ACCOUNT 781 Advanced Accounting Theory I

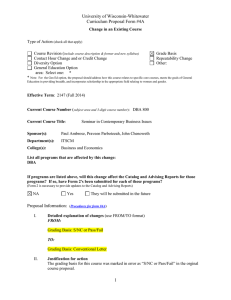

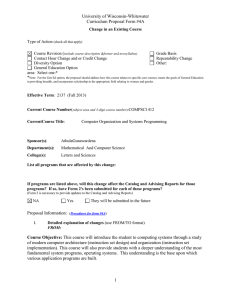

University of Wisconsin-Whitewater

Curriculum Proposal Form #4A

Change in an Existing Course

Type of Action

(check all that apply)

Course Revision (

include course description & former and new syllabus)

Contact Hour Change and or Credit Change

Diversity Option

Grade Basis

Repeatability Change

Other:

General Education Option

area: Select one: *

*

Note: For the Gen Ed option, the proposal should address how this course relates to specific core courses, meets the goals of General

Education in providing breadth, and incorporates scholarship in the appropriate field relating to women and gender.

Effective Term : 2157 (Fall 2015)

Current Course Number (

subject area and 3-digit course number )

: ACCOUNT 781

Current Course Title : Advanced Accounting Theory I

Sponsor(s) : Robert Gruber

Department(s): Accounting

College(s): Business and Economics

List all programs that are affected by this change:

Master of Professional Accountancy (MPA)

If programs are listed above, will this change affect the Catalog and Advising Reports for those programs? If so, have Form 2's been submitted for each of those programs?

(Form 2 is necessary to provide updates to the Catalog and Advising Reports)

NA Yes They will be submitted in the future

Proposal Information:

( Procedures for form #4A )

I.

Detailed explanation of changes (use FROM/TO format)

FROM: ACCOUNT 781. ADVANCED ACCOUNTING THEORY I. 3 Units.

This course focuses on accounting theory at an advanced level, including the role of accounting information in forecasting, market efficiency, valuation models, and earnings management. Other topics include the development of accounting theory, positive accounting theory, accrual-based vs. cased-based accounting measures, and economic consequences of accounting disclosures.

PREREQ: ACCOUNT 343 OR CONSENT OF DEPARTMENT

TO: ACCOUNT 781. APPLIED ACCOUNTING RESEARCH. 3 Units.

This course examines the relationship between decision theory (and decision-makers) and accounting information, alternative measurement theories, and conceptual frameworks. In addition, students will (1) learn to use applied research tools and (2) to develop their communication skills to real-life accounting issues in a variety of accounting environments. PREREQ: ACCOUNT 343 OR CONSENT OF

DEPARTMENT

1

II.

Justification for action

This course has steadily evolved from “pure theory” to “applied theory,” which is often referred to as

“practitioner research.” Pure theory would be consistent with a masters of science degree at a major research-oriented university that probably has a doctorate program in accounting. Applied or practitioner research is more consistent with the Accounting Department’s Mission and vision statements, particularly for a Master in Professional Accountancy. Course changes also recognize the need for accountants to continue to develop their research skills, including written and oral communication.

III.

Syllabus/outline (if course revision, include former syllabus and new syllabus)

Old syllabus

ADVANCED ACCOUNTING THEORY I (ACCOUNT 781)

Spring 2005

________________________________________________________________

INSTRUCTOR: Dr. Alka Arora

OFFICE: Carlson 5023

PHONE: 472-5452

OFFICE HOURS:

E-mail: aroraa@mail.uww.edu

M 10:00am – 1:00pm

[Online]

T 1:45 – 3:45 pm

R 12:45-3:45 pm

PREREQUISITES: Intermediate Accounting II (ACCOUNT 343/543) or consent of the instructor.

REQUIRED TEXT: Custom Textbook: Financial Accounting Theory, ACCOUNT 781, McGraw Hill/Irwin.

REQUIRED READINGS: Materials on electronic reserve.

COURSE OBJECTIVES: This course focuses on accounting theory at an advanced level, including the role of accounting information in forecasting, market efficiency, valuation models, and earnings management. Other topics include the development of accounting theory, positive accounting theory, accrual-based vs. cased-based accounting measures, and economic consequences of accounting disclosures.

LEARNING OBJECTIVES: After completing this course, students should be able to:

1. Explain the role played by the developments in finance literature which led to the evolution of accounting theory and the formulation of primary objectives underlying accounting information.

2. Describe the role of capital markets and various external users in the amount, format(s), and frequency of reporting principal financial statements as well as supplementary information.

3. Use basic and extended analysis techniques to analyze a firm’s cost of capital, and use this information in making capital budgeting decisions.

4. Demonstrate a clear understanding of financial indexes, computation of effective interest, and models such as economic value added, market value added, net present value, discounted payback period, and internal rate of return.

5. Demonstrate a clear understanding of the “Information Perspective” of accounting information.

Assess the efficiency and effectiveness of a publicly traded firm in regards to its performance by investigating the firm’s cost of capital, capital structure, and risk. Communicate the results of the analysis in writing and as well as an oral presentation in a professional manner.

2

ACCESSIBILITY: Please let me know if you need any special accommodations in the curriculum or assessment of this course to enable you to fully participate. I will try to maintain the confidentiality of the information you share with me.

ACADEMIC INTEGRITY: In this course you are responsible to perform to the utmost of your ability in an honest and sincere manner. Cheating, plagiarism, or any other form of academic misconduct will result in a severe penalty as permitted in UWS Chapter 14.

ATTENDANCE POLICY: Attendance at all class meetings is expected. Exams/written assignments missed without an approved excuse will be recorded with a score of zero.

ATTENDANCE: Attendance at all class meetings is expected. Exams/written assignments missed without an approved excuse will be recorded with a score of zero. If you miss three or more classes without an approved excuse, it will lower your grade. Taking the CPA exam is not an approved excuse.

UNIVERSITY STATEMENT: The University of Wisconsin-Whitewater is dedicated to a safe, supportive, and nondiscriminatory learning environment. It is the responsibility of all undergraduate and graduate students to familiarize themselves with University policies regarding Special

Accommodations, Academic Misconduct , Religious Beliefs Accommodations, Discrimination, and

Absence for University Sponsored Events. For details, refer to your Timetable ; the “Rights and

Responsibilities” section of the Undergraduate Bulletin (or comparable section of the graduate bulletin); UWS Chapter 14, “Student Academic Disciplinary Procedures”; and UWS Chapter 17,

“Student Nonacademic Disciplinary Procedures.”

As academic integrity is considered a primary value of a university, academic misconduct by either faculty or students cannot and will not be tolerated. Each student is expected to perform to the utmost of his or her ability in an honest and sincere manner. Cheating or plagiarism, including the use of unauthorized materials or the use of another’s problem solutions as one’s own, will result in severe penalties as provided for in UWS, Chapter 14.

Academic misconduct has always included, and continues to include, acts in which the student seeks to claim credit for the work or efforts of another, in whole or in part, or uses unauthorized materials or fabricated data in any academic exercise, plus other well-understood acts. Thus any work you turn in for credit must be obviously yours, and yours alone.

GRADING:

Exam I

Exam II

Exam III

Final: Take Home

Class Participation

Points Percent

56

56

50

24

Term Paper

Attendance at presentation 5 points

Presentation

Reports

5 points

40 points 50

4

250

22.4

22.4

20.0

9.6

24.0

1.6

100%

Attendance at Presentation:

All students are required to be present on the days the term projects are presented in class.

Class Participation:

To earn points for class participation, students are required to actively participate in class discussions.

3

Term Paper Reports

Reports Topic Due Date Points

1 Search Topics

Basic Co. Info.

1/20 2

2 2/8 3

Common size Statements & Ratios

3 2/24 7

Statement of Cash Flows

4 3/8 7

Return on Invested Capital

5 3/31 7

Interpreting Measures of Liquidity as Solvency

6 4/12 7

Capstone

7 5/3 or 5/5

Day of Presentation

7

40

New Syllabus

Catalog Description: This course examines the relationship between decision theory (and decision-makers) and accounting information. In addition, students will (1) learn to use applied research tools and (2) to develop their communication skills to real-life accounting issues in a variety of accounting environments. Finally, this course will equip students to continue to develop their research and communication skills in their professional careers.

Course Objectives: Upon the successful completion of this course, students should be able to:

Understand the role and value of information in a decision-making context, particularly accounting information.

Apply accounting research tools (e.g., FASB Accounting Standards Codification and eIFRS) to a variety of real-life, complex accounting situations

Communicate solutions and findings for accounting issues in a clear and concise manner, including writtem, oral, and small group presentations

Use various conceptual frameworks (e.g., FASB and IFRS) to analyze practical and theoretical accounting issues.

University Statement

The University of Wisconsin-Whitewater is dedicated to a safe, supportive and nondiscriminatory learning environment. It is the responsibility of all undergraduate and graduate students to familiarize themselves with University policies regarding Special Accommodations, Academic Misconduct, Religious Beliefs

Accommodation, Discrimination and Absence for University Sponsored Events. For details please refer to the Undergraduate and Graduate Timetables; the Rights and Responsibilities section of the

Undergraduate Catalog; the Academic Requirements and Policies and the Facilities and Services sections of the Graduate Catalog; and the Student Academic Disciplinary Procedures (UWS Chapter 14); and the Student Nonacademic Disciplinary Procedures (UWS Chapter 17).

College of Business & Economics’ Student Code of Ethics

As members of the University of WisconsinWhitewater College of Business & Economics’ community, we commit ourselves to act honestly, responsibly, and above all, with honor and integrity in all areas of campus life. We are accountable for all that we say and write. We are responsible for the academic

4

integrity of our work. We pledge that we will not misrepresent our work nor give or receive unauthorized aid. We commit ourselves to behave in a manner, which demonstrates concern for the personal dignity, rights and freedoms of all members of the community. We are respectful of college property and the property of others. We will not tolerate a lack of respect for these values and fully accept responsibility to maintain the honor code at all times.

AICPA Code of Professional Conduct

Students should be familiar with Rule 203 (ET: Accounting Principles) of the AICPA’s Code of

Professional Conduct, which specifies when a violation of GAAP is, and is not, an ethical concern. Only a fool asserts that they are acting ethically without knowledge of the relevant rules and considerations.

Grading Policies

Course grades will be based upon your performance on (1) two chapter exams, (2) selected homework assignments, (3) preparing for the BEC section of the CPA Exam.

(1) Exams

One exam will be given at the end of the fourth week of class.during class as indicated on the class schedule. The exam will cover the conceptual frameworks and decision theory. The format will be 50-60% objective-type questions and 40-50% free-response questions .

(2) Homework Assignments

Several problems will be assigned for the conceptuyal frameworks and decision theory part of the course. They are designed to provide additional practice and assess your mastery of key concepts. In addition, each topic in the reaserch portion of the course will have assigned (1) review questins and (2) exercises. Points will be awarded based upon accuracy, completeness, and presentation. In fairness to students who manage their time so as to get their homework done on time, late assignments will not be accepted under any circumstances. Each assignment will be assigned a point value based upon its length and difficulty.

(3) Case Analyses

Each topic in the research portion of the course includes case study questions that provide students with the opportunity to apply the research process presented in the chapter to more complex accounting issues. Responses will be in either email form or by drafting an accounting issue memo. It is likely that some of these cases will be done in small groups and/or presented to the class.

(4) Research Paper/Presentation

Topics to be selected by fourth week; Abstract and outline due by eigth week; First draft due by twelvth week; Final paper due by fifteenth week. Final papers will be presented to class, and hopefully other accounting instructors, during finals week.

Activity

Number of Tasks

Estimated

Points

Approximate

Percent

Exam

Homework problems

Review questions and exercises

Case analyses

Class Schedule:

Research paperpresentation

Total

1

2

10

10

1

100

30

100

120

50

400

25.0%

7.5%

25.0%

30.0%

12.5%

100.0%

Week Topic

1 Conceptual frameworks: FASB and IFRS

2

3

4

Decision theory

Decision models

Accounting under ideal conditions

5

5

6

7

8

Overview of accounting research and the FASB Codification system

The research process and guidelines for effective organization

Using nonauthoritative sources to supplement Codification research

Using the Codification to research Scope issues

9 Using the Codification to research meqsurement issues

10 Fair value measurements in the Codification

11 Spring break

12 Audit and professional services research

13 Governmental and Industry accounting research

14 The international research environment

15 Staying current with emerging accounting guidance

PREREQ: ACCOUNT 343 OR CONSENT OF DEPARTMENT

IV. Justification for action

This course has steadily evolved from “pure theory” to “applied theory,” which is often referred to as

“practitioner research.” Pure theory would be consistent with a masters of science degree at a major research-oriented university that probably has a doctorate program in accounting. Applied or practitioner research is more consistent with the Accounting Department’s Mission and vision statements, particularly for a Master in Professional Accountancy. Course changes also recognize the need for accountants to continue to develop their research skills, including written and oral communication.

V. Syllabus/outline (if course revision, include former syllabus and new syllabus)

Both the old and new syllabi are included above in III.