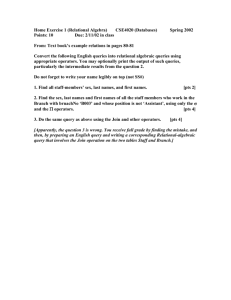

The Mobile Telecommunications Market

advertisement