August 2015 Baseline Update for U.S. Agricultural Markets

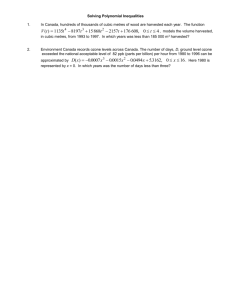

advertisement

Baseline Update for U.S. Agricultural Markets August 2015 FAPRI‐MU Report #03‐15 Prepared by the Integrated Policy Group, Division of Applied Social Sciences University of Missouri www.fapri.missouri.edu amap.missouri.edu Published by the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri (MU), 101 Park DeVille Drive, Suite E; Columbia, MO 65203. FAPRI–MU is part of the Division of Applied Social Sciences (DASS) in the College of Agriculture, Food and Natural Resources (CAFNR). http://www.fapri.missouri.edu This material is based upon work supported by the U.S. Department of Agriculture, under Agreement No. 58‐0111‐14‐001. Any opinion, findings, conclusions, or recommendations expressed in this publication are those of the authors and do not necessarily reflect the view of the U.S. Department of Agriculture nor the University of Missouri. The crop and biofuel projections in this report were prepared by the team at FAPRI‐MU, including Pat Westhoff (westhoffp@missouri.edu), Scott Gerlt (gerlts@missouri.edu), Jarrett Whistance (jwxbb@mail.missouri.edu), Julian Binfield (binfieldj@missouri.edu), Deepayan Debnath (debnathd@missouri.edu), Sera Chiuchiarelli (chiuchiarellis@missouri.edu) and Kateryna Schroeder (schroederkg@missouri.edu). The livestock, poultry, dairy and consumer price projections were prepared by the MU Agricultural Markets and Policy (AMAP) team, including Scott Brown (brownsc@missouri.edu) and Daniel Madison (madisondc@missouri.edu). FAPRI‐MU and AMAP are both part of the Integrated Policy Group in the MU Division of Applied Social Sciences. U.S. grains, oilseeds and cotton trade figures reported here were prepared with the help of Mike Helmar (mhelmar@cabnr.unr.edu) at the University of Nevada, Reno. Eric Wailes (ewailes@uark.edu) and Ed de la Cuesta Chavez (echavez@uark.edu) provided input for the rice projections. Permission is granted to reproduce this information with appropriate attribution to the authors and FAPRI–MU. The University of Missouri does not discriminate on the basis of race, color, religion, national origin, sex, sexual orientation, gender identity, age, genetics information, disability or status as a protected veteran. For more information, call Human Resource Services at 573‐882‐4256 or the US Department of Education, Office of Civil Rights. Summary Prices for grains, oilseeds, cotton, milk and hogs have declined sharply from record levels set in recent years, and no quick price recovery is expected. This report provides an update of the 2015 FAPRI‐MU long‐term baseline to reflect information available in mid‐August 2015. The baseline update uses 2015 acreage, yield and production estimates included in USDA’s August 2015 Crop Production report. It assumes that current agricultural and biofuel policies will continue, and that the global economy will evolve as forecast by IHS Global Insight in July 2015. Given all of the assumptions of the analysis, here are a few highlights of the results: Projected corn prices remain near the 2014/15 level of $3.70 per bushel for another two years, and only exceed $4 per bushel in 2018/19. U.S. corn acreage increases to more than 90 million acres in 2016 at the expense of other crops. Large global oilseed supplies contribute to a reduction in projected soybean prices, which fall to $9.12 per bushel in 2015/16 and remain near that level in 2016/17. Projected wheat prices also decline, to $5.10 per bushel for the 2015/16 crop, as U.S. stocks rise to the highest levels since 2010. A smaller U.S. crop contributes to a modest increase in cotton prices in 2015/16 to 65 cents per pound, but larger Chinese stock levels continue to weigh on global markets. Ethanol production prospects depend, in part, on EPA decisions about how to implement the Renewable Fuel Standard (RFS). Lower oil prices increase gasoline consumption and the use of ethanol in 10‐percent blends, but discourage higher‐level blends and ethanol exports. Increased production and a stronger dollar have contributed to sharply lower U.S. hog and milk prices in 2015. Projected prices for both remain far below the record levels of 2014. As U.S. cattle numbers and beef production expand, cattle prices decline from record levels. Projected fed cattle prices decline from $157 per hundredweight in 2015 to $122 by 2020. As retail prices for meat, milk and other products moderate, projected consumer food price inflation drops to 1.9 percent in 2015 and 1.3 percent in 2016. This baseline update provides a snapshot of what agricultural markets might look like under a particular set of assumptions. As more is learned about the size of the 2015 crop, the implementation of policies and the outlook for the general economy, these projections will need to be updated. In the meantime, they can be used as a point of reference in examining alternative scenarios. For more detail on the livestock, poultry and dairy sectors and on consumer food prices, see a companion report by the MU Agricultural Markets and Policy team, at http://amap.missouri.edu/. 1 Table of contents Macroeconomic assumptions Policy assumptions U.S. corn supply and use U.S. soybean supply and use U.S. wheat supply and use U.S. upland cotton supply and use U.S. rice supply and use Other U.S. feed grains supply and use Other U.S. oilseeds supply and use U.S. hay supply and use U.S. crop farm prices U.S. soybean product supply and use U.S. biomass‐based diesel supply and use U.S. ethanol supply and use U.S. beef sector U.S. pork sector U.S. poultry supply and use U.S. per‐capita meat consumption U.S. dairy sector U.S. consumer food price inflation 3 3 4 5 6 7 8 9 10 11 12 13 13 14 15 15 16 16 17 17 A few words about policy and macroeconomic assumptions The baseline update incorporates current policies, including provisions of the Agricultural Act of 2014 (the 2014 farm bill) and the Energy Independence and Security Act of 2007. The estimates here reflect available information about program implementation, such as the result of elections made by crop producers who had to choose between Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC). There remains considerable uncertainty about future implementation of the Renewable Fuel Standard (RFS). This baseline assumes RFS requirements for 2014‐2016 (and 2017 in the case of biomass‐based diesel) are implemented as proposed by the EPA in May 2015. Beyond 2016, modest growth rates are assumed for the overall and advanced requirements while the biomass‐based diesel requirement is held steady at the 2017 level. Furthermore, the expired biodiesel blenders tax credit is not renewed or reflected in these market projections. The macroeconomic forecast underlying this baseline was prepared by IHS Global Insight before the market turbulence of August 2015. As a result, there may be more uncertainty than usual regarding assumed levels of economic growth, exchange rates, oil prices and other indicators. 2 Macroeconomic assumptions* Calendar year 2013 2014 2015 Real GDP growth United S tates China World 2.2 7.7 2.6 2.4 7.4 2.8 2.2 6.5 2.6 U.S. CP I inflation 1.5 1.6 0.2 U.S. interest rates Federal funds rate Prime rate 0.1 3.3 0.1 3.3 0.3 3.3 0.75 2.16 6.15 0.75 2.35 6.16 0.91 3.08 6.21 Exchange rates Euro Brazilian real Chinese yuan 2016 2017 2018 2019 2020 2.7 6.5 3.4 2.5 6.5 3.5 2.5 6.8 3.6 2.5 6.8 3.6 1.8 2.3 2.5 2.4 2.0 1.2 4.2 2.7 5.7 3.5 6.5 3.5 6.5 3.5 6.5 (Currenc y per dollar) 0.90 0.84 3.18 3.22 6.29 6.31 0.78 3.25 6.27 0.75 3.30 6.21 0.74 3.39 6.14 2018 2019 2020 93.40 96.90 57.54 93.40 96.90 57.54 93.40 96.90 57.54 3.70 8.40 5.50 3.70 8.40 5.50 3.70 8.40 5.50 23.0 23.0 23.0 0.00 0.00 0.00 17.4 3.3 1.8 14.1 17.5 3.3 1.8 14.1 17.6 3.3 1.8 14.2 (Perc ent) 3.1 6.3 3.3 *S ourc e: IHS Global Insight forec ast, July 2015 Policy assumptions Year 2013 2014 2015 n.a. n.a. n.a. 93.40 96.90 57.54 (Perc ent of base ac res) 93.40 93.40 93.40 96.90 96.90 96.90 57.54 57.54 57.54 Target or reference prices Corn S oybeans Wheat 2.63 6.00 4.17 3.70 8.40 5.50 Conservation reserve area 26.8 25.4 Biodiesel tax credit 1.00 1.00 (Dollars per bushel) 3.70 3.70 8.40 8.40 5.50 5.50 (Million ac res) 24.2 24.0 23.0 (Dollars per gallon) 0.00 0.00 0.00 Renewable fuel standard Overall Advanc ed biofuels Biomass‐based diesel Conventional biofuel ʺgapʺ 16.4 2.7 1.3 13.7 15.4 2.5 1.6 12.8 15.8 2.8 1.6 13.0 ARC participation rate Corn S oybeans Wheat 2016 2017 3.70 8.40 5.50 (Billion gallons) 17.0 17.3 3.3 3.3 1.7 1.8 13.6 14.0 3 U.S. corn supply and use S eptember‐August year 13/14 14/15 Area Planted area Harvested area 95.4 87.5 90.6 83.1 158.1 171.0 Supply Beginning stoc ks Produc tion Imports 14,686 821 13,829 36 Domestic use Feed and residual Ethanol and c oproduc ts HFCS S eed Food and other 17/18 18/19 19/20 20/21 90.3 82.3 90.2 82.3 171.9 173.7 15,477 1,232 14,216 30 15,754 1,574 14,150 30 15,899 1,577 14,292 30 11,534 5,030 5,134 477 23 869 11,855 5,300 5,200 470 23 862 11,883 5,269 5,253 471 23 868 11,916 5,319 5,240 462 23 873 11,915 5,270 5,283 464 23 875 11,969 5,276 5,321 469 23 880 11,994 5,291 5,325 470 23 886 12,012 5,286 5,341 470 23 892 1,920 1,850 1,886 1,872 1,947 2,063 2,183 2,281 13,454 13,705 13,769 13,788 13,861 14,032 14,177 14,293 1,232 78 1,154 1,772 120 1,652 1,720 118 1,602 1,734 115 1,619 1,612 94 1,519 1,574 86 1,489 1,577 84 1,493 1,606 85 1,520 4.46 1.95 2.63 3.70 1.95 3.70 4.09 1.95 3.70 4.14 1.95 3.70 4.13 1.95 3.70 93.40 93.40 93.40 696.32 356.44 339.87 711.34 368.44 342.90 716.82 375.84 340.98 Exports Ending stocks Under loan Other stoc ks P rices, program provisions Farm pric e Loan rate Target or referenc e pric e ARC participation rate Market returns Gross market revenue/a. Variable expenses/a. Market net return/a. 16/17 (Million ac res) 88.9 90.5 89.2 90.1 81.1 82.6 81.3 82.1 (Bushels per harvested ac re) 168.8 166.8 168.6 170.1 (Million bushels) 15,488 15,522 15,474 15,606 1,772 1,720 1,734 1,612 13,686 13,772 13,710 13,964 30 30 30 30 Yield Total use 15/16 n.a. 705.28 358.72 346.56 93.40 632.67 360.08 272.59 (Dollars per bushel) 3.71 3.96 1.95 1.95 3.70 3.70 (Perc ent of base ac res) 93.40 93.40 93.40 3.68 1.95 3.70 620.87 340.05 280.82 (Dollars) 619.35 667.80 339.58 346.23 279.77 321.58 4 U.S. soybean supply and use S eptember‐August year 13/14 14/15 Area Planted area Harvested area 76.8 76.3 83.7 83.1 Yield 44.0 47.8 Supply Beginning stoc ks Produc tion Imports 3,570 141 3,358 72 Domestic use Crush S eed and residual 15/16 16/17 17/18 18/19 19/20 20/21 83.7 82.9 83.7 82.9 83.8 83.0 45.8 46.2 46.6 4,091 92 3,969 30 (Million ac res) 84.3 82.4 83.5 83.5 81.6 82.7 (Bushels per harvested ac re) 46.9 44.9 45.4 (Million bushels) 4,186 4,096 4,085 240 401 301 3,916 3,665 3,754 30 30 30 4,106 280 3,796 30 4,132 273 3,830 30 4,170 270 3,870 30 1,840 1,734 106 2,026 1,845 181 2,013 1,867 145 2,010 1,867 143 2,009 1,867 142 2,009 1,868 142 2,023 1,880 143 2,034 1,890 144 Exports 1,638 1,825 1,773 1,785 1,796 1,824 1,839 1,867 Total use 3,478 3,851 3,786 3,794 3,805 3,833 3,862 3,902 92 3 89 240 11 229 401 16 385 301 15 286 280 12 268 273 11 262 270 11 259 268 11 257 13.00 13.82 5.00 6.00 10.05 10.13 5.00 8.40 10.31 10.55 5.00 8.40 10.42 10.65 5.00 8.40 10.50 10.73 5.00 8.40 n.a. 96.90 96.90 96.90 96.90 Market returns Gross market revenue/a. Variable expenses/a. Market net return/a. 572.49 183.21 389.28 480.21 183.20 297.01 427.35 170.93 256.42 (Dollars) 410.98 453.01 170.58 174.72 240.40 278.28 472.09 180.21 291.88 481.34 185.60 295.75 489.85 187.79 302.06 Other indicators S oybean/c orn pric e ratio 48% soymeal pric e, $/ton S oybean oil price, c ents/lb. Crushing margin, $/bu. 2.91 489.94 38.23 2.11 2.72 370.00 32.00 2.39 2.48 326.73 30.47 1.79 2.46 330.67 29.25 1.84 2.52 360.38 32.47 1.79 2.52 365.85 32.86 1.86 2.55 364.19 33.87 1.85 Ending stocks Under loan Other stoc ks P rices, program provisions Farm pric e Illinois proc essor pric e Loan rate Target or referenc e pric e ARC participation rate (Dollars per bushel) 9.12 9.15 9.98 9.51 9.42 10.22 5.00 5.00 5.00 8.40 8.40 8.40 (Perc ent of base ac res) 96.90 96.90 96.90 2.52 352.09 31.78 1.84 5 U.S. wheat supply and use June‐May year 13/14 14/15 Area Planted area Harvested area 56.2 45.3 56.8 46.4 Yield 47.1 43.7 Supply Beginning stoc ks Produc tion Imports 3,022 718 2,135 169 Domestic use Feed and residual S eed Food and other 15/16 16/17 17/18 18/19 19/20 20/21 54.3 45.8 54.6 46.0 46.9 47.3 2,760 590 2,026 144 (Million ac res) 56.1 53.9 54.2 54.0 48.5 45.5 45.7 45.5 (Bushels per harvested ac re) 44.1 45.9 46.3 46.6 (Million bushels) 3,017 3,053 3,086 3,087 753 837 844 835 2,136 2,088 2,113 2,120 128 128 129 132 3,094 811 2,149 134 3,111 798 2,179 135 1,255 223 77 955 1,154 115 81 958 1,257 213 76 969 1,272 220 76 975 1,281 223 76 982 1,276 211 77 988 1,274 201 77 995 1,278 198 78 1,002 Exports 1,176 854 923 938 970 1,000 1,023 1,038 Total use 2,431 2,008 2,180 2,209 2,251 2,276 2,297 2,316 Ending stocks Under loan Other stoc ks 590 8 582 753 21 731 837 33 804 844 33 811 835 30 805 811 25 785 798 24 774 796 23 772 P rices, program provisions Farm pric e Loan rate Target or referenc e pric e 6.87 2.94 4.17 5.99 2.94 5.50 5.55 2.94 5.50 5.72 2.94 5.50 5.76 2.94 5.50 57.54 57.54 57.54 258.48 126.76 131.71 268.51 130.63 137.87 272.65 132.11 140.54 ARC participation rate Market returns Gross market revenue/a. Variable expenses/a. Market net return/a. n.a. 323.55 130.33 193.22 57.54 261.61 128.78 132.83 (Dollars per bushel) 5.05 5.24 2.94 2.94 5.50 5.50 (Perc ent of base ac res) 57.54 57.54 57.54 5.10 2.94 5.50 224.79 120.76 104.04 (Dollars) 231.86 242.47 120.25 122.95 111.62 119.53 6 U.S. upland cotton supply and use August‐July year 13/14 14/15 19/20 20/21 Area Planted area Harvested area 10.21 7.35 10.85 9.16 9.26 7.71 9.27 7.72 802 826 842 851 15.89 3.61 12.28 0.01 18.09 2.33 15.75 0.01 16.66 3.13 13.52 0.01 16.75 3.07 13.68 0.01 Domestic use Mill use 3.53 3.53 3.66 3.76 3.81 3.80 3.77 3.73 Exports 9.85 10.80 9.38 9.00 9.48 9.76 9.82 9.90 13.38 14.33 13.05 12.75 13.29 13.56 13.59 13.63 Unaccounted 0.19 0.33 0.00 0.00 0.00 0.00 0.00 0.00 Ending stocks 2.33 3.43 3.04 3.07 3.31 3.13 3.07 3.12 P rices, program provisions Farm pric e Loan rate Direc t payment or CTAP User payment 77.9 52.0 6.7 3.0 60.5 52.0 9.0 3.0 65.1 52.0 n.a. 3.0 65.8 52.0 n.a. 3.0 67.1 52.0 n.a. 3.0 67.2 52.0 n.a. 3.0 Market returns Gross market revenue/a. Variable expenses/a. Market net return/a. 765.66 512.08 253.58 608.16 534.17 73.99 Yield Supply Beginning stoc ks Produc tion Imports Total use 15/16 16/17 17/18 18/19 (Million ac res) 8.75 9.09 9.47 9.27 7.75 7.56 7.89 7.71 (Pounds per harvested ac re) 784 812 823 832 (Million bales) 16.09 15.83 16.61 16.69 3.43 3.04 3.07 3.31 12.65 12.78 13.53 13.37 0.01 0.01 0.01 0.01 613.55 505.91 107.64 (Cents per pound) 63.8 63.1 52.0 52.0 n.a. n.a. 3.0 3.0 (Dollars) 623.95 632.73 509.36 524.82 114.59 107.91 666.90 542.46 124.44 686.50 559.66 126.84 695.33 569.07 126.26 7 U.S. rice supply and use August‐July year 13/14 14/15 Area Planted area Harvested area 2.49 2.47 2.94 2.92 Yield 7,694 7,572 Supply Beginning stoc ks Produc tion Imports 249.5 36.4 190.0 23.1 277.9 31.8 221.0 25.0 (Million ac res) 2.77 2.91 2.89 2.88 2.74 2.89 2.86 2.86 (Pounds per harvested ac re) 7,472 7,603 7,685 7,757 (Million hundredweight) 278.4 288.5 292.2 295.4 47.9 43.3 46.3 47.5 205.0 219.7 220.1 221.6 25.5 25.5 25.8 26.2 Domestic use 124.4 129.0 129.4 129.7 130.9 93.3 101.0 105.7 112.5 217.7 230.0 235.1 31.8 47.9 43.3 16.30 15.40 19.20 Exports Total use Ending stocks P rices, program provisions Farm pric e Long grain Medium and short grain Adjusted world pric e Long grain Medium and short grain Loan rate Target or referenc e pric e Long grain Japonic a Other medium, short grain ARC participation rate Market returns Gross market revenue/a. Variable expenses/a. Market net return/a. 19/20 20/21 2.88 2.85 2.90 2.88 7,813 7,879 297.7 48.0 223.0 26.7 302.2 48.4 226.7 27.1 131.3 132.0 133.1 113.8 116.1 117.2 119.4 242.2 244.7 247.4 249.3 252.5 46.3 47.5 48.0 48.4 49.7 13.30 11.90 17.90 (Dollars per hundredweight) 13.78 13.84 13.71 14.06 11.95 12.45 12.33 12.79 18.65 17.73 17.62 17.56 14.26 13.08 17.71 14.32 13.16 17.83 11.77 12.08 6.50 10.56 10.78 6.50 10.17 10.45 6.50 12.18 10.18 6.50 12.60 10.27 6.50 12.83 10.35 6.50 10.50 10.50 10.50 14.00 16.10 14.00 14.00 16.10 14.00 14.00 16.10 14.00 14.00 16.10 14.00 14.00 16.10 14.00 4.90 4.90 4.90 1090.83 557.48 533.34 1113.87 579.46 534.41 1128.54 582.87 545.67 n.a. 1254.05 581.78 672.27 4.90 1007.11 574.13 432.98 15/16 16/17 11.39 10.29 6.50 17/18 11.60 10.22 6.50 14.00 14.00 16.10 16.10 14.00 14.00 (Perc ent of base ac res) 4.90 4.90 4.90 1029.98 505.46 524.52 (Dollars) 1052.12 1053.24 515.06 532.88 537.06 520.35 18/19 8 Other U.S. feed grains supply and use Marketing year 13/14 14/15 Sorghum Planted area Harvested area 8.08 6.59 7.14 6.40 Yield 59.6 67.6 Produc tion Imports Domestic use Exports Ending stoc ks 392 0 162 211 34 433 0 100 350 17 Farm pric e Target or referenc e pric e 4.28 2.63 4.00 3.95 Barley Planted area Harvested area 3.53 3.04 2.98 2.44 Yield 71.3 72.4 Produc tion Imports Domestic use Exports Ending stoc ks 217 19 219 14 82 177 24 190 14 79 Farm pric e Target or referenc e pric e 6.06 2.63 5.30 4.95 Oats Planted area Harvested area 2.98 1.01 2.72 1.03 Yield 64.1 67.7 Produc tion Imports Domestic use Exports Ending stoc ks 65 97 172 2 25 70 107 146 2 54 Farm pric e Target or referenc e pric e 3.75 1.79 3.21 2.40 15/16 16/17 17/18 (Million ac res) 8.74 8.33 7.95 7.67 6.81 6.51 (Bushels per harvested ac re) 74.6 64.0 64.1 (Million bushels) 573 436 418 0 0 0 118 122 130 434 318 293 38 35 30 (Dollars per bushel) 3.90 3.73 3.90 3.95 3.95 3.95 (Million ac res) 3.41 3.58 3.44 2.92 3.10 2.97 (Bushels per harvested ac re) 71.8 71.6 72.3 (Million bushels) 210 222 215 21 17 16 212 216 213 16 19 20 81 85 83 (Dollars per bushel) 4.58 4.40 4.62 4.95 4.95 4.95 (Million ac res) 3.06 2.95 2.95 1.22 1.16 1.15 (Bushels per harvested ac re) 70.0 65.0 65.6 (Million bushels) 85 76 75 93 98 99 172 169 172 2 2 2 59 62 63 (Dollars per bushel) 2.35 2.66 2.72 2.40 2.40 2.40 18/19 19/20 20/21 7.91 6.48 7.85 6.44 7.81 6.40 64.1 64.3 64.5 416 0 131 287 28 414 0 131 283 27 413 0 126 286 28 4.02 3.95 4.04 3.95 4.04 3.95 3.44 2.97 3.39 2.92 3.38 2.92 72.7 73.3 73.8 216 16 213 19 82 214 16 212 19 81 215 16 212 19 82 4.75 4.95 4.83 4.95 4.83 4.95 2.89 1.11 2.84 1.09 2.83 1.09 66.0 66.5 67.0 74 100 171 2 62 73 100 171 2 62 73 99 170 2 62 2.77 2.40 2.80 2.40 2.80 2.40 9 Other U.S. oilseeds supply and use Marketing year 13/14 14/15 1.07 1.04 1.35 1.33 Yield 4,001 3,932 Produc tion Imports Domestic use Exports Ending stoc ks 4,173 88 4,079 1,096 1,858 5,210 85 4,179 1,110 1,864 Farm pric e Target or referenc e pric e 24.90 24.75 22.00 26.75 1.58 1.46 1.56 1.51 Yield 1,380 1,469 Produc tion Imports Domestic use Exports Ending stoc ks 2,022 143 2,039 265 201 2,215 163 2,133 265 181 Farm pric e Target or referenc e pric e 21.40 12.68 22.25 20.15 1.35 1.26 1.71 1.56 Yield 1,748 1,614 Produc tion Imports Domestic use Exports Ending stoc ks 2,211 2,044 3,798 351 285 2,511 1,698 3,907 344 243 Farm pric e Target or referenc e pric e 20.60 12.68 17.00 20.15 P eanuts Planted area Harvested area Sunflowerseed Planted area Harvested area Canola Planted area Harvested area 15/16 16/17 17/18 (Million ac res) 1.60 1.45 1.38 1.57 1.42 1.34 (Pounds per harvested ac re) 3,950 3,827 3,880 (Million pounds) 6,181 5,431 5,206 85 85 85 4,438 4,399 4,371 1,150 1,151 1,137 2,542 2,507 2,291 (Cents per pound) 20.02 19.61 21.27 26.75 26.75 26.75 (Million ac res) 1.68 1.80 1.77 1.61 1.67 1.65 (Pounds per harvested ac re) 1,474 1,559 1,568 (Million pounds) 2,376 2,610 2,589 163 163 163 2,194 2,323 2,351 354 422 410 171 201 191 (Cents per pound) 19.10 19.02 19.84 20.15 20.15 20.15 (Million ac res) 1.57 1.68 1.65 1.52 1.60 1.57 (Bushels per harvested ac re) 1,648 1,686 1,695 (Million bushels) 2,511 2,704 2,657 1,676 1,582 1,637 3,858 3,910 3,936 338 374 358 235 238 238 (Dollars per bushel) 16.68 16.54 17.05 20.15 20.15 20.15 18/19 19/20 20/21 1.37 1.34 1.40 1.36 1.42 1.38 3,931 3,987 4,042 5,259 85 4,392 1,119 2,124 5,439 85 4,437 1,106 2,105 5,580 85 4,507 1,118 2,146 22.36 26.75 23.13 26.75 22.95 26.75 1.74 1.62 1.72 1.60 1.72 1.59 1,572 1,579 1,588 2,544 163 2,341 369 189 2,518 163 2,329 355 186 2,533 163 2,352 343 187 20.18 20.15 20.60 20.15 20.79 20.15 1.63 1.56 1.63 1.55 1.64 1.56 1,702 1,709 1,717 2,646 1,659 3,954 351 238 2,651 1,666 3,970 347 237 2,676 1,674 4,002 347 238 17.52 20.15 18.06 20.15 18.26 20.15 10 U.S. hay supply and use May‐April year 13/14 14/15 15/16 Area harvested 57.90 57.09 56.54 2.33 2.45 2.51 135.0 130.0 19.2 139.8 134.5 24.5 142.1 140.9 25.7 176.00 172.00 155.90 Yield Produc tion Disappearanc e Ending stoc ks All hay pric e 16/17 17/18 18/19 19/20 20/21 57.47 57.69 57.85 2.43 2.44 2.46 139.9 140.3 23.4 141.0 141.1 23.3 142.1 141.9 23.5 170.35 173.84 174.46 17/18 18/19 19/20 20/21 (Million ac res) 90.45 89.18 82.36 83.46 53.95 54.15 9.09 9.47 8.33 7.95 3.58 3.44 2.95 2.95 2.91 2.89 1.80 1.77 1.45 1.38 1.68 1.65 1.23 1.25 0.89 0.87 90.06 83.74 53.98 9.27 7.91 3.44 2.89 2.88 1.74 1.37 1.63 1.26 0.85 90.29 83.68 54.31 9.26 7.85 3.39 2.84 2.88 1.72 1.40 1.63 1.26 0.84 90.22 83.77 54.56 9.27 7.81 3.38 2.83 2.90 1.72 1.42 1.64 1.26 0.83 (Million ac res) 56.92 57.18 (Tons per ac re) 2.41 2.42 (Million tons) 137.4 138.6 138.6 139.3 24.5 23.8 (Dollars per ton) 155.39 164.16 U.S. planted and idled area Marketing year 13/14 14/15 15/16 P lanted area Corn S oybeans Wheat Upland c otton S orghum Barley Oats Ric e S unflower seed Peanuts Canola S ugar beets S ugarc ane harvested 95.37 76.84 56.24 10.21 8.08 3.53 2.98 2.49 1.58 1.07 1.35 1.20 0.91 90.60 83.70 56.82 10.85 7.14 2.98 2.72 2.94 1.56 1.35 1.71 1.16 0.87 88.90 84.34 56.08 8.75 8.74 3.41 3.06 2.77 1.68 1.60 1.57 1.16 0.90 261.82 264.41 262.96 260.68 260.40 261.02 261.35 261.61 57.90 57.09 56.54 56.92 57.18 57.47 57.69 57.85 319.72 321.50 319.50 317.60 317.58 318.49 319.04 319.45 26.84 25.45 24.24 24.00 23.00 23.00 23.00 23.00 346.56 346.95 343.74 341.60 340.58 341.49 342.04 342.45 6.81 5.61 4.95 4.85 5.01 5.08 5.11 5.14 339.75 341.34 338.79 336.75 335.57 336.42 336.93 337.31 13‐crop planted Hay area harvested 13 crops + hay Conservation reserve (CRP ) 13 crops + hay + CRP Double crop area Total minus double crop 16/17 11 U.S. crop farm prices Marketing year 13/14 14/15 15/16 16/17 17/18 18/19 19/20 20/21 Corn ($/bu.) S oybeans ($/bu.) Wheat ($/bu.) Durum Other spring Winter 4.46 13.00 6.87 7.46 6.73 6.89 3.70 10.05 5.99 8.81 5.75 5.92 3.68 9.12 5.10 6.31 5.38 4.94 3.71 9.15 5.05 6.01 5.35 4.91 3.96 9.98 5.24 6.23 5.55 5.09 4.09 10.31 5.55 6.61 5.87 5.39 4.14 10.42 5.72 6.82 6.05 5.56 4.13 10.50 5.76 6.87 6.09 5.59 Upland c otton (c ents/lb.) S orghum ($/bu.) Ric e ($/c wt) Long grain Medium/short (exc . Japonic a) Japonic a 77.90 4.28 16.30 15.40 15.70 20.70 60.50 4.00 13.30 11.90 14.60 20.50 65.07 3.90 13.78 11.95 14.81 21.01 63.78 3.73 13.84 12.45 14.95 19.44 63.10 3.90 13.71 12.33 14.86 19.31 65.84 4.02 14.06 12.79 14.81 19.25 67.07 4.04 14.26 13.08 14.92 19.40 67.22 4.04 14.32 13.16 15.03 19.54 Barley ($/bu.) Oats ($/bu.) Peanuts (c ents/lb.) S unflower seed ($/c wt) Canola ($/c wt) 6.06 3.75 24.90 21.40 20.60 5.30 3.21 22.00 22.25 17.00 4.58 2.35 20.02 19.10 16.68 4.40 2.66 19.61 19.02 16.54 4.62 2.72 21.27 21.27 17.05 4.75 2.77 22.36 20.18 17.52 4.83 2.80 23.13 20.60 18.06 4.83 2.80 22.95 20.79 18.26 Flaxseed ($/bu.) Lentils ($/c wt) S afflower ($/c wt) Mustard seed ($/cwt) Dry peas ($/c wt) 13.80 19.80 27.90 37.20 14.60 11.80 24.40 25.00 35.00 12.00 9.86 19.03 23.44 32.81 10.82 10.11 19.03 23.44 32.79 10.79 10.64 19.95 24.47 34.01 11.29 10.91 20.45 25.03 34.79 11.71 11.01 20.64 25.24 35.12 11.91 11.07 20.74 25.36 35.27 11.98 Rapeseed ($/c wt) Large c hic kpeas ($/c wt) S mall c hic kpeas ($/c wt) Crambe ($/c wt) S esame seed ($/c wt) 25.10 31.20 22.90 35.10 44.00 23.70 28.80 20.70 28.40 46.00 19.40 24.93 18.00 26.31 37.79 19.37 24.86 17.95 26.25 37.71 20.76 26.07 18.85 27.45 39.46 21.31 27.03 19.57 28.41 40.81 21.49 27.48 19.91 28.86 41.43 21.68 27.64 20.03 29.02 41.66 12 U.S. soybean product supply and use Oc tober‐S eptember year 13/14 14/15 15/16 Soybean meal Produc tion Imports Domestic use Exports Ending stoc ks 40,685 383 29,547 11,546 250 44,200 350 31,850 12,650 300 Soybean oil Produc tion Imports Domestic use Biodiesel Food and other Exports Ending stoc ks 20,130 165 18,958 5,010 13,948 1,877 1,165 Decatur prices S oybean meal 48% protein S oybean oil 16/17 17/18 18/19 19/20 20/21 44,425 325 32,911 11,839 300 (Thousand tons) 44,415 44,419 325 325 33,803 33,888 10,937 10,862 300 294 44,425 325 34,108 10,641 295 44,721 325 34,320 10,724 297 44,958 325 34,640 10,640 300 21,055 250 19,000 5,000 14,000 1,950 1,520 21,642 200 19,464 5,131 14,333 2,086 1,813 (Million pounds) 21,637 21,639 200 200 19,684 20,004 5,102 5,362 14,581 14,642 2,207 1,886 1,760 1,709 21,642 200 20,000 5,272 14,728 1,820 1,731 21,786 200 19,964 5,123 14,840 1,997 1,757 21,902 200 19,900 4,972 14,928 2,225 1,733 489.94 370.00 326.73 360.38 365.85 364.19 38.23 32.00 32.47 32.86 33.87 (Dollars per ton) 330.67 352.09 (Cents per pound) 30.47 29.25 31.78 U.S. biomass‐based diesel supply and use Calendar year 2013 2014 2015 Supply and use Produc tion Biodiesel From soybean oil From c orn oil From other fats and oils Cellulosic diesel Renewable diesel Net exports Domestic disappearanc e Ending stoc ks 1,776 1,359 715 138 506 0 417 ‐146 1,820 160 1,606 1,240 624 126 490 0 366 ‐130 1,768 127 4.63 3.03 0.73 3.47 2.82 0.56 P rices and RIN values Biodiesel rac k, Des Moines #2 diesel, refiner sales Biodiesel RIN (per RIN gal.) 2016 2017 2018 2019 2020 1,732 1,376 658 247 471 0 356 ‐76 1,738 197 (Million gallons) 1,760 1,818 1,404 1,450 669 660 257 306 478 484 1 2 355 366 ‐69 ‐48 1,844 1,873 182 175 1,881 1,497 708 299 489 4 380 9 1,875 171 1,891 1,490 677 324 489 6 395 31 1,862 170 1,915 1,496 662 349 486 8 410 55 1,861 169 2.96 1.73 0.84 (Dollars per gallon) 3.04 3.11 1.87 2.03 0.88 0.82 3.17 2.31 0.72 3.22 2.54 0.64 3.27 2.46 0.74 13 U.S. ethanol supply and use Calendar year 2013 2014 97.96 100.47 92.97 92.23 2.90 3.53 2.66 3.37 Motor gasoline supplied 135,563 136,782 Ethanol supply and use Produc tion From c orn From other feedstoc ks Cellulosic Imports 13,526 13,235 292 0 377 14,334 14,243 90 1 60 14,496 14,422 71 3 62 14,473 14,398 66 9 63 Domestic disappearanc e In low‐level blends In flex fuel vehic les Exports 13,449 13,277 172 619 13,449 13,272 176 847 13,825 13,645 180 725 Ending stoc ks 690 787 795 Ethanol prices Conventional rac k, Omaha Other advanc ed rac k Effec tive retail Ethanol/gasoline retail ratio 2.47 2.57 2.49 0.71 2.34 2.40 2.56 0.76 RIN values Conventional ethanol Other advanc ed ethanol 0.60 0.71 0.49 0.54 P etroleum fuel prices Petroleum, W. Texas interm. Petroleum, refiners ac quisition Unl. gasoline, FOB Omaha Unleaded gasoline, retail 2015 2018 2019 2020 2017 78.03 77.31 87.39 86.31 84.04 82.26 2.26 2.87 2.48 3.11 2.40 3.06 141,674 140,733 139,921 14,479 14,396 65 19 67 14,708 14,613 63 31 64 14,805 14,702 61 42 61 14,822 14,712 58 52 58 13,942 13,758 184 588 13,936 13,752 184 603 14,087 13,895 192 677 14,145 13,948 198 713 14,170 13,966 203 704 802 808 815 822 829 1.85 2.16 1.99 0.81 (Dollars per gallon) 1.83 1.84 2.25 2.52 2.02 2.31 0.82 0.89 1.91 2.44 2.34 0.81 1.94 2.35 2.34 0.75 1.96 2.22 2.13 0.70 0.53 0.84 (Dollars per gallon) 0.46 0.14 0.88 0.82 0.19 0.72 0.22 0.64 0.48 0.74 (Dollars per barrel) 57.92 66.17 58.35 66.08 (Dollars per gallon) 1.79 1.81 1.98 2.46 2.45 2.59 (Million gallons) 140,189 140,512 141,648 54.62 52.17 14 2016 U.S. beef sector Calendar year 2013 2014 2015 Beef cows (Jan. 1) Dairy cows (Jan. 1) Cattle and calves (Jan. 1) 29.6 9.2 90.1 29.1 9.2 88.5 25,790 2,250 25,475 2,589 584 Beef supply and use Produc tion Imports Domestic use Exports Ending stoc ks P rices Total all grades, 5‐area direc t steers 600 ‐ 650 lb. Oklahoma City feeder steers Boxed beef c utout Beef retail 2016 2017 2018 2019 2020 29.7 9.3 89.8 (Million head) 30.7 31.4 9.3 9.3 93.1 95.9 31.6 9.3 97.4 31.7 9.2 97.6 31.5 9.2 97.0 24,320 2,947 24,686 2,573 591 23,848 3,527 25,054 2,360 553 (Million pounds) 24,662 25,909 3,140 2,869 25,338 26,115 2,444 2,621 573 615 26,904 2,674 26,736 2,811 646 27,612 2,647 27,255 2,979 670 28,007 2,654 27,547 3,101 683 125.89 154.56 (Dollars per hundredweight) 156.89 149.10 136.60 129.80 124.77 122.12 158.84 195.64 225.07 239.21 242.01 243.75 181.60 210.95 168.93 205.76 162.75 203.20 5.29 5.97 5.98 5.97 5.96 2017 2018 2019 2020 224.95 198.26 233.63 218.42 (Dollars per pound) 6.33 6.21 6.05 U.S. pork sector Calendar year 2013 2014 2015 Breeding herd (Dec. 1*) Market hogs (Dec. 1*) 5.82 60.4 5.76 59.0 5.94 61.8 (Million head) 6.02 5.94 63.4 65.0 5.83 64.8 5.70 64.4 5.59 63.7 23,204 880 19,099 4,992 618 22,861 1,008 19,070 4,857 560 24,460 1,117 20,576 4,924 637 (Million pounds) 24,948 25,416 1,063 1,016 20,882 21,104 5,112 5,315 655 668 25,442 1,003 20,954 5,498 661 25,381 999 20,708 5,684 648 25,341 1,007 20,545 5,811 639 64.05 91.69 76.03 110.10 53.10 81.65 55.18 84.09 3.64 4.02 3.88 3.97 P ork supply and use Produc tion Imports Domestic use Exports Ending stoc ks P rices Barrows & gilts, national base 51‐52% lean equivalent Pork c utout value Pork retail (Dollars per hundredweight) 51.08 48.07 47.56 50.12 80.06 76.99 75.23 77.94 (Dollars per pound) 3.78 3.65 3.63 3.73 * Prec eding year 15 2016 U.S. poultry supply and use Calendar year 2013 2014 2015 Broiler Produc tion Imports Domestic use Exports Ending stoc ks 37,425 122 30,184 7,345 669 38,137 117 30,942 7,301 680 39,971 120 33,207 6,837 727 Turkey Produc tion Imports Domestic use Exports Ending stoc ks 5,729 22 5,051 759 237 5,756 29 5,023 805 193 5,662 35 5,117 562 211 99.70 196.47 99.75 165.90 104.88 196.27 107.59 160.13 96.17 195.81 112.76 156.78 P rices National c omposite wholesale broiler Broiler retail 8‐16 lb. national turkey hens Turkey retail 2016 2017 2018 2019 2020 (Million pounds) 41,417 42,120 116 118 34,390 34,887 7,102 7,341 768 779 42,373 120 34,926 7,578 768 42,569 122 34,891 7,814 754 42,951 124 35,030 8,053 746 6,281 29 5,494 784 269 6,401 29 5,604 813 283 6,442 30 5,636 831 287 6,489 30 5,668 847 290 (Cents per pound) 90.74 90.24 194.15 193.42 106.79 97.88 155.86 152.20 93.13 200.79 96.07 151.27 96.38 208.84 97.40 154.77 98.22 213.54 98.42 157.38 5,972 28 5,252 722 238 U.S. per‐capita meat consumption Calendar year 2013 2014 2015 2016 2017 2018 2019 2020 Beef Pork Broiler Turkey S um 56.3 46.8 81.9 16.0 201.1 54.2 46.4 83.4 15.8 199.8 54.6 49.7 88.8 15.9 209.0 (Pounds) 54.8 56.0 50.0 50.2 91.2 91.8 16.2 16.8 212.2 214.7 56.9 49.4 91.1 17.0 214.4 57.5 48.4 90.3 17.0 213.2 57.7 47.7 90.0 17.0 212.3 16 U.S. dairy sector Calendar year Milk supply Dairy c ows (thou. head) Milk yield (lbs. per c ow) Milk produc tion (bil. lbs.) All milk price Wholesale prices Butter, CME Cheese, Am., 40#, CME Nonfat dry milk, AA Evaporated Dairy product production Americ an c heese Other c heese Butter Nonfat dry milk 2013 2014 2015 2016 2017 2018 2019 2020 9,224 21,816 201.2 9,257 22,258 206.0 9,314 22,419 208.8 9,322 22,854 213.0 9,300 23,165 215.4 9,261 23,474 217.4 9,235 23,769 219.5 9,224 24,062 221.9 20.11 24.07 (Dollars per hundredweight) 16.96 16.70 17.63 18.32 18.76 19.00 1.56 1.76 1.72 2.12 2.16 2.11 1.74 2.24 1.77 1.62 0.92 1.81 (Dollars per pound) 1.68 1.69 1.56 1.62 1.06 1.22 1.79 1.84 1.72 1.69 1.29 1.88 1.72 1.73 1.34 1.91 1.72 1.75 1.37 1.93 4,420 6,682 1,863 1,999 4,534 6,916 1,856 2,214 4,621 7,015 1,812 2,257 (Million pounds) 4,693 4,705 7,157 7,247 1,869 1,918 2,344 2,373 4,714 7,342 1,956 2,428 4,735 7,459 1,985 2,484 4,766 7,590 2,013 2,541 U.S. consumer food price inflation Calendar year 2013 2014 2015 2016 2017 2018 2019 2020 Food 1.4% 2.4% (Change from the previous year) 1.9% 1.3% 1.7% 2.2% 2.3% 2.0% Food at home Cereal and bakery Meat Dairy Fruits and vegetables Other food at home 0.9% 1.0% 2.1% 0.1% 2.5% 0.0% 2.4% 0.2% 7.2% 3.6% 1.5% 0.7% 1.3% 1.1% 3.4% ‐1.0% ‐0.7% 1.8% 0.5% 1.1% ‐1.7% ‐0.2% 2.1% 1.5% 1.2% 1.4% ‐1.5% 2.3% 3.1% 1.9% 1.9% 1.9% 0.9% 2.7% 2.6% 1.8% 2.2% 2.0% 1.7% 2.5% 2.6% 1.9% 1.9% 1.6% 1.7% 2.0% 2.3% 1.6% Food away from home 2.1% 2.4% 2.5% 2.4% 2.3% 2.5% 2.4% 2.1% 17