Competitive price discrimination

advertisement

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

RAND Journal of Economics

Vol. 32, No. 4, Winter 2001

pp. 1–27

Competitive price discrimination

Mark Armstrong∗

and

John Vickers∗∗

We model firms as supplying utility directly to consumers. The equilibrium outcome of competition

in utility space depends on the relationship π (u) between profit and average utility per consumer.

Public policy constraints on the “deals” firms may offer affect equilibrium outcomes via their

effect on π(u). From this perspective we examine the profit, utility, and welfare implications of

price discrimination policies in an oligopolistic framework. We also show that an equilibrium

outcome of competitive nonlinear pricing when consumers have private information about their

tastes is for firms to offer efficient two-part tariffs.

1. Introduction

This article has two main aims. First, we propose a framework that we hope will be useful

in analyzing situations where firms compete by offering various “deals” involving tariffs, bundles

of outputs, and so on. Models of markets where firms simultaneously compete on a number of

dimensions are often hard to work with. In many cases, however, this analysis can be simplified

by taking a dual approach and modelling firms as competing directly in utility space. Viewed

from this perspective, a firm’s strategy is just to choose the (scalar) level of utility, or “value for

money,” offered to customers. A firm’s market share naturally increases the more utility it offers

relative to its rivals. Central to the analysis of competition in utility space is the function π (u),

which gives the maximum profit per consumer a firm can extract when it provides utility u to its

consumers. This function succinctly captures not just the relevant cost and demand information;

it also reflects any public policy (or other) constraints on the deals firms may offer. The second

aim of the article is to illustrate the usefulness of this dual approach by examining the profit,

utility, and welfare implications of public policy toward various kinds of price discrimination in

oligopoly.1

∗

Nuffield College, Oxford; mark.armstrong@nuffield.oxford.ac.uk.

All Souls College, Oxford; john.vickers@economics.oxford.ac.uk.

We are grateful for comments from Simon Anderson, Frank Fisher, Anke Kessler, Preston McAfee, John Moore,

Babu Nahata, Barry Nalebuff, and Dick Schmalensee, and we especially thank Lars Stole and two referees for very

detailed advice that improved the clarity and accuracy of this article. All remaining errors are our own.

1 The modelling of firms as competing in utility space is also a useful way to think about competition in network

industries. For instance, see Armstrong (forthcoming) for a survey of recent contributions to this topic, viewed from the

perspective of firms offering utility directly to their subscribers.

∗∗

Copyright © 2001, RAND.

1

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

2

/

THE RAND JOURNAL OF ECONOMICS

Competition in utility space. We suppose that consumers differ in their tastes for the

utilities supplied by the firms (although the framework continues to be valid in the extreme case

of perfect substitutes). We do this by using a discrete-choice framework, so that if u i is the utility

supplied by firm i, a consumer’s net utility is u i plus an idiosyncratic shock. (Thus we can think

of u i as the “average” utility offered by firm i to its population of consumers.) This framework

includes such familiar models of product differentiation as the Hotelling location model and

the logit model. As well as being convenient to work with from a theoretical perspective, such

a framework accords well with the simplest forms of many econometric models of consumer

choice.

A convenient feature of this approach is that the effect of the profit function in equilibrium is

completely separable from the effect of the discrete-choice model. For instance, in a symmetric

model with a fixed number of firms, we show that equilibrium utility maximizes an additively

separable function

φ(u) + log π (u),

where φ is an increasing function depending only on the discrete-choice framework (see Proposition 1 below). Similarly, in a symmetric circular Hotelling model with free entry, we show that

equilibrium utility maximizes

u

1

−

,

τ2

π (u)

where τ is a parameter measuring the competitiveness of the market. Thus one can perform comparative statics analysis on the profit function and on the discrete-choice framework independently,

and in the article we do this repeatedly. This analysis is contained in Section 2.

Perhaps the article closest to our competition-in-utility-space approach is Bliss’s (1988)

model of retail competition, in which the role of a shop is to assemble a collection of goods in one

place and offer a price list to consumers. The value of a price list to a consumer is measured by an

indirect utility function. A recurrent theme in Bliss’s analysis is that retailers choose Ramsey-like

markups. This is because a firm’s problem can often be decomposed into (i) how much utility to

offer to consumers, and (ii) how to set prices to maximize profit while offering a given consumer

utility. Whereas Bliss focused on (ii), which is a Ramsey problem, our main concern is with (i),

though (ii) is implicit in our analysis.

While our competition-in-utility-space method is perhaps less familiar, we embed this approach into the well-known discrete-choice framework for consumer choice—see Anderson, de

Palma, and Thisse (1992) for a description of discrete-choice models, and Caplin and Nalebuff

(1991) for a general model of imperfect competition that includes the discrete-choice model as

a special case. Although there are exceptions, most discrete-choice models involve, first, an assumption that product characteristics are exogenously fixed before competition takes place, and,

second, that consumers have unit demands. In particular, a firm’s only decision is the price at

which it offers its single product, while a consumer’s only decision is which firm (if any) to buy

from. The latter assumption is too strong for many applications of interest—for instance, situations where firms offer multiple products and where consumers may wish to purchase multiple

units of a given product—and one aim of the article is to extend the discrete-choice framework

to cover multiproduct, multiunit situations.

Caplin and Nalebuff (1991) and Anderson, de Palma, and Nesterov (1995) provide an earlier

analysis of elastic consumer demand, though the focus is still on single-product firms. These

analyses make the simplifying assumption that consumers make all their purchases from a single

firm, and we shall follow the same approach here.2 This “one-stop-shopping” assumption is not

innocuous, and in future work it would be useful to analyze the implications of allowing consumers

2 Rochet and Stole (forthcoming) have consumers choosing qualities rather than quantities, although formally the

analysis is similar. However, the interpretation of the choice as quality—so that consumers have unit demands—has the

benefit that there is no need to make an assumption that consumers purchase from a single firm.

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

ARMSTRONG AND VICKERS

/

3

to pick and choose from the various products offered by firms to make up their own bundle. It

is certainly true in much of our analysis that in equilibrium, consumers will choose to obtain all

products from a single firm, since that way they incur the transport cost only once (in the Hotelling

context) and pay the fixed charge of a two-part tariff only once (when such tariffs are offered).

However, it does not follow from this that the ability of consumers to shop from two firms has no

effect on the equilibrium. (This issue is discussed further in Section 4.)

Once we allow for elastic consumer demand, we have to decide how the additive shock that

underpins the discrete-choice model interacts with a consumer’s volume of demand. For instance,

in a Hotelling transport cost model, one could imagine incurring the transport cost per unit of

product consumed, or, alternatively, the cost could just be incurred per trip, independently of the

volume of consumption. Because it greatly simplifies the analysis, we take the latter approach.3

However, our model of price discrimination in Section 4 could be interpreted as one in which

consumers pay a transport cost per product (but not per unit of each product).4

Competitive price discrimination. The second main aim of the article is to use this

competition-in-utility-space framework to investigate the profit, consumer surplus, and welfare

implications of various price discrimination policies in oligopoly. We define a firm’s pricing to

be discriminatory if it sells units of its output(s) at different prices when marginal costs do not

differ correspondingly. We will see that the welfare effects of permitting price discrimination

in oligopoly depend in large part on whether discrimination takes the form of what we term

intrapersonal discrimination or whether it is interpersonal discrimination. To illustrate the distinction, consider the case of air travel. Different kinds of tickets, say “business” or “leisure”

tickets, can be charged at different rates, depending on the consumer demand characteristics. It

may be that travellers are segmented, so that some people always want one kind of ticket while

others always want the other. When these tickets have different prices we would call this practice

interpersonal price discrimination, since different consumers face different prices. Alternatively,

it could be that a given traveller demands a mix of business and leisure tickets, depending on the

nature of the planned journeys, and differential charging here is an example of intrapersonal price

discrimination.5

We analyze three information structures:

Homogeneous case. In this case, consumers are assumed to be “homogeneous,” in the sense

that all consumers generate the same level of profits for a given level of utility, i.e., that the

function π(u) is the same for all consumers. (This is a slight abuse of terminology, however, since

consumers continue to differ in their tastes for the utilities offered by firms.)

Observable heterogeneity case. Here consumers are heterogeneous and differ by an observable

characteristic on which firms can base their tariffs. Examples might be where consumers are

regionally segmented, or where the age or occupation of the consumer can be determined.

Unobservable heterogeneity case. Consumers are heterogeneous and differ by unobservable characteristics (in addition to their differing tastes for the utilities offered by firms). Thus the profit

function π (u | θ ) here depends on a parameter θ that is private information to consumers.

In Section 3 we discuss in more detail the simple case of homogeneous consumers who

make all their purchases from a single firm, and here we can apply our competition-in-utilityspace framework directly. Clearly, in the homogeneous consumer case, the only possible kind of

3 The same assumption is made in Anderson, de Palma, and Nesterov (1995). Similarly, in their model of quality

choice, Rochet and Stole (forthcoming) assume that the transport cost does not depend upon a consumer’s choice of

quality.

4 See Stole (1995), and the references therein, for an analysis of the more complicated case where transport costs

(or brand preferences) do interact with the quantity/quality choice.

5 It is fair to say that many economists would reserve the term “price discrimination” for what we call interpersonal

price discrimination. For instance, Varian (1989) defines (third-degree) discrimination to be where different consumers

are charged different prices.

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

4

/

THE RAND JOURNAL OF ECONOMICS

price discrimination is of the intrapersonal variety. The key idea is that a more constrained firm

will be able to make less profit for a given utility level than would a less constrained firm. Thus,

the function π D (u) if a firm practices price discrimination of some kind will generally differ from

the function π N (u) if it cannot: indeed, π D (u) ≥ π N (u) with strict inequality almost always. Both

nonlinear pricing—which, in the homogeneous case, reduces to two-part tariffs—and third-degree

forms of discrimination are discussed, although the analysis is more general than this and covers

virtually any constraints placed on firms in the way they can offer deals to their customers.

When there are fixed costs associated with serving consumers, so that marginal-cost pricing

of services does not allow firms to break even, greater flexibility allows firms to offer a higher

level of utility before losses are made. In such cases, allowing firms in competitive markets greater

flexibility causes an increase in consumer utility and overall welfare (Proposition 2). If there is no

such fixed cost, then the analysis required is more delicate, and we show that greater flexibility

causes profits and overall welfare to increase in competitive markets, although now consumers

may be made worse off (Proposition 3). The results for welfare are true both when there is a fixed

number of firms and when there is free entry. The key feature of the homogeneous consumer

framework, combined with the one-stop-shopping assumption, is that firms, when permitted to

do so, choose socially desirable prices—i.e., profits are maximized subject to a consumer utility

constraint. Thus, firms will make their prices relate to the underlying costs and to the demand

elasticities in the correct Ramsey manner. In particular, (i) when two-part tariffs are used then

marginal prices equal marginal costs, and (ii) when linear pricing is used, then prices are, roughly

speaking, higher for those products with less elastic demand.

Section 4 covers cases where consumers are heterogeneous, and we analyze both observable

and unobservable heterogeneity. The focus here is naturally on interpersonal price discrimination. We cannot directly apply the competition-in-utility-space framework here, although various

features of that model will be useful ingredients in the analysis. In the first part of Section 4

we discuss the case of interpersonal third-degree discrimination, and in contrast with the homogeneous consumer case, the welfare consequences of competitive price discrimination are

ambiguous. For instance, it may be that competition forces firms to set a lower price in less elastic

markets compared to the no-discrimination case. More generally, it will only be by chance that

prices are Ramsey-like. There is thus a fundamental difference between the “intrapersonal” and

“interpersonal” forms of discrimination in terms of their welfare effects. But although the total

welfare effect is ambiguous, the effect on consumers and profits separately is not: profits increase

but aggregate consumer utility decreases if discrimination is permitted in competitive markets

(Proposition 4).

In the second part of Section 4 we discuss a model with unobserved heterogeneity, where

consumers have private, product-specific information about their tastes (in addition to their private

information about their tastes for the deals offered by firms). We make two important assumptions.

First, we assume that the market is competitive, in the sense that all consumers choose to participate

in the market in equilibrium. Second, we assume that the “vertical” taste parameter does not interact

with the “horizontal” taste parameter. (This assumption has two parts: the two taste parameters

are statistically independently distributed, and, as discussed above, the horizontal taste parameter

is unaffected by the quantities chosen by consumers.) Under these conditions it is an equilibrium

for firms to offer cost-based two-part tariffs (Proposition 5). In particular, there is no screening in

this equilibrium, and all consumers face the same marginal prices. In effect, the need to compete

dominates any benefit derived from screening consumers. Thus, just as in the homogeneous

consumer case, allowing firms to have maximum flexibility in tariff choice can induce an efficient

outcome.

Contrasts with monopoly price discrimination. The above results contrast with familiar

results for monopoly; see Varian (1989) for an analysis of price discrimination with monopoly. A

general disadvantage of price discrimination—both in monopoly and in oligopoly—is that output

is suboptimally distributed to consumers because their marginal utilities will be unequal. This

drawback may be overcome if price discrimination leads to a sufficient increase in output. We

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

ARMSTRONG AND VICKERS

/

5

can deduce that if output falls when discrimination is introduced, then welfare must also fall.

(When we discuss interpersonal third-degree discrimination in duopoly, we shall use this fact

to find conditions under which discrimination is socially undesirable.) For instance, in the case

of third-degree price discrimination, with independent linear demands (and all markets served),

total output is exactly the same with discrimination as without, so discrimination reduces welfare. More generally, the sign of the total output effect in the monopoly case can be related

to the convexity/concavity properties of demands—see Varian (1989). The monopoly model of

price discrimination does not distinguish between the intrapersonal and the interpersonal kinds

of discrimination, since all that matters for the analysis is aggregate demand. As discussed above,

though, we argue that this distinction makes a crucial difference to the desirability of discrimination in oligopoly, and in the homogeneous consumer case we argue that price discrimination

is unambiguously good for welfare in competitive markets. In particular, we can simply infer

without explicit analysis that the output effect is positive if discrimination is permitted.

Turning next to price discrimination when there is unobservable heterogeneity, Armstrong

(1996) and Rochet and Choné (1998) analyze multiproduct nonlinear pricing by a monopolist

facing consumers with private information about their tastes. It is argued that the problem of

designing the profit-maximizing nonlinear tariff is complex, and explicit solutions seem obtainable

in only a few cases. In particular, Armstrong shows that a monopolist will generally choose to

exclude some consumers from the market at the optimum, while Rochet and Choné show that

for those consumers who do participate there will be “bunching,” i.e., that some consumers with

different tastes will choose to purchase the same bundle of products. In practice, these two features

of the optimum make it hard to find closed-form solutions. By contrast, in Section 4 we shall

show that these same models often have a very straightforward equilibrium—without exclusion

or bunching—when there is a reasonable degree of competition.

Other work on price discrimination in oligopoly. The literature on price discrimination

in competitive settings is not as extensive as the analysis for monopoly, though see Varian (1989)

and Wilson (1993) for some references. One very relevant article, however, is Holmes (1989),

who examines the output and profit effects of (interpersonal) third-degree price discrimination

in a symmetric duopoly model with product differentiation. (We examine a very similar model

in Section 4.) He shows that the sign of the total output effect depends not only on the convexity/concavity properties of industry demands—as in the monopoly case—but also upon a term

involving interfirm cross-price elasticities, which reflect competitive interactions. Holmes also

shows that it is possible for equilibrium profit to be higher when price discrimination is banned.

However, few clear-cut results are derived, and little is said about the welfare effects of allowing

discrimination. In Section 4, however, we shall argue that as markets become very competitive

the Holmes model becomes easier to interpret and stronger results emerge; we show that the

effect on profits and on aggregate consumer welfare is unambiguous, and we provide a simple

criterion for predicting when the total output effect is negative (which implies that discrimination

is undesirable).6

Turning to nonlinear pricing in oligopoly, Stole (1995) considers—as we shall—nonlinear

pricing in oligopoly when firms are spatially differentiated. Consumers differ both in their brand

preferences (horizontal differentiation) and their quality preferences (vertical differentiation).

He characterizes optimal pricing schedules and shows how they depend on consumers’ private

information about brand and quality preferences, and on the intensity of competition. A major

difference between Stole’s model and ours is that he allows the two kinds of private information to

interact, in that transport costs are assumed to depend on the quantities consumed (and hence on a

consumer’s taste for the output), whereas we make the simplifying assumption that transport costs

are a lump-sum cost. A model very similar to ours is Rochet and Stole (forthcoming), which was

prepared independently of this work. They assume the same lump-sum transport cost technology

as we do, and find conditions implying that efficient two-part tariffs emerge as an equilibrium.

6

© RAND

See also Katz (1984) and Borenstein (1985) for earlier analyses in a monopolistic competition framework.

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

6

/

THE RAND JOURNAL OF ECONOMICS

Customer poaching. Finally, we mention one important kind of price discrimination that

our framework cannot easily handle, when a firm offers a deal to those customers who “belong”

(in some sense) to rival firms that differs from the deal it offers its “own” customers. In most

cases we expect the firm to offer a better deal to rival firms’ customers in order to build market

share. A feature of such models is that, compared to the situation where deals are uniform,

price discrimination can act to intensify competition, in the sense that all prices come down and

equilibrium profits decrease.7 (This is in direct contrast with, say, our model in the first part of

Section 4, where allowing price discrimination causes some prices to rise and some to fall, while

total profits increase.) The basic reason why this kind of discrimination intensifies competition

across the board is that it makes it cheaper for a firm to target its rivals’ customers without

damaging the profits it can extract from its own customer base: when all firms target each others’

customers, though, all prices come down.8

In our model there is no sense in which customers “belong” in any observable way to one

or another firm. However, the kinds of situations where customers are associated with particular

firms include the following: First, in a spatial model Thisse and Vives (1988) suppose that a

consumer’s location is observable, so that consumers are known to be more loyal to one firm

than the other. In this case, when firms can base their prices on consumer location, all prices

might fall compared to the case where prices are constrained to be uniform. Second, Corts (1998)

examines a market where one firm supplies a higher-quality product than the other. There are two

identifiably different consumer groups, one that cares about quality and one that cares only about

price. Corts shows that allowing discrimination could cause both prices to fall compared to the

uniform price regime. The reason is that the two firms behave differently in response to the ability

to discriminate: the high-quality firm will choose to set the higher price in the “choosy” market,

whereas the low-quality firm sets its low price in that market, and so competition is stronger in

both markets. Finally, there is the interesting recent literature on customer poaching, including

Villas-Boas (1999) and Fudenberg and Tirole (2000). Here, the focus is on the dynamics of market

share. Firms know whether a consumer was a previous customer and so can target other consumers

accordingly. Again, a result is that all prices might fall with this kind of discrimination.9

2. Competition in utility space

A framework. There are two symmetrically placed firms, A and B, facing differentiated

consumers. (This analysis applies equally to any fixed number of firms—see below for the

extension to endogenous numbers of firms.10 ) Consumers buy all products from one or the other

firm, or they consume an outside option. Suppose that the “deal” offered by firm i gives each

consumer a utility u i , and that the outside option gives utility u 0 . We use a discrete-choice

framework and assume that a consumer of type ζ = (ζ0 , ζ A , ζ B ) has net utility u i + ζi if he buys

from firm i, and net utility u 0 + ζ0 if no purchase is made. Therefore, a consumer’s maximum

utility is max{u A + ζ A , u B + ζ B , u 0 + ζ0 }. The triplet ζ = (ζ0 , ζ A , ζ B ) is distributed across the

population according to a known distribution. There is a continuum of potential consumers, with

measure normalized to one.

Aggregate consumer utility is given by

V (u A , u B ) ≡ E max{u A + ζ A , u B + ζ B , u 0 + ζ0 } ,

7 In fact, Holmes (1989) shows that the same effect can occur when consumers do not “belong” to particular firms.

Moreover, Nahata, Ostaszewski, and Sahoo (1990) show that when profit functions are not single-peaked, the same effect

can occur even in monopoly.

8 Armstrong and Vickers (1993) present a model where price discrimination can cause all prices to rise. An

incumbent multimarket firm faces a threat of entry in one market. Permitting discrimination makes the incumbent react

aggressively to entry—since it does not have to sacrifice profits in the captive market—which can deter entry.

9 For instance, Villas-Boas has infinitely-lived firms facing an overlapping sequence of two-period consumers,

and he shows that in the steady state, prices can be lower when there is “customer recognition” than without.

10 The only result that depends on duopoly seems to be the fact that we can rule out asymmetric equilibria in

Proposition 1 below. See Perloff and Salop (1985) for a discussion of the issue.

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

ARMSTRONG AND VICKERS

/

7

where E denotes expectation with respect to the distribution for ζ . By the envelope theorem the

function V has partial derivative11

V1 (u A , u B ) ≡ s(u A , u B ),

where s(u A , u B ) is the number of consumers who choose to buy from firm A given the pair of

gross utilities u A and u B . (Differentiating V with respect to u A has two effects: (i) the direct

effect on those consumers who buy from A anyway, which is just s(u A , u B ), and (ii) a shift in

the set of consumers who choose to buy from A. However, those consumers on the boundary in

(ζ0 , ζ A , ζ B )–space between buying from A and other options are indifferent between A and the

other options, so there is no aggregate consumer welfare effect from (ii) at the margin.)

We focus throughout on the case where consumers’ tastes for the two firms’ products are

symmetrically distributed, so that V (u A , u B ) ≡ V (u B , u A ). This implies that the number of B’s

consumers is just s(u B , u A ). Clearly it is necessary that s(u A , u B ) + s(u B , u A ) ≤ 1, with equality

if all consumers participate. It is also necessary that s is increasing in the first argument and

decreasing in the second.12

Suppose that if a firm offers consumers a “deal”—i.e., package of products for sale using

a certain tariff—that gives them utility u, then its maximum profit per consumer is π (u). For

this function to be well defined, we assume the firms have constant-returns-to-scale technology

in serving consumers, so that profit per consumer does not depend on the number of consumers

served. Until we reach Section 4, we assume consumers are homogeneous in the sense that the

function π(u) is the same for all consumers. The form the relationship π (u) takes depends on the

cost structure of the firms, on the consumer demand functions they face, and also on the types of

tariff they are permitted to offer—see the next subsection for examples. Using this notation, firm

i = A, B wishes to maximize s(u i , u j )π (u i ) given the rival’s choice of utility u j .

We need to make some regularity assumptions in order to guarantee existence of equilibrium.

First, we impose the following condition on s:13

s1 (u A , u B )

is weakly increasing in u B .

s(u A , u B )

(1)

Since s is decreasing in the second argument, this condition requires that s1 not be decreasing

too fast in the second argument. In economic terms, this implies that firms’ reaction functions in

utility space are upward sloping. Second, we need to ensure that very low utility levels ultimately

drive all consumers away. To be precise, we assume that the “collusive” utility level u ∗ , which

is defined to be the utility that maximizes (symmetric) joint profits, exists. More specifically, we

assume

there exists u ∗ > −∞ that maximizes s(u, u)π (u).

(2)

Finally, it is economically natural to assume that π (u) is ultimately negative for large values of u,

so let ū be the largest utility level that allows a firm to break even. (For instance, supplying very

high utility ultimately involves offering products at prices below costs.) Therefore, assume there

exists ū defined by

π (ū) = 0, π (u) < 0 if u > ū.

(3)

11 We assume that this derivative exists, which requires that there is only a measure-zero set of potential consumers

who can be indifferent between any pair of options. A sufficient condition for this is for ζ to be distributed according to

a bounded density function.

12 To see this algebraically, one can show, for example, that the set of consumers who buy from A contracts if u

B

is increased.

13 For s to be differentiable, we can assume that the density function for ζ is continuous. In fact, the Hotelling

example we often use has kinked market-share functions. However, when all consumers participate in the market—as is

the case below—this problem does not arise.

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

8

/

THE RAND JOURNAL OF ECONOMICS

In this framework a symmetric Nash equilibrium in utility space exists, the equilibrium is

often unique, and, most importantly for our purposes, there is a simple formula for the equilibrium

utility:

Proposition 1. Assume (1)–(3) hold. Let φ(u) be a function satisfying

φ (u) =

s1 (u, u)

≥ 0.

s(u, u)

(4)

(This is unique up to a constant.) Then a symmetric equilibrium is given by each firm choosing

utility û that maximizes

φ(u) + log π (u).

(5)

This equilibrium utility û is strictly greater than the collusive utility level u ∗ . There are no

asymmetric equilibria. This is the unique (pure-strategy) equilibrium if (5) is concave.

Proof. All proofs are in the Appendix.

Thus equilibrium in this market involves the maximization of the sum of log profits and an

increasing function φ of consumer utility. In this result, the term s1 /s in (4) gives the proportional

increase in a firm’s customer base caused by unilaterally raising utility when both firms offer the

same utility level. This is a natural measure of the degree of product substitutability in the market.

The larger the term, the more weight is placed on consumer utility compared to profits in the

equilibrium.14

Examples of profit functions π (u). In this section we list a few examples of π (u) derived

from primitives in the market. In all cases except the last these will be necessary ingredients in

the subsequent analysis of price discrimination. In all cases we assume consumer preferences are

quasi-linear in income.

Single-product linear pricing. Suppose firms offer a single product and each consumer has the

demand function Q(P). Let V (P) be the consumer surplus function associated with Q(P), so

that V (P) ≡ −Q(P). (Recall that preferences are assumed to be quasi-linear.) Therefore, a

consumer’s utility is just u = V (P). Each firm has a constant marginal cost c for providing the

service, together with a fixed cost per consumer for providing service to a consumer of k ≥ 0.15

A firm’s profit per consumer if it offers utility u = V (P) is therefore Q(P)(P − c) − k, so that

π (u) is defined implicitly by

π(V (P)) ≡ Q(P)(P − c) − k.

(6)

If k = 0, then the maximum break-even level of utility, which defines ū in (3), corresponds to

marginal-cost pricing, i.e., ū = V (c). On the other hand, if k > 0, then the maximum break-even

level of utility is the one corresponding to average-cost pricing, i.e., if P av > c is the lowest price

that allows a firm to break even with linear pricing then ū = V (P av ). Differentiating (6) yields

π (u) = −(1 − σ (u)),

(7)

where

σ (V (P)) ≡ (P − c)

−Q (P)

.

Q(P)

14 See Bergstrom and Varian (1985) and Slade (1994) for an analysis of when an oligopoly in equilibrium can be

considered as maximizing a single objective function (as here). More generally, the duopoly game described in Proposition

1 is a “potential game”—see Monderer and Shapley (1996) for details.

15 These per-consumer fixed costs are often relevant, as with the costs of handsets in mobile telephony, the costs of

laying cables into homes in fixed telephony, the cost of digital decoders in pay-TV markets, or even the costs of parking

spaces and checkout staff in shops.

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

ARMSTRONG AND VICKERS

/

9

(The function σ represents the elasticity of demand at a given utility level expressed in terms of

the markup (P − c) instead of price P.) If the weak condition σ (u) ≤ 0 holds when u ≤ V (c),

then (7) implies that π(u) is concave in u when π (u) ≥ 0.16 It will be useful for later to note that

when k = 0, so that ū = V (c), (7) implies that

π (ū) = −1.

(8)

Multiproduct linear pricing. Suppose, generalizing the above, that firms sell n products.

Consumer demands may be interdependent across products, and if p = ( p1 , . . . , pn ) is the vector

of prices, then each consumer’s demand for product i is qi (p). A consumer’s surplus is v(p),

where ∂v/∂ pi ≡ −qi . Firms incur a fixed cost k ≥ 0 of supplying a customer, and a vector of

constant marginal costs c = (c1 , . . . , cn ) for supplying the n products.

In this framework, π(u) is given by the solution to the Ramsey problem:

π(u) = max :

n

p≥0

qi (p)( pi − ci ) − k | v(p) = u .

(9)

i=1

If k = 0, then ū, the maximum utility that allows a firm to break even, is again induced by

marginal-cost pricing, i.e., ū = v(c). On the other hand, if k > 0, then pricing at marginal cost

will not cover costs, and ū will be lower. Indeed, unless at least one product has perfectly inelastic

demand (which we rule out from now on), there will be deadweight losses and ū < v(c) − k. In

sum,

= v(c)

if k = 0

ū

(10)

< v(c) − k if k > 0.

For a given u let λ(u) be the Lagrange multiplier used to solve problem (9).17 For any λ ≤ 1 let

p̂(λ) be the price vector that maximizes the function

n

qi (p)( pi − ci ) + λv(p).

(11)

i=1

In particular, p̂i (1) = ci . The price vector that solves problem (9) is therefore p̂(λ(u)), where λ(u)

is defined implicitly by

v(p̂(λ(u))) ≡ u.

(12)

π (u) = −λ(u).

(13)

The envelope theorem implies that

Note that λ(u) is increasing, so that π(u) is concave. Suppose that k = 0, so that ū = v(c). Then

marginal-cost pricing (which corresponds to λ = 1) is the policy that generates utility ū, i.e.,

18

π (ū) = −λ(ū) = −1.

(14)

Two-part tariffs. Consider the same framework as above but allow firms to use two-part tariffs

instead of linear prices. Suppose a firm chooses a vector of marginal prices p and a fixed charge

16 This discussion is very closely related to Section 3 of Anderson, de Palma, and Nesterov (1995), where the case

of single-product firms competing for consumers with elastic demand is analyzed. In particular, the function η in their

assumption A4 is our function σ in the text, i.e., σ (V (P)) ≡ η(P).

17 We assume demand functions are well behaved enough so that the Lagrangian method is valid—see Diamond

and Mirrlees (1971) for a full discussion of when the Lagrange method works for the Ramsey-unique solution.

18 To see this, note that the optimized value of (11), viewed as a function of λ, is convex in λ and has derivative

equal to v(p(λ)). Therefore, v(p(λ)) is increasing in λ, which, in combination with (12), implies that λ(u) is increasing.

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

10

/

THE RAND JOURNAL OF ECONOMICS

f . Then consumer utility is u = v(p) − f . The profit-maximizing method of generating u is to

set prices equal to marginal cost, in which case utility is u = v(c) − f . Profit as a function of u is

therefore given by the linear relationship

π (u) = v(c) − k − u,

(15)

and the maximum utility that allows a firm to break even is

ū = v(c) − k.

(16)

Comparing this expression with (10), we see that when there are per-consumer fixed costs, the use

of two-part tariffs enables a higher level of utility to be achieved compared with linear pricing.

Advertising in media markets. Although the remainder of the article is focused on pricing issues,

here we briefly consider how the competition-in-utility-space framework can be applied to the

equilibrium balance between advertising and retail charges in media markets such as newspapers

and pay-TV. Suppose that consumers obtain utility from consuming the media product equal to

u = v − D(a) − p,

where v is the gross surplus from consuming the service, a is the volume of advertising, D(·) is

the function giving how much consumers dislike advertising, and p is the charge to the consumer

for the product. Advertising revenues for a media firm are closely related to their subscriber base,

so suppose that if a firm chooses advertising volume a it obtains advertising revenue R(a) per

subscriber. Suppose that a firm incurs a cost k per subscriber in providing the service. Therefore,

its profit per subscriber is p + R(a) − k, which in terms of u is v − u − k + R(a) − D(a), and so

its maximum profit per subscriber—if the firm is free to choose the balance between consumer

prices and advertising—is given by the function

π(u) = v − u − k + max{R(a) − D(a)},

a

which is of the same linear form as the two-part tariff case above.

Examples of discrete-choice models. Here we provide two examples of preferences that

generate particular instances of the market-share function s(u A , u B ). (See Anderson, de Palma,

and Thisse (1992) for further examples.)

Hotelling preferences. The simplest Hotelling model involves customers being uniformly located

on the unit interval [0, 1]. A customer located at 0 ≤ x ≤ 1 receives net utility u A − t x if she

buys from A and net utility u B − t(1 − x) if she buys from B. Thus firm A is located at zero and

firm B is located at one. The parameter t > 0 is a consumer’s “transport cost” per unit distance

of buying from one firm or the other. If an agent buys from neither firm, she receives zero net

utility.19 Therefore, a consumer at x will buy from firm A if (i) u A − t x ≥ u B − t(1 − x) and (ii)

u A − t x ≥ 0. These inequalities can be rearranged to give

1

uA − uB

uA

x ≤ min :

1+

,

.

2

t

t

Therefore, s is given by

1

uA − uB

uA

s(u A , u B ) = min :

1+

,

.

2

t

t

(17)

19 Thus, in terms of the notation developed above, u = 0, ζ ≡ 0, ζ = −t x, and ζ = −t(1 − x), where x is a

A

B

0

0

random variable uniformly distributed on [0, 1].

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

ARMSTRONG AND VICKERS

/

11

(There are obvious modifications when u A and u B differ by so much that s above lies outside

the interval [0, 1], which never occurs in equilibrium.) Unfortunately, the Hotelling model has

the well-known technical drawback that market shares are kinked at a point where there exists

a consumer who is indifferent between the three options of buying from A, buying from B, or

buying nothing. This means that we cannot directly apply Proposition 1. However, the following

similar result is easily obtained:

Lemma 1. Suppose that log π(u) is concave and that

t ≤ 2β,

(18)

where β > 0 is the value of u that maximizes (1/2) log u + log π (u). Then equilibrium utility,

denoted û(t), maximizes

u

+ log π (u).

(19)

t

Condition (18) implies that if û(t) maximizes (19), then û(t) ≥ β and so all consumers are willing

to pay the transport cost to obtain this utility, i.e., that the market is covered.

For an illustration of Lemma 1, consider the case where two-part tariffs are used, so that the

profit function is given by (15). Then Lemma 1 shows that, provided parameters are such that the

market is covered in equilibrium, which in this case reduces to requiring20

t≤

2

[v(c) − k] ,

3

(20)

π̂ (t) ≡ t,

(21)

in equilibrium we have

so that a firm’s profit per customer is equal to the differentiation parameter t. Although tariffs

are not the focus of our approach in this section, it is useful for later to note that the tariff that

generates this level of profits is

T ∗ (q) = t + k +

n

ci qi .

(22)

i=1

This is a two-part tariff with prices equal to marginal costs, and the margin of the fixed charge

over the fixed cost is the product-differentiation parameter t. In particular, this equilibrium tariff

does not depend on any consumer-demand characteristics, and this feature will play a major role

when we discuss tariff design under asymmetric information at the end of the article.

It will be useful to understand the asymptotic properties of the equilibrium as the market

becomes highly competitive. (Note that Lemma 1 certainly applies when t is close to zero.) As

described above, û(t) denotes equilibrium consumer utility with transport cost t. Similarly, let

π̂ (t) ≡ π(û(t)) be equilibrium profits, and let ŵ(t) ≡ û(t) + π̂ (t) be unweighted welfare (not

including consumers’ transport costs which, except in the next subsection, are identical in all

equilibria, and hence irrelevant for welfare). Then we have the following result:

Lemma 2. Suppose π(u) is at least twice continuously differentiable. In the Hotelling duopoly

model for small t, the equilibrium utility, profits, and welfare are given by the following secondorder Taylor approximations:

û(t) ≈ ū − t +

t2

2

π (ū)

π (ū)

π̂ (t) ≈ −tπ (ū) + t 2 π (ū)

20

© RAND

In this case, β = (1/3)[v(c) − k] in Lemma 1.

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

12

/

THE RAND JOURNAL OF ECONOMICS

ŵ(t) ≈ ū − t(1 + π (ū)) +

t2

π (ū)

2π (ū) + .

2

π (ū)

When we come to discuss the impact in competitive markets of various price discrimination

policies, we will use these Taylor expansions—which relate outcomes to the slope and curvature

of π at ū—to evaluate a change in the tariff regime in terms of its effect on consumers, firms, and

overall welfare.

Logit preferences. With the normalization u 0 = 0 the logit model with product-differentiation

parameter µ implies that the market-share function takes the form

s(u A , u B ) =

eu A /µ

eu A /µ

.

+ eu B /µ + 1

(A significant difference between the logit and the Hotelling models is that in the former there

are always some consumers who choose not to participate.) Then

s1 (u, u) 1 eu/µ + 1

=

,

s(u, u)

µ 2eu/µ + 1

and so Proposition 1 implies that equilibrium utility û maximizes

log π(u) +

u

1

− log 2eu/µ + 1 .

µ 2

(One can check that (1) is satisfied.) When µ is small, this maximization problem is closely

approximate to maximizing log π(u) + u/(2µ), which is the same problem as (19) when t = 2µ.

In particular, all the asymptotic results for the Hotelling model contained in Lemma 2 above are

valid for the logit model as well if we write t = 2µ.

Free entry. Here we extend the model to allow for free entry of firms. We need to be more

specific about consumer preferences here, and so we use the familiar Salop (1979) extension of

the Hotelling model where consumers of mass one are uniformly distributed around a circle of

circumference one.21 Transport cost is t and there is an overall fixed cost per firm K . Let π(u) be

the same per-consumer profit function as previously. We assume that market equilibrium implies

that firms are equally spaced around the circle, and that integer concerns are not significant.

Analogously to Lemma 1 above, equilibrium u for a given number of firms n satisfies

π (u) π (u)

+

= 0.

n

t

(23)

Given equilibrium utility u, the number of firms n is given by the zero-profit condition

π (u) = n K .

We assume that transport cost t is large relative to the fixed cost K so that free-entry equilibrium

allows a reasonable number of firms to enter the market. Define τ by τ 2 = K t. Then the above

pair of conditions implies that

(π (u))2 + τ 2 π (u) = 0

(24)

21 An alternative approach would be to follow Perloff and Salop (1985) and Anderson, de Palma, and Nesterov

(1995) and model endogenous entry by assuming that a consumer’s utility shocks ζi are independently and identically

distributed across all potential firms.

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

ARMSTRONG AND VICKERS

/

13

defines free-entry equilibrium level of gross utility as a function of τ , denoted û(τ ). Assuming that

log π(u) is concave, this implies that −1/π is also concave, and so (24) implies that equilibrium

û(τ ) maximizes the function

u

1

−

,

τ2

π (u)

which is the free-entry version of (19) above. Clearly û(τ ) is decreasing in τ and tends to ū, the

maximum break-even level of utility, as τ → 0. Notice that, like (21) in the duopoly model, when

firms offer two-part tariffs the expression (24) implies that equilibrium profits, excluding K , are

π(û(τ )) ≡ τ .

Since free entry drives profits to zero, total welfare with parameter τ , denoted ŵ(τ ), is just

net consumer utility, which is utility û(τ ) minus average transport costs, and is given by

ŵ(τ ) = û(τ ) −

t

π (û(τ ))

= û(τ ) +

,

4n

4π (û(τ ))

(25)

where the second equality comes from (23).

The following lemma, which is analogous to Lemma 2 derived in the duopoly case, describes

the asymptotic properties of ŵ:

Lemma 3. The second-order Taylor expansion of ŵ(τ ) about τ = 0 is

ŵ(τ ) ≈ ū −

5τ

τ 2 π (ū)

1

√ .

+

4 −π (ū) 8 (π (ū))2

3. Discrimination with homogeneous consumers

For the remainder of the article we examine the welfare effects of allowing firms more

discretion over their choice of tariffs. In this section we focus on the case of homogeneous

consumers, so that, using the terminology of the Introduction, price discrimination must be of the

intrapersonal variety.

Let π D (u) be the profit function if firms can engage in price discrimination in some way, and

let π N (u) be the corresponding function if no discrimination is possible. Note that the cause of a

change in tariff regime need not be a change in public policy, but could result from technological

developments that facilitate more complex tariffs. To illustrate the following discussion, consider

two natural kinds of price discrimination that use the profit functions derived in Section 2.

Two-part tariffs versus linear prices. Here, π N is the profit function corresponding to

multiproduct linear pricing, as in (9), and the break-even level of utility, ū N , is given by (10).

When two-part tariffs are used, the profit function, π D , is given by (15), and the break-even

level of utility, ū D , is given by (16). We will see that the relative performance of these tariffs in

competitive markets depends on whether or not there is a fixed cost k associated with serving a

customer. Comparing (16) with (10), we see that when k > 0 we have ū D > ū N . In contrast,

when k = 0, we have ū D = ū N = v(c), while (14) and (15) give π D (ū) = π N (ū) = −1.

Intrapersonal third-degree price discrimination. Suppose the multiproduct firms have

the same marginal cost c for each product. A ban on price discrimination requires a firm to set

a uniform (linear) price pi ≡P for all products, in which case the demand function aggregated

n

over all products is Q(P) ≡ i=1

qi (P, . . . , P). Let V (P) ≡ v(P, . . . , P) be consumer surplus

at the uniform price P. Then the single-product linear pricing analysis in Section 2 applies, so

π N , the profit function with the uniform pricing constraint, is given by (6). If k = 0, then ū N , the

maximum utility that allows break-even without price discrimination, is just V (c), and (8) implies

that π N (ū N ) = −1. If k > 0, let P av denote the minimum uniform price that allows a firm to

break even, in which case ū N = V (P av ).

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

14

/

THE RAND JOURNAL OF ECONOMICS

If firms can offer different prices for different services, then π D (u) is given by (9) above (with

c j ≡ c). As above, if k = 0, then ū D = V (c), and from (14) we see that π D (ū D ) = −1. If k > 0,

then—except for the knife-edge case where uniform pricing happens to be the utility-maximizing

way to cover the fixed cost k—we have ū D > ū N , since the firm could choose to set price P av in

each market, but there is generically a more profitable way to generate utility ū N .

We wish to emphasize, however, that the following argument applies more generally than

to this pair of choices, and virtually any pair of profit functions such that π D corresponds to a

situation where firms have more flexibility over their choice of tariff than is the case with π N

will work. For instance, another case might be where π D corresponds to unrestricted multiproduct

linear pricing, and π N is the function induced when firms are not permitted to set any prices below

the associated marginal cost (i.e., where “loss-leading”is banned).22

When firms can engage in price discrimination, they have more ways to generate a given

level of utility, and so it follows that π D (u) ≥ π N (u), where the inequality will often be strict. In

particular, if ū D and ū N are the respective maximum utilities that allow firms to break even, then

ū D ≥ ū N . The above examples—of linear versus two-part pricing and uniform versus nonuniform

pricing—suggest that the inequality ū D ≥ ū N typically is strict when there are positive fixed

costs of supplying services to a consumer (k > 0), for in that case discrimination provides a more

efficient means with which to cover fixed costs. In sum,

k > 0 =⇒ ū D > ū N .

(26)

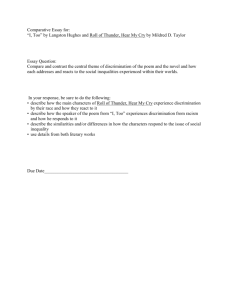

The fixed per-consumer cost case is illustrated in Figure 1, which applies to the duopoly

Hotelling model. From (19), the equilibrium utilities, denoted u N and u D in the figure, satisfy

tπi (u i ) + πi (u i ) = 0, the tangent to πi (·) at the point u i intersects the horizontal axis a distance t

to the right of equilibrium utility. In fact, because π D (u) is a straight line with π D (u) ≡ −1, this

diagram illustrates the case of two-part tariffs versus linear pricing—see (15) above. Therefore

equilibrium profits with discrimination in this case are t, as in (21) above. The figure is intended

to show what may happen when the market is not particularly competitive (i.e., t is quite large),

in which case equilibrium utility is lower when discrimination is allowed.

On the other hand, when there are no fixed costs to cover, so that k = 0, then we expect that

ū N = ū D = ū, say. The reason for this is that marginal-cost pricing—which is nondiscriminatory—

is the most efficient way to supply utility to consumers. Moreover, when k = 0, we expect that

π D (ū) = π N (ū) = −1. Again, this makes sense from an economic standpoint: when k = 0,

we know that ū corresponds to marginal-cost pricing, and since total welfare per consumer,

u + π (u), is maximized at marginal-cost pricing, it follows that π (ū) = −1. Finally, note that

since π D (u) ≥ π N (u) and the first two terms in a Taylor expansion about ū are equal for the two

profit functions, i.e., π D (ū) = π N (ū) = 0 and π D (ū) = π N (ū) = −1, it is necessarily the case that

π D (ū) ≥ π N (ū). Except in knife-edge situations, this last inequality will be strict.23 In sum,

k = 0 =⇒ ū D = ū N = ū, π D (ū) = π N (ū) = −1, π D (ū) > π N (ū).

(27)

Unfortunately, we have mostly been able to obtain general results only in the competitive

limit, e.g., as the product-differentiation parameter t or τ is close to zero in the Hotelling models.

Results for less competitive markets have been possible to obtain only by specifying the market

and the kinds of tariffs in more detail. For instance, by specifying a functional form for consumer

demand (such as linear independent demand functions) one can explicitly work out the welfare

comparison between nonuniform versus uniform multiproduct linear pricing over the whole range

22 Alternatively, in the media-markets model above, π could be the profit function if firms are unrestricted, and

D

π N could be the one corresponding to when firms are restricted in some way, for instance in the amount of advertising

they can supply.

23 For instance, in the case of intrapersonal third-degree price discrimination, one can show that π (ū) = π (ū)

D

N

only if all the appropriate elasticities of demand for the n products are equal (when evaluated at marginal-cost pricing).

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

ARMSTRONG AND VICKERS

/

15

FIGURE 1

DUOPOLY MODEL WITH k > 0

of transport costs.24 However, one result that holds outside the competitive limit is the following

application of monotone statics:

Lemma 4. In the duopoly model, suppose that ū N = ū D = ū and log π D (u) − log π N (u) is

decreasing in u for u < ū. Then equilibrium utility is lower when price discrimination is permitted

than when it is not.

Thus we see that if π D /π N decreases in u, so that the proportional benefit of engaging in price

discrimination is higher when less utility is offered to consumers, in equilibrium consumer utility

will fall with discrimination. (Of course, this result says nothing about the effect of discrimination

on overall welfare; we will see below that welfare often rises despite a fall in consumer surplus

when discrimination is introduced.) One application of this result is to the comparison between

linear and two-part pricing.

Corollary 1. Suppose k = 0. In the duopoly model, equilibrium utility is lower with two-part

tariffs than with linear pricing.

For the remainder of this section we focus on the competitive limit. We use the Hotelling

discrete-choice model, in both the duopoly and free-entry frameworks. This is because it is

convenient to use a parameterized family of preferences that can allow services to become closely

substitutable. But since the logit model closely approximates the Hotelling model in competitive

markets—see above—all the following results for competitive markets apply equally with that

discrete-choice example as well. A simple corollary of Lemmas 2 and 3 is that in the fixed

per-consumer cost case of (26), we have consumer utility and total welfare being higher when

discrimination is allowed, provided the market is sufficiently competitive:

Proposition 2 (fixed per-consumer cost case). Suppose ū D > ū N . Then

(i) in the duopoly Hotelling model if there is sufficiently strong competition—t close to

zero—both consumer utility and welfare are higher if price discrimination is permitted;

(ii) in the free-entry Hotelling model if there is sufficiently strong competition—τ close to

zero—welfare (which equals consumer utility) is higher if price discrimination is permitted.

24 This was done in an earlier version of the article, and we showed that allowing discrimination was better for

overall welfare for a large range of transport costs, not just for those near zero.

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

16

/

THE RAND JOURNAL OF ECONOMICS

Notice that Figure 1 applies to the case where ū D > ū N and where the market is not especially

competitive, when consumers are worse off when discrimination is permitted. However, one can

see from the diagram that as t becomes small we have equilibrium utility u D being greater than

the maximum possible utility without discrimination, ū N , and hence greater than the equilibrium

utility without discrimination.

The intuition for this result is straightforward: in competitive markets firms can attract

consumers only by delivering utility that is close to the maximum possible; restricting the ways

in which firms can deliver utility reduces this maximum utility. In the duopoly model, profits are

approximately zero in the competitive case, so welfare then is also higher with discrimination.25

In the free-entry model, profits are always zero, but in the competitive case, transport costs are

close to zero (either because the per-unit transport cost t is small or because there are many firms

and so the distance travelled is small), and therefore welfare here is also increased by allowing

discrimination. This simple result does not depend on the particular Hotelling specification of

tastes. Any parameterized model in which equilibrium utility tends to the maximum possible

break-even utility as competition becomes more intense will have the same property.26

The analysis required is more delicate in the case where there are no per-consumer costs, as

in (27). However, we have the following corollary of Lemmas 2 and 3:

Proposition 3 (no fixed per-consumer cost case). Suppose ū N = ū D = ū, π N (ū) = π D (ū) = −1

and π D (ū) > π N (ū). Then

(i) in the duopoly Hotelling model if there is sufficiently strong competition—t close to zero—

consumer utility decreases and profits and welfare increase if price discrimination is permitted;

(ii) in the free entry Hotelling model if there is sufficiently strong competition—τ close to

zero—welfare (which equals consumer utility) is higher if price discrimination is permitted.

See Figure 2—which is the same as Figure 1 except that ū N = ū D = ū—for an illustration of

this result in the Hotelling duopoly case. In fact, this figure precisely illustrates the case covered

by Corollary 1 comparing linear pricing with two-part tariffs.

Comparing Propositions 2 and 3, notice that, with the duopoly framework, changing one

apparently minor feature of the model specification—whether or not there exist per-consumer

fixed costs—reverses the ranking of the two tariffs as far as consumers are concerned (though

not for overall welfare). A technical reason for this can be found by looking at Lemma 2. When

ū D > ū N , the impact of allowing discrimination in competitive markets is immediately seen

simply by the limiting value of the functions û and ŵ as t tends to zero, and no information about

the derivatives of the functions π N and π D is needed for the comparison. Thus, only “0th-order”

information is needed for the comparison. When ū D = ū N , however, not only are the limiting

values of π N and π D equal, but so are their first derivatives. (Compare (27) with (26).) This means

that second-order information on these profit functions is required to be able to understand the

impact of price discrimination. Roughly speaking, whenever 0th-order effects are sufficient to

compare the two regimes, everyone is better off with discrimination in the competitive limit; when

we have to move to second-order comparisons, the ranking is reversed for consumers.

Why, when there are no fixed per-consumer costs, are consumers worse off with discrimination in competitive markets? Because second-order effects are involved, it seems hard to get

much direct economic intuition. However, one explanation can be found by looking at Lemma 4.

Taking a second-order expansion of πi (u) about ū, one obtains (for i = N , D)

1

πi (u) ≈ ū − u + (ū − u)2 πi (ū).

2

Since we know that π D (ū) > π N (ū), it follows that locally around ū we have that log π D − log π N

25 In fact, Lemma 2 shows that in competitive markets, equilibrium profits are higher with discrimination whenever

π D (ū D ) < π N (ū N ), which is certainly true in the two-part tariff versus linear-pricing comparison.

26 See Perloff and Salop (1985) for a fairly general analysis of when this happens with unit demands.

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

ARMSTRONG AND VICKERS

/

17

FIGURE 2

DUOPOLY MODEL WITH k = 0

is decreasing in u, and we can apply Lemma 4. (In the competitive limit we know that we can

restrict attention to u ≈ ū.)

Finally, we mentioned in the Introduction that one concern of the previous literature has

been to determine the effect of price discrimination on total output. In all the many cases where

we have seen that discrimination raises welfare, we can simply infer that total output rises when

discrimination is allowed. Indeed, it must rise by enough to offset the welfare cost of unequal

marginal utilities.

4. Discrimination with heterogeneous consumers

Interpersonal third-degree price discrimination. In this section we discuss a model first

analyzed by Holmes (1989), in which two firms operate in two distinct markets, denoted 1 and

2, and each supplies a single product in each market. For simplicity, we analyze the duopoly

Hotelling model as before. Firms have the same constant marginal cost c in each market, and

there are no per-consumer fixed costs. Firms offer linear tariffs, and let pi denote a firm’s price

in market i. Suppose the fraction of customers in market 1 is α (and the fraction in market

2 is 1 − α). Each customer in market i has the demand function qi ( pi ). The two markets are

separate, and a customer in one market is not able to purchase the product in the other market. Let

q̄( p) ≡ αq1 ( p) + (1 − α)q2 ( p) denote the average demand across the two markets with common

price p. Let vi ( pi ) denote the consumer-surplus function associated with demand function qi , and

let v̄( p) be that associated with q̄. Let πi (u) be the per-customer profit function in market i, so

that πi (vi ( pi )) = qi ( pi )( pi − c) as in (6). Let ηi = −cqi (c)/qi (c) be the elasticity of demand in

market i with marginal-cost pricing. Without loss of generality, suppose that markets are labelled

so that market 1 is the more elastic:

η1 ≥ η2 .

(28)

We allow the product-differentiation parameter (or transport cost) to differ in the two markets, so

let t be the parameter in market 1 and γ t be that in market 2. In sum, if firms A and B set the

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

18

/

THE RAND JOURNAL OF ECONOMICS

prices p1A and p1B respectively in market 1, then firm i obtains total profits of

αq1 ( p1i )( p1i

j

1 v1 ( p1i ) − v1 ( p1 )

− c)

+

2

2t

(29)

in that market (and similarly for market 2).

The regimes of no discrimination and discrimination are described below.

Price discrimination. In this case we can consider the two markets separately. From (8) we know

that πi (vi (c)) = −1, and so Lemma 2 implies that equilibrium utilities in the two markets are, to

first order in t, approximately given by

u 1 ≈ v1 (c) − t; u 2 ≈ v2 (c) − γ t.

(30)

Therefore, aggregate consumer welfare is approximately given by

u D (t) ≈ v̄(c) − t [α + γ (1 − α)] .

(31)

From (30) the prices in the two markets are approximately given by

p1 ≈ c +

t

γt

; p2 ≈ c +

,

q1 (c)

q2 (c)

and so market 2 is the more “competitive,” in the sense that equilibrium price is lower there if

price discrimination is permitted, provided that

q2 (c) > γ q1 (c).

(32)

Notice that this condition governing which market has the lower price has nothing to do with the

industry-level demand elasticities that are relevant for welfare: a market could be highly inelastic

at the industry level and yet competition could force firms to choose the lower price there. In more

detail, from (29) a firm’s own-price elasticity in market 1 when the two firms choose the same

price p1 is

p1 q 1 ( p1 )

,

t

where η1 ( p1 ) = − p1 q1 ( p1 )/q1 ( p1 ) is the industry-level elasticity. Thus a firm’s own-price

elasticity in a market, which is inversely related to the equilibrium price, does depend on the

industry-level elasticity η1 , but in highly competitive markets (t close to zero) this factor is

swamped by the second competitive interaction term, which yields the relation (32).

From Lemma 2, aggregate profits are approximately given by

η1 ( p 1 ) +

π D (t) ≈ t [α + γ (1 − α)] .

(33)

Finally, total output under discrimination is approximately given by

Q D (t) ≈ q̄ −

t

[αη1 + γ (1 − α)η2 ] ,

c

(34)

where q̄ = q̄(c).

No price discrimination. A ban on price discrimination requires a firm to set p1 = p2 = p. Using

the expression (29), and the corresponding expression for market 2, the first-order condition for

the equilibrium uniform price p is

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

ARMSTRONG AND VICKERS

/

19

1

d

d

αq1 ( p)π1 (v1 ( p)) + (1 − α)q2 ( p)π2 (v2 ( p)) = t α π1 (v1 ( p)) + (1 − α) π2 (v2 ( p))

γ

dp

dp

or

φ( p)( p − c) = t q̄( p) + q̄ ( p)( p − c) ,

where

φ( p) ≡ α (q1 ( p))2 +

1−α

(q2 ( p))2 .

γ

Writing p = p(t), differentiating this first-order condition gives

d

d q̄( p) + q̄ ( p)( p − c) p (t) = q̄( p) + q̄ ( p)( p − c),

[φ( p)( p − c)] − t

dp

dp

which implies that p (0) = q̄/φ, where these quantities are evaluated at marginal-cost prices.

Therefore, aggregate consumer surplus for small t is approximately

u N (t) = v̄( p(t)) ≈ v̄(c) − t

q̄ 2

.

φ

(35)

Similarly, aggregate profits are approximately given by

π N (t) ≈ t

q̄ 2

.

φ

(36)

Finally, total output without discrimination is approximately

q̄

Q N (t) ≈ q̄ + t q̄ .

φ

(37)

Proposition 4. For sufficiently small t,

(i) except in the knife-edge case where q2 (c) = γ q1 (c), aggregate consumer surplus is lower

and profits are higher if price discrimination is permitted;

(ii) if (32) holds, then welfare is lower when price discrimination is permitted.

Notice in particular that profits always increase if discrimination is permitted in competitive

markets, which shows that Holmes’s (1989) result that profits may fall with discrimination requires

markets to be reasonably uncompetitive. Also, it is aggregate consumer surplus that falls with

discrimination: clearly consumers in the “weak” market benefit from the lower prices caused by

allowing discrimination.27

Figure 3 illustrates this result. The point ( p, p) is the equilibrium uniform price vector, and

iso-welfare, iso-total output, iso-profit, and iso-consumer surplus contours are drawn through this

point. The iso-welfare and iso-output contours are tangent at this point, since welfare is maximized

for a given level of total output when prices are chosen to be uniform. (One can also check that

the former lies inside the latter.) Since we assume that market 1 is more elastic, the iso-profit and

iso-consumer surplus contours are less steep than the iso-welfare contour through this point, with

the former being less steep than the latter. Improvements to consumer surplus and welfare that

maintain the same level of profitability all lie in the region p2 > p1 . However, assumption (32)

implies that firms choose a lower price in market 2 if they are allowed to discriminate, something

27 It is straightforward to show that the equilibrium uniform price lies between the two discriminatory prices. As

discussed in the Introduction, this feature contrasts with models of “customer poaching” in which all prices might fall

with discrimination.

© RAND

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

20

/

THE RAND JOURNAL OF ECONOMICS

FIGURE 3

INTERPERSONAL THIRD-DEGREE PRICE DISCRIMINATION

that increases profits but reduces consumer surplus and overall welfare—this is a point like A on

the figure.

Intuitively, the fact that firms reduce the price in the inelastic market and raise the price in

the elastic market causes total output to fall—this is shown rigorously in the proof—and this must

reduce welfare compared to the no-discrimination case. In sum, and in contrast to our earlier

analysis with homogeneous consumers, a firm’s incentives when choosing its pattern of relative

prices may diverge from those of the economy as a whole, and Ramsey-like prices are offered

only by chance.

If the inequality (32) is reversed but not too much, then firms choose to raise price in the

“correct” market, but this effect is not sufficient to cause total output to rise, and the welfare

effect is still negative—this is a point like C on the figure. On the other hand, if (32) is reversed

sufficiently strongly, then the welfare effect is reversed, as in point B on the figure.

Inter- or intrapersonal price discrimination? In this section we have chosen to interpret the

industry as one where there are two disjoint groups of consumers.28 However, to bring out

connections with the analysis of intrapersonal price discrimination in Section 3, we can also

interpret the model as one where there is a single group of “homogeneous” consumers, each of

whom buys two products.

To see this, suppose that a consumer incurs the “transport cost” of going to one firm or the

other on a per-product basis (rather than the per-trip basis of Section 3). Specifically, suppose

that the transport cost is t for product 1 and γ t for product 2 (per unit of distance). Suppose a

consumer lies at location x1 ∈ [0, 1] with respect to product 1, and lies at location x2 ∈ [0, 1]

with respect to product 2, and that the marginal distribution of each xi is uniform on [0, 1]. A

consumer’s demand for product i with the price pi is (1/2)qi ( pi ), and there are no cross-price

effects across the two markets. Then for any pair of price vectors offered by the two firms, it is

clear that the outcomes of this homogeneous consumer model coincide precisely with those of

the segmented market model (setting α = 1/2) discussed earlier in this section: because transport

28

© RAND

We are grateful to a referee for encouraging us to provide the following discussion.

2001.

mss # Armstrong&Vickers; AP art. # 1; RAND Journal of Economics vol. 32(4)

ARMSTRONG AND VICKERS

/

21

costs are incurred per product and there are no cross-price effects, the prices offered in one market

do not affect a consumer’s preferences over the choice of firm in the other market. For instance, in

this homogeneous-consumer framework, the profits generated in market 1 for firm i do not depend

at all on firm behavior in market 2 and are given by the expression (29) above (with α = 1/2).

The extent of correlation between a consumer’s location parameters x1 and x2 , i.e., whether or

not consumers systematically favor one firm or the other for the two products, plays no role in

this analysis.

In particular, when transport costs are levied per product rather than per trip, there is no

reason to suppose that a firm will offer Ramsey-like prices for its two products when price

discrimination is permitted, by contrast with the analysis in Section 3. This discussion suggests that

the welfare effects of discrimination are not determined so much by the “homogeneous-” versus

“heterogeneous-”consumer dichotomy that we have so far emphasized; rather, it is determined by

whether the “one-stop-shopping” assumption we imposed in Section 3 is appropriate. If consumers

choose products on a mix-and-match basis from the two firms, then these consumers behave much

as if there were two segmented consumer groups, each of which buys only one product. In

particular, while price discrimination is desirable in competitive markets where one-stop shopping

is the relevant model, when mix-and-match shopping is the more appropriate framework the

welfare effects of price discrimination are less clear-cut.

Finally, it should be emphasized that this close parallel between multiproduct consumers and

segmented, single-product consumers only applies to this setting with linear pricing. For instance,

even with per-product transport costs it will most likely be in the interests of firms to bundle the

two products together when they face multiproduct consumers, so that joint consumption is

encouraged (or perhaps discouraged) endogenously.29 However, this bundling policy makes no

sense when the industry is made up of two segmented groups of single-product consumers.

Price discrimination with unobserved consumer heterogeneity. Here, suppose consumers have private information about their tastes for the services (and not just about their

location). As in Section 2, each firm offersn products, and if it supplies quantities q = (q1 , . . . , qn )

n

ci qi .

to a consumer a firm incurs the cost k + i=1

We employ a similar utility specification as in the monopoly model of Armstrong (1996),

but extended to a duopoly Hotelling model with transport cost t. Specifically, a consumer’s type