Competitive Analysis of Virginia's Aviation Industry

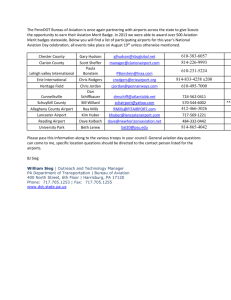

advertisement