Decision Support Systems 46 (2009) 755–762

Contents lists available at ScienceDirect

Decision Support Systems

j o u r n a l h o m e p a g e : w w w. e l s ev i e r. c o m / l o c a t e / d s s

Reservation price reporting mechanisms for online negotiations

Seungwoo Kwon a,1, Byungjoon Yoo b,⁎, Jinbae Kim a,2, Wei Shang c,3, Gunwoong Lee d,4

a

Korea University Business School, Anam-dong, Seongbuk-gu, Seoul 136-701, South Korea

Graduate School of Business, Seoul National University, 599 Gwanangro, Shinlim9-dong, Gwanakgu, Seoul 151-916, South Korea

c

Institute of Systems Science, Academy of Mathematics and Systems Science, Chinese Academy of Sciences, Room429, SiYuan Building. No.55, East Zhongguancun Rd. Haidian Dist.,

Beijing, 100190, China

d

Krannert School of Management, Purdue University, West Lafayette, IN 47907-2056, USA

b

a r t i c l e

i n f o

Available online 20 November 2008

Keywords:

Online negotiation

Reservation price

a b s t r a c t

To facilitate online negotiations, this paper proposes a reservation price reporting mechanism (RPR) and its

extended version (ERPR), in which negotiators are invited to report their reservation price to a third-party

system before initiating negotiations. Analyses using analytical models show that sellers and buyers report

their true reservation prices under certain conditions with respect to the back-dragging costs. Analytical

models also show that total social welfare can be increased by two reservation price reporting mechanisms.

Then lab experiments are conducted to compare the performance of RPR, ERPR and the traditional direct

bargaining (TDB). Consistent with the analytical models, results of the lab experiments show that RPR and

ERPR reduce the number of negotiation rounds before reaching an agreement and increase negotiators' social

welfare. These lab results testify to the efficiency of RPR and ERPR over TDB.

© 2008 Elsevier B.V. All rights reserved.

1. Introduction

Modern information technologies facilitate convenient information exchange with less temporal and geographical restrictions and

provide decision support functions with higher expected profits.

Online negotiations may enable negotiators to achieve better payoffs

by facilitating information exchange, even though the information

provided is somewhat noisy [1]. Online negotiations can be conducted

directly between participants by means of information technology

such as emails or virtual meetings. However, one of the most

promising ways is third-party mediated online negotiation. A third

party may neutrally serve as a mediator or host of an e-marketplace.

Buyers and sellers get together at a third-party website to negotiate

with each other. Practitioners perceive that internet-based online

negotiation can be useful, but still have low confidence in pure online

negotiation especially when risks are involved [7].

Online negotiation can be classified according to the number of

parties involved in: bilateral negotiations and multilateral auctions

[10]. Mechanisms for e-auctions are widely discussed. Most e-auction

mechanisms are designed on the basis of existing auction mechan-

⁎ Corresponding author. Tel.: +82 2 880 2550.

E-mail addresses: winwin@korea.ac.kr (S. Kwon), byoo@snu.ac.kr (B. Yoo),

jinbae@korea.ac.kr (J. Kim), shangwei@amss.ac.cn (W. Shang), lee633@purdue.edu

(G. Lee).

1

Tel.: +82 2 3290 2604.

2

Tel.: +82 2 3290 1958.

3

Tel.: +86 62565817.

4

Tel.: +1 765 494 4375.

0167-9236/$ – see front matter © 2008 Elsevier B.V. All rights reserved.

doi:10.1016/j.dss.2008.11.006

isms, such as English Auction or Vickery Auction. Trust and shillbidding are among the main issues to be resolved in terms of

mechanism design [14]. However, there is little research on mechanism design for bilateral electronic negotiations.

Another way to use information technology for negotiation is the

Negotiation Support System (NSS). NSS has been evolved from the

Decision Support System (DSS). NSS is a man-machine interaction

system that assists negotiators in analyzing and solving negotiation

problems by helping them structure their preferences and view data

regarding negotiations [15]. NSS, as a result, leads negotiators to make

better decisions and maximize profits (e.g., Negotiator [2], Negoisst

[12]). Existing NSSs mostly try to imitate the traditional face-to-face

(F2F) negotiations or decision support throughout the process of

online negotiation [5]. The suggested benefits of using NSS mainly

include helping negotiators construct their interests and offering

them some kind of post-transaction settlement [3] or the automation

of a negotiation process without human agents by using intelligent

agents [4]. Although issues such as preference elicitation and conflict

resolution have been studied extensively, very few studies employ

mechanisms beyond the frame of traditional F2F negotiation. Specially

designed negotiation mechanisms are indispensable for more effective online negotiations.

This paper focuses on designing a negotiation support mechanism

to support bilateral business negotiations between agents. Two new

mechanisms, reservation price reporting mechanism (RPR) and

extended reservation price reporting mechanism (ERPR), are proposed. We examine analytical models under the proposed mechanisms from an economic perspective. Then, we assess the proposed

mechanisms in the laboratory from a psychological perspective.

756

S. Kwon et al. / Decision Support Systems 46 (2009) 755–762

2. Economic models for bilateral negotiation

Economic models on negotiations originated to explain people's

behavior and predict the outcome of game theory [13]. People's

behaviors in negotiations are usually modeled as players' strategies,

which are indicated by sequences of bidding prices. A negotiator's

payoffs are generally calculated by the differences of the deal price and

their costs or reservation prices. Expected outcome of a negotiation is

predicted by the equilibrium of a particular game. Sophisticated

economic models of bilateral negotiations have been developed. For

the circumstance that two parties bid in turn and both suffer a certain

amount each round, both parties' bidding strategies and final

solutions can be predicted by Rubinstein's model [11]. Based on this

model, there are further studies on one-sided incomplete information

settings [8] and two-sided information settings [6].

Most economic negotiation models consider only one issue of

price, since price can always be generalized as a utility function in a

multi-issue negotiation problem according to utility theory. This

simplification is necessary when we focus mainly on the bidding

strategy and final outcomes. Contextual factors which influence the

process of negotiation are usually studied in behavioral negotiation

studies [9] and are beyond our economic approach. Therefore,

without losing any generality, the price bargaining between a buyer

and seller is taken as the context of the bilateral negotiation model in

this study.

Since negotiators engage in negotiations for their own interest,

how much they can get from the negotiation is the most important

factor influencing their behavior. As a result, a negotiator's gain is

usually referred to as his payoff. For the simplest case of price

bargaining from an economic perspective, the seller's payoff can be

calculated by the final deal price minus his/her cost and the buyer's

payoff can be measured by his/her budget price minus the final deal

price.

To ensure minimum payoffs, the negotiator always has a baseline

or resistance point, which means he or she will not continue a deal if it

is under this baseline. For example, a seller has a minimum price to

accept in mind. This minimum price is the seller's baseline. The

buyer's baseline is the highest price he or she is willing to pay for the

object being negotiated. This baseline is referred to as the buyer's

willingness-to-pay (or seller's reservation price). When the buyer's

willingness-to-pay is lower than the seller's reservation price, then

there is almost no chance of a deal. This kind of situation is referred to

as a negative bargaining zone. In each round of negotiation, costs such

as time, money and labor are involved in the bidding. If a negotiator

rejects an offering but continues to drag the partner(s) into another

round of negotiations, bidding costs as well as opportunity loss will be

incurred by both sides. Bidding cost and opportunity loss are referred

to as back-dragging cost.

3. Mechanism design for online negotiations

3.1. Reservation price reporting mechanism

In the RPR mechanism, negotiators are asked to report their

reservation prices (from sellers) or willingness-to-pay (from buyers)

to a third-party before they start negotiations. Specifically, a buyer is

asked to report the highest price that she can accept and a seller is

asked to report the lowest price that she can accept. When a buyer's

willingness-to-pay is higher than a seller's reservation price (i.e., the

negotiation is in a negative bargaining zone), there is no possibility

that an agreement can be reached. Therefore, from a theoretical

perspective, revelation of the reservation price can allow negotiators

to avoid wasting time and energy in a negotiation with a negative

bargaining zone. In practice, however, revelation of the reservation

price and willingness-to-pay could be risky, since the other party will

attain more negotiation power by capturing private information.

In the RPR mechanism, negotiators report reservation price or

willingness-to-pay to the electronic third-party. The electronic thirdparty is regarded as more neutral and more reliable by negotiation

participants than the physical third-party. Therefore, negotiators can

avoid useless negotiations in the negative bargaining zone using the

RPR mechanism. It should be noted that ‘reservation price’ in this

study does not have the same meaning as ‘reservation price’ in an

auction where the reservation price is known to bidders. In reality, the

seller's reservation price or the buyer's willingness-to-pay is rarely

announced in negotiations. If the reservation price or willingness-topay is known to the opposite party, then the party who released the

information would be placed at a disadvantage in the negotiations.

The RPR mechanism is conducted in three steps: 1) Potential

sellers and buyers report their reservation prices or willingness-topay to the mediation system. 2) The system checks whether a positive

bargaining zone exists between pairs of buyers and sellers. If so, then a

negotiation session is initiated. Otherwise, the process terminates. 3)

If a negotiation session begins, the buyer and the seller bid in turn

until a proposal is accepted by both sides or one side quits. In our

study, we focused on price negotiations, which may be generalized to

multi-criteria cases when the utility of different issues can be

calculated in one dimension.

To illustrate how the RPR mechanism works, an example of trading

used cars is presented as follows. Suppose that used cars are traded on

a website and the website requires all participants to submit their

reservation prices or willingness-to-pay to the system. A used car

seller first advertises the car on the website. The seller submits a

reservation price, say $1200, and other product information to the

system. The reservation price of the seller is not revealed to potential

buyers. Potential buyers can visit the website and freely review the

product information. If a buyer is interested in the used car, he is

required to report his willingness-to-pay to the system. The buyer's

willingness-to-pay is not revealed to the seller. Suppose the buyer

submits a willingness-to pay of $1100. Then the buyer's willingnessto-pay is lower than the seller's reservation price of $1200, which

means there is no possibility of agreement. The system notifies this

fact to both participants and the negotiations do not start.

Now suppose that the buyer submits a willingness-to-pay of

$1500. Then the maximum price the buyer is willing to pay is higher

than the seller's reservation price, which means that there is a positive

bargaining possibility. The system lets the two parties start negotiations. The seller makes the first bid at $1550. The buyer cannot accept

this price, but is aware that the lowest possible selling price is lower

than his willingness-to-pay. Therefore, the buyer refuses the first

proposal and makes a counterbid of $1250. While this bid is within the

seller's acceptable price range, the seller wants a higher profit. Hoping

that the buyer will accept a higher price, the seller proposes $1350.

The buyer accepts the proposed price because the price is within the

acceptable range and does not want to continue bargaining. However,

even when the seller's reservation price is lower than the buyer's

willingness-to-pay, it is possible that a deal can not be made. For

example, after a number of rounds of bids, the buyer or seller may

decide that continuing the negotiation is not worthwhile and

terminate the negotiation without reaching a deal.

3.2. Extended RPR mechanism

Offering more information may lead to higher efficiency. For

example, Priceline.com, an online site, sometimes provides bidders

extra information, such as a message, “Your bid is too far from

acceptable.” With this message, the bidder has an option of increasing

the bid price. This extra piece of information makes the whole

negotiation process quicker without revealing too much private

information, such as reservation price or willingness-to-pay.

Bidders tend to bid far from the baseline, especially at the early

stages of negotiation, to ensure more room to negotiate. This strategy,

S. Kwon et al. / Decision Support Systems 46 (2009) 755–762

however, is not efficient because if there is a larger bargaining zone, it

will take more time for the negotiators to reach an agreement. Thus,

both sides will incur greater costs in terms of bidding and time.

Therefore, we designed a guiding mechanism during negotiations,

which is similar to the message in Priceline.com. Before a bid is

submitted, the user has a chance to alter it with the system's advice.

For example, if the bidder decides to bid $1000, he receives the

system's advice to bid higher, because $1000 is much lower than the

seller's reservation price. That is, the system informs the bidder that

the price $1000 is too low and a higher price may have a greater

chance to be accepted. Given this information, the bidder may

increase the bid to get a quicker deal or the bidder may not change

the bid if he is not eager to make a deal right away.

The guiding mechanism should be carefully designed, otherwise

the bidder may find out the seller's reservation price by analyzing the

pattern of the system's advice. Therefore, the following considerations

should be taken into account when editing the guiding mechanisms:

First, the advice must be given only once each time. Second, the

criteria should be designed based on some random coefficients. More

details on this will be presented in Section 5.

4. Analytical models

buyer's reaction. Herewith, the seller's expected utility of price PS (t) at

time t is:

EUS ðPS ðt Þ; tÞ = US ðPS ðtÞ; tÞ Prðbuyer acceptsÞ + EUS ðt + 1Þ

Prðbuyer bargainsÞ + U0S ðtÞ Prðbuyer quitsÞ

A1. Two agents, a buyer and a seller, are involved in price bargaining.

A positive bargaining zone exists, where the deal price must be

decided within the zone.

A2. Each agent tries to maximize his or her own utility. Payoffs can

be calculated by the difference between agreed price and

reservation price.

A3. The seller's own reservation price, the minimum price to sell, or

the buyer's willingness-to-pay, the maximum price to pay, is

exogenous and held privately, but since the probability

distribution of all agents' reservation prices and willingnessto-pay are uniformly distributed between Pmin and Pmax, the

knowledge about the distribution of reservation prices and

willingness-to-pay is considered as common knowledge.

A4. Agents bid in turn. Each agent's bidding price sequence is

monotonic.

A5. Time is precious. Failure to make a deal at a certain round will

cost both agents a fixed amount.

A6. Each agent is risk averse.

4.1.2. Payoff structure

Without losing generality, we examine the seller's payoff structure.

Suppose PS(t) is the price proposed by the seller at time t. Seller's

utility of PS(t) is represented by function US(PS(t), t), if buyer accepts

PS(t). However, the buyer has two more options, one of which is to quit.

If the buyer quits the negotiation, then the seller can only have U0S (t) for

leaving the negotiation at time t. The buyer's third option is to bargain.

Suppose that the buyer is not satisfied with the seller's proposed price,

yet he is confident of making a better deal at a later time. Then the

buyer will choose to bargain, which means PS(t) is rejected and a new

price PB(t + 1) is proposed. The process will accordingly continue to the

next round and it is the seller's turn to make the decision whether to

accept, quit or bargain. Seller's utility in the next round can be denoted

by EUS(t + 1).

Since the seller is not certain whether the other party will accept,

reject, or bargain in response to the proposed price PS(t), a subjective

probability may be adopted to model the seller's belief about the

ð1Þ

and Prðbuyer acceptsÞ + Prðbuyer bargainsÞ + Prðbuyer quitsÞ = 1

According to A2 and A5, an agent's utility of price P at time t can be

calculated by the difference between agreed price and reservation

price (RS) minus the back-dragging cost (CS per round) at time t.

Reservation price here is the minimum price at which the seller is

willing to sell the item under negotiation. Thus, the seller's utility

function is US(PS(t), t) = PS(t) − RS − (t − 1)·CS. Since quitting the negotiation does not bring either party any benefit, but results in both parties incurring costs, the payoff of ‘quit' option can be denoted as: U0S(t)=

−(t− 1)·CS and U0B(t)=−(t − 1)·CB.

For the expected utility of the next round, the best outcome is for

the parties to make a deal at PS(t) and the worst is for the buyer to quit

the negotiation. Therefore, we have −t·CS ≤ EUS (t + 1) ≤ PS(t) − RS − t·CS.

Let α be the coefficient of risk preferences, as follows:

EUS ðt + 1Þ = ð −t CS Þ ð1−α Þ + ðPS ðtÞ−RS −t CS Þ α = −t CS + ðPS ðtÞ−RS Þ

α; ð0 V α V 1Þ:

4.1. Basic model for the RPR mechanism

4.1.1. Assumptions

In order to assess the proposed RPR mechanism, we examine a

simplified basic model in this section. Some basic assumptions on the

negotiation process under the RPR mechanism are as follows:

757

For simplicity of analysis, we assume totally risk averse agents, and

α here is supposed to be 0, which refers to the seller's expected utility

gain from the worst case where the buyer quits the negotiation. With

this simplification, a closed form solution for optimal strategies can be

induced, and it is expected that all the results would hold even when α

is non-zero. The utility function is then as follows:

EUS ðPS ðt Þ; t Þ = US ðPS ðtÞ; tÞ Prðbuyer acceptsÞ + EUS ðt + 1Þ

Prðbuyer bargainsÞ + U0S ðtÞ Prðbuyer quitsÞ

= ðPS ðtÞ−RS − ðt−1Þ CS Þ Prðbuyer acceptsÞ−t CS

Prðbuyer bargainsÞ− ðt−1Þ CS Prðbuyer quitsÞ

ð2Þ

= − ðt −1ÞCS + ðPS ðtÞ−RS Þ Prðbuyer acceptsÞ−CS

Prðbuyer bargainsÞ:

4.1.3. Bidding strategy

In economic models, all subjects are supposed to maximize their

utility. That is:

½

Max EUS ðPS ðtÞ; tÞ = − ðt−1ÞCS + Max ðPS ðtÞ−RS Þ Prðbuyer acceptsÞ

PS ðtÞ

PS ðtÞ

−CS Prðbuyer bargainsÞ :

ð3Þ

The fundamental trade-off of our model is in accordance with the

general bargaining situation. If a higher PS(t) is proposed, the seller

may possibly obtain a higher profit; however, the possibility of buyer

acceptance would be lower.

Given the seller's proposed price PS(t), the buyer will choose an

action which makes him better off according to the payoff structure:

8

< UB ðPS ðtÞ; tÞ

EUB ðPB ðt + 1Þ; t + 1Þ

: 0

UB ðtÞ

; accept

; bargain :

; quit

ð4Þ

Based on the model proposed above, truth revelation and

efficiency of the RPR mechanism are examined in the following part

of this section.

4.2. Truth revelation in the RPR mechanism

Whether the reported reservation price is the same as the actual

one is crucial to the performance of the RPR mechanism. We therefore

758

S. Kwon et al. / Decision Support Systems 46 (2009) 755–762

examine the agents' strategies and a possible equilibrium and then

analyze truth revelation in a risk-averse situation.

4.2.1. One-round bidding

In the context of one-round bidding, each side bids only once. If the

bidding price of one side is acceptable to the other side, a deal is made

at this price. Otherwise, the negotiation breaks down. Pmin is the

minimum price for the item in the market and Pmax is the maximum

price for the item in the market. As stated above in assumption A3,

suppose all the reservation prices of the seller (RS) and the

willingness-to-pay of the buyer (RB) are expected to be in the range

[Pmin, Pmax] and uniformly distributed, and all the traders, including

the seller and the buyer, know Pmax and Pmin. Suppose all the bidding

prices are in the range [Pmin, Pmax], then a negotiator will accept the

other party's offer. RPR informs negotiators about the existence of a

positive bargaining zone, which means that the willingness-to-pay of

the buyer (RB) is greater than the reservation price of the seller (RS).

In this case, if both negotiators are rational, the probability of quitting

the negotiation is theoretically zero because ‘quitting' is not a rational

strategy. When there is a positive bargaining zone, negotiators

can reach an agreement at the price that is less than the buyer's

willingness-to-pay and more than the seller's reservation price. In

this case, it is rational to reach an agreement since both the seller

and the buyer can benefit. According to Eq. (3), in order to

maximize his expected utility, the seller's bidding price PS should

satisfy:

PS

Pmax −PS

PS −RS

= ðPS −RS Þ −CS Pmax −RS

Pmax −RS

Pmax + RS −CS

:

2

RS + PS ðt−1Þ−CS

2

ð10Þ

PB ðtÞ =

RB + PB ðt−1Þ + CB

:

2

ð11Þ

If the first bidding price is known, then the recursive expression of

bidding strategy can be resolved as a dependent variable of the first

bidding price and time t:

1

1

t Pmax + ðRS −CS Þ 1− t

2

2

1

1

PB ⁎ðtÞ = t Pmin + ðRB + CB Þ 1− t :

2

2

PS ⁎ðtÞ =

ð12Þ

ð13Þ

According to the reservation-price-deal rule, a seller will accept

any offer that is higher than or equal to his or her reservation price and

a buyer will accept any offer that is lower than or equal to his or her

willingness-to-pay. According to the proposed mechanism, the final

deal price can be proposed by either the seller or buyer. Suppose there

are equal chances for each case:

+ PB ⁎ðtÞ PrðBuyer proposes the final dealing priceÞ

ð5Þ

then,

PS =

PS ðtÞ =

EP⁎ðt Þ = PS ⁎ðtÞ PrðSeller proposes the final dealing priceÞ

max EUS ðPS Þ = ðPS −RS Þ PrðRB z PS Þ−CS PrðRB bPS Þ

f B ðRB ÞdRB −CS ∫RPSS f B ðRB ÞdRB

= ðPS −RS Þ ∫PPmax

S

Therefore, if the proposed price of the seller is considered the

maximum possible deal price Pmax, and the minimum possible deal

price is Pmin of the buyer, then the situation is the same as that of a

one-shot bid within a single round. The pricing strategy of the seller

and buyer at time t (t N 1) can be induced from the previous section:

ð6Þ

The chance of a deal is the probability that seller's bidding price is

smaller than or equal to the buyer's willingness-to-pay, i.e.,

Pmax −PS

Prðdealing at first roundÞ = PrðRB z PS Þ =

Pmax −RS

RS + PS ⁎ðt−1Þ−CS 1 RB + PB ⁎ðt−1Þ + CB 1

+

:

=

2

2

2

2

ð14Þ

Suppose the extreme case where the bargaining zone is so small that

the maximum turns are needed before a price within the reservation

prices is proposed by one side. In this case, a deal is made when t → ∞,

and we can assume P ⁎ (t) ≈ P ⁎ (t − 1). If this is substituted into Eq. (14),

we have:

EP⁎ðtÞ =

RS + RB −CS + CB

:

2

ð15Þ

ð7Þ

If a seller proposes the final deal price with probability γ, and the

buyer proposes with probability 1 − γ, then the expected deal price is:

EP ⁎ (t) = (RS − CS)·γ + (RB + CB) (1 − γ).

If the back-dragging costs are the same for the two sides, the

expected deal price under the given mechanism is in accordance with

the “fair” allocation rule in common system-mediated mechanisms,

i.e., dividing the cake into two equal parts.

Similarly, the buyer's bidding price can be inferred. Then, the

chance to reach a deal is the probability of the buyer making a

counteroffer, as in Eq. (9).

4.2.3. Proof of truth revelation

According to Eq. (15), if the reservation price is truthfully reported,

then the seller's expected utility is:

Pmax + RS −CS

2

Pmax −RS

Pmax −

=

=

PB =

Pmax −RS + CS

:

2ðPmax −RS Þ

Pmin + RB + CB

:

2

ð8Þ

Prðnegative bargaining zoneÞ

RS + RB −CS + CB

Pmax −RS

RS −Pmin

−RS −CS :

=

2

Pmax −Pmin

Pmax −Pmin

Prðdealing at second roundÞ = ð1 −PrðRB z PS ÞÞ PrðRS V PB Þ

PB −Pmin

=

RB −Pmin

=

Pmin + RB + CB

−Pmin

2

RB −Pmin

EUTS = ðEP⁎ −RS Þ Prðpositive bargaining zoneÞ−CS

ð9Þ

RB −Pmin + CB

:

2ðRB −Pmin Þ

4.2.2. Equilibrium for risk-averse agents

Risk-averse agents perceive minimal expected utility on future

rounds under the condition that no deal is made in the current round.

ð16Þ

If the reservation price is falsely reported by increasing the

reservation price ΔRS N 0, then the seller's expected utility is:

EUFS =

ðRS + ΔRS Þ + RB −CS + CB

Pmax − ðRS + ΔRS Þ

−RS −CS

Pmax −Pmin

2

ðRS + ΔRS Þ−Pmin

:

Pmax −Pmin

ð17Þ

S. Kwon et al. / Decision Support Systems 46 (2009) 755–762

Comparing the expected utility:

EUTS −EUFS =

ΔR2S + ðRB + CB + CS −Pmax Þ ΔRS

:

2ðPmax −Pmin Þ

ð18Þ

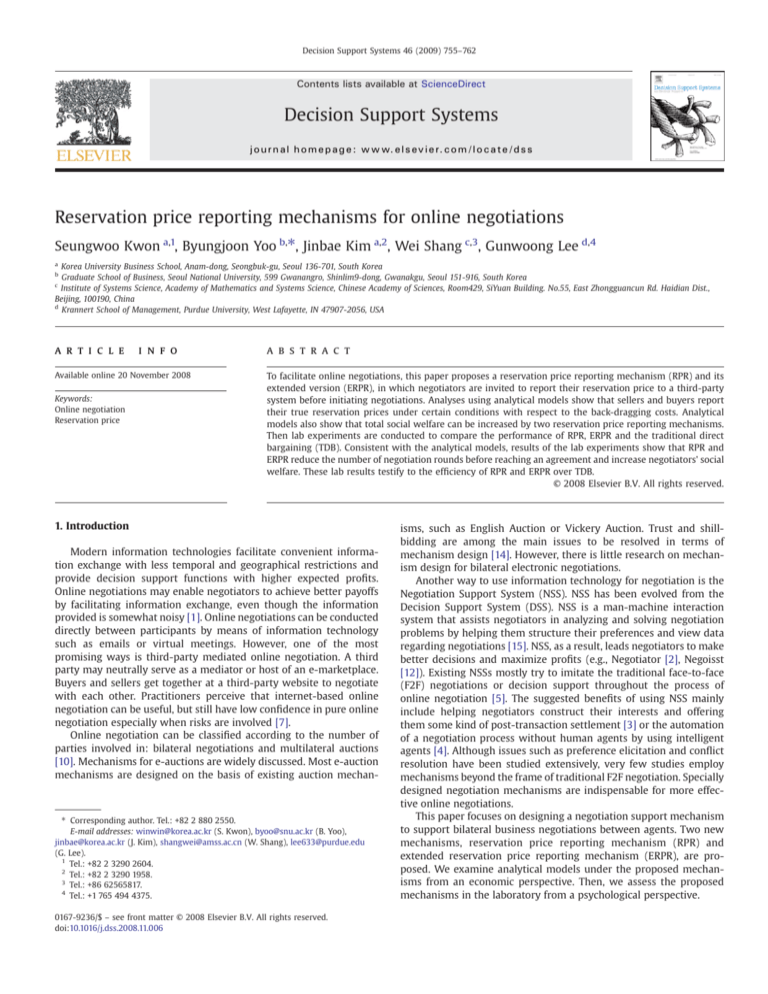

Therefore, if the buyer's back-dragging cost is large enough to

satisfy CB + CS ≥ Pmax − RB (i.e., RB + CB + CS − Pmax ≥ 0), then there is no

need for the seller to report a false reservation price (as shown in

Fig. 1), since Eq. (18) will always be greater then zero, which means

truth-telling may bring more expected utility to the seller.

If CB + CS b Pmax − RB (as the dashed curve in Fig. 1.), then the seller

will increase his reservation price by ΔRS = Pmax − RB2− CB − CS for maximum

expected utility. When the seller makes the decision of whether to tell

the truth, he does not know the buyer's exact willingness-to-pay,

which is needed in order to evaluate whether truth telling is more

profitable. Since the possible price range of the product in the market

is common knowledge, however, the expected value of the buyer's

willingness-to-pay can be estimated by ERB = Pmax 2+ Pmin according to A3.

And the truth telling decision condition will be CB + CS z Pmax 2− Pmin . If

this condition is not met, then the seller will report a false reservation

price by ΔRS = Pmax − Pmin2 − CB − CS. The higher the sum of the back-dragging

cost, the less likely it is that a fake amount will be reported.

Similarly, we may infer that the buyer will also have an incentive to

tell the truth on this condition. If this condition does not hold, then the

likelihood of a false report will be ΔRB = Pmax − Pmin2 − CB − CS . Therefore, we

propose the following:

Proposition 1. If the sum of the buyer's and the seller's back-dragging cost

is no less than half of the difference between the maximum and minimum

prices, then both sides will report their true reservation price or willingness

ΔRS = 0

to-pay for the item. (

; when CB + CS z Pmax 2− Pmin ) In addition,

ΔRB = 0

both sides will be( more honest if the sum of the back-dragging cost is

0

0

0

ΔRS NΔRS

if CB + CS bCB + CS ).

relatively higher. (

0 ;

ΔRB NΔRS

4.3. Increased social welfare in the RPR mechanism

The RPR mechanism is superior to the traditional bargaining

mechanism because it may increase dealings by ensuring a positive

bargaining zone before the negotiation starts. Further, overall social

welfare is also expected to increase by decreasing total back-dragging

cost.

4.3.1. Decrease of the expected number of rounds

Deals may increase through the RPR mechanism by 1) terminating

the negotiation process before the first round, if there is a negative

759

bargaining zone; 2) facilitating trust among agents based on a positive

bargaining zone and truth-telling incentives. The free bargaining case

will be further examined and compared with the RPR mechanism in

the next section.

Aside from acceptance and rejection by rational agents, there

is a third possibility of termination (i.e., negotiation terminates

without further communication) in free bargaining without a deal

guarantee in RPR. Expected utility function in the context of free

bargaining is as shown in the following function. For one-round

bidding, we have:

max EUS ðPS Þ = ðPS −RS Þ PrðRB z PS Þ−CS PrðRS V RB bPS Þ + U0S PrðRB bRS Þ

PS

f B ðRB ÞdRB −CS ∫RPSS f B ðRB ÞdRB

= ðPS −RS Þ ∫PPmax

S

S

+ U0S ∫PRmin

f B ðRB ÞdRB

Pmax −PS

PS −RS

RS − Pmin

= ðPS −RS Þ − CS + U0S Pmax − Pmin

Pmax −Pmin

Pmax − Pmin

PS =

Pmax + RS −CS

:

2

ð19Þ

ð20Þ

As shown above, the pricing strategy is not different with the RPR

mechanism. However, the chance of a deal is different from that of the

RPR mechanism:

PrFREE ðdealing at first roundÞ = PrðRB z PS Þ =

=

Pmax −PS

Pmax −Pmin

Pmax −RS + CS

:

2ðPmax −Pmin Þ

ð21Þ

Suppose the possible range of deal prices [Pmin, Pmax] and the backdragging costs are the same in free bargaining and RPR; we may

compare this with Eq. (7):

PrFREE ðdealing at first roundÞ V PrRPR ðdealing at first roundÞ

PrFREE ðdealing at first roundÞNPrRPR ðdealing at first roundÞ

; Pmin V RS

; Pmin NRS

ð22Þ

This equation shows that when conflict is low (i.e., Pmin N RS), free

bargaining has a higher probability of reaching a deal in the first

round. On the other hand, when conflict is high (i.e., Pmin ≤ RS),

negotiations under RPR have a higher probability of reaching a deal in

the first round. Further, the probability of reaching a deal in later

rounds is higher under the RPR mechanism than free bargaining when

conflict is relatively high.

Therefore, compared to free bargaining as in the TDB mechanism,

the RPR mechanism facilitates a higher chance of obtaining a deal. At

the same time, the expected payoffs for agents under the RPR

mechanism are not lower than under free bargaining, since the pricing

strategy is almost the same in both cases. Therefore, we may conclude

that the RPR mechanism can function as an incentive for rational

agents.

As we have already proved above in Eqs. (21) and (22), the chance

of a deal in each round is increased using the RPR mechanism.

Therefore, under the RPR mechanism, the total expected number of

rounds will decrease accordingly. We propose the following:

Proposition 2. When seller's reservation price and buyer's willingnessto-pay are within the range of the minimum price and the maximum

price, negotiations under the RPR mechanism will have fewer rounds than

those under the TDB mechanism. (EtFREE ≥EtRPR, when RS, RB ∊[Pmin, Pmax]).

Fig. 1. Difference on expected utility.

4.3.2. Overall increase in return

According to our assumptions, in a certain round, bargaining under

the RPR mechanism can be considered as a zero-sum game, in which

one side's gain is the other side's lost. However, from the view of the

760

S. Kwon et al. / Decision Support Systems 46 (2009) 755–762

whole negotiation process, if a deal is not made in a certain round,

both sides will incur some amount of back-dragging cost.

Usocial = US + UB = P⁎ −RS −CS Et⁎ Þ + ðRS −P⁎ −CB Et⁎ Þ = − ðCS + CB Þ Et⁎

ð23Þ

It has been proved that Et⁎ decreases under the RPR mechanism.

Therefore, we expect an average increase in terms of social welfare.

An overall increase in return is obtained under the RPR mechanism

as a result of: 1) eliminating occasions of a negative bargaining zone

which will lead to no deal; 2) setting up reservation-price deal rules

that help agents save time, since any bid that is between the

reservation price and willingness-to-pay is likely to end the negotiation without the need for further rounds.

4.4. The ERPR mechanism

Given the guidance such as ‘your bid is good' or ‘your bid is not

reasonable’, the agents may alter their bids before submission.

According to A4 and A5, after viewing the system's guidance, the

seller will lower his or her price or not change it and the buyer will

increase his or her bid or not change it. Suppose the seller will

alter his or her bid by ΔPS (ΔPS ≤ 0), then the seller's bidding price

will be PS + ΔPS. If the new bidding price is substituted in (7), then

PrERPR ðdealing at first roundÞ = Pmax 2−ðRPSmax+ C−SR−S Þ2ΔPS . Since ΔPS is no greater

than zero, the result is PrERPR (dealing at first round) ≥ PrRPR (dealing

at first round). Similar to previous discussion, the negotiations

under the ERPR mechanism were found to have fewer expected

rounds than those under the RPR mechanism since the chance of

acceptance is greater in each round under the ERPR mechanism.

Proposition 3. With extended bid information, the buyer and seller tend

to make greater concessions and rounds will be fewer in number under

the ERPR mechanism than under the RPR mechanism. (EtRPR ≥ EtERPR).

5. Experimental design

We conducted an experiment to test the effectiveness of the TDB,

RPR and ERPR mechanisms in a controlled negotiation context.

Combinations of buyer's willingness-to-pay and seller's reservation

price and back-dragging costs were designed to prove the three

propositions in our analytical model.

5.1. A prototype NSS

We developed a prototype NSS for the experiments. This system

should: 1) generate experimental negotiation sessions; 2) support the

TDB, RPR and ERPR mechanisms; 3) randomly assign buyers and sellers to

one negotiation session. Subjects who participated in the experiment

were asked to log into the NSS. Then, the system matched negotiation

pairs and informed the subjects about the reservation prices and

willingness-to-pay for the items up for negotiation. The system was

designed as a three-layered browser/server based architecture. Persistent

data entities, process handlers and interface presentations were

independent of each other so that modification of the system would be

easier. We implemented the system using a Java framework, which has

been used in several other applications and has been proved to be reliable.

5.2. Methodology

5.2.1. Participants and design

Sixty-seven undergraduate students, enrolled in introductory

courses in management sciences, participated in the experiment.

Participants received extra course credit in exchange for their

participation. In addition, participants received cash rewards based

on their performance in the experiment. The experiment design was a

2 × 3 factorial, with back-dragging costs (high vs. low) and types of

negotiation support system mechanism (TDB, RPR, ERPR).

5.2.2. Manipulations

5.2.2.1. NSS mechanism. There were 3 types of NSS mechanisms.

First, the TDB mechanism led negotiators to take turns bidding through

the website. Second, the RPR mechanism informed subjects of their

reservation price or willingness-to-pay. Then, subjects were asked to

report their true reservation price or willingness-to-pay to the system.

The subjects were warned that reporting a false reservation price or

willingness-to-pay might prevent the start of a negotiation session.

Third, the ERPR mechanism extended the RPR mechanism by

providing negotiators with advice on their bidding in addition to

reporting their reservation price or willingness-to-pay to the system. If

bids were too far from the reasonable range (25% range with respect to

the middle point of the seller's reservation price and the buyer's

willingness-to-pay), the system informed bidders that their bids were

not reasonable. Negotiators received the system's advice on their bids

before they were actually delivered to the negotiation partner.

Therefore, negotiators had one chance to alter their bids.

5.2.2.2. Back-dragging cost. There were 2 types of back-dragging cost

conditions. In the high back-dragging cost condition, each negotiator

(i.e., seller and buyer) lost 4% of the size of the bargaining zone when

an additional round was added. In the low back-dragging cost

condition, each negotiator lost 1% of the size of the bargaining zone

when an additional round was added.

5.2.3. Task and procedure

We adopted the scenario of trading laptop computers as presented in

the third section. Subjects were randomly assigned to one of the NSSs

(TDB, RPR, ERPR) and the role of buyer or seller by prototype NSS. The

system generated four negotiation sessions for each subject. The first

two sessions were practice sessions for subjects to get familiar with the

operation of the website. The next two sessions were real and the final

reward was calculated based on the results of these two sessions. One of

the real experiments was a high back-dragging cost condition (4% of the

size of the bargaining zone for seller and buyer each) and the other was

low back-dragging cost condition (1% of the size of the bargaining zone).

A negotiator did not know who his or her negotiating partner was. Only a

three digit user ID was revealed to the negotiating partner. Prior to the

bidding, the experimenters explained the process to the subjects. Based

on the profits made during the real sessions, participants were rewarded

with cash after the experiment.

6. Results and discussions

Table 1 summarizes the bidding records as well as the final results

of each negotiation session.

Table 1

Summary of results

TDB

RPR

ERPR

Total number of Sessions

Success rate (%)

38

0.97

53

0.91

32

0.88

Successful sessions

Number

Average number of rounds

Standard deviation

Average total profit

37

4.0

3.20

92.32

48

3.1

2.08

92.91

28

2.4

1.57

96.04

5

3.4

2.30

−5.00

4

1.3

1.26

−2.00

Failed sessions

Number

Average number of rounds

Standard deviation

Average total profit

1

5.0

−18.00

S. Kwon et al. / Decision Support Systems 46 (2009) 755–762

761

significance (p = .06). Therefore, Proposition 1 regarding truth revelation was supported.

Table 2

Truth revelation

Data

High back-dragging cost

Low back-dragging cost

Number of reports

Deviation ratio

Number of rounds

Statistical significance

70

6.9%

2.50

p b .10 (p = .06)

79

8.2%

3.18

Since the payoff structures were not the same, we normalized all

records to make them comparable to each other. Table 1 reports the

success rates, the average number of rounds to reach agreement, and

the average total profit the subjects achieved using each of the three

mechanisms. Negotiators had positive bargaining zones; therefore

reaching an agreement was possible. However, some negotiators

could not reach an agreement under all three mechanisms. In this

section, the results are discussed in terms of the number of rounds to

reach an agreement, truth revelation, and fairness.

6.1. Number of rounds and social welfare

Generally, the fewer the number of rounds to reach an agreement

and the higher the joint profits (i.e., the sum of two negotiators'

profits), the more efficient the negotiation sessions were. We

compared three mechanisms (TDB, RPR and ERPR) in terms of the

number of rounds in successful sessions, because fewer rounds

brought more social welfare as a result of lower back-dragging costs.5

Planned contrast was used to determine whether the RPR and ERPR

mechanisms shortened the number of rounds compared with the TDB

mechanism (proposition 2) [5]. Planned contrast indicated that the

RPR and ERPR mechanisms led negotiators to reach an agreement

faster than the TDB mechanism (t = 2.488, p b .01). Compared with TDB,

both RPR and ERPR are more effective in reducing the number of

rounds. Therefore, Proposition 2 of the analytical model is supported.

To test Proposition 3, we compared 2 NSSs (RPR vs. ERPR). The

result of the t-test shows that there was a significant difference

between the number of rounds of ERPR and RPR (t = 1.440, p b .10,

ERPR: 2.4 vs. RPR: 3.1). That is, participants reached an agreement

faster under the ERPR system rather than under the RPR system.

Therefore, Proposition 3 was supported.

6.2. Truth revelation

Proposition 1 of our analytical model was empirically tested; that

is, we tested whether negotiators were more honest when the sum of

back-dragging costs was relatively higher. In our experiment, the

extent of truth revelation was calculated by the average deviation ratio

(See Table 2 for results). We measured the deviation ratio by

calculating how much a negotiator's reporting price deviated from

the reservation price. The reservation price of the seller is the actual

cost of the item and that of the buyer is the true amount of money he

or she is willing to pay for the item. For example, the average deviation

ratio of a seller is lower when the reporting price is closer to the actual

cost of the item, while the average deviation ratio of a buyer is lower

when the reporting price is closer to the true amount of money he or

she is willing to pay. Therefore, the lower the average deviation ratio,

the higher is the level of truth revelation. We found that the average

deviation ratio of reporting price with high back-dragging cost (6.9%)

was lower than with low back-dragging cost (8.2%) with statistical

5

This negotiation exercise was a type of distributive negotiation due to there being

only one issue in the negotiation. However, this was not a zero-sum game because of

back-dragging costs. That is, the total profits of the two negotiators were affected by

back-dragging costs. In addition, the total profits were strongly correlated with the

number of rounds needed to reach an agreement in that both of them were associated

with back-dragging costs. Therefore, the significance test was performed only for the

number of rounds.

6.3. Fairness

In our experiment, sellers placed bids before buyers. That is, sellers

initiated the negotiation. In the TDB and RPR conditions, there were no

differences in terms of payoffs between initiators (i.e., sellers) and

followers (i.e., buyers). In the ERPR mechanism condition, however,

buyers' payoffs were much higher than sellers' (buyer: 61.9, seller:

34.2, t = 5.08, p b .001).

This result was interesting since it was not expected in our

analytical model. With the examination of subjects' bidding behaviors,

we found that the information provided in the ERPR sessions resulted

in less aggressive starting bids by the sellers. The sellers in the TDB and

RPR conditions made extreme first offers and used those as anchors. In

contrast, the sellers in the ERPR condition did not make extreme first

offers. Their offers were closer to their reservation price or willingness-to-pay than those of TDB and RPR. As a result, the sellers in

ERPR sold the object at cheaper prices. Future study should investigate

how to reduce the unfairness resulting from the information provided

in the ERPR mechanism.

7. Conclusion

Two new mechanisms (RPR and ERPR) were proposed to support

online negotiations by asking negotiators to report their reservation

price or willingness-to-pay to the NSS. In the RPR mechanism,

negotiators should report their reservation price or willingness-topay to the NSS at the start of a negotiation. Negotiations would be

initiated only when a positive bargaining zone was detected by the

NSS. The ERPR mechanism provided negotiators with information on

how far their bids were from the acceptable range before delivering

this bid information to the negotiation partners.

An analytical model was developed to find the equilibrium points and

assess the performance of the mechanisms. Under the assumption of

uniformly distributed reservation prices or willingness-to-pay and risk

aversion, the agents were shown to have incentives to reveal their actual

reservation price or willingness-to-pay to the NSS. When the agents did

not reveal the truth, higher back-dragging costs (resulting from more

rounds) led to smaller profits. The RPR mechanism was found to be more

efficient than the traditional free bargaining system in that negotiators in

RPR achieved higher social welfare than those in TDB. By the same token,

the ERPR mechanism was more efficient than the RPR mechanism.

In our lab experiment, the average social welfare level generated by

the three mechanisms was ordered as expected in our analytical model.

In addition, negotiators were more honest in the high back-dragging

cost conditions rather than in the low back-dragging cost conditions. We

found an interesting phenomenon in terms of fairness, which was not

considered in our analytical model. That is, the ERPR mechanism was

less favorable to the initiators of the negotiation compared with the

followers. The advice provided by the ERPR system discouraged the

initiator from opening the negotiation with an extreme offer. As a result,

the agreed price was favorable to the follower. In sum, the ERPR

mechanism resulted in an issue of fairness between the initiator and the

follower, even though higher levels of social welfare were engendered

compared with the RPR mechanism.

We conclude that the RPR mechanism helped negotiators achieve

better performance levels compared with the traditional TDB mechanism. Therefore, the RPR or ERPR negotiation support system is

recommended when designing an online negotiation mechanism. The

introduction of the RPR and ERPR mechanisms would be revolutionary

for the existing e-business trading mechanisms. The RPR and ERPR

mechanisms could be used successfully for electronic negotiations

where trusted third parties (e.g., e-marketplaces and intermediaries)

exist. Established e-commerce sites or e-marketplaces may introduce

762

S. Kwon et al. / Decision Support Systems 46 (2009) 755–762

the RPR/ERPR mechanisms as an option for their customers who are

willing to report their reservation price or willingness-to-pay in order to

find a more reasonable bargaining partner.

However, for wider application of this study, assumptions of the

analytical model need to be eased in order to represent more general

cases, such as arbitrary reservation price distribution cases and risk

neutral or risk seeking cases. In a future study, we plan to consider the

various levels of agent risk preferences and further factors. Also, further

experiments on fairness and truth revelation with different conditions

are expected to reveal more detailed suggestions on NSS design.

Acknowledgements

The authors would like to thank the reviewers and editors for their

helpful comments and suggestions. Byungjoon Yoo thanks Management Research Center at Seoul National University College of Business

Administration for grant funding. Jinbae Kim and Seungwoo Kwon

appreciate the financial support of a Korea University Grant. This

research was partially supported by the Natural Science Foundation of

China (NSFC Project Number: 70471027, 70801059), and the China

Postdoctoral Science Foundation for Wei Shang.

Appendix A

Summary of notations

Notations Description

PS

PB

RS

RB

ΔRS

ΔRB

CS

CB

Pmax

Pmin

ERS

ERB

α

EP

EUtS

EUtB

The bidding price of seller in t (Endogenous variable)

The bidding price of buyer in t (Endogenous variable)

The reservation price of seller (Exogenous variable)

The buyer's willingness-to-pay (Exogenous variable)

The false report amount (Endogenous variable)

If ΔRS = 0, it means a seller truthfully reports the reservation price

The false report amount (Endogenous variable)

If ΔRB = 0, it means a buyer truthfully reports the willingness-to-pay for item

The back-dragging cost of seller (Exogenous variable)

The back-dragging cost of buyer (Exogenous variable)

The maximum price for the item in the market (Exogenous variable)

The minimum price for item in the market. (Exogenous variable)

The expected value of seller's reservation price

The expected value of buyer's reservation price

The coefficient of risk preferences

The expected final deal price

The seller's expected utility in t

The buyer's expected utility in t

[13] J. Von Neumann, O. Morgenstern, Theory of Games and Economic Behavior,

Princeton University Press, 1953.

[14] W. Wang, H. Zoltán, A.B. Whinston, Shill bidding in multi-round online auctions—

system sciences, Proceedings of the 35th Hawaii International Conference on

System Sciences, 2002.

[15] D. Wei, Electronic Business-Oriented Negotiation Support System (PhD dissertation, Harbin Institute of Technology, 2001).

Kwon, Seungwoo is an associate professor of management

at Korea University Business School. He received his Ph.D.

in Organizational Behavior and Theory from Carnegie

Mellon University. His articles have been published in

journals such as Journal of Personality and Social Psychology, Journal of Applied Psychology and Human Resource

Management. He received outstanding article award from

the International Association for Conflict Management

(2002) and was nominated for the best paper based on

dissertation (Conflict Management Division) at the Academy of Management conference (2002). His current

research interests include conflict management, negotiation, compensation, and justice in organizations.

Yoo, Byungjoon is working for Graduate School of Business

at Seoul National University as an assistant professor. Before

he joined Seoul National University, he worked at Korea

University and Hong Kong University of Science and

Technology. He received a Ph.D. in Information Systems

from Carnegie Mellon University. His research interests are

on B2B e-commerce, online auctions and pricing strategies

of digital goods such as software products and online games.

He has published on these topics in journals such as

Management Science, Journal of Management Information

Systems, and Journal of Organizational Computing and

Electronic Commerce. He has consulting experiences with

Korea Stock Exchange, Korea Game Industry Agency and other companies.

Kim, Jinbae is a professor at Korea University Business School.

Before he joined Korea University, he had been an assistant

professor at Boston University. He received an MBA from the

University of Chicago and a Ph.D. from Carnegie Mellon

University. His research interests are on empirical tests of the

agency model, performance-reward relation and corporate

governance. He has published various papers in journals

including Accounting Research Journal, Journal of Accounting

and Auditing Research, Asia-Pacific Journal of Accounting and

Economics and Asia-Pacific Management Accounting Journal.

References

[1] A. Barua, C.H. Kriebel, T. Mukhopadhyay, MIS and information economics:

augmenting rich descriptions with analytical rigor in information systems design,

Proceedings of 10th International Conference on Information Systems, Boston, 1989.

[2] T. Bui, Building DSS for negotiators: a three-step design process, Proceedings of the

25th Hawaii International Conference on System Sciences, Hawaii, 1992.

[3] T. Bui, M.F. Shakun, Negotiation processes, evolutionary systems design, and

negotiator, Group Decision and Negotiation 5 (4-6) (1996).

[4] C. Cheng, C.H. Chan, K. Lin, Intelligent agents for e-marketplace: negotiation with

issue trade-offs by fuzzy inference systems, Decision Support Systems 42 (2006).

[5] D.K.W. Chiu, S.C. Cheung, P.C.K. Hung, S.Y.Y. Chiu, A.K.K. Chung, Developing eNegotiation support with a meta-modeling approach in a web services environment, Decision Support Systems 40 (2005).

[6] P. Cramton, Strategic delay in bargaining with two-sided uncertainty, Review of

Economic Studies 59 (1) (1992).

[7] Q. Dai, R.J. Kauffman, Business models for Internet-based E-procurement systems

and B2B electronic markets: an exploratory assessment, Proceedings of the 34th

Hawaii International Conference on System Sciences, 2001.

[8] S.J. Grossman, M. Perry, Sequential bargaining with one-sided incomplete information, Journal of Economic Theory 39 (1) (1986).

[9] M.A. Neale, G.B. Northcraft, Behavioral negotiation theory — a framework of conceptualizing dynamic bargaining, Research in Organizational Behavior 13 (1991).

[10] H. Raiffa, The Art and Science of Negotiation, Harvard University Press, Cambridge,1982.

[11] A. Rubinstein, A bargaining model with incomplete information about time

preference, Econometrica 53 (1985).

[12] M. Schoop, A. Jertila, T. List, Negoisst: a negotiation support system for electronic

business-to-business negotiations in e-commerce, Data and Knowledge Engineering 47 (3) (2003).

Shang, Wei is now a postdoctoral researcher at Institute of

Systems Science, Academy of Mathematics and Systems

Science, Chinese Academy of Sciences. She got her Ph.D. Degree

from Harbin Institute of Technology and visited Korea University for a year as a visiting student. Her research interests

include Negotiation Support Systems, Group Decision Making,

Macroeconomics Analysis Systems, and Software Engineering.

She has published papers in major conferences and journals

and participated in several national supported research projects

related to Negotiations and Group Decision-Making Systems.

Lee, Gunwoong is a Ph.D. student at Krannert School of

Management at Purdue University. Before his Ph.D. program,

he worked at Korea Association of Game Industry as a

research fellow. His research focuses on online reputation

systems and information economics. He has a MSc in

Management Information Systems, and a BSc in Computer

Science from Korea University.