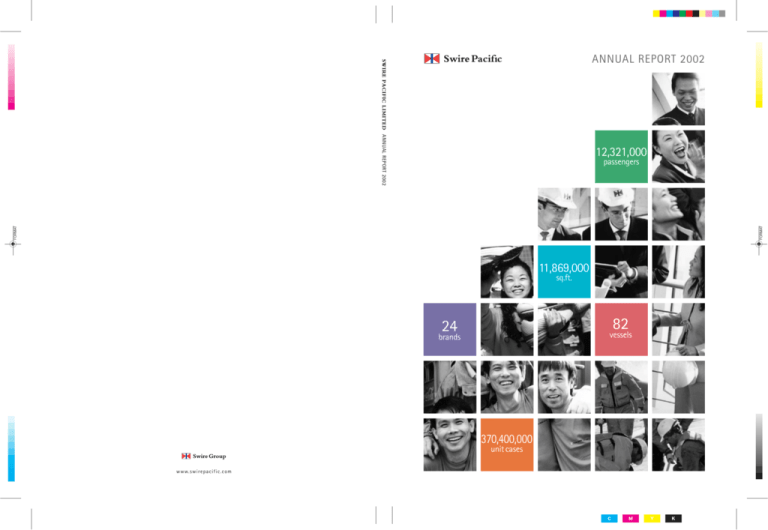

Annual Report - Swire Pacific Limited

advertisement