Engaging Consultants to File PIC Claims

advertisement

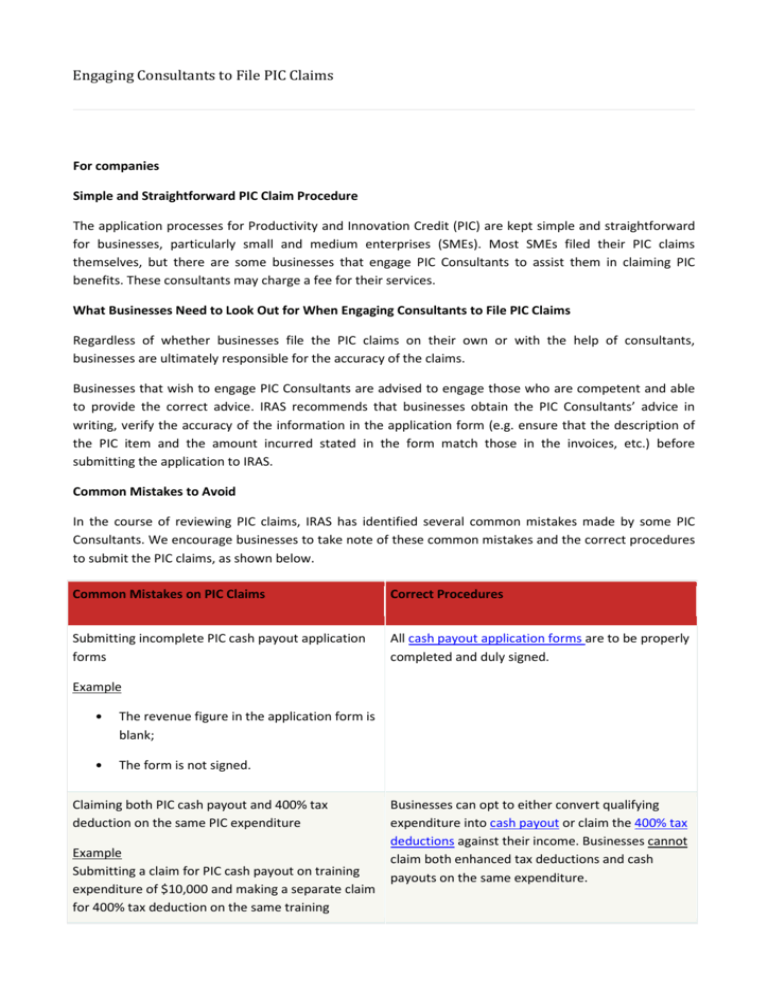

Engaging Consultants to File PIC Claims For companies Simple and Straightforward PIC Claim Procedure The application processes for Productivity and Innovation Credit (PIC) are kept simple and straightforward for businesses, particularly small and medium enterprises (SMEs). Most SMEs filed their PIC claims themselves, but there are some businesses that engage PIC Consultants to assist them in claiming PIC benefits. These consultants may charge a fee for their services. What Businesses Need to Look Out for When Engaging Consultants to File PIC Claims Regardless of whether businesses file the PIC claims on their own or with the help of consultants, businesses are ultimately responsible for the accuracy of the claims. Businesses that wish to engage PIC Consultants are advised to engage those who are competent and able to provide the correct advice. IRAS recommends that businesses obtain the PIC Consultants’ advice in writing, verify the accuracy of the information in the application form (e.g. ensure that the description of the PIC item and the amount incurred stated in the form match those in the invoices, etc.) before submitting the application to IRAS. Common Mistakes to Avoid In the course of reviewing PIC claims, IRAS has identified several common mistakes made by some PIC Consultants. We encourage businesses to take note of these common mistakes and the correct procedures to submit the PIC claims, as shown below. Common Mistakes on PIC Claims Correct Procedures Submitting incomplete PIC cash payout application forms All cash payout application forms are to be properly completed and duly signed. Example • The revenue figure in the application form is blank; • The form is not signed. Claiming both PIC cash payout and 400% tax deduction on the same PIC expenditure Example Submitting a claim for PIC cash payout on training expenditure of $10,000 and making a separate claim for 400% tax deduction on the same training Businesses can opt to either convert qualifying expenditure into cash payout or claim the 400% tax deductions against their income. Businesses cannot claim both enhanced tax deductions and cash payouts on the same expenditure. expenditure in the income tax return. Claiming for expenditure on equipment that does not fall under the PIC IT and Automation Equipment List Example Submitting a PIC claim for basic telephones, furniture and audio equipment Claiming for non-qualifying expenditure Businesses can only claim for expenditure on prescribed IT and automation equipment, i.e. equipment in the PIC IT and Automation Equipment List . If the equipment is not in the list, businesses must apply to IRAS for it to be approved, on a case-by case basis, before making a claim for PIC on that equipment. Claims should only be made on qualifying expenditure. Example Some non-qualifying expenditure include: • GST paid by a GST-registered trader on an item that qualifies for PIC (GST component is not claimable for income tax purpose as the GST trader can claim input tax in its GST return) • Expenditures that are not applicable to the IT and automation equipment such as warranty fees and service maintenance fees • Consultancy fees and PIC audit fee claimed as training expenditure Insufficient records to substantiate claims Example Some companies have not been able to furnish documents to support their claims, when requested, such as: • Evidence of payment, e.g. bank statement • Invoices • CPF payment records Businesses are required to maintain all supporting documents for a period of 5 years. These should be submitted to IRAS upon request.