RESOLVING THE CATCH 22 - Robert H. McKinney School of Law

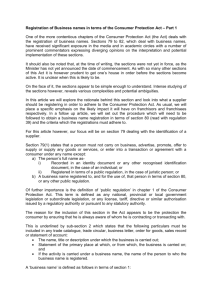

advertisement