What is PIC? - APEX ADWORDS ANALYTICS AGENCIES

advertisement

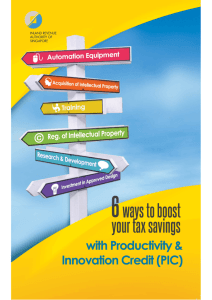

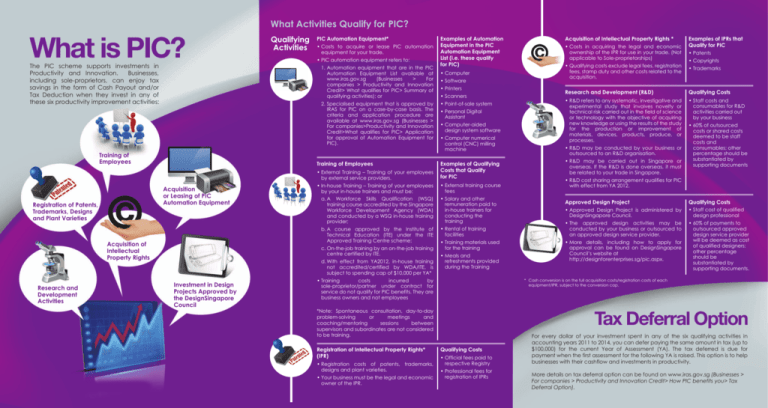

What Activities Qualify for PIC? What is PIC? The PIC scheme supports investments in Productivity and Innovation. Businesses, including sole-proprietors, can enjoy tax savings in the form of Cash Payout and/or Tax Deduction when they invest in any of these six productivity improvement activities: • Costs to acquire or lease PIC automation equipment for your trade. • PIC automation equipment refers to: 2. Specialised equipment that is approved by IRAS for PIC on a case-by-case basis. The criteria and application procedure are available at www.iras.gov.sg (Businesses > For companies>Productivity and Innovation Credit>What qualifies for PIC> Application for approval of Automation Equipment for PIC). Training of Employees Acquisition or Leasing of PIC Automation Equipment Acquisition of Intellectual Property Rights Research and Development Activities PIC Automation Equipment* 1. Automation equipment that are in the PIC Automation Equipment List available at www.iras.gov.sg (Businesses > For companies > Productivity and Innovation Credit> What qualifies for PIC> Summary of qualifying activities); or Training of Employees Registration of Patents, Trademarks, Designs and Plant Varieties Qualifying Activities • Computer • Software • Printers • Scanners • Point-of-sale system • Personal Digital Assistant • Computer-aided design system software • Computer numerical control (CNC) milling machine • External Training – Training of your employees by external service providers. Examples of Qualifying Costs that Qualify for PIC • In-house Training – Training of your employees by your in-house trainers and must be: • External training course fees a. A Workforce Skills Qualification (WSQ) training course accredited by the Singapore Workforce Development Agency (WDA) and conducted by a WSQ in-house training provider; • Salary and other remuneration paid to in-house trainers for conducting the training b. A course approved by the Institute of Technical Education (ITE) under the ITE Approved Training Centre scheme; • Rental of training facilities c. On-the-job training by an on-the-job training centre certified by ITE. d. With effect from YA2012, in-house training not accredited/certified by WDA/ITE, is subject to spending cap of $10,000 per YA* Investment in Design Projects Approved by the DesignSingapore Council Examples of Automation Equipment in the PIC Automation Equipment List (i.e. these qualify for PIC) • Training materials used for the training • Meals and refreshments provided during the Training • Training costs incurred by sole-proprietor/partner under contract for service do not qualify for PIC benefits. They are business owners and not employees • Registration costs of patents, trademarks, designs and plant varieties. • Your business must be the legal and economic owner of the IPR. • Costs in acquiring the legal and economic ownership of the IPR for use in your trade. (Not applicable to Sole-proprietorships) • Qualifying costs exclude legal fees, registration fees, stamp duty and other costs related to the acquisition. Examples of IPRs that Qualify for PIC • Patents • Copyrights • Trademarks Research and Development (R&D) Qualifying Costs • R&D refers to any systematic, investigative and experimental study that involves novelty or technical risk carried out in the field of science or technology with the objective of acquiring new knowledge or using the results of the study for the production or improvement of materials, devices, products, produce, or processes. • Staff costs and consumables for R&D activities carried out by your business • R&D may be conducted by your business or outsourced to an R&D organisation. • R&D may be carried out in Singapore or overseas. If the R&D is done overseas, it must be related to your trade in Singapore. • 60% of outsourced costs or shared costs deemed to be staff costs and consumables; other percentage should be substantiated by supporting documents • R&D cost sharing arrangement qualifies for PIC with effect from YA 2012. Approved Design Project Qualifying Costs • Approved Design Project is administered by DesignSingapore Council. • Staff cost of qualified design professional • The approved design activities may be conducted by your business or outsourced to an approved design service provider. • 60% of payments to outsourced approved design service provider will be deemed as cost of qualified designers; other percentage should be substantiated by supporting documents. • More details, including how to apply for approval can be found on DesignSingapore Council’s website at http://designforenterprises.sg/pic.aspx. * Cash conversion is on the full acquisition costs/registration costs of each equipment/IPR, subject to the conversion cap. Tax Deferral Option *Note: Spontaneous consultation, day-to-day problem-solving or meetings and coaching/mentoring sessions between supervisors and subordinates are not considered to be training. Registration of Intellectual Property Rights* (IPR) Acquisition of Intellectual Property Rights * Qualifying Costs • Official fees paid to respective Registry • Professional fees for registration of IPRs For every dollar of your investment spent in any of the six qualifying activities in accounting years 2011 to 2014, you can defer paying the same amount in tax (up to $100,000) for the current Year of Assessment (YA). The tax deferred is due for payment when the first assessment for the following YA is raised. This option is to help businesses with their cashflow and investments in productivity. More details on tax deferral option can be found on www.iras.gov.sg (Businesses > For companies > Productivity and Innovation Credit> How PIC benefits you> Tax Deferral Option). How does PIC benefit you? On your spending for accounting years 2010 to 2014 [Years of Assessment (YA) 2011 to 2015] Payout Option 400% Tax Deduction * You can enjoy 400% tax deduction on up to $400,000 of your investment spending each year in each of the six activities. means * This deduction of a tax up to $1.6 million ($400,000 x 400%) for each activity per YA. * In addition, you can combine your spending across YAs for each activity to enjoy the maximum PIC benefits as follows: YA 2011 & 2012 Cash 2013 to 2015 Combined $800,000 spending ($400,000 x 2) cap per activity $1,200,000 Maximum $3.2 million tax ($800,000 deduction at 400%) per activity $4.8 million ($400,000 x 3) ($1.2 million at 400%) can apply to convert * You up to $100,000 of your total investment spending in all six activities into a non-taxable cash payout instead of claiming tax deduction. This option may be more beneficial for businesses with low or no taxable income. How do I apply? 400% Tax Deduction How to Claim/Apply When to Submit Claim tax deduction in “Allowable Business Expenses” of the 4-line statement in your Income Tax Return (Form B/Form P). Submit Income Tax Return and PIC Declaration Form by the filing due date of 15 April Submit PIC Enhanced Allowances/Deduction Declaration Form for Sole-proprietors & Partnerships www.iras.gov.sg Quick Links > Forms>Individuals Cash Payout Submit PIC Cash Payout Application Form Tax Deferral Submit the PIC Tax Deferral Form. www.iras.gov.sg Quick Links > Forms > Individuals www.iras.gov.sg Quick Links> Forms > Individuals • A sum of $60,000 (60% x $100,000) for each YA from YA 2013 to YA 2015; To qualify for cash payout, your business must: • employ at least three local employees (Singapore Citizens or Permanent Residents with CPF contributions, excluding sole-proprietors and partners under contract for service); and • carry on business operation in Singapore. Note: Please deduct any grant or subsidy given on your investment and claim PIC benefits only on the net spending. Any time after incurring qualifying expenditure but not later than the end of the current financial year-end. Sole-Proprietorship A is in the manufacturing business. In year 2012, it invested in a Computer Numerical Control (CNC) cutting machine and sent staff to attend external courses. With the new automated machine, the business is able to automate some of its manufacturing processes and increase production capacity. The external courses help to upgrade the staff’s competency level and improve productivity. The expenditure incurred is as follows: maximum cash payout * The is: • A total of $60,000 for YA 2011 and YA 2012 combined (30% x combined spending cap of $200,000). Any time after the end of your financial quarter(s), but not later than the filing due date of the Income Tax Return (Form B/ Form P) Total qualifying PIC costs: BILL $23,000 Sole-Proprietorship A $20,000 + $3,000 = $23,000 Case Study Assuming that the Sole-Proprietor’s TAX STATEMENT chargeable income [CI] for YA 2013 before TAX PAYABLE deducting equipment and training cost is $200,000. His tax payable* is $20,750. $20,750 Acquisition of PIC automation equipment: $20,000 (CNC cutting machine) Training: $5,000 (Only $3,000 incurred on training of employees. The balance of $2,000 was for training of the Sole-Proprietor) The Sole-Proprietor will receive a cash payout of $13,800 ($23,000 x 60%). He will still need to pay tax of $20,750. Effectively, his PIC benefit is $6,950 ($20,750-$13,800). PIC BENEFIT $6,950 ($20,750-$13,800) He will be able to claim a total tax allowance of $92,000 ($23,000 x 400%) and his CI will be further reduced to $108,000 ($200,000 - $92,000). In this case, his tax payable* will be $6,570. Effectively, his PIC benefit will be $14,180 ($20,750-$6,570). If the Sole-Proprietor opts for cash payout for the total expenditure of $23,000, the equipment and training costs cannot be claimed as a deduction against his income. PIC BENEFIT $14,180 ($20,750-$6,570) Alternatively, the Sole-Proprietor can claim tax deduction on the expenditure incurred. Apply for Cash Payout Claim Tax Deduction *Tax payable is calculated based on the progressive individual income tax rates. For more information on PIC, contact us: Helpline for Self-employed / Partnership: (65) 6351 3534 | Email: picredit@iras.gov.sg | Website: www.iras.gov.sg Businesses > For companies> Productivity and Innovation Credit 6 ways to boost your tax savings with Productivity & Innovation Credit (PIC) (For Sole-Proprietors and Partnerships)