors in Tunisia • • • • • • • • • • • BG Lee Cooper Group Oxford University Press Regus International Pertrofac Shell Unilever Elektron Coats Viyella Fashion Wear International Check Safety First Bilateral Agreements In 2004, the UK and Tunisia signed a Memorandum of Understanding (MoU) on Energy providing a framework for UK energy companies to learn about new opportunities in Tunisia. Its steering committee meets twice a year, co-chaired by British Embassy Tunis and the Tunisian Directorate of Energy. The MoU also provides for regular exchange of expertise and commercial visits. Other agreements signed by the UK and Tunisia, establishing a framework for business development, are: • • • • • investment promotion and protection agreement, convention for the avoidance of double taxation, road haulage transport agreement, MoU for public services reform, and Tunisia/UK Bilateral Forum (between respective Ministries of Foreign Affairs). Economy According to official estimates, the Tunisian economy achieved GDP growth of 3.1% for 2009. This was partly due to a 6% growth rate in the agriculture sector due to good harvests. But this export-led economy suffered from the reduction in worldwide, and in particular EU, consumer demand. Other estimates suggest that the GDP growth may be about half the official rate. The Tunisian government anticipates the economy will grow by 4% in 2010, but 3% might be more realistic. Year 2004 2005 2006 2007 2008 GDP Growth 6.0% 4.1% 5.3% 6.3% 4.6% 2009 3.1% 2010 projected 4.0% The global economic crisis had some good news because lower global food and fuel prices meant inflation fell from 5% on 2008 to 3.5% (year on year) in June 2009. But in September 2009 the UK Trade & Investment Doing business in Tunisia Prime Minister confirmed during The Economist conference in London that the government had given support costing 0.6% of GDP to Tunisian business suffering from reduced demand from abroad. As a result the ratio of public debt to GDP has stopped falling. Also, if subsidies increase along with global commodity and fuel prices, this will put pressure on the budget. Stock Market The stock market has performed well, with an increase of 44.3 % in 2009 compared to 2008. This rate was achieved despite the worldwide financial crisis and was the highest in its history. Quite Competitive The latest World Bank/African Development Bank World Economic Forum African Competitiveness Report found that Tunisia was first in Africa (ahead of second-place South Africa, third-place Botswana and fourth-place Mauritius) and 40th in the world (ahead of all of the BRIC (=Brazil, Russia, India and China) except China, and ahead of EU states Poland, Italy and Hungary). Tourism/Air Transport Tourism in 2009 was sluggish, but not as bad as many feared. Official figures show that tourism was actually up 3% Year on Year (YoY) in the first 5 months of 2009 and by autumn this was 3.6% (tourism receipts in dinars, 0.5 % rise in Pounds). The number of tourists entering the country was up 2% YoY in September 2009, whereas other sources indicate that tourism was down 2.2% YoY in June 2009. According to official figures, the number of eastern European (Polish, Czech and Russian) tourist entries was down 20-25%, Italian tourists was 15% lower, French tourists dropped 3% and the number of UK tourists rose 5%. These reductions were offset by larger numbers of visitors from Libya and Algeria. Plans for future growth are based in part on the new airport at Enfidah. This has planned initial capacity of between 5-7 million passengers annually, rising to 20-30 million per year. International Monetary Fund (IMF) The IMF conducted its Article IV consultation on 1 September 2009 in Tunis and it made the following recommendations for future progress: challenging chronic high unemployment (steady at about 14-15% officially), more pro-active bank supervision and systematic bank stress-testing, Stopping new Non Performing Loans (NPLs) and reducing older stock of NPLs, and maintaining an appropriate exchange rate policy leading to full convertibility of the Tunsian dinar (deadline now 2014). Politics Tunisia is a republic with a strong presidential system dominated by the ruling political party the Democratic Constitutional Rally (Rassemblement constitutionnel démocratique or RCD). President Zine El Abidine Ben Ali took office in1987. The president is elected to 5-year terms. He was last elected in October 2009 and the next presidential elections are expected in 2014. The president appoints a prime minister and cabinet, who play a strong role in the execution of policy. Regional governors and local administrators are also appointed by the central government. Mayors and municipal councils are elected. The Tunisian legislature contains a Chamber of Deputies (lower house of parliament) and a Chamber of Advisors (upper house of parliament). The judiciary is nominally independent, but responds to executive direction, especially in politically sensitive cases. The military is professional and does not play a role in politics. UK Trade & Investment Doing business in Tunisia Population Main statistics: 10.4 million inhabitants (2008) Demographic growth rate: 1.18% Life expectancy: 73.6 years for men 77.2 years for women 2/3 of Tunisians live in urban areas Ethnic groups: 97% of Tunisians are of Arab-Berber origin the rest are of European origin Religions: 98 % Muslim (Sunni) 1% Christian 1% Jewish and other Languages: Arabic (official, administration & education French (widely used in commerce) English (making inroads as business language) Getting here and advice about your stay FCO Travel Advice The FCO website has travel advice to help you prepare for your visits overseas and to stay safe and secure while you are there. For advice please visit the FCO Travel section UK Trade & Investment Doing business in Tunisia Preparing to Export to Tunisia Identifying an importer-distributor with a good reputation is a key step towards succeeding in the Tunisian market. This should follow a careful assessment of the potential of the market. The UKTI team in Tunisia can provide a range of services to British-based companies wishing to grow their business in the Tunisian market and also in Africa more widely through the AfDB. Our services include the provision of market information or validated lists of agents/potential partners, identifying key market players or potential customers, establishing the interest of such contacts in working with your company and arranging appointments. In addition, we can also organise events for you to meet contacts or promote your company and your products/services. You can commission our Overseas Market Introduction Services to assist your company to enter or expand your business in Tunisia. Under this service, the Embassy’s Trade & Investment Advisers, who have wide local experience and knowledge, can identify business partners and provide the support and advice most relevant to your company's specific needs in the market. To find out more about commissioning work, please contact your local UKTI office. See also: www.ukti.gov.uk UK Trade & Investment Doing business in Tunisia How to do business in Tunisia Gateways/Locations – Key Areas for Business Greater Tunis, in the north of the country, with a population of 1.944 million (2005), is the capital city and the main centre of government, business and industry. It is also the chief port. Sfax (population 869,700) is located on the east coast and about four hours drive away from Tunis. It is the second economic city and also has a port. The main industries in Sfax are based on phosphates and offshore gas fields. Sfaxians pride themselves on their industrial and commercial success. Sousse (population 557,700) on the east coast and Bizerte (population 529,400) on the north coast, are ports and industrial administrative centres. Sousse is also a popular resort for European package tourists. Kairouan (population 547,700), in central Tunisia, is an administrative centre and an Islamic holy city. Almost all important business is handled through Tunis and, with the exception of Sousse and Sfax, the other towns are of little commercial importance. Customs and Regulations Custom duties are ad valorem duties based on the CIF value. Tunisia utilises the Harmonised System of Classification (HS) which is the standard classification of goods used by most countries. Goods have to carry an 11-digit number, the first 6 digit of the harmonised code are the international classification and the following 5-digit are the national nomenclature. Importers must have a customs code number before they can obtain an import certificate, an import authorisation, an import licence or an import card for controlled products. Customs duties for most goods vary between 0% and 43%, depending on the product's importance to the Tunisian economy. The zero rate is applicable only to capital goods which have no locally manufactured equivalent. A Customs Inspection Tax of 3% of the CIF value is levied on all declared items inspected by customs. Since 2008 Tunisia has liberalized the trade of industrial goods with Europe due to the Association Agreement signed in 1995. Most of EU manufactured goods can be imported in Tunisia without paying any customs duties. You will be able to check the duties on your products from with the EU Market Access Database: http://mkaccdb.eu.int/mkaccdb2/indexPubli.htm The EU is working on a project to translate this website into English. To enjoy the EU preferential rates, an EUR 1 Certificate will need to be provided. EUR 1 movement certificates are issued for goods (of EU origin) which enjoy preferential access to Tunisia. At least two copies of the invoice are required, bearing the declaration: Nous certifions que les marchandises faisant l'objet de cette fourniture sont de fabrication (nom du pays) par nous-memes et que la valeur surmentionnee est juste et conforme a nos ecritures. (We certify that the goods described in this invoice are manufactured in (name of country) by us and that the value stated above is correct and agrees with our records). UK Trade & Investment Doing business in Tunisia Health certificates are required for some foodstuffs and for plants and live animals. Packing lists and bills of lading are required; there are no special regulations on the form these should take. Import Control SGS provides control services to exporters and importers from the UK and Tunisia: SGS Tunisia Rue 8612, Impasse no.5 Z.I. La Charguia I 2035 Tunis Carthage Tel: +216 71 205 100/71 205 464 Fax: +216 71 205 082 Email: sgs.tunisie@sgs.com URL: http://www.sgs.com Some goods are prohibited from import, including coins, currency notes (except in registered letters and subject to exchange controls), gold, jewellery, platinum, precious stones, silver (except in registered letters) and playing cards. Narcotics and pornographic materials are strictly prohibited. The import of explosives, military and security-related equipment is tightly controlled and is by licence only. There are restrictions on the importation of cigarettes, cigars and tobacco. Commercial Samples and Temporary Imports Samples of no commercial value are admitted free of duty and taxes. Samples of commercial value can be granted temporary duty free admission, on payment of a deposit or the provision of a bond equivalent to the normal duties and taxes. The deposit is refunded, or the bond cancelled, provided the samples are re-exported within six months. Enterprises that are defined as off-shore (wholly exporting companies with off-shore status in the form of bonded factories, which can be established anywhere in Tunisia) are allowed to import goods duty free for transformation and re-export. Goods may also be granted temporary entry for use in trade fairs. Legislation and Local Regulations Local Regulations Barriers to foreign investment-such as outright bans on participation in some sectors and discriminatory operating approval procedures-have been removed. Foreign investors may invest in Tunisia without prior approval, under the same conditions as Tunisian investors except from limited services activities, which require the High Commission of Investment authorisation when foreign participation to the capital exceeds 50%. The legal definition of foreign investor also includes Tunisians domiciled outside the national territory. Foreign investors may remit abroad any net and realised profits as a result of their investments and may also repatriate their capital. Private Ownership and Establishment Companies with foreign capital may access the domestic credit market with the same rights and conditions as domestic capital. Foreign entities may own 100% of a company's capital and may repatriate capital and remit profits back to the home country without limit. Foreigners can also purchase shares in listed and non-listed companies for up to 49% without any restriction. Nonresident foreign portfolios have been able since July 1995 to buy stakes in other non-resident companies established in Tunisia. Foreigners may lease farmland. The Tunisian Code of Commerce provides for a variety of business forms, all of which are available to foreign investors under Tunisia's liberal foreign investment policies. Investors are free UK Trade & Investment Doing business in Tunisia to structure their business activities using corporations, partnerships, joint ventures, branch offices or subsidiaries, co-operative society or simple agency or licensing agreements. Debt-to-Equity Requirement No debt-to-equity requirements are imposed in Tunisia except for financial institutions. Tax System Tax rules have been designed to favour corporate investment, regional development and international expansion. These include measures such as accelerated depreciation, exemptions and loss carry forwards. Non-Double Taxation Agreement A non-double taxation agreement between the UK and Tunisia came into effect on 1 January 1984 covering income tax, corporation tax and capital gains tax. These are taxed in the state where the activity is performed. Dividends and interest are taxed differently, depending on whether the source is Tunisian or foreign. The agreement is accessible on the website http://www.inlandrevenue.gov.uk. Accounting and Reporting Standards Tunisia adopted in 1996 a new charter of accounts to bring its requirements in line with the international accounting standards (IAS). The new charter of accounts includes a balance sheet, an income statement, a financial flows statement and explanatory notes. Various depreciation methods may be used including the straight-line declining balance or variable methods. Exchange Control Exchange control is administrated by the Central Bank of Tunisia (BCT). With the introduction in 1993 of the convertibility of the Tunisian Dinar for current transactions, transfer relating to payments concerning current operations may be made freely. Current convertibility implies payments in foreign currency for foreign trade transactions, operations related to production such as technical assistance, analysis and expertise, transport, insurance operations, operations related to the revenues of the capital and general operations such as advertising and subscriptions. Most trade-related transactions are controlled through letters of credit. Repatriation of Revenues Foreign entities may repatriate capital and remit profits back to the home country without limit. This include dividends and profits distributed to the net income royalties including payments for the use of technical process, studies and technical assistance, interest charged on loans and proceeds from sales or liquidators even if these amounts exceed the initial invested capital. Tunisian branches of foreign companies may freely remit profits. The repatriation in Tunisia of sales revenues deriving from exports is not required for: non-resident totally exporting companies, non-resident international trade companies, and non-resident companies operating in free-trade zones. Wages of foreigners may be freely remitted up to 50% net of tax. Dispute Settlement Tunisia is a member of the International Centre for the Settlement of Investment Disputes (ICSID) and is a signatory to the 1958 New York Convention on the Recognition and Enforcement UK Trade & Investment Doing business in Tunisia of Foreign Arbitral Awards. An arbitration Code has been ratified by law 93-42 of 26 April 1993 and is largely inspired from the New York convention. The Tunisian arbitral authority guarantee therefore the enforcement of arbitral awards rendered in any country and in any language. In case of disagreement, parties can submit the disputes to the ICSID. A Centre for Mediation and Arbitration has been created in order to promote the arbitration culture for resolving business disputes and to control the application of arbitration procedures conducted either ad hoc or institutional arbitration on the national or international level. Protection of Property Rights Tunisia belongs to the World Intellectual Property Organisation (WIPO) and is a signatory to the Bern Convention for the Protection of Literary and Artistic Works (copyright) and the Paris Convention for the Protection of Industrial Property (patent, trademark and related industrial property). As a member of the World Intellectual Property Organisation (WIPO) and a signatory to the UNCTAD agreement on the protection of patents and trademarks, Tunisia undertakes to protect foreign property rights (but see below). Representatives in the Market These will depend to a great extent on the nature of the business. However, the Tunisians do like to deal with someone with whom they can build up mutual respect. Good interpersonal skills are therefore important, as well as the technical ability to inspire confidence in the product or service as well as the capacity to make decisions locally. Language aptitude is highly desirable. It may be a better option to employ a Tunisian national than to try to represent yourself. Investment - Why Invest? Investment from overseas countries is actively encouraged and a package of attractive incentives is available. Areas in which investment would be particularly welcome pharmaceutical, automotive components, hosiery and electronics. A unified investment code was introduced in January 1994 and covers most sectors except energy, mining, finance and domestic trade. Some of the incentives available to encourage foreign investment include: tax exemption of 35% for income earned and reinvested in Tunisia, suspension of VAT and Consumption tax on capital goods manufactured locally, and reduction of customs duties to 10% on imported equipment (where none similar is manufactured locally). Further information can be obtained from the website of the Foreign Investment Promotion Agency (FIPA) http://www.investintunisia.tn/ Setting Up in Business - What is the Best Way of Setting Up? There is no barrier to setting up a 100% owned foreign company in Tunisia with resident or offshore status. The Tunisian Code of Commerce provides for the following forms of business enterprise: public limited company private limited company general partnership company limited partnership societies by participation sole proprietorships The public limited company and the private limited company are the most commonly used forms of business enterprise. UK Trade & Investment Doing business in Tunisia Responding to Tenders Although private enterprise is developing and is generates many business opportunities, stateowned companies still provide a large source of business opportunities. These public owned companies can contract with private companies only through issuing calls for tenders either national or international for projects that exceed the value of 5,000 Tunisian dinars (about £2,500). The Tenders’ specification books are usually issued in French and are available only in a hard copy format. Recruiting and Retaining Staff Employment law in Tunisia is contained in the Labour Code, which was enacted in 1966 and has been amended on several occasions. The Labour Code applies to private, governmental, religious and non-religious employers in the industrial, trade and agricultural sectors. It also covers the liberal professions, handicraft enterprises, co-operatives, civil companies (companies that are considered to be non-commercial under Tunisian law, such as mutual funds), unions and associations. The Labour Code is complemented by: general Mutual Agreements, and 46 sector-based Mutual Agreements covering the different sectors of the Tunisian economy. These Mutual Agreements fix the following: wages; bonuses; criteria for performance evaluation and for promotion; severance pay; and paid holidays. Mutual Agreements must be in writing. They apply to all employment contracts, unless the terms of particular employment contracts are more favourable to the workers. Wages in the private sector are set by Mutual Agreements. In the government sector, a salaries' grid, which is enacted by decree, sets wages. For employees of state-owned companies, wages depend on the status of the particular employee. Labour is inexpensive and depends on qualification and seniority. The employer's social costs represent 16% of gross wages, plus a professional tax varying between 1-2% depending upon the type of activity. In addition, there is a premium for work injury, varying between 0.5% and 7.2%, according to the type of activity. A bonus of a quarter of the maximum premium payable for work injury is given to those enterprises that show they have taken measures to reduce the risk of work-related accidents. Inspection officers are responsible for enforcing the rules governing work relations between employers and employees. To further the efficient application of the law, the inspection officers provide information and technical assistance to employers and employees. Labour disputes are heard by the industrial tribunal, which is supervised by the magistrate's court and is composed of a presiding magistrate, an employer representative and an employee representative. Strikes are uncommon in Tunisia. Employers are represented by the Tunisian Union for Industry, Trade and Handicrafts. The Tunisian Workers General Union represents employees. Farmers and fishers are represented by the Tunisian Agriculture and Fishing Union. In general, a foreign national wishing to work in Tunisia must sign an employment contract and obtain a work permit. After obtaining a work permit, the foreign national must obtain a residence permit that contains the language "authorised to work in Tunisia". Before a foreign employee begins employment in Tunisia, the employer must submit to the Ministry of Professional Training and Employment a signed employment contract with the employee. The employer must establish UK Trade & Investment Doing business in Tunisia that no suitably qualified Tunisian national is available. If the Ministry approves the contract, it issues a work permit for the employee and signs the employment contract. Employment contracts with foreign employees must have one-year terms and may be renewed once; additional renewals are subject to Ministry authorisation. Standards and Technical Regulation Tunisia has moved towards ISO9000 standards. The Tunisian standards organisation is: National Institute for Standardisation and Industrial Property (INNORPI) 8, rue 8451 (par la rue Alain Savary) BP.57, Cite El Khadra 1003 TUNIS Tel: +216 71 806 758 Fax: +216 71 807 071 Email: innorpi@planet.tn http://www.innorpi.com.tn The INNORPI website includes a database listing all the Tunisian standards and their reference numbers. The text of the standards can be provided on payment basis and can be provided by the UKTI team in Tunis as part of an OMIS service. The INNORPI include Standards for labeling, which were amended recently to require an Arabic translation of the text providing name of manufacturer, the importer and the date of manufacturing and expiring. Intellectual Property Rights Tunisia is a signatory to many multilateral conventions and agreements, including the: World Organisation of Copyrights, Paris Convention (protection of patents), Hague Agreement (registration of industrial plans and models), and Vienna Agreement (trade mark classification). Tunisia is also a member of the World Intellectual Property Organisation (WIPO) and a signatory to the UNCTAD agreement on the protection of patents and trade marks. The National Institute for Standardisation and Industrial Property (INNORPI) is responsible for patents and trademarks. Foreign patents and trademarks should be registered with INNORPI. Tunisian law does not provide protection for those that are unregistered. The duration of patents is 20 years from date of filing; additional patents expire with principal patent. The registration of a trademark is granted for 15 years from the date of application and is renewable for like periods indefinitely. There is evidence of imitation of trade marks in Tunisia, particularly in clothing, cassettes, videos and computer software. Copyright Tunisia is a party to both the Berne Convention for the Protection of Literary and Artistic Rights and the Universal Copyright Convention. Since both the UK and Tunisia are parties to the Berne Convention works of UK nationals, residents or works first published in the UK are entitled to the same protection as Tunisia grants to its own nationals. UK Trade & Investment Doing business in Tunisia Tunisia's 1966 Law Relating to Literary and Artistic Property applies to "all original literary, scientific or artistic works, irrespective of their value, purpose, manner or expression". However, on closer inspection, it does not appear to protect sound recordings as such or computer works specifically as literary creations. The general duration of protection is lifetime plus 50 years. The Organisme Tunisien de Protection des Droits d'Auteur (OTDPDA, The Tunisian Organism for the Protection of Authors’ Rights) is responsible for the administration and management of authors' rights. Although Tunisian law appears to be broadly in line with internationally accepted standards, its enforcement is variable. Infringement of copyright is particularly prevalent in the area of print, audio and video media. UK Trade & Investment Doing business in Tunisia Business Etiquette, Language and Culture Clothing Formal attire should be worn for business meetings. However beach wear should be limited to tourist resorts. In the summer months, men will need light weight clothing. Women should take light weight dresses or suits during the summer months, and a light wrap for evenings. For the remainder of the year, clothing as worn in Britain is suitable. Although temperatures never fall to freezing in the winter, buildings are rarely heated, and it is therefore necessary to have warmer suits or dresses for the winter months. From November to March, visitors should take a warm topcoat. It is advisable to take a raincoat and umbrella from October to May, particularly in the north of the country. Social Customs The legacy of French rule is considerable in the towns and a rather formal attitude to courtesy prevails. Personal relationships are important in business and time is usually spent in light conversation over tea or coffee before embarking on business matters. Regular visits and personal contact are essential to maintain the business relationship. Ramadan is a month of fasting, when virtually the whole population will fast from sunrise to sunset each day. If visits must be made during Ramadan, expect business to become harder to conduct, with a shorter working day and an attitude of postponing decisions and action until after Ramadan is over. Visitors should not eat, drink or smoke in public during daylight hours in Ramadan. Some mosques in Tunisia are open to non-Muslims, provided visitors dress discreetly, covering the head, arms and legs. Women Business Travelers The constitution provides for equal treatment of women in Tunisia, and there are many women now in high positions in politics and commerce. Attitudes towards gender in the major cities are more cosmopolitan, although female visitors should dress modestly if they do not wish to receive unwelcome attention. Such attention rarely poses any danger, but can become annoying. UK Trade & Investment Doing business in Tunisia What are the challenges? Getting Paid - Terms of Payment It is recommended to use letters of credit. This is the best secure payment method as adavance payments are not possible due currency exchange controls. Tunisian companies can also pay for the imported goods on sight of documents. This payment method is recommended once the two parties know each other well. Total convertibility of the Tunisian dinar is expected by 2014, and this will make advance payment possible. Language Although the Tunisian government is making huge effort to increase the use of English, French remains the prevailing business language. Furthermore, all the tenders issued by public institutions and bidding will need either to have French speaking staff or to allocate a budget for translating. Administration Linked to language above, dealing with administration can be difficult. Businesses should not underestimate the delays possible due to procedures with authorities such as customs officials. Size of the Market and Strong Competition The Tunisian market remains a small market with limited natural resources. This explains the reliance on soft finance and on aid from many sources, particularly from France (a traditional business partner). Other countries have also a strong position in Tunisia thanks to the financial support they provide. This is the case of the Germans, the Italians and the Spanish. EU Market Access Facilitation The EU is creating a mechanism with the Tunisian authorities to resolve the constraints that EU exporters may encounter. For example, during a meeting in March 2010 with the Ministry of Commerce, the EU was able to clarify the situation regarding the import of alcoholic drinks. The import of these products was unclear after the privatisation of the company who had the monopoly of their importation. The Ministry of Commerce has confirmed that the import of beer and wine does not require an import licence. But the Ministry has also confirmed that the import of spirits could only be done through the company called Magro. This demonstrates that doing business here can be complicated, and it is advisable to obtain specialist advice, either from the British Embassy UKTI team or from a local lawyer. Working with the African Development Bank (AfDB) There are many opportunities in Tunisia and throughout Africa via the AfDB. The AfDB has been through an intensive programme of upgrading policy and procedures to World Bank standards, particularly in terms of good governance, economic reforms, transparency and accountability. However, doing business with the AfDB can present difficulties. It is recommended for companies interested in doing business with the AfDB register their interest on the AfDB website. It is also essential for companies to develop a good understanding of AFDB procedure. For that, companies may need advice from the UKTI team at British Embassy in Tunis and/or the services of a local company. The UKTI Team in Tunis can provide assistance under the Overseas Market Introduction Service (OMIS). We can also help you to identify companies who can provide assistance. Because of the long lead-times we highly recommend making contact with the British Embassy UKTI team for help well in advance. UK Trade & Investment Doing business in Tunisia How to Invest in Tunisia British companies intending to invest in Tunisia are recommended to contact the London office of the Tunisian Foreign Investment Promotion Agency (FIPA). The FIPA website includes useful information to identify sectors of investment and costs of key factors. FIPA also provides assistance for companies to set-up in Tunisia and to prepare all the necessary documentations. The FIPA website is: http://www.investintunisia.tn Financial Assistance Tunisia has 20 banks, 2 merchant banks and 8 offshore banks and a range of specialized financial institutions. All these institutions can provide finance for new projects. New investment in these high priority areas will enjoy the financial support of the Tunisian government. This level of support can vary up to the quarter of the value of the investment. UK Trade & Investment Doing business in Tunisia Contacts If you have a specific export enquiry about the Tunisian market which is not answered by the information on this report, you may contact: UK Trade & Investment Enquiry Service Tel: +44 (0)20 7215 8000 Fax: +44 (0)141 228 3693 Email: enquiries@ukti.gsi.gov.uk You will be signposted to the appropriate section on our website, or transferred directly to the British Embassy in Tunisia British Embassy Tunis Ms Julia Smyth Head of Trade and Investment British Embassy Tunis Email: julia.smyth@fco.gov.uk Sector of responsibility: Aid Funded Business In the UK Kate Roye Senior Manager, Tunisia UK Trade & Investment Kingsgate House 66-74 Victoria Street London SW1E 6SW Tel: 020 7215 4892 Email: kate.roye@ukti.gsi.gov.uk Sandrine Jayet Country Manager, Tunisia UK Trade & Investment Kingsgate House 66-74 Victoria Street London SW1E 6SW Tel: 020 7215 4947 Email: sandrine.jayet@ukti.gsi.gov.uk Mr Rached Chaibi Deputy Head of Commercial Section / Senior Trade Officer British Embassy Tunis Email: rached.chaibi@fco.gov.uk Sector of responsibility: Financial services including banking, insurance and capital markets, construction and retail Ms Monia Djelassi Boumaiza Trade Officer British Embassy Tunis Email: monia.boumaiza@fco.gov.uk Sector of responsibility: Energy including renewable energy, EU and aid-funded business Mrs Faten Kacem Trade Officer British Embassy Tunis Email: faten.kacem@fco.gov.uk Sector of responsibility: Education UK Trade & Investment Doing business in Tunisia Resources/Useful Links Business Link: International Trade Business Link’s International Trade pages provide an overview of export basics including licensing, customs procedures, classifying and movement of goods, other regulatory information and export paperwork issues. It also introduces exporters to the UK Trade Tariff. Essential reading for exporters! Find out more at: http://www.businesslink.gov.uk/bdotg/action/layer?r.s=tl&r.lc=en&topicId=1079717544 Country Information: British Embassy website: http://ukintunisia.fco.gov.uk BBC Website: http://news.bbc.co.uk/1/hi/country_profiles/default.stm FCO Country Profile: http://www.fco.gov.uk/en/travel-and-living-abroad/travel-advice-by-country/country-profile/ Customs & Regulations: HM Revenue & Customs: www.hmrc.gov.uk Import Controls and documentation (SITPRO): http://www.sitpro.org.uk Tunisian customs website: http://www.douane.gov.tn/ Culture and communications: CILT – National Centre for Languages - Regional Language Network in your area: http://www.cilt.org.uk/workplace/employer_support/in_your_area.aspx Kwintessential culture guides: http://www.kwintessential.co.uk/ Economic Information: Economist: http://www.economist.com/countries/ Export Control Export Control Organization: http://www.berr.gov.uk/whatwedo/europeandtrade/strategic-export-control/index.html/strategicexport-control/index.html Export Finance and Insurance: ECGD: http://www.ecgd.gov.uk/ Intellectual Property UK Trade & Investment Doing business in Tunisia Intellectual Property Office: www.ipo.gov.uk Market Access Market Access Database for Tariffs (for non-EU markets only): http://mkaccdb.eu.int/mkaccdb2/indexPubli.htm SOLVIT – Overcoming Trade Barriers (EU Markets only) www.bis.gov.uk/EUMarketAccessUnit Standard and Technical Regulations: British Standards Institution (BSI): http://www.bsigroup.com/en/sectorsandservices/Disciplines/ImportExport/ National Physical Laboratory: http://www.npl.co.uk/ Intellectual Property: http://www.ipo.gov.uk/ Tunisian Standards Institution: http://www.innorpi.com.tn Trade Statistics: National Statistics Information: http://www.statistics.gov.uk/hub/index.html UK Trade Info: https://www.uktradeinfo.co.uk/ Travel Advice: FCO Travel: http://www.fco.gov.uk/en/travel-and-living-abroad/ NHS: http://www.nhs.uk/nhsengland/Healthcareabroad/ Travel health: http://www.travelhealth.co.uk/ UK Trade & Investment Doing business in Tunisia