international

advertisement

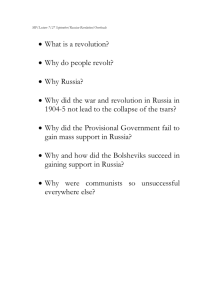

BENEFITS & COMPENSATION INTERNATIONAL T O TA L R E M U N E R AT I O N A N D PENSION INVESTMENT Compensation and Benefit Trends in the Russian Federation Karina Khudenko Karina Khudenko is a Partner with the Human Resource Services department at PwC Russia. She specializes in individual taxation and HR consulting, advising multinational and Russian clients on the most efficient types of employee remuneration. In her 20 years at PwC Russia, she has advised a significant number of multinational companies on the options for setting up in business in Russia, employment and secondment and approaches to remuneration and incentive plans. Ms Khudenko has a PhD in Labour Economics and runs taxation and HR programmes for the Economics Faculty of Lomonosov Moscow State University. rate from 2000 to 2008, they also grew respectively in US dollar, euro, etc. equivalents as well. For a large number of multinational companies working in such sectors as FMCG*, energy, pharmaceuticals and automotive, Russia has been among the most important emerging markets, with significant growth potential; being among the growing territories, Russian subsidiaries of multinational companies have been placing a special focus on managing local workforces. For almost a decade, up until 2008, the Russian market was marked by rapid GDP† growth, sweeping changes in various industries, the heating up of the labour market and an increasing shortage of skills. However, despite recent economic deceleration and consumer resistance in such industries as financial services and car manufacturing, the labour market is still experiencing a noticeable shortage of resources while the competitiveness of compensation packages remains a key issue in recruitment and retention. This article looks into the main characteristics of the Russian labour market and reviews data on changing policies for compensating managers and employees. Certain changes in salary growth took place after 2009 and, although growth continues, fluctuations in salaries and in the variable part of remuneration have become much more segmented, depending on industry and specific position. For example, according to my firm’s 2013 salary survey, the aggregate income of mid-level management grew by 15.4%, while for employees income grew by only 5.4% (which, given the rate of inflation, is in fact a reduction in purchasing power for the latter).1 When comparing average Russian salaries with those of other countries, it is obvious that, despite a serious increase in revenues in the last 15 years, the average salary in Russia remains low versus those in the leading world economies. FIGURE 2, also overleaf, compares the average Russian salary with those of several European countries. FIGURE 2 shows that employees’ salaries continue to be low, especially considering the quality and professional skills of the workforce – their qualifications and education, on average, remain high. According to Rosstat, at present the share of the population with higher education (including retirees) is 23% and, among people born between 1981 and 1985, those with higher education account for 37%. Compared with other emerging markets, the Russian labour market is characterized by the availability of a highly skilled workforce, still with comparatively low salaries. In other emerging markets, the share of young people with higher- or secondary-level professional education is growing, though it still remains quite low compared with Russia. WHAT SALARY SURVEYS SHOW The 1998 economic crisis was triggered by a default on Russian government debt. However, this was followed by a fairly quick recovery and a decade of rapid economic upturn, accompanied by substantial growth in personal incomes in general‡, and salaries in particular. FIGURE 1 overleaf shows year-by-year growth for salaries in Russia between 2000 and 2013 (as reported by the Russian Federal State Statistics Service, Rosstat). Actual annual salary growth was in double figures, making both annual salary indexation and continuous monitoring of the salary market necessary tools for keeping compensation packages competitive. Unlike in the 1990s, when salaries in foreign companies operating in Russia were largely set in US dollars, in the 2000s this practice only remained in some companies and usually just in respect of the salaries of particular executives. Today, we are therefore looking at salaries denominated in roubles and their growth has been significantly affected by ongoing high inflation rates (in recent years reaching at least 6-7% annually). Nevertheless, salaries outpaced inflation and, more importantly, considering the fairly stable (and increasingly so) rouble exchange * fast-moving consumer goods † gross domestic product ‡ The population’s growing prosperity was also a result of increasing social benefits (State pensions and other allowances) which are not examined in this article. 1 Average Annual Wages in Russia (2000-13) FIGURE 1 Rbs 35,000 29,960 Average annual wage 30,000 26,629 25,000 23,369 20,952 20,000 17,290 18,638 15,000 13,593 10,634 10,000 8,555 5,000 2,223 3,240 4,360 2001 2002 6,740 5,499 0 2000 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Year Source: Accrued Average Monthly Wages of Employees of Organizations, Russian Federal State Statistics Service, 2014 Comparison of Average Salaries in Various European Countries vs. Russia FIGURE 2 € 70,000 59,157 Average annual salary 60,000 55,627 50,000 45,215 41,895 40,000 36,890 35,000 34,500 38,681 35,947 30,000 30,000 20,000 11,070 0 9,918 7,859 10,000 11,852 y ia of lic ria ark ance an str p. lga epub enm Au Fr erm , Re Bu R D G d h lan ec Ire Cz 6.756 5,616 4,219 y d d ia ia al m tvia lands an lan do Russ rwa Polan ortug La zer King er om No t P i h R t Sw ited Ne Un ly Ita Country NOTE: Amounts are in euro. Source: ‘Personal income tax in the European Union’, PwC, 2013, and Russian Federal State Statistics Service, 2014 Comparison of Base Salary in Moscow with those of the Largest Cities in Russia FIGURE 3 % 100 100 90 87.0 80 Percentage 70 69.0 67.6 65.5 61.9 58.9 60 57.1 55.8 53.3 53.1 52.6 52.1 d zan oro Ka vg o yN hn Niz sk Om d gra lgo o V rm Pe 53.4 50 40 30 20 10 0 k k ar rg sk ow urg sto ars od bu sc ibir sb oy sn ivo rin os n a e ter d Mo v r t s e a a K P Vl No Kra Ek St City Source: ‘PwC Russia PayWell Salary Survey 2013’ 2 ra on -D ma Sa -on v sto Ro Another important feature of the Russian labour market is that, although revenues for all grades of employee have grown, salaries of top managers have increased even faster. This has led to an increasing divide between the salaries of entry-level and senior employees, while the salaries of top managers in large companies have already reached European and US levels and sometimes even exceed those of similar employees throughout an industry, e.g. financial services. This situation is the result of a sharp increase in top management’s remuneration in the 2000s in many large Russian companies and the remaining significant shortage of professional executives among Russian top managers. The only virtually mandatory benefit included in the employee packages of office employees in Moscow is voluntary medical insurance. It is important to note that medical services in Russia remain largely free of charge for the general public. Outside Moscow and among small and medium-sized businesses, for instance, medical insurance is still uncommon and is considered to be something of a privilege, since employees can receive free State medical assistance even though it is not always of a very high quality. However, in Moscow medical insurance is a standard benefit for all types of employee. According to the ‘PwC Russia PayWell Salary Survey 2013’, all survey participants provided their employees with medical insurance. Notably, most employers do not offer different insurance policies to different employee groups. Nonetheless, in a few years we can expect demand for premium medical insurance to grow among top managers. This may include medical examinations and treatment abroad, among other features. MOSCOW AND THE REGIONS The substantial difference between compensation packages provided in Moscow and those in other cities is an important characteristic of the Russian labour market. Variations in salary levels do not always correlate with current regional differences in the cost of living and price levels, but largely relate to the supply of, and demand for, skilled labour. Talking about other types of employee insurance, it is worth mentioning that there is a visible difference in the provision of life/disability insurance between Russian and multinational companies – the latter group includes this benefit in the package much more frequently, whereas for Russian companies the provision of life/disability insurance is still quite uncommon. On average, around half of employers (based on the PwC 2013 salary survey) offer basic life/disability insurance to their employees. In the absence of life/disability insurance coverage, many Russian employers provide some sort of financial assistance for their employees in the case of accidents (and there are even tax exemptions for such types of compensation) but payment of this kind of assistance would usually be discretionary. In future, we expect growing demand for employee life/disability insurance driven by employees (at least in the whitecollar segment of the market) as they become more educated about insurance products and more sophisticated in their expectations of the compensation package. FIGURE 3 opposite illustrates salary variations between Moscow and 13 large Russian cities in 2013. In recent years, the differences between Moscow and some of these cities have tended to decline. For instance, the index for St Petersburg grew from 59% in 2010 to 87% in 2013. However, the high concentration of businesses in Moscow will continue to drive its leadership in respect of remuneration levels. The stark remuneration differences existing across Russia make it difficult for companies operating in various regions to plan employee travel and develop respective compensation packages. Redeploying employees from Moscow to other regions is one of the hardest tasks since employees expect their compensation package, which is structured for the Moscow market, to improve. They also expect additional compensatory payments to be made owing to their relocation. This creates a huge divide between the salaries of redeployed employees and the local market. So-called ‘status benefits’ included in compensation packages also play an important role. Such benefits include a corporate, business-class or luxury vehicle with a driver and business-class airfares for business trips. Many foreign companies must take this into consideration. Russian companies take a more liberal attitude towards the benefits of their top executives working in head offices and, as such, these managers of foreign companies in Russia might feel a certain discomfort in relation to their peers in domestic companies. It should be noted that domestic staff mobility in Russia is very low (due to several historical and cultural factors), which is also one of the reasons for the vast difference in salaries of the same professionals working in various regions. WHAT ABOUT BENEFITS? After reviewing the compensation policies of Russian employers and the demands of job applicants, it is evident that the key element in any compensation package is the monetary part provided as guaranteed salary and annual bonus. Benefits play a secondary role in the compensation package and their absolute and relative value remains insignificant (rarely do benefits total more than 10% of aggregate employee compensation). However, in developing their compensation packages, employers must take note of certain specifics and trends pertaining to benefits since, for many employers, a competitive social package with other non-monetary elements can always act as a decisive advantage in the market. A meal allowance is one of the remaining features of benefits and social packages (usually provided through subsidized cafeterias located in office premises). Furthermore, in many conventional Russian companies, catering services in manufacturing plants and offices are not outsourced and are, instead, a company unit or department. Russian companies, which had emerged from Soviet enterprises, still have kindergartens and recreational and sports facilities in their infrastructure. Even those companies that disposed of their non-core assets and social structures in an effort to improve efficiency in the 1990s have recently been focusing 3 more on expanding their social infrastructure. Companies understand that such services give them a competitive advantage in the job market and reflect their commitment to being socially responsible. benefit policies in other countries do not extend this practice to cover Russia. PENSIONS? WHAT PENSIONS? – the insubstantial weight of benefits in the overall remuneration package, combined with the small number of companies providing a variety of benefits, There are some other reasons why flexible benefits are not popular. I believe the main deterrents are: Corporate pensions constitute one of the clear differences between the Russian and international approaches to structuring compensation packages. Russian corporate pension programmes are rather immature, since the first programmes appeared in the early 1990s as the respective laws on Non-State Pension Funds were passed. Historically, the State was responsible for paying pensions in Russia and the State pension system has been ‘pay-as-you-go’ so far. However, after pension reforms, State pensions were supplemented with insurance and individual accounts (which are still being reformed). The ongoing reform of the State pension system and annual developments in pension contribution laws may have been factors hindering the development of corporate pension programmes, as the mandatory payroll burden was rather high for employers and, in an environment uncertain about the further progression of pension reforms, many employers could not decide whether to create a corporate pension pool, which obviously has long-term implications for companies. – the existence of tax and legal restrictions preventing the provision of flexible benefits for employees, and – the complex administration of flexible benefits with low demand on the part of employees for such benefits. While the use of flexible benefits is low in terms of popularity, once implemented such approaches can help employers become more visibly differentiated in the market. This is especially important for employers hiring various groups of employees – differing in age, gender and professional characteristics – with varying needs and aspirations. When their programmes meet the needs of various employee categories (age being the most explicit differentiating factor in Russia), companies can achieve a significantly higher degree of employee satisfaction as regards social packages while maintaining salary levels. However, in order to obtain such results, employers must thoroughly understand the needs of their employees (by conducting satisfaction surveys) and take advantage of technological resources (IT platforms) that can help to reduce administrative costs. As a result, less than 20% of employers representing multinational companies now have corporate pension plans in place (according to PwC salary surveys2 and other sources). Corporate pension programmes are likely to become more common for Russian and multinational companies in the coming years owing to such drivers as: BRINGING EXPATRIATES TO RUSSIA – the rising average age of employees and thus a growing interest in corporate pensions as an element of the compensation package, Many multinational companies still need to send expatriates to Russia. It is important to note that Russia (and especially Moscow) continues to be one of the most expensive destinations for employers in terms of the compensation package for expatriates. Hardship allowances that were generously paid out by employers in the first decade of expatriate secondments to ‘far off and frozen’ Russia have been substituted by compensation packages strictly tied to the value of additional living expenses where the cost of accommodation and children’s education remains the most material. The other material cost items are the provision of a car with a driver, home-leave expenses and compensation for travel costs for commuters whose number is growing both in Russia and globally. – the substantial gap that exists between average salary, especially at managerial level, and State pensions, and – projected tax benefits for corporate pension plans. An interesting feature in establishing corporate pension programmes in Russia is the prevailing reason why employers are eager to propose such benefits, i.e. corporate social responsibility as a reason for establishing a corporate pension plan in at least 50% of cases, which is more important than retention, according to my firm’s 2011 pensions survey3. Another positive finding is that over 80% of companies with pension programmes in place consider these to be an efficient tool for motivation and retention, and thus value it highly. When thinking of ways to make Russia a more desirable destination for expatriates, it is important to note the existing favourable migration regime in place to attract foreign professionals to Russia, according to which foreign nationals eligible as Highly Qualified Specialists are guaranteed a low income tax rate of 13%, with a social contribution exemption granted to their employer. This latter fact makes it more advantageous for employers to attract highly qualified foreign specialists willing to work in Russia on a local compensation package, i.e. without any additional compensation paid, than to hire a Russian local, as an employer can save up to about BEING FLEXIBLE One of the most paradoxical practices of the Russian remuneration market by employers is the minimum (sometimes a single case) take-up of a flexible benefits policy. According to PwC surveys, the number of companies using single benefit systems is only 5% of total market players. Moreover, even those multinational companies that extensively use flexible 4 US$14,000* in social contributions for each US$100,000 of annual gross income, while the transaction costs to obtain permits for foreigners are quite low. As incomes of top managers in Russia are equal to those of their peers in most countries in Western Europe (and even higher in many sectors) and income tax is at the minimum level, employers in Russia should find it easy to attract foreign managers to occupy vacant positions in such a favourable environment. This trend was evolving rapidly before 2010. However, the number of foreign specialists has been decreasing both in foreign and Russian companies since then. Evidently, this trend should be studied and analysed as a separate and rather interesting feature of the Russian labour market. SUMMARY In closing, flexibility and fast responses to the constantly changing environment of the labour market (salary levels, deficits for certain professions, legal and tax developments and the ability to make prompt decisions) are critical for the success of remuneration policies applied by companies in Russia. The time taken for decision-making is one of the areas where multinational companies sometimes lag behind Russian employers as review and approval of changes in policies often take weeks or even months, whereas local competitors make prompt decisions and often override their official policies, which gives them an advantage in, for example, negotiations with prospective employees. However, multinational companies have significantly influenced and are still shaping Russian remuneration practices, bringing in the best approaches for developing incentive programmes along with transparent and fair remuneration to the local market. This is definitely a favourable driver for fostering further development of the labour market. Ω * £1 = US$1.61; €1 = US$1.26 as at 10 October 2014 References 1 1 ‘PwC Russia PayWell Salary Survey 2013’. 1 2 PwC salary surveys, 2006-13. 1 3 ‘Pensions Survey 2011’, PwC Russia, 2011. Copyright © Pension Publications Limited 2014. Reproduced from Benefits & Compensation International, Volume 44, Number 4, November 2014. Published by Pension Publications Limited, London, England. Tel: + 44 20 7222 0288. Fax: + 44 20 7799 2163. Website: www.benecompintl.com Produced by The PrintZone (www.theprintzone.co.uk). Prior written permission required to reprint in bulk.