Program of FERM2014

advertisement

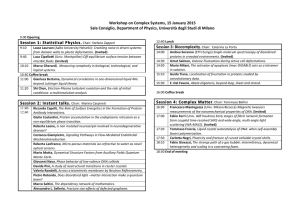

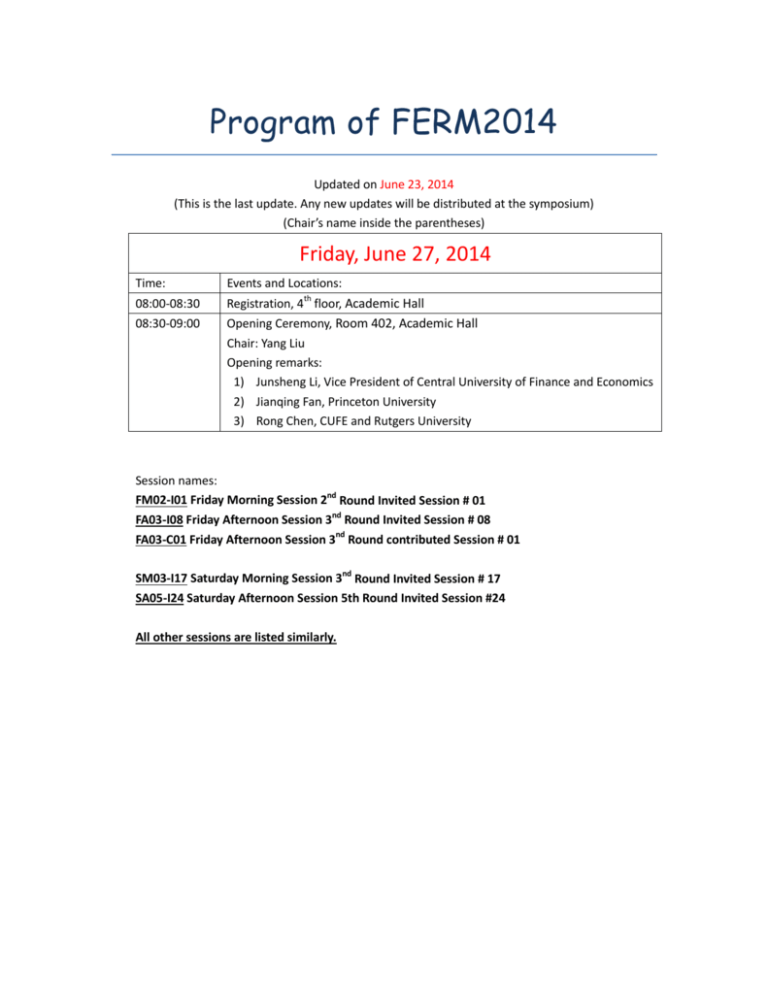

Program of FERM2014 Updated on June 23, 2014 (This is the last update. Any new updates will be distributed at the symposium) (Chair’s name inside the parentheses) Friday, June 27, 2014 Time: Events and Locations: 08:00-08:30 Registration, 4th floor, Academic Hall 08:30-09:00 Opening Ceremony, Room 402, Academic Hall Chair: Yang Liu Opening remarks: 1) Junsheng Li, Vice President of Central University of Finance and Economics 2) Jianqing Fan, Princeton University 3) Rong Chen, CUFE and Rutgers University Session names: FM02-I01 Friday Morning Session 2nd Round Invited Session # 01 FA03-I08 Friday Afternoon Session 3nd Round Invited Session # 08 FA03-C01 Friday Afternoon Session 3nd Round contributed Session # 01 SM03-I17 Saturday Morning Session 3nd Round Invited Session # 17 SA05-I24 Saturday Afternoon Session 5th Round Invited Session #24 All other sessions are listed similarly. Friday, June 27, 2014 Time: Events and Locations: 09:00-09:45 Keynote Speech, Lars Hansen: Misspecified Recovery Room 402, Academic Hall Chair: Rong Chen 09:45-10:25 Coffee/Tea Break (6th and 7th floor) 10:30-12:00 Room 603 Room 604 Room 702 Room 706 Room 602 (I01, Li, F) (I02, Kimmel, R.) (I03, Ran, J.) (I04, Wallentin, F.) (C01, Chang, Y.) Huang, Kanglin Hafner, Christian. Yang, Jian. Zhou, Yahong Wang, Huiying Tang, Yi Halin, Marc. Wang, Chih-Wei Zhu, Pingfang Guo, Feng Zhu, Zhongyan Fan, Jianqing. Zhu, Xiaoneng. Zhu, Xi Rivera-Mancia, E. Jin, Shaobo 12:00-13:30 Lunch (Royal King Residence Hotel, Please bring your lunch coupon) 13:30-15:00 (I05, Fan, J.) (I06, Ji, H. ) (I07, Tang, Y.) (I08, Jiang, G.) (C02, Peng, Z.) Yao, Qiwei Zhu, Ke Chen, Songxi Zhou, Guofu Huang, Chunyan Linton, Oliver Li, Muyi Flesaker, B. Zhang, Hao Sun, Bo Xiao, Han Chen, Min Cao, Huining Li, Feng Qu, Leming Overbeck, Ludger (Henry) 15:00-15:15 Coffee/Tea Break (6th and 7th floor) 15:15-16:45 (I09, Wang, H.) (I10, Peng, L.) (I11, Wang, Y.) (I12, Haerdle, W.) (C03, Guo, F.) Spokoiny, V. Chen, Rong Kimmel, Robert Wang, Weining Xue, Yushan Keppo, Jussi Chen, Ying Peng, Zixiong Li, Nan Yang, Lijian Pei, Pei Belomestny, D. Zhilova, M. (Rutgers) Davis, R. Shi, Lei Liu, Huihong Ao, Mengmeng th th 16:45-17:00 Coffee/Tea Break (6 and 7 floor) 17:00-18:30 (I13, Xiao, H.) (I14, Tang, Y.) (I15, Chen, S X) (I16, Zhou, Y.) (C04, Shia, Ben-Chang Jing, Bingyi Li, Yingying Fu, Wenjiang Rivera-Mancia, E.) Wang, Hansheng Li, Chenxu Wang, Yazhen Sun, Liuquan Chang. Yiming Zhang, Zhongyuan Sun, Jian Zou, Jian Liu, Yutao Li, Jie Tong, Shenghui Bauman, Evgeny Lin, Mu Dinner: 19:00 Royal King Residence Hotel (Please bring your dinner coupon). Saturday, June 28, 2014 Time: Events and Locations: 08:30-09:15 Keynote Speech, Jin-chuan Duan: Local-momentum autoregression and the modeling of interest rate term structure Room 402, Academic Hall Chair: Zhengjun Zhang 09:15-10:00 Keynote Speech, Weiying Zhang: Policy uncertainty and entrepreneurship Room 402, Academic Hall Chair: Yangru Wu 10:00-10:30 Coffee/Tea Break (6th and 7th floor) 10:30-12:00 Room 603 Room 604 Room 702 (I17, Spokoiny, V.) (I18, Ji, H. 中文) (I19, Yang, J.) Xiu, Dacheng Dou, Changsheng Zhao, Feng Sit, Tony Tao, Guiping Liao, Yin Fan, Yanqin Ye, Fei Wu, Yangru Room 706 (I20, Mi, Z.中文) Chen, Rong Room 602 (C05, Ao, M. ) Ando, Tomohiro (Xiamen) Zhang, Li Zhu, Zhongyi Xiang, Ju Han, Liyan Liu, Yue Fang, Yan 12:00-13:30 Lunch (Royal King Residence Hotel, Please bring your lunch coupon) 13:30-15:00 (I21, Wu, Y.) (I22, Zhu, J.) (I23, Li, Q.) (I24, JI, H. 中文) (C06, Ma, Y.) Zhong, Rui Cai, Zongwu Wang, Christina Liu, Jingquan Li, Shijie Zhu, Kevin X. Wei, John Wang, Fangfang Ma, Jinyi Liu, Hao Jiang, George Wu, Lan Zheng, Xinghua Zhang, Juan Zheng, Andi Wang, Huijuan Hu, Di th th 15:00-15:15 Coffee/Tea Break (6 and 7 floor) 15:15-16:45 (I25, Guo, J.) (I26, Tong, S.) (I27, Sun, L.) (I28, Yao, Q.) (C07, Ma, J.中文) Gao, Jiti Wu, Weixing Wallentin, Fan Tu, Yundong Ma, Yong Zhou, Yong Li, Dong Wang, Zhaojun Mammen, E. Liu, Limin Zhu, Jianping Hu, Hao Hu, Charlie Zhang, Meijuan Chen, Naihui th th 16:45-17:00 Coffee/Tea Break (6 and 7 floor) 17:00-18:30 (I29, Wang, Z.) (I30, Davis, R.) (I31, Han, L.中文) (I32, Tu, Y. 中文) Hou, Jie Haerdle, W. Wang, Changyun Guo, Jianhua Li, Qi Peng, Liang Wang, Xiaojun Lin, Lu Xu, Haiqing Zhang, Zhengjun Su, Zhi Sun, Zhimeng Friday, June 27, 2014 8:00-8:30 Registration (4th floor of Academic Hall) 8:30-9:00 Opening (Room 402, Academic Hall) Chair: Yang Liu Opening remarks: 1) Junsheng Li, Vice President of Central University of Finance and Economics 2) Jianqing Fan, Princeton University 3) Rong Chen, CUFE and Rutgers University 9:00-9:45 Keynote Speech (Room 402, Academic Hall) Speaker: Lars Hansen, Misspecified recovery Chair: Rong Chen 09:45-10:30 Coffee/Tea Break 10:30-12:00 Session-FM02 Invited Session-FM02-I01, Room 603 Title: Financial Engineering and Statistical Modeling Organizer: Rong Chen, Rutgers University Chair: Feng Li, CUFE • • • Kanglin Huang, Financial engineering overview and risk management practices in China Yi Tang, Introduction to enterprise-level derivatives modeling. Zhongyan Zhu, Top financial institutions, net liquidity provision, and financial contagion. Invited Session-FM02-I02, Room 604 Title: High Dimension Factor Pricing Models and Dynamic Volatilities Organizer: Yang Liu, Central University of Finance and Economics Chair: Robert Kimmel, National University of Singapore • Christian Hafner, A new approach to high-dimensional volatility modelling. • Marc Halin, General dynamic factors and volatilities. • Jianqing Fan, Large panel test of factor pricing models. Invited Session-FM02-I03, Room 702 Title: Risk and Regime Switching Organizer: Jian Yang, University of Colorado Denver and Nankai University Chair: Jimmy Ran, Lingnan University in Hong Kong • Jian Yang, What makes safe-haven currencies? Evidence from conditional co-skewness. • Chih-Wei Wang, Financial crises, financing sources, and default risks. • Xiaoneng Zhu, Regime shifts in bond allocation. Invited Session-FM02-I04, Room 706 Title: Statistical Methods in Econometric Modeling Organizer: Pingfang Zhu, Shanghai Academy of Social Sciences Chair: Fan Wallentin, Uppsala University • Yahong Zhou, Nonparametric identification and estimation of sample selection models under symmetry. • • Pingfang Zhu, Broadband and economic growth: Evidence from China. Xi Zhu, Questioning moral hazard in agricultural insurance: Non-evidence from a quasi-natural experiment on livestock insurance in China. Contributed Session-FM02-C01, Room 602 Title: Nonparametric and Bayesian Inference in Econometric Models Chair: Yiming Chang, Beihang University • Huiying Wang, Optimal wavelet estimators for density derivative • Feng Guo, Estimate term structure of the U.S. treasury securities: An interpolation approach. • Elena Rivera-Mancia, Bayesian inference in Extreme Value Theory. • Shaobo Jin, Exploratory factor analysis via penalized maximum likelihood 12:00-13:30 Lunch () 13:30-15:00 Session-FA03 Invited Session-FA03-I05, Room 603 Title: Advances in Multivariate Time Series Inferences Organizer: Qiwei Yao, LSE Chair: Jianqing Fan, Princeton University • • • Qiwei Yao, Segmenting multiple time series by a contemporaneous linear transformation. Oliver Linton, Some approaches to nonparametric modelling of high dimensional time series. Han Xiao, Generalized ARMA models with martingale difference errors. Invited Session-FA03-I06, Room 604 Title: Financial Time Series Analysis Organizer: Min Chen, AMSS, Sinica, Beijing Chair: Hong Ji, Capital U. of Econ. and Busi. • Ke Zhu, A bootstrapped spectral test for adequacy in weak ARMA models. • Muyi Li, On mixture memory GARCH models. • Min Chen, Weighted least absolute deviations estimation for ARFIMA time series with finite or infinite variance. Invited Session-FA03-I07, Room 702 Title: Derivatives Modeling: Selected Topics I Organizer/Chair: Yi Tang, Morgan Stanley • • • Songxi Chen, Extracting short rate information and market price of risk from bond prices. Bjorn Flesaker, Positive interest revisited: Interest rate modeling in low rate environments. Huining (Henry) Cao, Speculative innovation. Invited Session-FA03-I08, Room 706 Title: Modeling Financial Crashes and Covariate-contingent Correlation Organizer: Zhengjun Zhang, University of Wisconsin Chair: George Jiang, Washington State University • Guofu Zhou, Taming momentum crashes: A simple stop-loss strategy. • Hao Zhang, Modeling the magnitude and frequency of extreme event. • Feng Li, Modeling covariate-contingent correlation and tail-dependence with copulas. Contributed Session-FA03-C02, Room 602 Title: Structural Modeling and Inferences Chair: Zixiong Peng, CUFE • Chunyan Huang, Analytic regularity for the derivative Ginzburg-Landau equation. • Bo Sun, Multiple positive solutions for a Sturm-Liouville-like boundary value problem. • Leming Qu, High dimensional copula density estimation by Archimedean copula mixture model. • Ludger Overbeck, Heterogeneous Archimedean copula and t-copula with application in credit portfolio modeling. 15:00-15:15 Coffee/Tea Break ( ) 15:15-16:45 Session-FA04 Invited Session-FA04-I09, Room 603 Title: Statistical Methods in Financial Engineering Organizer: Vladimir Spokoiny, Weierstrass Institute and Humboldt University Berlin Chair: Hansheng Wang, Peking University • Vladimir Spokoiny, Bernstein - von Mises Theorem for a quasi-posterior. • Denis Belomestny, Regression with errors in variables: Penalized maximum-likelihood approach. • Mayya Zhilova, Uniform confidence bands for generalized regression via multiplier bootstrap. Invited Session-FA04-I10, Room 604 Title: Functional and Non-causal Time Series Organizer: Zhengjun Zhang, University of Wisconsin Chair: Liang Peng, Fudan University and Georgia State University • Rong Chen, Convolutional autoregressive models for functional time series. • Richard Davis, Noncausal vector AR processes with application to economic time series. • Lei Shi, Comparison and selection of perturbation schemes in local influence for financial time series models. Invited Session-FA04-I11, Room 702 Title: Asset pricing and Macroeconomic Factors Organizer: Robert Kimmel, National University of Singapore Chair: Yazhen Wang, University of Wisconsin • Robert Kimmel, Estimation and testing of asset pricing models---asking the right question. • Jussi Keppo, The impact of Volcker rule on bank profits and default probabilities. • Nan Li, Measuring intangible capital with uncertainty. Invited Session-FA04-I12, Room 706 Title: Dynamic Tail Event Management in Very High Dimensions Organizer/Chair: Wolfgang Haerdle, Humboldt-Universitat zu Berlin • Weining Wang, Dynamics of natural rate of unemployment: A structural forward looking approach. • Ying Chen, Adaptive functional autoregressive modeling for stationary and non-stationary functional data. • Lijian Yang, Oracally efficient estimation of autoregressive error distribution with simultaneous confidence band. Contributed Session-FA04-C03, Room 602 Title: Optimal Portfolio Models Chair: Feng Guo, CUFE • Yushan Xue, Innovative research of financial risk soliton prediction and control methods based on financial soliton theory and big data ideation. • Zixiong Peng, An optimization model of loan portfolio selection for commercial bank based on default risk under uncertain random environment. • Pei Pei, Backtesting portfolio value-at-risk with estimated portfolio weights. • Huihong Liu, Optimal composed investment strategies with sub-accounts for the social security fund. • Mengmeng Ao, Solving the Markowitz optimization problem: A tale of sparse solutions 16:45-17:00 Coffee/Tea Break ( ) 17:00-18:30 Session-FA05 Invited Session-FA05-I13, Room 603 Title: Cloud Computing and Network Studies Organizer: Yang Liu, Central University of Finance and Economics Chair: Han Xiao, Rutgers University • Ben-Chang Shia, The ERA of big data statistics: data mining in the cloud computing ERA. • Hansheng Wang, Estimating social intercorrelation with sampled network data. • Zhongyuan Zhang, Overlapping community detection in complex networks using symmetric binary matrix. Invited Session-FA05-I14, Room 604 Title: Derivatives Modeling: Selected topics II Organizer/Chair: Yi Tang, Morgan Stanley • Bingyi Jing, Modeling high-frequency financial data by pure jump processes • Chenxu Li, Estimating jump-diffusions using closed-form likelihood expansions. • Jian Sun, Implied remaining variances in derivative pricing. Invited Session-FA05-I15, Room 702 Title: High Dimensional Volatility Matrix Estimation and Inference Organizer: Yazhen Wang, University of Wisconsin Chair: Song Xi Chen, Peking University and Iowa State University • Yingying Li, Statistical properties of microstructure noise and estimation of the integrated volatility. • Yazhen Wang, Asymptotic theory for large volatility matrix estimation based on high-frequency financial data. Jian Zou, Statistical methods for large portfolio risk management. • Invited Session-FA05-I16, Room 706 Title: Advanced Models for Health Risk and Censored Data Organizer: Rong Chen, Rutgers University and CUFE Chair: Yong Zhou, Shanghai University of Finance and Economics • Wenjiang Fu, Why using standard population in age-standardization is a bad strategy - an illustration using us life insurance policy sales data and cancer mortality data. • • Liuquan Sun, An additive-multiplicative means model for marker data contingent on recurrent event with an informative terminal event. Yutao Liu, Nonparametric estimator of quantile residual lifetime for right censored data. Contributed Session-FA05-C04, Room 602 Title: Operational Risk and CVaR Chair: Elena Rivera-Mancia, McGill University • Yiming Chang, Research on identification of motor insurance frauds based on SVM. • Jie Li, Can complete sterilization sterilize completely?. • Shenghui Tong, How do powerful CEOs view dividends and stock repurchases? Evidence from the CEO pay slice (CPS). • • Evgeny Bauman, CVaR and downside risk parity. Mu Lin, Ruling out the uncertainty of fractal dimension estimated by box-counting method for river networks. Saturday, June 28, 2014 08:30-09:15 Keynote Speech (Room 402, Academic Hall) Speaker: Jin-chuan Duan, Local-momentum autoregression and the modeling of interest rate term structure Chair: Zhengjun Zhang 09:15-10:45 Keynote Speech (Room 402, Academic Hall) Speaker: Weiying Zhang, Policy uncertainty and entrepreneurship Chair: Yangru Wu 09:45-10:30 Coffee/Tea Break 10:30-12:00 Session-SM03 Invited Session-SM03-I17, Room 603 Title: Statistical Inference for High Frequency Volatilities and Option Pricing Organizer: Ruey Tsay, University of Chicago Chair: Vladimir Spokoiny, Weierstrass Institute and Humboldt University Berlin • • • Dacheng Xiu, The idiosyncratic volatility puzzle: A reassessment at high frequency. Tony Sit, Combining returns and option prices in empirical likelihood. Yanqin Fan, Inference for subsets of partially identified parameters with an application to option pricing. Invited Session-SM03-I18, Room 604 Title: Statistical Models and Estimation (in Chinese) Organizer/Chair: Hong Ji, Captial U. of Econ. and Busi. • Changsheng Dou, Low Mach number limit to solutions of compressible Navier-Stokes equations in bounded domain. • Guiping Tao, The robust decision models study under Knightian uncertainty. • Fei Ye, General relative error criterion and M-estimation. Invited Session-SM03-I19, Room 702 Title: Empirical Asset Pricing Organizer: Yangru Wu, Rutgers University and Central University of Finance and Economics Chair: Jian Yang, University of Colorado Denver and Nankai University • Feng Zhao, Cautious risk-takers: Investor preferences and demand for active management. • Yin Liao, Structural credit risk model with stochastic volatility: A particle-filter approach. • Yangru Wu, Exploiting closed-end fund discounts: The market may be much more inefficient than you thought? Invited Session-SM03-I20, Room 706 Title: Statistical Modeling for Volatility and Asset Allocation (in Chinese) Organizer: Qiwei Yao, LSE Chair: Zichuan Mi, Shanxi University of Finance and Economics • Rong Chen, Implied Hurst exponent and fractional implied volatility: A variance term structure model . • • Zhongyi Zhu, Functional single-index model for volatility. Liyan Han, International assets allocation via multi-stage stochastic programming. Contributed Session-SM03-C05, Room 602 Title: Market Structure and Dynamic Study Chair: Mengmeng Ao, Hong Kong University of Science and Technology • Tomohiro Ando, Multifactor asset pricing with a large number of observable risk factors and unobservable common and group-specific factors. • Li Zhang, Research on quantifying interest rate risk in the term structure perspective. • Ju Xiang, How credit default swaps increase credit risk via creditor’s safety covenant and debtor’s strategic debt service. • Yue Liu, Optimal stopping for selling a derivative based on a generalized Black-Scholes' model • Yan Fang, The dynamic correlation between China's and U.S. stock market. with regime-switching. 12:00-13:30 Lunch () 13:30-15:00 Session-SA04 Invited Session-SA04-I21, Room 603 Title: Information Uncertainty and Market Risk Organizer: George Jiang, Washington State University Chair: Yangru Wu, Rutgers University and CUFE • • • Rui Zhong, Rollover risk and volatility risk in credit spread models: A unified approach. Kevin X. Zhu, Information shocks and short-term market underreaction George Jiang, Uncertainty creation and resolution: Evidence from the changes of VIX from “close-to-open” and “open-to-close”. Invited Session-SA04-I22, Room 604 Title: Statistical Modeling and Inference for Financial Time Series I Organizer: Rong Chen, Rutgers University and CUFE Chair: Jianping Zhu, Xiamen University • Zongwu Cai, Testing instability of predictability of asset returns. • John Wei, The profitability premium: Macroeconomic risks or expectation errors?. • Lan Wu, Statistical models for financial investment strategy. Invited Session-SA04-I23, Room 702 Title: Statistics of High Frequency Financial Data Organizer: Per Mykland, University of Chicago Chair: Qi Li, Texas A&M, Capital U. of Econ. and Busi. • Christina Wang, Estimation of the leverage effect in jump processes. • Fangfang Wang, Realized periodogram-based estimation of integrated volatility in the presence of microstructure noise. • Xinghua Zheng, Efficient estimation of integrated volatility incorporating trading information. Invited Session-SA04-I24, Room 706 Title: Statistics and Applications (in Chinese) Organizer/Chair: Hong Ji, Captial U. of Econ. and Busi. • • • Jingquan Liu, Identification of recession avoidance preferences and inflation avoidance preferences in central bank. Jingyi Ma, A more efficient algorithm for regularization path of generalized linear models with group lasso penalties. Juan Zhang, The application of generalized semi-parametric additive credit score model based on Group-LASSO method. Contributed Session-SA04-C06, Room 602 Title: Financial Crisis, Inflation, Risk and Indexes Chair: Yong Ma, Hunan University • Shijie Li, Financial crisis’ impacts on transactions of financial derivatives——A measurement based on grey forecast model. • Hao Liu, Modelling risk return relation using high frequency data: A new prospective from realized garch-nln model. • Andi Zheng, A comparison of the implicit cycles of gold and US dollar index. • Huijuan Wang, Human capital: net exporter or net importer?——study on analyzing of employment embodied in China’s international trade. Di Hu, Inflation targeting applicable for China? --Study on emerging economies with synthetic control methods. • 15:00-15:15 Coffee/Tea Break ( ) 15:15-16:45 Session-SA05 Invited Session-SA05-I25, Room 603 Title: Advanced Modeling of Nonlinear Financial Risks Organizer: Yang Liu, CUFE Chair: Jianhua Guo, Northeast Normal University • Jiti Gao, Nonlinear predictive model and co-integration. • Yong Zhou, Some statistical models and inferences in measurement of financial risk and their applications. • Jianping Zhu, The research path to financial high-frequency data mining: An analysis and exploration based on statistics Invited Session-SA05-I26, Room 604 Title: Statistical Modeling and Inference of Financial Time Series II Organizer: Rong Chen, Rutgers University and CUFE Chair: Shenghui Tong, CUFE • • Weixing Wu, Short- and long-run business conditions and expected returns. Dong Li, Least absolute deviations estimation of double autoregressive models without strict stationarity constraints. • Hao Hu, Behavioral pattern modeling of a-share investors -- A big data and cloud computing approach based on WQUANT. Invited Session-SA05-I27, Room 702 Title: Statistical Inference in High Dimension Organizer: Hong Ji, Capital U. of Econ. and Busi. Chair: Liuquan Sun, Academy of Mathematics and System Sciences • Fan Wallentin, Asymptotic efficiency of the pseudo-maximum likelihood estimator in multi-group factor models with pooled data. • Zhaojun Wang, Outlier detection for high dimensional data. Invited Session-SA05-I28, Room 706 Title: Nonlinear Time Series and Inferences Organizer/Chair: Qiwei Yao, LSE • Yundong Tu, Functional moving average model. • Enno Mammen, Asymptotics for stochastic volatility models with application to the parametric GARCH-in-mean model. • Charlie Hu, Nonparametric eigenvalue-regularized precision or covariance matrix estimator". Contributed Session-SA05-C07, Room 602 Title: Regressions, Transform, and Structures (in Chinese) Chair: Jingyi Ma, CUFE • Yong Ma, Pricing synthetic CDO with MGB2 distribution • Limin Liu, The generalized Riesz transform. • Meijuan Zhang, Branching structure for the transient random walk in random environment on a strip. • Naihui Chen, Black-Scholes partial differential equation in Asia type with arithmetic mean . 16:45-17:00 Coffee/Tea Break ( ) 17:00-18:30 Session-SA06 Invited Session-SA06-I29, Room 603 Title: Robust Methods in Estimating Financial Econometric Models Organizer: Qi Li, Texas A&M, Capital U. of Econ. and Busi. Chair: Zhaojun Wang, Nankai University • Jie Hou, Modified local Whittle estimator for long memory processes in the presence of low frequency (and other) contaminations. • • Qi Li, Varying coefficient single-index models with endogeneity: theory and application. Haiqing Xu, Identication and estimation of strategic credit rating. Invited Session-SA06-I30, Room 604 Title: Tail Events and Their Financial/Economic/Social Impacts Organizer: Zhengjun Zhang, University of Wisconsin Chair: Richard Davis, Columbia University • • • Wolfgang Haerdle, TENET - Tail Event driven NETwork risk. Liang Peng, Tail dependence via conditional Kendall's tau. Zhengjun Zhang, Nested Asymptotic (In)dependent Extreme Value Copulas in Max-stable Processes with Application to High-Frequency Financial Data. Invited Session-SA06-I31, Room 702 Title: Studies on China Financial Market (in Chinese) Organizer: Yang Liu, Central University of Finance and Economics Chair: Liyan Han, Beihang University • Changyun Wang, Are Chinese warrants the option-type derivatives? • Xiaojun Wang, China's pension deficit:Scale and the uncertainty • Zhi Su, The quantified estimates of international impact by introducing RMB into the SDR basket Invited Session-SA06-I32, Room 706 Title: Statistical Methodology in Regression and Classification (in Chinese) Organizer: Feng Li, Central University of Finance and Economics Chair: Yundong Tu, Peking University • Jianhua Guo, Extensions of naive Bayes model with applications to Chinese document classification • • Lu Lin, Penalized maximum-least-squares estimation for sublinear expectation linear regression. Zhimeng Sun, Frequentist model averaging estimator of quantile partial linear regression model with censored response.