annual report - Chartered Tax Institute of Malaysia

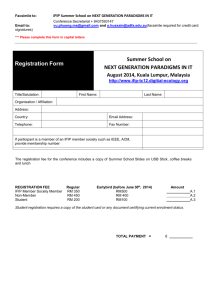

advertisement