IRslabel LOUISIANA RURAL WATER ASSOCIATION 72

advertisement

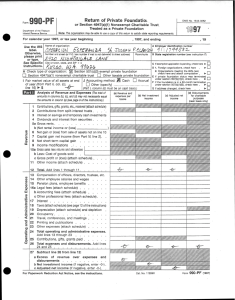

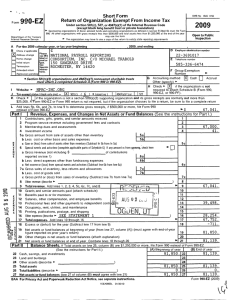

Form OMB No 1545-0047 990 RA WRONF v O TAMPraX 200 Under section 501(c ), 527, or 4947(aXl) of the Internal Revenue Code " Q r- ntb Pubfic (except black lung benefit trust or private foundation ) Department of the Treasury Internal Revenue Service (77) For the 2007 calendar year, or tax y ear be g innin g B Check if applicable Address change Name change Initial return 7/01 , 2007, and endin g 6 /30 C IRslabel LOUISIANA RURAL WATER ASSOCIATION orprint P.O . BOX 180 orty pe . see KINDER, LA 70648-0180 Termination , 2008 D Employer Identification Number E Telephone number F Accou n ting method : 72-0839514 337-738-2896 specific Instruc tions. Amended return Application pending H (a ) is this a group return for affiliates' H (b) if 'Yes ,' enter number of affiliates Organization type K if the organization is not a 509(a)(3) supporting organization and its Check here ^ gross receipts are normally not more than $25,000. A return is not required, but if the organization chooses to file a return, be sure to file a complete return. ^ ( check onl y one X 501(c) (insert no ) 6 - 4947( a)(1) or Gross recei p ts: Add lines 6b, 8b, 9b, and 10b to line 120, 2, 018 a b c d 836. Contributions, gifts, grants, and similar amounts received: Contributions to donor advised funds Direct public support (not included on line 1a) Indirect public support (not included on line 1 a) Government contributions (grants) (not included on line 1a) e IT atthroughlld)(cash 2 3 E 527 4 5 6a b c 7 $ 1,487,391. noncash E N le Program service revenue including government fees and contracts (from Part VII, line 93) Membership dues and assessments. Interest on savings and temporary cash investments 2 3 4 Dividends and interest from securities Gross rents Less. rental expenses Net rental income or (loss). Subtract line 6b from line 6a Other investment income (describe . ^ No 1-1 Yes X No 5 Program services (from line 44 , c umo_(B))..a. 1 , 487 , 391. 501 , 703. 29 , 742. 6a 6b 6c 7 (B) Other 8a Gross amount from sales of assets other 8a than inventory 8b b Less' cost or other basis and sales expenses 8c c Gain or (loss) (attach schedule) d Net gain or (loss). Combine line 8c, columns (A) and (B) . . 9 Special events and activities (attach schedule). If any amount is from gaming , check here of contributions a Gross revenue (not including $ 9a reported on line lb) 9b b Less- direct expenses other than fundraising expenses c Net income or (loss) from special events. Subtract line 9b from line 9a 10a 10a Gross sales of inventory, less lOb b Less: cost of goods sold REC ttach sc c J rom line 10a c Gross profit or (loss) from sales of Inv ntor 11 Other revenue (from Part VII, pre 103. 41 12 Total revenue . Add lines le, 2 , 5^ 14 Yes 11 1 , 487 , 391. $ (A) Securities 13 a No Grou p Exem tion Number ^ Check ^ X if the organization is not required to attach Schedule B (Form 990, 990-EZ, or 990-PF). 1a 1b 1c 1d Ix Management and general fro line R 15 Fundraising (from line 44, col n-( E 16 Payments to affiliates (attach schedule) S 17 Total ex penses . Add lines 16 and 44, column (A) A 18 Excess or (deficit) for the year. Subtract line 17 from line 12 N 5 19 Net assets or fund balances at beginning of year (from line 73, column (A)) T T 20 Other changes in net assets or fund balances (attach explanation) s 21 Net assets or fund balances at end of year. Combine lines 18, 19, and 20 BAA For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. x H (d) is this a separate return filed by an organization covered by a group ruiing7 I M E]Yes Revenue . Expenses . and Chanaes in Net Assets or Fund Balances (See the instructions ) 1 R E v N E Accrual ^ H (c) Are all affiliates included' (If'No,' attach a list See instructions) J LkJ N H andl are not applicable to section 527organrmhons • Section 501 C X organizations and 4947(a X l ) nonexempt charitable tru sts must attach a completed s c hedule A G Web site: ^ WWW . LRWA. ORG Part I Cash other (specify) ^ Form 990 or 990-E Z). Z)' L h spection ^ The organization may have to use a copy of this return to satisfy state reporting requirements A 7 8d c 10c 11 12 13 2, 018, 836. 1,375,382. 14 614,202. 15 16 17 18 19 20 21 TEEA0109L 12/27/07 1,989,584. 29,252. 801,004. 830, 256. Form 990 (2007) lW 72-0839514 Page 2 Form 990 (2007 ) LOUISIANA RURAL WATER ASSOCIATION art 1I Statement of Functional Expenses All organizations must complete column (A) Columns (B), (C), and (D) are required for section 501 Cc)(3) and (4) organizations and section 4947 (a)(1) nonexempt charitable trusts but optional for others. ( See instruct) (C) Management (B) Program Do not include amounts reported on line (D) Fundraising (A) Total and g eneral services 6b, 8b, 9b, 10b, or 16 of Part l 22a Grants paid from donor advised funds (attach sch) (cash $ non-cash $ If this amount includes foreign grants, check here 22b Other grants and allocations (att sch) $ (cash non-cash $ 22a If this amount includes foreign grants, check here 22b Specific assistance to individuals (attach schedule) 23 Benefits paid to or for members (attach schedule) 24 25a Compensation of current officers, directors, key employees, etc. listed in Part V-A 25a 80 , 000. 73 1 600. 6 , 400. 0. directors, key employees, etc. listed in Part V-B 25b 0. 0. 0. 0. c Compensation and other distributions, not included above, to disqualified persons (as defined under section 4958(f)(1)) and persons described in section 4958(c)(3)(B) . 25c 0. 0. 0. 06 559 743. 519 586. 40 , 157. 155 917. 15 , 512. 136 589. 11 , 232. 19 , 328. 4 , 280. 23 24 b Compensation of former officers, 26 27 28 Salaries and wages of employees not . included on lines 25a, b, and c 26 Pension plan contributions not included on lines 25a, b, and c 27 Employee benefits not included on lines 25a - 27 29 Payroll taxes . 28 29 . 30 31 32 33 34 35 36 37 38 50,853. 39 Travel. 39 287 213. 40 Conferences, conventions, and meetings 40 167 , 231 . 30 31 32 33 34 35 36 37 38 41 Professional fundraising fees Accounting fees Legal fees Supplies Telephone Postage and shipping Occupancy Equipment rental and maintenance Printing and publications 19 , 688. 167 , 231. 41 Interest 42 42 Depreciation, depletion, etc (attach schedule) 21, 988 . 18 , 461. 3 , 527. 318 054. 1 , 515. 28,820. 6 , 183. 8 , 940. 230 , 050. 22 , 049. 35,516. - a Advertising Dues b ------------------c Indirect ----------------dMis_cell_a_n_eou_s _ _ _ _ _ _ _ eTrainin_cL ----_--_--__ - Other expenses not covered above (itemize) - 43 50 , 853. 267 525. 43a 43b 43c 43d 4 6 , 183. 8 , 940. 548 104. 23 , 564. 64,336. f ------------------- 43f 43g 9 44 Total functional expenses Add lines 22a throu h 43g (Or anizations completing columns B) - D), carry t^ese totals to lines 13-15 44 1 , 989 , 584. 1 , 375 , 382. 1 614 202. 0. Joint Costs . Check "H if you are following SOP 98-2. Yes X No ' Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services? $ (ii) the amount allocated to Program services If 'Yes,' enter (i) the aggregate amount of these joint costs and (iv) the amount allocated (iii) the amount allocated to Management and general $ $ to Fundraising $ Form 990 (2007) BAA TEEAO1021. 08/02/07 Form 990 2007 LOUISIANA RURAL WATER ASSOCIATION Statement of Program Service Accomplishments (See the instructions ) Pat tit 72-0839514 Pa ge 3 Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular organization. How the public perceives an organization in such cases may be determined by the information presented on its return. Therefore, please make sure the return is complete and accurate and fully describes, in Part III, the organization's programs and accomplishments. Program Service Expenses What is the organization's primary exempt purpose? ^ Technical Assistance_ and Traininq All organizations must describe their exempt purpose achievements in a clear and concise manner. State the number of ^e^) organ zr^at0ions andand clients served publications issued etc. Discuss achievements that are not measurable. (Section 501(c)(3) and (4) organ ^947(a)(1) trusts, but izations and 4§47 (a)( 1 ) nonexem p t charitable trusts must also enter the amount of g rants and allocations to others. ) opeona for others ) a To Provide-training and technical-assistance to rural-and-small _ _ municipal-water and wastewater personnel and systems.---------------------------------- --------------------------------3151 Systems Served ---------- ------------------------------------------------ --------- ------------------------------If this amount includes forei g n grants, check here (Grants and allocations $ 1, 375, 382. b ------------ --------- --------------------------------- ------------ -- - ----- - - ---- ----- ---------------------------------- --------- -------------------------------------------- --------- ------------------------------If this amount includes foreign grants, check here ^ (Grants and allocations $ C ------------- --------- -------------------------------------------- --------- -------------------------------------------- -- --- --- - --- -- ------ --------------------------------- --------- -------------------------------------------- --------- -----------------------------If this amount includes foreign grants, check here (Grants and allocations $ d ------------ --------- ---------------------------------- --- -- ----- - - ------- ---------------- -- ---- -- -- ----- ------------- --------- --------------------------------$ ) If this amount includes forei gn grants, check (Grants and allocations -----------------------------------------------e Other program services If this amount includes forei g n g rants, check here b, $ (Grants and allocations f Total of Program Service Expenses (should equal line 44, column (B), Program services) - EJ 1, 375, 382. Form 990 (2007) BAA TEEA0103L 12/27/07 Form 990 2007 LOUISIANA RURAL WATER ASSOCIATION [ Part 1V Balance Sheets (See the Instructions) Note : 72-0839514 Where required, attached schedules and amounts within the description column should be for end-of-year amounts only (A) Beginning of year Pag e 4 (B) End of year 45 Cash - non-interest-bearing 556 r 583. 45 627, 435. 46 Savings and temporary cash investments 161 047. 171, 150. 47a Accounts receivable b Less: allowance for doubtful accounts 47a 47b 48a Pledges receivable b Less, allowance for doubtful accounts 48a 49 46 47c 48b 48c Grants receivable 204 920. 50 a Receivables from current and former officers, directors, trustees, and key employees (attach schedule) 49 170 074. 50a b Receivables from other disqualified persons (as defined under section 4958(f)(1)) and persons described in section 4958(c)(3)(B) (attach schedule) 50b A 51 a Other notes and loans receivable (attach schedule) b Less allowance for doubtful accounts r; s 52 51 a 51 b 51 c Inventories for sale or use 52 53 Prepaid expenses and deferred charges 54a Investments - publicly-traded securities b Investments - other securities (attach sch) 55a Investments - land, buildings, & equipment: basis b Less: accumulated depreciation (attach schedule) 56 Investments - other (attach schedule) 57a Land, buildings, and equipment: basis b Less: accumulated depreciation (attach schedule) Statement 1 44,872. : Cost Cost B FMV FMV 55b 55c 56 57a 1, 232, 389. 57b 548, 809. 59 60 Accounts payable and accrued expenses 61 Grants payable 1 62 Deferred revenue B i i E 63 s 65 66 A S 706, 912. 57c 58 1, 674, 334. 30,288. 59 1,705,097. 60 65,483. 131, 577. 62 64b 341, 968. 65 338,054. 336,872. 873, 330. 66 874,841* 801 004. 67 830 256. 369, 497. _S e e_ S t a t eme n_t 2_ Other liabilities (describe ^ Total liabilities . Add lines 60 throu h 65 _ _ - - - - - _) ^X and complete lines 67 67 Unrestricted Temporarily restricted 68 69 Permanently restricted 69 and complete lines o Organizations that do not follow SFAS 117, check here^ F 70 through 74. H 70 Capital stock, trust principal, or current funds B 71 Paid-in or capital surplus, or land, building, and equipment fund 72 Retained earnings, endowment, accumulated income, or other funds 74 134, 432. 63 64a 68 73 683, 580. 61 Loans from officers, directors, trustees, and key employees (attach schedule) 64a Tax-exempt bond liabilities (attach schedule) b Mortgages and other notes payable (attach schedule) Organizations that follow SFAS 117, check here ^ through 69 and lines 73 and 74. 52,858. 55a Other assets, including program-related investments (describe ^ ) -----------------------------Total assets (must equal line 74). Add lines 45 through 58 58 53 54a 54b Total net assets or fund balances . Add lines 67 through 69 or lines 70 through 72. (Column (A) must equal line 19 and column (B) must equal line 21) Total liabilities and net assetslfund balances . Add lines 66 and 73 BAA 70 71 72 004. 73 830 256. 1, 674, 334. 74 1,705 , 097 . 801 Form 990 (2007) TEEA0104L 08102107 LOUISIANA RURAL WATER ASSOCIATION Form 990 2007 72-0839514 Part IV-A Reconciliation of Revenue per Audited Financial Statements with Revenue per Return (See the instructions ) Total revenue, gains, and other support per audited financial statements Amounts included on line a but not on Part I, line 12 1 Net unrealized gains on investments 2Donated services and use of facilities 3Recoveries of prior year grants 4Other (specify): ------------------------------ a b Subtract line b from line a d Amounts included on Part I, line 12, but not on line a: bl b2 b3 b4 b c 1 Investment expenses not included on Part I, line 6b 2Other (specify): 2 , 0 8836. d1 ------------------------------ --------------------------------------Add lines dl and d2 d2 d 110- 1 e Total revenue (Part I, line 12) . Add lines c and d e 2 018, 836. a - -------------------------------------Add lines bl through b4 c Pa g e 5 2, 018, 836. Part IV-B Reconciliation of Expenses per Audited Financial Statements with Expenses p er Return a b Total expenses and losses per audited financial statements Amounts included on line a but not on Part I, line 17: 1 Donated services and use of facilities 2Prior year adjustments reported on Part I, line 20 3Losses reported on Part I, line 20 . a 1,989,584. b1 b2 b3 4Other (specify): c ------------------------------------------------------------------ .. Add lines b1 through b4 Subtract line b from line a d Amounts included on Part I, line 17, but not on line a: 1 Investment expenses not included on Part I, line 6b 2Other (specify): ------------- .. .. c 1, 989, 584. d e 1,989,584. ----------------d2 Total ex p enses ( Part I, line 17). Add lines c and d Pad vA b .. d1 --------------------------------------Add lines dl and d2 e b4 ^ Current Officers , Directors, Trustees , and Key Employees (List each person who was an officer, director, trustee, or key employee at any time during the year even if they were not compensated) (See the instructions ) (A) Name and address (B) Title and average hours per week devoted to position (C) Compensation (if not paid , enter -0-) ----------------------------------------See Statement 3 80,000. (D) Contributions to employee benefit plans and deferred compensation plans 5,600. (E) Expense account and other allowances 0. -------------------------------------------------------------------------------------------------------------------------------------------------------------------- ------------------------------------------BAA TEEA0105L 08/02107 Form 990 (2007) Form 990 (2007 ) LOUISIANA RURAL WATER ASSOCIATION PartyA Current Officers , Directors , Trustees , and Key Em p lo yees continued 75a Enter the total number of officers, directors, and trustees permitted to vote on organization business at board meetings 818 72-0839514 Pa g e 6 Yes No b Are any officers, directors, trustees, or key employees listed in Form 990, Part V-A, or highest compensated -----------employees listed in Schedule A, Part I, or highest compensated professional and other independent contractors listed in Schedule A, Part II-A or II-B, related to each other through family or business relationships? If 'Yes,' attach a statement that identifies the individuals and explains the relationship(s) 75b c Do any officers, directors, trustees, or key employees listed in form 990, Part V-A, or highest compensated employees listed in Schedule A, Part I, or highest compensated professional and other independent contractors listed in Schedule A, Part II-A or II-B, receive compensation from any other organizations, whether tax exempt or taxable, that are related to the organization? See the instructions for the definition of 'related organization' 75c If 'Yes,' attach a statement that includes the information described in the instructions. d Does the or g anization have a written conflict of interest p olicy ? 75d X X X Part V-B Former Officers , Directors, Trustees, and Key Employees That Received Compensation or Other Benefits (If an y former officer, director, trustee, or key employee received compensation or other benefits (described below) during the year, list that person below and enter the amount of compensation or other benefits in the appropriate column See the instructions.) (A) Name and address (B) Loans and Advances (C) Compensation (if not paid, enter -0-) (D) Contributions to employee benefit plans and deferred compensation plans (E) Expense account and other allowances None ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Part Vl Other Information See the instructions ) Yes Did the organization make a change in its activities or methods of conducting activities? If 'Yes,' attach a detailed statement of each change 77 Were any changes made in the organizing or governing documents but not reported to the IRS? If 'Yes,' attach a conformed copy of the changes. 78a Did the organization have unrelated business gross income of $1,000 or more during the year covered by this return?. b If 'Yes,' has it filed a tax return on Form 990 -T for this year? .. No 76 79 Was there a liquidation, dissolution, termination, or substantial contraction during the year? If 'Yes,' attach a statement 80a Is the organization related (other than by association with a statewide or nationwide organization) through common membership, governing bodies, trustees, officers, etc, to any other exempt or nonexempt organization? b If 'Yes,' enter the name of the organization ^ N/A ---------------------------------- ____________________________ and check whether it is 11exemptor 81 a Enter direct and indirect political expenditures (See line 81 instructions) 81 a b Did the or g anization file Form 1120 -POL for this ear? BAA TEEA0106L 12/27/07 76 77 78a 78b !Xd X X 79 X 80a X 1b X Rnonexempt. 0. Form 990 (2007) Form 990 2007 LOUISIANA RURAL WATER ASSOCIATION 72-0839514 Pa e 7 Part VI Other Information continued Yes No 82a Did the organization receive donated services or the use of materials, equipment, or facilities at no charge or at substantially less than fair rental value? b If 'Yes,' you may indicate the value of these items here Do not include this amount as revenue in Part I or as an expense in Part II. (See instructions in Part III.) 82b 83a Did the organization comply with the public inspection requirements for returns and exemption applications? b Did the organization comply with the disclosure requirements relating to quid pro quo contributions? 84a Did the organization solicit any contributions or gifts that were not tax deductible? 82a X N/A 83a 83b 84a b If 'Yes,' did the organization include with every solicitation an express statement that such contributions or gifts were not tax deductible ? 85a 501 (c)(4), (5), or (6) Were substantially all dues nondeductible by members? b Did the organization make only in-house lobbying expenditures of $2,000 or less? X N A X 84b 85a 85b N A 85g N A 85h NIA X X If 'Yes' was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a waiver for proxy tax owed for the prior year. c d e f g Dues, assessments, and similar amounts from members Section 162(e) lobbying and political expenditures Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices Taxable amount of lobbying and political expenditures (line 85d less 85e) Does the organization elect to pay the section 6033(e) tax on the amount on line 85f? 85c 0. 85d 85e 27,228. 2..1 229. 0. 85f h If section 6033(e)(1)(A) dues notices were sent, does the organ ization agree to add the amount on line 85f to its reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the following tax year? . 86 501 (c)(7) organizations Enter: a Initiation fees and capital contributions included on line 12, b Gross receipts, included on line 12, for public use of club facilities 87 501(c)(12) organizations Enter: a Gross income from members or shareholders. b Gross income from other sources . (Do not net amounts due or paid to other sources against amounts due or received from them 86a N/A 86b 87a N/A N/A 87b N/A 88a At any time during the year , did the organization own a 50% or greater interest in a taxable corporation or partnership, or an entity disregarded as separate from the organization under Regulations sections 301 7701-2 and 301.7701-3? If 'Yes,' complete Part IX 88a X b At any time durin the year, did the or g anization, directly or indirectly , own a controlled entity within the meaning of section 512(b)(13) ? If 'Yes,' complete Part XL ^ 88b 89a 501 (c)(3) organizations . Enter : Amount of tax imposed on the organization during the year under: section 4911 ^ N/A ; section 49121N / A ; section 4955 1-_ _ _ _ _ _ - - N/A b 501(c)(3) and 501(c)(4) organizations Did the organization engage in any section 4958 excess benefit transaction during the year or did it become aware of an excess benefit transaction from a prior year? If ' Yes,' attach a statement explaining each transaction X 89b N A c Enter : Amount of tax im p osed on the or g anization managers or disqualified persons during the year under sections 4912, 4955, and 4958 ^ N/A d Enter - Amount of tax on line 89c, above , reimbursed by the organization ^ N/A e All organizati ons At any time during the tax year, was the organization a party to a prohibited tax shelter transaction? 89e f All organ izations Did the organization acquire a direct or indirect interest in any applicable insurance contract? 89f X X g For supporting organizations and sponsoring organizations maintaining donor advised funds Did the supporting organization, or a fund maintained by a sponsoring organization, have excess business holdings at any time during the year? X 89g 90a List the states with which a copy of this return is filedNone -------------------------------------b Number of employees employed in the pay period that includes March 12, 2007 (See instructions.) . . 91a The books are in care of ^ PATRICIA BROUSSARD Telephone number ^ located at ^ P.O. BOX 180, - KINDER, --LA 190bl 0 337-738-2896 ZIP +4- 70648-01 80 b At any time during the calendar year, did the organization have an interest in or a signature or other authority over a financial account in a foreign country (such as a bank account, securities account, or other financial account)? If 'Yes,' enter the name of the foreign country- Yes 91 b No X See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of Foreign Bank and Financial A ccounts. BAA Form 990 (2007) TEEA0107L 09/10/07 Form 990 (2007) LOUISIANA RURAL WATER ASSOCIATION Part VI Other Information (continued) 72-0839514 Page 8 Yes No c At any time during the calendar year, did the organization maintain an office outside of the United States? If 'Yes,' enter the name of the foreign country0l _ - - _ - _ 92 Section 4947(a)(1) nonexempt charitable trusts filing Form 990 rn lieu of Form 1041 -Check here 92 and enter the amount of tax-exem p t interest received or accrued durin g the tax y ear Part VII I Analy sis of Income-Producin g Activities (Seethe instructions Unrelated business income Excluded by section 512, 513, or 514 Note: Enter gross amounts unless (A) Business code otherwise indicated (B) Amount (C) Exclusion code 91 c X N/A 0- 11 N/A Related E or exempt function income (D) Amount Program service revenue. 93 a b c d e If Medicare/Medicaid payments g Fees & contracts from government agencies 94 Membership dues and assessments 95 Interest on savings & temporary cash invmnts 1 73101 27,602.1 1 1 474,101. 29.742. Dividends & interest from securities Net rental income or (loss) from real estate a debt-financed property b not debt-financed property 98 Net rental income or (loss) from pers prop 99 Other investment income 96 97 100 Gain or (loss) from sales of assets other than inventory 101 Net income or (loss ) from special events 102 Gross profit or ( loss) from sales of inventory 103 Other revenue: a b c d e 27, 602. Subtotal ( add columns ( B) , (D), and (E)) and line columns (B), (D), (E)) 105 Total (add 104, Note : Line 105 plus line 1 e, Part 1, should equal the amount on line 12, Part 503,843. 104 531, 445. ^ Part VIII Relationshi p of Activities to the Accom p lishment of Exem pt Purp oses (See the Instructions. Line No . Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment of the organization ' s exempt purposes (other than by providing funds for such purposes). N/A Part IX Information Re gardin g Taxa ble Subsidiaries and Disre g arded Entities (See the Instruc tions. (A) (B) (C) (D) (E) Name, address, and EIN of corporation, partnership, or disregarded entity Percentage of ownership interest Nature of activities Total income End-of-year assets N/A Part X % % % Information Re g ardin g Transfers Associa ted with Personal Benefit Contracts (See the instructions a Did the organization, during the year, receive any funds, directly or indirectly, to pay premiums on a personal benefit contract? b Did the organization , during the year, pay premiums, directly or indirectly, on a personal benefit contract? Note : If 'Yes' to (b), file Form 8870 and Form 4720 (see instructions) BAA TEEA0108L 12/27107 Yes H Yes X No X No Form 990 (2007) Form 990 2007 LOUISIANA RURAL WATER ASSOCIATION 72-0839514 Part Xi Information Regarding Transfers To and From Controlled Entities . Complete only if the oraanizatfon is a controllina oroanfzatfon as defined in section 512(b)(13). Pa ge 9 Yes 106 Did the reporting organization make any transfers to a controlled entity as defined in section 512(b)(13) of the Code? If 'Yes,' com p lete the schedule below for each controlled entity Name , add ess, of each controlled entity a Employer Identification Number Description of transfer No x (D) Amount of transfer ------------------------------------------------------------------------- b ------------------------------------------------ c -----------------------Totals Yes 107 Did the reporting organization receive any transfers from a controlled entity as defined in section 512(b)(13) of the Code? If 'Yes,' com p lete the schedule below for each controlled entity (A) Name, address, of each controlled entity (B) Employer Identification Number a ------------------------------------------------- b ------------------------------------------------- c ------------------------------------------------- (C) Description of transfer No X (D) Amount of transfer Totals Yes 108 Did the organization have a binding written contract in effect on August 17, 2006, covering the interest, rents, royalties, and annuities descr ed in question 107 above? Under pen es f true, corre , a Please Sign Here erl mp I have exa o f preparer I e ed If s retwn irndidmgdaccompan ing sdiedrls er than othcer is as on a information o w ^ Sign re f offs er ^ Date i4 D1,ee- T Type or print name and bd Paid Pre- Preparer's signature parer's Firm's name (or yoursif self' ^ a dd reo sedand Use Only id statements , and to the b est of my knowledge and belief, it is preparer as any knowlacge m vP+a ^ Gra on Casida y & Guillo ast Street Lake Charles, LA 70601 14 E BAA TEEA011OL No X 2007 Federal Statements Page 1 LOUISIANA RURAL WATER ASSOCIATION Client 5317 72-0839514 03:56PM 12/11/08 Statement 1 Form 990 , Part IV, Line 57 Land , Buildings , and Equipment Category Accum. Deprec. Basis Miscellaneous $ Total 1 , 232 , 389. $ 1,232,389. Book Value 548 809. $ 548,809. 683 , 580w 683,580. Statement 2 Form 990 , Part IV, Line 65 Other Liabilities Vacation & Sick Leave Payable $ Total 336 872. 336,8727 Contribution to EBP & DC Expense Account/ Other Statement 3 Form 990 , Part V-A List of Officers, Directors , Trustees , and Key Employees Name and Address PATRICK CREDEUR P.O. BOX 180 KINDER, LA 70648 Title and Average Hours Per Week Devoted Executive Direc $ 40.00 Compensation 80,000. $ 5,600. $ 0. JERON FITZMORRIS 518 N COLUMBIA STREET COVINGTON, LA 70433 Member 0 0. 0. 0. LEWIS GALLOWAY 415 WEST 25TH AVENUE COVINGTION, LA 70433 Member 0 0. 0. 0. JAMES CLARK P.O. BOX 1059 DENHAM SPRINGS, LA 70726 Member 0 0. 0. 0. SID KINCHEN P.O. BOX 1883 ALBANY, LA 70711 Member 0 0. 0. 0. DONALD NASH 13186 Terre Haute VACHERIE, LA 70090 Member 0 0. 0. 0. DONDI TROXLER 207 BEAU PLACE DES ALLEMANDE, LA 70030 Member 0 0. 0. 0. /l J e Federal Statements 2007 Page 2 LOUISIANA RURAL WATER ASSOCIATION Client 5317 72-0839514 12/11 /08 03.56PM Statement 3 (continued) Form 990 , Part V-A List of Officers , Directors , Trustees, and Key Employees Name and Address Title and Average Hours Per Week Devoted Contribution to EBP & DC Compensation Expense Account/ Other GARY SOILEAU P.O. BOX 155 KROTZ SPRINGS, LA 70750 Member $ 0 0. $ 0. $ 0. GLENN BRASSEAUX P.O. DRAWER 10 CARENCRO, LA 70520 Member 0 0. 0. 0. LEE CLEMENT 6075 GRAND MARAIS ROAS JENNINGS, LA 70546 Member 0 0. 0. 0. President 0 0. 0. 0. Member 0 0. 0. 0. Vice President 0 0. 0. 0. LARRY MERRITT P.O. BOX 128 SIBLEY, LA 71073 Member 0 0. 0. 0. P.M. WOODS P.O. BOX 1093 ZWOLLE, LA 71486 Member 0 0. 0. 0. TOM OWENS P.O. BOX 1272 WEST MONROE, LA 71294 Member 0 0. 0. 0. Treasurer 0 0. 0. 0. 0. 0. 0. 80,000. 5,600. 0. WAYNE FONTENOT P.O. BOX 247 KINDER, LA 70648 AUBREY PETERSON P.O. BOX 310 GRAYSON, LA 71435 GLEN WOMACK P.O. BOX 653 HARRISONBURG, LA 71340 FRANK JONES P.O. BOX 176 PIONEER, LA 71266 0 Total m 8868 Application for Extension of Time To File an Exempt Organization Return (R e v April 2007) (R Department of the Treasury OMB No 1545-1709 ^ File a separate application for each return. Internal Revenue Service • If you are filing for an Automatic 3-Month Extension , complete only Part I and check this box • If you are filing for an Additional (not automatic ) 3-Month Extension , complete only Part li (on page 2 of this form) Do notcornp/etePart //unless you have already been granted an automatic 3-month extension on a previously filed Form 8868. Part t ^ u Automatic 3-Month Extension of Time . Only submit original (no copies needed). Section 501(c) corporations required to file Form 990-T and requesting an automatic 6-month extension -check this box and complete Part ^ only All other corporations (including 1120-C filers), partnerships , REM/CS, and trusts must use Form 7004 to request an extension of time to file Income tax returns Electronic Filing (e-file). Generally, you can electronically file Form 8868 If you want a 3-month automatic extension of time to file one of the returns noted below (6 months for section 501(c) corporations required to file Form 990-T). However, you cannot file Form 8868 electronically if (1) you want the additional (not automatic) 3-month extension or (2) you file Forms 990-BL, 6069, or 8870, group returns, or a composite or consolidated Form 990-T. Instead, you must submit the fully completed and signed page 2 (Part II) of Form 8868. For more details on the electronic filing of this form, visit www irs gov/e file and click on e-file for Charities & Nonprofits Type or punt File by the due date for filing your return See instructions Name of Exempt Organization Employer Identification number LOUISIANA RURAL WATER ASSOCIATION 72-0839514 Number , street , and room or suite number if a P 0 box , see instructions P.O. BOX 180 City, town or post office , state , and ZIP code For a foreign address, see instructions KINDER, LA 70648-0180 Check type of return to be filed (file a separate application for each return): Form 990-T (corporation) X Form 990 Form 990-T (section 401(a) or 408(a) trust) Form 990-BL Form 990-T (trust other than above) Form 990-EZ Form 1041-A Form 990-PF • The books are in the care Form 4720 Form 5227 Form 6069 Form 8870 PATRICIA BROUSSARD Telephone No. ^ 337-738- 2896 ----___ FAX No. ^ • If the organization does not have an office or place of business in the United States , check this box . .. ^ U . If this is for the whole group, • If this is for a Group Return, enter the organization ' s four digit Group Exemption Number (GEN) check this box ^ U - If it is for part of the group , check this box ^ F land attach a list with the names and EINs of all members the extension will cover. 1 I request an automatic 3-month (6 months for a section 501(c) corporation required to file Form 990-T) extension of time until 2/1 5_ _ _ , 20 09_, to file the exempt organization return for the organization named above. The extension is for the organization ' s return for: ^ ^ 2 calendar year 20 - _ _ or X tax year beginning _ 7/01__- , 20 07 If this tax year is for less than 12 months , check reason : and ending - 6/30___ , 20 11 Initial return 08 U Final return U Change in accounting period 3a If this application is for Form 990 -BL, 990-PF, 990-T, 4720, or 6069 , enter the tentative tax, less any nonrefundable credits. See instructions $ 0. b If this application is for Form 990-PF or 990-T, enter any refundable credits and estimated tax payments made. Include any prior year overpayment allowed as a credit $ 0. c Balance Due . Subtract line 3b from line 3a. Include your payment with this form, or, if required, deposit with FTD coupon or, if required, by using EFTPS (Electronic Federal Tax Payment System). See instructions $ 0. Caution . If you are going to make an electronic fund withdrawal with this Form 8868, see Form 8453-EO and Form 8879-EO for payment instructions. BAA For Privacy Act and Paperwork Reduction Act Notice , see instructions . FIFZ0501L 05/01/07 Form 8868 (Rev 4-2007