2011 Study SAA – OESA Presentation

23 May 2011

11th Annual North American

Automotive OEM - Tier 1 Supplier

Working Relations Study

OEM Purchasing Summit

23 May 2011

John W. Henke, Jr., Ph.D.

Planning Perspectives, Inc. Professor of Marketing

Birmingham, MI

Oakland University

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

1

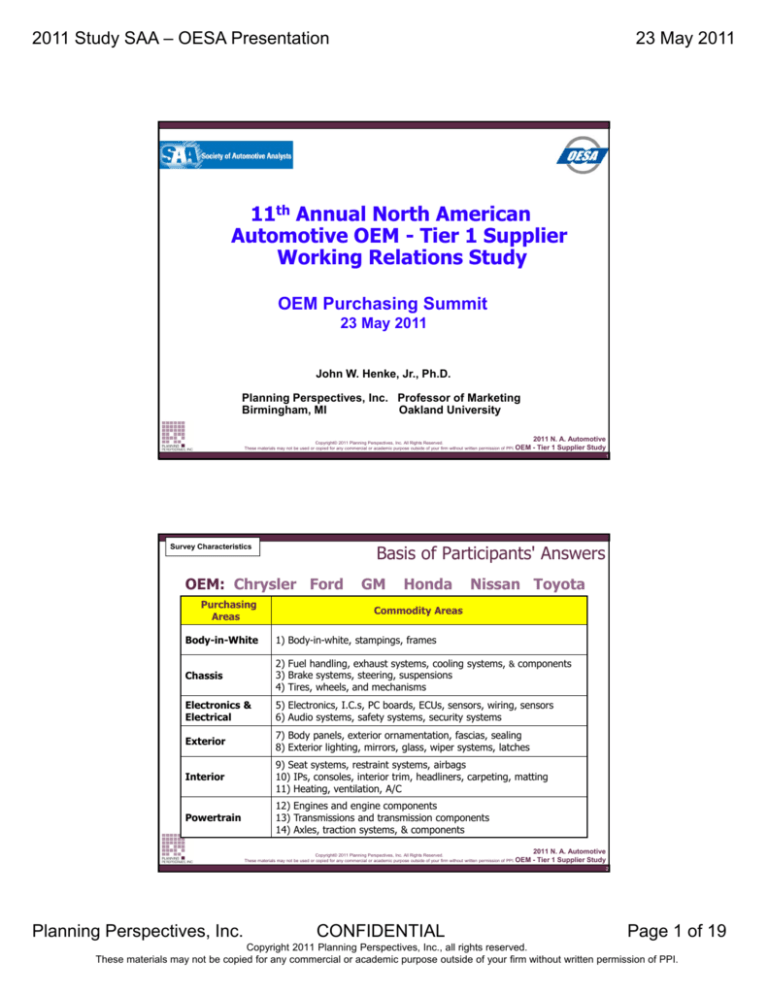

Basis of Participants' Answers

Survey Characteristics

OEM: Chrysler Ford

Purchasing

Areas

GM

Honda

Nissan Toyota

Commodity Areas

Body-in-White

1) Body-in-white, stampings, frames

Chassis

2) Fuel handling, exhaust systems, cooling systems, & components

3) Brake systems, steering, suspensions

4) Tires, wheels, and mechanisms

Electronics &

Electrical

5) Electronics, I.C.s, PC boards, ECUs, sensors, wiring, sensors

6) Audio systems, safety systems, security systems

Exterior

7) Body panels, exterior ornamentation, fascias, sealing

8) Exterior lighting, mirrors, glass, wiper systems, latches

Interior

9) Seat systems, restraint systems, airbags

10) IPs, consoles, interior trim, headliners, carpeting, matting

11) Heating, ventilation, A/C

Powertrain

12) Engines and engine components

13) Transmissions and transmission components

14) Axles, traction systems, & components

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

2

Planning Perspectives, Inc.

CONFIDENTIAL

Page 1 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

2011 Survey Participants

Survey Characteristics

• Time Frame: Early-March to Mid-April

• Internet-Based

• 540 sales personnel

• 415 Tier 1 suppliers

–

–

–

–

37 N.A. Top 50 suppliers

63 N.A. Top 100 suppliers

80 N.A. Top 150 suppliers

2010 annual N.A. sales equals 63% of six OEMs‘ annual buy

• 1984 buying situations (OEM – Commodity Area

combinations)

• Anonymous and confidential

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

OEM – Supplier

Working Relations

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

4

Planning Perspectives, Inc.

CONFIDENTIAL

Page 2 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

Buyer – Supplier

Working Relations Index™

Working Relations Index

Buyer – Supplier Working Relations

Very Poor

Adequate

Very Poor - Poor

0

100

200

Adversarial

Limited & Questionable

300

Relationship

Buyer

Communication

Very Good

Good – Very Good

400

Mutually Trusting

Open & Honest

Less

Buyer Help

More

A Lot

Buyer Hindrance

Little

Smaller

Supplier

Profit Opportunity

500

Greater

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

16

OEM – Supplier Working Relations

Components

Buyer – Supplier

Working Relations Index™

Working Relations Variables

Relationship

1) Supplier trust of OEM

2) Supplier perception of working relations with OEM

OEM

Communication

3) OEM open and honest communication with suppliers

4) OEM communicates timely information

5) OEM communicates adequate amounts of information

OEM Help

6) Help OEM gives to suppliers to reduce costs

7) Help OEM gives to suppliers to improve quality

OEM Hindrance

8) OEM late/excessive engineering changes (reverse measure)

9) Conflicting objectives across OEM functional areas (reverse measure)

10) Supplier given flexibility to meet piece price/tooling cost objectives

11) Supplier involvement in OEM product development process

Supplier

Profit

Opportunity

12)

13)

14)

15)

16)

17)

OEM shares savings from suppliers' piece price cost reduction proposals

OEM shares savings from suppliers' value chain cost reduction proposals

OEM rewards high performing suppliers with new/continued business

OEM covers sunk costs on cancelled or delayed programs

OEM concern for supplier profit margins when asking price reductions

Suppliers' opportunity to make acceptable return over long term

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

6

Planning Perspectives, Inc.

CONFIDENTIAL

Page 3 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

OEM – Supplier

Working Relations Index™

Working Relations Index™

GOOD–VERY GOOD

ADEQUATE

415

415

409

407

400

375

349

368

340

359

334

316

314

300

367

380

384

300

298

302

297

327

339

330

199

196

161

167

161

163

156

247

236

221

228

187

191

186

177

271

249

218

175

264

268

253

232

200

309

289

259

227

VERY POOR–POOR

OEM – Supplier Working Relations

500

174

157

163

174

161

162

150

183

162

131

114

100

2002

2003

2004

2005

2006

2007

2008

2009

2010

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011

2011 N. A. Automotive

- Tier 1 Supplier Study

7

Very Poor–Poor Supplier Working

Relations with Each OEM

Working Relations Index™

100%

2009

51%

48%

44%

50%

57%

45%

52%

60%

59%

68%

71%

2011

56%

29%

27%

25%

21%

30%

40%

21%

Percent of Suppliers

80%

76%

2010

20%

0%

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

8

Planning Perspectives, Inc.

CONFIDENTIAL

Page 4 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

Good–Very Good Supplier Working

Relations with Each OEM

Working Relations Index™

100%

2009

2010

2011

Percent of Suppliers

80%

45%

47%

47%

41%

51%

49%

60%

26%

28%

20%

15%

19%

21%

3%

8%

20%

7%

16%

18%

28%

40%

0%

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

9

Supplier Preference of OEM

as a Customer

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

10

Planning Perspectives, Inc.

CONFIDENTIAL

Page 5 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

Degree to Which OEM is

a Preferred Customer

Supplier Preferred Customer

Most Preferred

(6.0)

2009

2010

4.6

4.5

4.6

4.8

3.7

3.8

3.7

3.8

3.2

3.6

Preferred

(4.0)

3.8

4.1

4.3

4.4

4.7

Very Preferred

(5.0)

2.9

3.0

Somewhat

Preferred

(3.0)

2.6

Customer Preference

2011

Ambivalent

(2.0)

Would Prefer Not

Doing Business

With Them

(1.0)

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

11

Suppliers Who Prefer Not Doing

Business with OEM/Ambivalent

Supplier Preferred Customer

2009

100%

2010

2011

54%

41%

8%

5%

10%

5%

5%

9%

21%

20%

14%

14%

19%

20%

14%

21%

31%

40%

21%

60%

45%

Percent Of Suppliers

80%

0%

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

12

Planning Perspectives, Inc.

CONFIDENTIAL

Page 6 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

Supplier Preferred Customer

23 May 2011

Suppliers Who Consider OEM to be

Very Preferred-Most Preferred Customer

2009

100%

2010

2011

56%

54%

48%

31%

28%

25%

28%

5%

14%

20%

12%

33%

40%

28%

41%

56%

67%

61%

50%

60%

13%

Percent Of Suppliers

80%

0%

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

13

Why should an OEM care

about supplier relations?

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

14

Planning Perspectives, Inc.

CONFIDENTIAL

Page 7 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

Economic Benefits Realized by Buyers from

Trusting Supplier Working Relations

Buyer Integration Benefits

- Greater speed to market

- Increased Supplier investments specific to Buyer

needs

- Reduced/minimal Supplier opportunistic behavior

- Increased Supplier commitment

- Increased patents

- Increased Supplier involvement in Buyer new

product development

- Increased and improved mutual communication and

information exchange

- Reduced adversarial activities; increased cooperation

Buyer Operational Benefits

- Reduced number of purchasing agents

- Improved Just-in-Time performance

- Reduced supply base

- Reduced WIP and finished goods inventories

- Reduced cycle times

- Reduced supplier response times

- Improved quality

- Increased Supplier new technology sharing

- Improved delivery performance

- Increased competitiveness

- Supplier support of best personnel and resources

- Increased Supplier open and honest communication

Buyer Financial Benefits

- Increased Supplier R&D activities related to Buyer

needs

- Supplier conducts research on Buyer end-customers

- Reduced transaction costs

- Lower cost of goods

- Increased profit margins and profits

- Greater Supplier price concessions

- Increased ROI

- Increased NBIT

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

15

Important Working Relations

Changes Impacting Both OEMs

and Suppliers

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

16

Planning Perspectives, Inc.

CONFIDENTIAL

Page 8 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

Excessive/Late OEM Engineering Changes:

Hurt Ability to Develop Product on Time

OEM Hindrance

Great

2009

2.7

2.8

2.7

(3.00)

2.7

3.0

2.9

Some

3.0

3.2

F

3.1

GM

3.3

3.4

3.2

3.4

3.5

2011

3.2

3.4

2010

3.3

Extent of Engineering Changes

3.6

(4.00)

Little

(2.00)

Very

little

(1.00)

C

N

H

T

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

17

Excessive/Late OEM Engineering Changes:

Hurt Ability to Meet Quality Targets

OEM Hindrance

Great

2009

(4.00)

2.6

2.6

2.5

2.8

2.8

2.6

2.8

2.7

2.7

3.0

3.0

3.1

3.0

2.9

(3.00)

2.9

Some

2.9

3.2

2011

2.9

Extent of Engineering Changes

2010

Little

(2.00)

Very

little

(1.00)

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

18

Planning Perspectives, Inc.

CONFIDENTIAL

Page 9 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

Supplier Trust of OEMs

OEM – Supplier Working Relations

Very

Great

(5.00)

2009

2010

2011

3.5

3.5

3.5

3.4

2.9

2.9

2.9

3.1

3.1

2.8

2.3

2.5

2.7

2.7

(3.00)

2.8

Some

2.1

Supplier Trust Of OEM

3.7

(4.00)

3.7

Great

Little

(2.00)

Very

little

C

(1.00)

GM

F

N

H

T

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

19

OEM Confidential Treatment of Supplier

Proprietary Information/Intellectual Property

OEM Hindrance

Non-WRI

3.5

2011

3.3

3.2

3.1

3.2

3.1

2.8

2.9

3.0

3.0

2.9

(3.00)

2.6

2.6

OEM Treatment

Some

3.6

3.6

2010

3.7

2009

3.5

(4.00)

3.4

Great

Little

(2.00)

Very

little

(1.00)

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

20

Planning Perspectives, Inc.

CONFIDENTIAL

Page 10 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

H

T

2.9

Some

2.5

2.6

(3.00)

2.5

Terms and Conditions Fair

(4.00)

3.1

Great

OEM Ts and Cs Concerning Supplier Proprietary

Information and Intellectual Property Fair and

Equitable

3.1

OEM Hindrance

Non-WRI

23 May 2011

C

GM

Little

(2.00)

Very

little

(1.00)

F

N

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

21

OEM Price Pressures

and

Supplier Concessions

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

22

Planning Perspectives, Inc.

CONFIDENTIAL

Page 11 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

OEM Pressure on Suppliers

to Reduce Prices

Cost & Quality Pressures

Very

Great

2009

(5.00)

OEM Pressure

3.9

3.9

3.7

3.9

3.7

3.8

4.0

4.0

3.9

3.9

3.9

4.1

4.1

3.8

(4.00)

2011

3.9

3.9

Great

3.8

4.2

2010

Some

(3.00)

Little

(2.00)

Very

little

(1.00)

C

GM

F

N

H

T

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

23

OEM Covers Sunk Costs When Programs

are Delayed, Cancelled, Don’t Meet Volumes

Supplier Profit Opportunity

Great

2009

(4.00)

2010

Some

1.6

2.4

2.4

2.4

2.3

2.0

2.1

1.9

1.6

1.7

(2.00)

1.8

1.9

2.0

Little

2.2

2.1

2.3

2.5

(3.00)

1.9

OEM Coverage

2011

Very

little

(1.00)

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

24

Planning Perspectives, Inc.

CONFIDENTIAL

Page 12 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

OEM Concern of Supplier Profit Margins

When Asking for Price Reductions

Supplier Profit Opportunity

Great

2009

(4.00)

2010

2011

2.0

1.9

1.8

2.6

2.6

2.6

2.6

1.6

1.4

1.4

1.7

1.8

(2.00)

1.9

Little

2.0

2.2

2.5

2.6

(3.00)

1.7

OEM Concern

Some

Very

little

(1.00)

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

25

Most Important Reason for Price Concession:

OEM threat of reduced business/Fear of OEM retaliation

Cost & Quality

Supplier

Price Concessions

80%

2008

2009

2010

43%

4%

10%

8%

5%

14%

8%

8%

12%

22%

16%

21%

16%

21%

17%

20%

23%

19%

24%

28%

29%

34%

36%

37%

40%

31%

Percent of Suppliers

2011

60%

0%

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

26

Planning Perspectives, Inc.

CONFIDENTIAL

Page 13 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

OEM Purchasing Areas

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

27

TABLE 2. 2011 High - Low Purchasing Area WRIs for Each OEM

Highest Ranked

OEM

Lowest Ranked

Purchasing Area

WRI™

Purchasing Area

Chrysler

Interior

234

Body-in-White

193

General Motors

Exterior

264

Interior

204

Nissan

Powertrain

290

Interior

208

Ford

Electrical & Electronics

289

Interior

237

Honda

Electrical & Electronics

336

Body-in-White

271

Toyota

Powertrain

358

Exterior

290

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

WRI™

2011 N. A. Automotive

- Tier 1 Supplier Study

28

Planning Perspectives, Inc.

CONFIDENTIAL

Page 14 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

Impact of the OEM “Buyer”

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

29

Buyer Actively Working Toward Building

More Trusting Supplier Working Relations

Supplier Working Relations

2.8

2.7

7

8

9

10

11

12

13

2.0

2.3

2.8

6

2.6

2.8

5

2.6

2.8

4

2.8

3

2.8

(3.00)

2.9

Some

2.9

Extent of Working

3.3

(4.00)

3.7

Great

Little

(2.00)

Very

little

(1.00)

1

2

14

15

OEM Commodity Area

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

30

Planning Perspectives, Inc.

CONFIDENTIAL

Page 15 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

Purchasing Agent Impact on

Supplier Trust

PPI Research Studies

Purchasing Agent

Knowledge,

Skills, Communication

Commercial knowledge

Product technical knowledge

Engineering/manufacturing

process knowledge

Knowledge of supplier’s:

- products

- capabilities

Purchasing Agent

Professional

Knowledge

Strives for mutually equitable

solutions

Supplier’s advocate with other

functional areas

Considers supplier’s commercial

& financial interests

Purchasing Agent

Fairness Toward

Supplier

Technology roadmap

Purchasing strategy for supplier

products

Supplier’s role in long-term

purchasing strategy

Innovation/new technologies

importance

Various supplier-related programs

Purchasing Agent

Strategic

Communication

Purchasing Agent

Impact on Supplier Trust

Supplier Intention for

Future Transactions

Respectful of supplier personnel

High integrity

Overall trustworthy

Supplier Trust

of

Purchasing Agent

Supplier Trust

of

Customer

Customer

of

Choice

Treats supplier as valued

Lives up to the spirit of its commitments

Fair in dealing with supplier

Overall supplier trust of buyer firm

Journal of Operations Management, May 2011

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

Supplier Reciprocal

Behavior

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

32

Planning Perspectives, Inc.

CONFIDENTIAL

Page 16 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

Supplier Willingness to Invest in New

Technology in Anticipation of New Business

Supplier Actions

Very Great

(5.00)

2009

3.8

3.7

3.4

3.3

3.1

3.2

3.7

3.9

3.8

2.7

(3.00)

2.8

Some

3.1

3.2

3.4

3.4

3.6

(4.00)

3.8

2011

Great

2.4

Supplier Willingness to Invest

2010

Little

(2.00)

Very

little

(1.00)

C

GM

F

N

H

T

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

33

Supplier Willingness to Share

New Technology Without Assurance of a P.O.

Supplier Actions

Very Great

(5.00)

2009

2010

3.3

3.2

3.2

3.2

3.3

3.0

2.8

2.8

2.9

2.8

2.5

2.5

2.3

2.6

2.8

(3.00)

2.7

Some

3.2

(4.00)

2.2

Supplier Willingness to Share

2011

Great

Little

(2.00)

Very

little

(1.00)

C

GM

F

N

H

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

T

2011 N. A. Automotive

- Tier 1 Supplier Study

34

Planning Perspectives, Inc.

CONFIDENTIAL

Page 17 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

Supplier Involvement:

Increasing Supplier Innovation

PPI Research Studies

Journal of Operations Management, Nov/Dec 2009

MIT Sloan Management Review , Winter 2010

Cooperation

- Early product dev.

involvement

- Effective use of

supplier skills

Buyer Supplier

Involvement

Innovation

- Open and honest

communication

- Timely information

- Adequate information

- Help reduce costs

- Help improve quality

- Flexibility to meet

cost objectives

Supplier’s

Willingness

to Invest/Share

Innovation

Buyer

Communication

Buyer

Assistance

- Willingness to invest

in new technology

- Willingness to share

new technology

Moderating

Effect

Relational

Stress

Competition

- Conflicting objectives across

functional areas

- Excessive/late engineering changes

- Price reduction pressure

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

Now Come the

German OEMs

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

36

Planning Perspectives, Inc.

CONFIDENTIAL

Page 18 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.

2011 Study SAA – OESA Presentation

23 May 2011

2011 OEM – Supplier

Working Relations Index™

Working Relations Index

GOOD–VERY GOOD

ADEQUATE

400

323

327

328

309

300

271

257

236

221

VERY POOR–POOR

OEM – Supplier Working Relations

500

247

200

100

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

37

11th Annual North American

Automotive OEM - Tier 1 Supplier

Working Relations Study

OEM Purchasing Summit

23 May 2011

John W. Henke, Jr., Ph.D.

Planning Perspectives, Inc. Professor of Marketing

Birmingham, MI

Oakland University

Copyright© 2011 Planning Perspectives, Inc. All Rights Reserved.

These materials may not be used or copied for any commercial or academic purpose outside of your firm without written permission of PPI. OEM

2011 N. A. Automotive

- Tier 1 Supplier Study

38

Planning Perspectives, Inc.

CONFIDENTIAL

Page 19 of 19

Copyright 2011 Planning Perspectives, Inc., all rights reserved.

These materials may not be copied for any commercial or academic purpose outside of your firm without written permission of PPI.