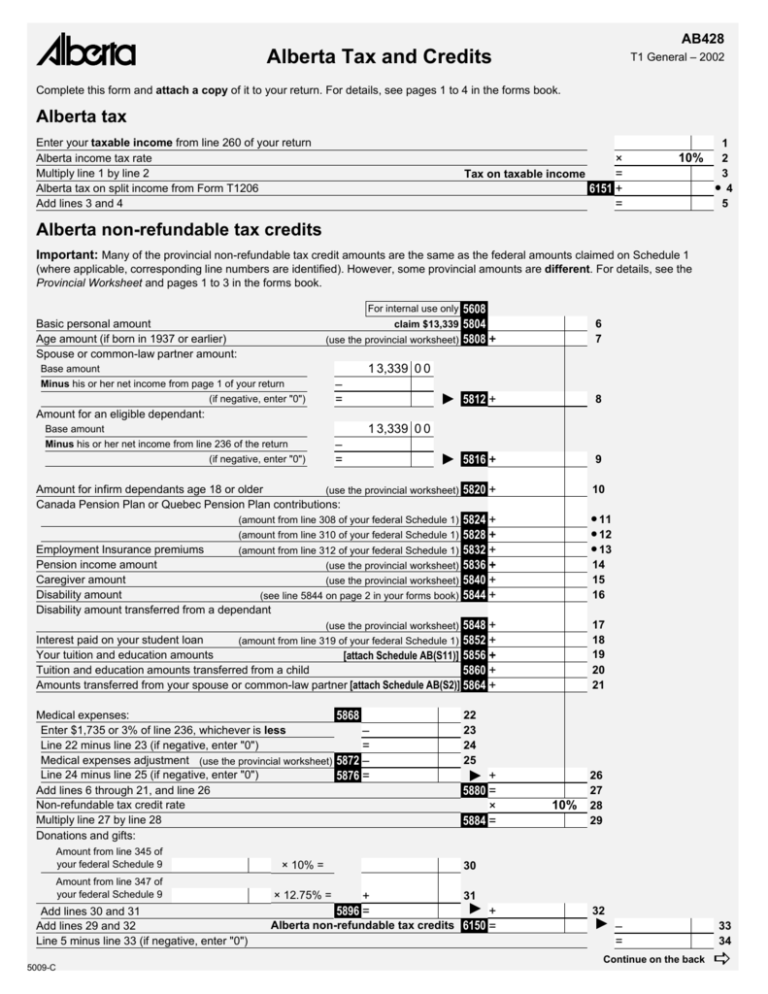

Alberta Tax and Credits

advertisement

AB428 Alberta Tax and Credits T1 General – 2002 Complete this form and attach a copy of it to your return. For details, see pages 1 to 4 in the forms book. Alberta tax Enter your taxable income from line 260 of your return Alberta income tax rate Multiply line 1 by line 2 Alberta tax on split income from Form T1206 Add lines 3 and 4 × Tax on taxable income = 6151 + = 10% 1 2 3 l 4 5 Alberta non-refundable tax credits Important: Many of the provincial non-refundable tax credit amounts are the same as the federal amounts claimed on Schedule 1 (where applicable, corresponding line numbers are identified). However, some provincial amounts are different. For details, see the Provincial Worksheet and pages 1 to 3 in the forms book. 5608 5804 5808 + 6 7 5812 + 8 5816 + 9 Amount for infirm dependants age 18 or older (use the provincial worksheet) 5820 + Canada Pension Plan or Quebec Pension Plan contributions: 10 For internal use only Basic personal amount Age amount (if born in 1937 or earlier) Spouse or common-law partner amount: claim $13,339 (use the provincial worksheet) 1 3,339 0 0 Base amount – = Minus his or her net income from page 1 of your return (if negative, enter "0") Amount for an eligible dependant: 1 3,339 0 0 Base amount – = Minus his or her net income from line 236 of the return (if negative, enter "0") (amount from line 308 of your federal Schedule 1) (amount from line 310 of your federal Schedule 1) Employment Insurance premiums (amount from line 312 of your federal Schedule 1) Pension income amount (use the provincial worksheet) Caregiver amount (use the provincial worksheet) Disability amount (see line 5844 on page 2 in your forms book) Disability amount transferred from a dependant (use the provincial worksheet) 5824 + 5828 + 5832 + 5836 + 5840 + 5844 + l 11 5848 + 17 18 19 20 21 l 12 l 13 14 15 16 Interest paid on your student loan (amount from line 319 of your federal Schedule 1) 5852 + Your tuition and education amounts [attach Schedule AB(S11)] 5856 + Tuition and education amounts transferred from a child 5860 + Amounts transferred from your spouse or common-law partner [attach Schedule AB(S2)] 5864 + Medical expenses: 5868 Enter $1,735 or 3% of line 236, whichever is less – Line 22 minus line 23 (if negative, enter "0") = Medical expenses adjustment (use the provincial worksheet) 5872 – Line 24 minus line 25 (if negative, enter "0") 5876 = Add lines 6 through 21, and line 26 Non-refundable tax credit rate Multiply line 27 by line 28 Donations and gifts: Amount from line 345 of your federal Schedule 9 × 10% = Amount from line 347 of your federal Schedule 9 × 12.75% = Add lines 30 and 31 Add lines 29 and 32 Line 5 minus line 33 (if negative, enter "0") 5009-C 22 23 24 25 + 5880 = × 5884 = 10% 26 27 28 29 30 + 5896 = 31 + Alberta non-refundable tax credits 6150 = 32 – = Continue on the back 33 34 a Alberta tax (continued) Enter the amount from line 34 on the front of this form Alberta dividend tax credit: Amount from line 120 of your return Alberta overseas employment tax credit: Amount from line 426 of federal Schedule 1 Alberta minimum tax carry-over: Amount from line 427 of federal Schedule 1 Add lines 35, 36, and 37 Line 34 minus line 38 (if negative, enter "0") Alberta additional tax for minimum tax purposes from Form T1219 Add lines 39 and 40 Enter the provincial foreign tax credit from Form T2036 Line 41 minus line 42 34 × 6.4% = 6152 + l 35 × 35% = 6153 + l 36 × 35% = 6154 + = l 37 – = + = – = 38 39 40 41 42 43 (maximum $750) – = – 45 46 47 Alberta tax = 48 Alberta political contribution tax credit Enter the Alberta political contributions made in 2002 Credit calculated for line 45 on the Provincial Worksheet Line 43 minus line 45 (if negative, enter "0") Enter your royalty tax rebate from Form T79 Line 46 minus line 47 (if negative, enter "0") Enter the result on line 428 of your return 5009-C 6003 44