PPS Guide for Payroll Administrators

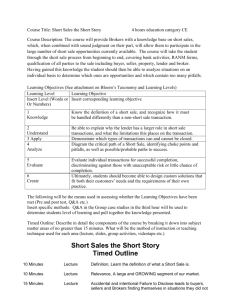

advertisement