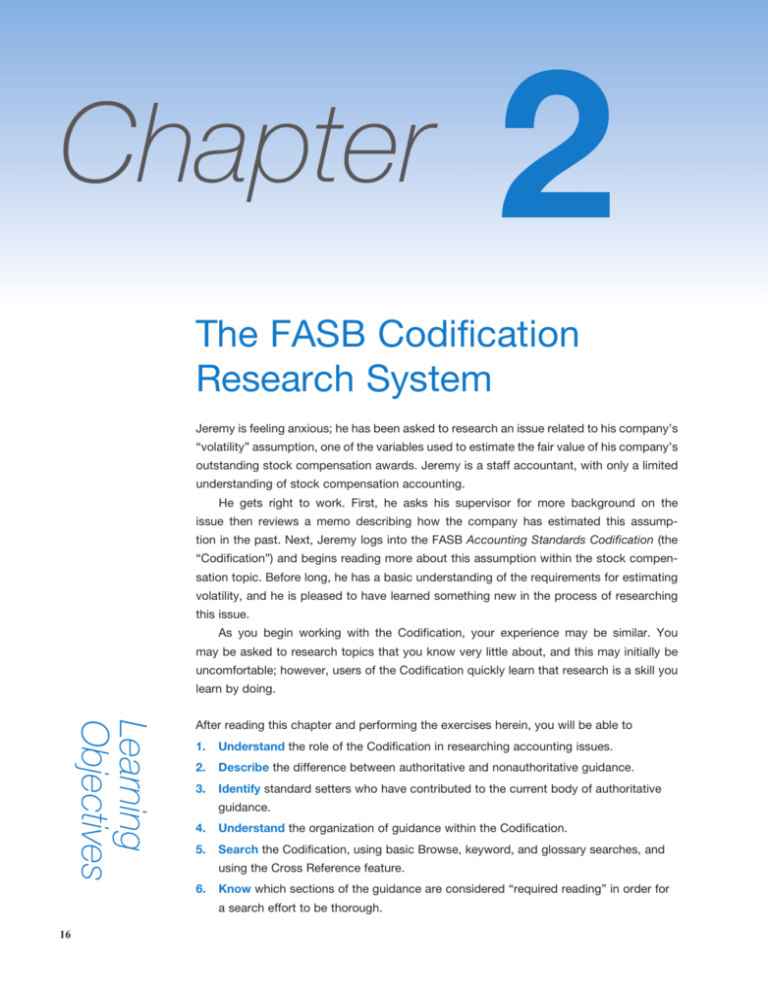

The FASB Codification Research System Learning Objectives

advertisement