Telecommunications Billing & Strategy

advertisement

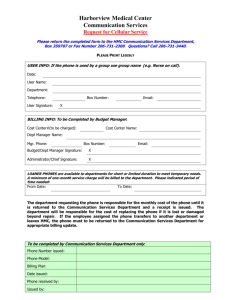

Telecommunications Billing in the Competitive Wireline Arena Hong Kong, May 2007 Cliff Lui, Hui Ka Yu, Richard Shi, Jacky Pang Billing in the Competitive Arena » Structure Structure “Billing is the life of our company.” – Nexus AG This paper will begin with a review of the changing landscape of the Hong Kong wireline telecommunications market. It will then discuss how competitive pressures affected the billing and operational support systems of local telecom companies and will conclude with thoughts on what the future bodes for billing operations support systems, especially relating to developments in Next Generation Networks. 1. FROM MONOPOLY TO COMPETITIVE BATTLEFIELD: THE EVOLVING LANDSCAPE OF HONG KONG WIRELINE TELECOMMUNICATIONS .............1 2. NEW ENTRANTS’ READINESS PREPARATION ................................................... 2 2.1. BUSINESS PROCESSES AND ORGANIZATIONAL STRUCTURE ............................2 2.2. BILLING AND OPERATIONS SUPPORT SYSTEM (BOSS) READINESS .................2 3. SERVICE LAUNCHES IN THE COMPETITIVE WIRELINE ENVIRONMENT ... 3 3.1. TELECOM SERVICES MARKETING AND PROMOTION..........................................3 3.2. PRICING FOR PROFIT – THE BUSINESS IMPERATIVE .........................................4 3.3. COMPETITION FRENZY AND IMPLICATIONS FOR BOSS (IMPORTANT)........... 7 3.3.1. BILLING SYSTEM COMPONENTS .........................................................................8 3.4. ANALYSIS OF BILLING-RELATED CUSTOMER INFORMATION ........................ 12 3.4.1. CUSTOMER RELATIONSHIP MANAGEMENT (CRM) .......................................... 13 3.4.2. DATA WAREHOUSING ...................................................................................... 15 4. SIX YEARS INTO THE COMPETITION; ASSESSING OPTIONS OF AN ENHANCED BILLING PLATFORM........................................................................16 5. BILLING IN THE NEW MILLENNIUM................................................................. 18 5.1. NEXT GENERATION NETWORKS............................................................................ 18 5.2. IMPLICATIONS FOR BOSS ........................................................................................ 19 5.2.1. SPECIFIC ENHANCEMENTS REQUIRED FOR BOSSS ..........................................20 6. CONCLUSION ...........................................................................................................21 7. REFERENCES .......................................................................................................... 23 Billing in the Competitive Arena » From Monopoly to Competitive Battlefield: The Evolving Landscape of Hong Kong Wireline Telecommunications 1. From Monopoly to Competitive Battlefield: The Evolving Landscape of Hong Kong Wireline Telecommunications The first telephone services were introduced to Hong Kong in 1882 by the Oriental Telephone and Electric Company. It was taken over by the newly formed Hong Kong Telephone Company Limited (HKTC) in 1925. The Hong Kong Government granted HKTC the monopoly right to supply and operate telephone services in Hong Kong for a period of 50 years commencing 1 July, 1925. In 1968, the Government extended HKTC’s monopoly for a further 20 years with effect from 1 July 1975, conditional upon HKTC modernising its management of the company. In those years, local wireline services were in short supply, and both the residential and business subscribers had to wait in long queues before getting the most basic telecom services. With the introduction of new management, HKTC developed into a well-respected utility company, progressing in line with the rapid development of HK as a trading and financial services centre in the Asia Pacific region. In 1988, a merger between HKTC and Cable and Wireless (Hong Kong) Ltd. resulted in Hong Kong Telecommunications Limited (HKT), which was subsequently restructured in 1990 to form Hong Kong Telephone Company Limited, Hong Kong Telecom International Limited (formerly Cable and Wireless (Hong Kong) Limited), Hong Kong Telecom CSL Limited and Computasia Limited. With the expiry of the Hong Kong Telephone Company’s (HKTC) monopoly licence in 1995, four new Fixed Telecommunications Network Services (FTNS) licences were issued to HKTC, Wharf Holding’s New T&T (Hong Kong) Ltd, Hutchison Communications Ltd. and New World Telephone Ltd. This marked the first time competitors came into Hong Kong’s wireline telecom market. -1- Billing in the Competitive Arena » New entrants’ readiness preparation 2. New entrants’ readiness preparation 2.1. Business processes and organizational structure A telco takes years to progressively build up its network and deploy revenuegenerating services. For the incumbent operator (HKT), with an established market and network infrastructure, the network division is usually the largest and most influential organizational unit (the Chief Engineer is as important as the Financial Controller). This is followed by the Customer Operations division, looking after customer requests and their satisfaction. However, priorities are a little different for new wireline entrants who tend to value the marketing division more and entrusts many important regulatory issues to the legal division. Supporting the bottom line of both the incumbent and new entrants, however, is the oft-overlooked but missioncritical billing and operations support systems (BOSS) in the Information Systems (IS) division. 2.2. Billing and Operations Support System (BOSS) Readiness The incumbent, HKT, had been working with BOSSs since the late 60s, and had gone through several generations of re-development: e.g. building its own billing, network resources allocation, order processing, repair and maintenance application software in the late 70s; acquired and adapted more sales and marketing-oriented BOSSs for their mobile business unit in the mid-80s. In the late 80s, it acquired and enhanced a new BOSS for their wireline business unit. HKT’s BOSS was then far more mature than those of fledgling new entrants. [One new wireline entrant] decided to acquire a BOSS package that had a clientele in both the US and the competitive South Pacific region consisting of small-sized telcos and one medium-sized telco. As part of the solution’s implementation, a complete set of the key business procedures surrounding the billing functions was included as part of the package, and an implementation team from IBM was stationed in Hong Kong -2- Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment for software enhancement and adaptation. To ensure successful implementation by the target launch date (1 year on), the new entrant recruited an IS director with extensive telco applications experience to direct the project and set up an in-house IS division to support its subsequent operations management. The system was successfully implemented and deployed in less than 9 months, meeting the targeted launch date. 3. Service launches in the Competitive Wireline Environment 3.1. Telecom services marketing and promotion Initially (Oct 95 to Dec 96), new entrants focussed on the wireline business market because business customers had higher demand for telecommunications services and thus yielded better revenues as compared to non-business consumers. This was further assisted by new number portability provisions, enforced by OFTA as part of the licensing regime. In March 1998, HKT’s monopoly licence in the international calls (IDD) market was lifted, resulting in intense competition. Promotion Examples New Year Promotion from 27 Jan to 10 Feb $0.28/min to USA & Canada $0.38/min to Guangzhou, Shenzhen, Shanghai & Beijing Valid from 10pm to 1:59am during the promotion period Print ads, TV spots Special Rate of $0.58 & $0.78 $0.58/min applicable to calls made to China during Mon-Sun 12mid night to 3am $0.78/min applicable to calls made to China during Mon-Sun 7pm to 12 mid night Other time slots: $2.09-$2.99/min -3- Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment By September 1999, saturation in the business market and the introduction of new interconnection terms by OFTA drove new entrants to refocus on ($88 Home Telephone Service) residential wireline services. By 2001 January, fierce competition again erupted in the IDD market after substantial reduction of IDD interconnection charges for the China market (comprising over 50% of the total IDD traffic). 3.2. Pricing for Profit – the Business Imperative While each telco is competing with the ever-decreasing prices of each other, management still need to be fully aware of the bottom-line. One crucial aspect of developing a value-enhancing business is to sort out the process of product pricing within the wider context of managing the company’s portfolio of products, i.e. product portfolio management (PPM). This applies to both individual products and services, as well as to bundles of products and services in package deals. -4- Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment ([•]) To assess each service from idea through to retirement, the PPM process needs data on customer demands and requirements from the marketing and product planning departments. Financial data on unit costs of services, sub-services and an indication of the proportion of the network elements that contribute to the service is also needed to form an initial price decisions. This is an arduous task for both the incumbent and new wireline entrants. Direct costs are easier to estimate: e.g. a new content service might require additional servers, staff and IP routers. Variable costs, however, like network infrastructure expenses and necessary improvements to the existing billing system are difficult to estimate. Marginal costs can often be larger than often appreciated. These costs cannot be obtained from normal accounting systems, and must be obtained from a specialised cost and revenue allocation tool. By linking different departments, PPM ensures coordinated decision-making. This ensures that pricing is a holistic exercise, and results in value-creating prices. -5- Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment How to price within PPM At the heart of a pricing decision is access to data. Cost and profit data comes from a specialised cost allocation tool that supplies information on all products, customers, dealers, etc. The cost allocation tool supplies the raw data for pricing tools and business case evaluations of planned products in the PPM pipeline. A new product evaluation combines costs from using existing network systems with the new elements. Additional customer lifetime (churn) information is needed to give a lifetime cost view and so combine one-off and on-going costs. Cost allocations cannot be arbitrary – real cost drivers must be identified. Arbitrary allocations result in products that are vulnerable to competitive pricing strategies. Pricing needs to correctly combine data on the unit cost of basic products – this is important since basic products, such as an ‘IDD call minute’, are often not sold as such, but are bundled into packages. Package or bundled pricing requires the usage profile of customer preferences that measures or estimates how customers use basic products. Consumers might make an average of 100 minutes of calls a month, but a few might use 1,000 minutes. These customers will also use other products. We can use this information to build up a total cost of each customer type and their cost distribution – profiling the entire spectrum of users. A tariff plan can now be defined for a customer type that can be priced in any way desired. Some basic products might be ‘free’, others per minute, others part of a fixed price package. By using the cost and price-volume data we can see that, overall, the price package will be profitable. A few customers might be allowed to be loss making (typically very low volume users on a volume related package or high volume users on a fixed price package). ‘Free calls’ can be profitable, so long as the overall usage of the -6- Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment customer on all services is covered in the price deal and free calls are paid for in other ways. Bundling techniques also apply for business customers. With sound cost data and a known overall corporate usage, operators can charge fixed amounts per month or only bill for calls made, even if the services include leased lines and internet access. Further flexibility for prices managers is supplied by knowledge of cost ranges. Marginal costs, full incremental costs, full costs including some fixed overheads and the stand-alone costs (including all of the fixed costs) are all available from a good costing system, and provide upper and lower price bounds. So long as all products are not priced at marginal cost, pricing managers can use this to target niches and to retain customers with ‘sweetener deals’. Pricing of one customer or product clearly cannot be conducted in isolation from others. 3.3. Competition Frenzy and Implications for BOSS (important) Competition in the IDD market came initially not from the three wireline new entrants, but from HK City Telecom, which began its business via ‘call-back’ operations based in Canada and USA. Lower international call charges for weekends and off-peaks hours for routes between HK and North America sparked competition. Eventually, complex discounting schemes and spectacular marketing promotions adding coverage for non-North American routes emerged, including: pricing bundles for a number of cities, extremely low prices for a certain period of time (e.g. only during Chinese new year), free calling for the first x minutes… IDD calls became so cheap (from HK$9.5 in 1995 to HK$0.47 in 2003) that people were (and still are) befuddled as to how telephone companies made money. Indeed, the new entrants had a hard time making money, but revenue trickled in from equally elaborate threshold and loyalty programs, e.g. bundling discounts for multi-lines after a certain number of lines were installed, variable monthly charges -7- Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment over the contract period, free monthly rentals for the beginning and ending of a contract… In the residential and business wireline market, campaigns included discounted or free installation charges, variable monthly rates and bundling fixedline discounts with IDD discounts. The billing of systems promised by these promotions and marketing campaigns needs to be addressed by the BOSS. Some special promotions can be handled relatively easily by adjusting the existing parameters in the available rate plans and parameter options in the billing system; others can be handled by semi-automated manual adjustments and special programmed runs involving a number of other related operations support systems. In some cases though, substantial manpower costs needs to be incurred. Some require software enhancements, the substantial costs of which need to be balanced against the business benefits achieved. Meetings are held where the marketing division teams up with the IS division to present a business case to be assessed by management. While many of the pricing changes were successfully handled by the then BOSS, they were sometimes realized only together with a lot of sweat and blood. 3.3.1. Billing System Components Before studying the changes required due to competitive pressures, it is instructive to see what elements a billing system incorporates: Registration, product and service management This element of the system handles the registration of customers and the products and services they purchase or subscribe to. Some operators use the same system to manage both corporate and residential customers. However, here are much greater complexities associated with handling corporate accounts, which involve multiple accounts and complex hierarchies. The billing system needs to offer corporate customers flexible account structures and extensive reporting capabilities: e.g. a -8- Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment corporate customer may want to have fixed rentals for voice and broadband services billed to different departments, summary bills to their respective division and one bill to the corporate finance to include the IDD charges. With the myriad services and products being offered during promotion campaigns, one needs to be able to enter promotional deals into the services and products rate tables quickly (sometimes overnight) to match or beat a competitor’s offer. It is not surprising to see people use a generic spreadsheet application to quickly set it up and then special programs to upload the revised rates into the billing system’s rates table. Such workarounds can ideally be handled via a more user-friendly GUI for services and product catalogues entry, as ell as standard interfaces for external feeds. Customer care Most billing systems are sold as 'billing and customer care solutions', but customer care often goes little further than the registration process described above. Customer care management (CRM) includes, amongst other elements, complaint management, trouble ticketing (logging and dealing with faults) and workforce management (assigning staff to deal with connections, complaints or faults). There is a broad range of specialized CRM products that can be used to handle elements of the relationship between the operator and the customer, depending on the operator's needs. A good billing system needs to have standard interfaces to accept external data from other OSS systems. Rating At the heart of the billing system is the rating engine. This takes the call detail records (CDRs) internet protocol detail records (IPDRs) from the network, and then applies the appropriate rating plans to turn the information into a charge ready to be associated with the customer. Rating engines vary in complexity in relation to both the plans they are able to create and their use. Operators need to have rating engines that enable them to offer the range of services their customers need, and enable them -9- Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment to change rating plans swiftly. Vendors need to address this if they wish to compete in the marketplace. While re-rating of usage for volume-sensitive plans, tapered pricing, threshold-level pricing, application of price overrides, calculations according to contract terms and monitoring against compliances, term commitment, volume commitment, combination of terms and volumes are supported, some are patched and partial, and needs re-modelling for a more structured approach. For example, BOSS enhancements are needed to handle the following change requests of [a new entrant]: Billing Once a CDR has been rated it is applied to the customer’s account where discounts can be applied and a bill is created. Operators usually produce bills in cycles, spreading the load over a month or quarter to even out cash flow. The billing data is used to produce a bill image, whatever the format. Traditionally, the bill images that can be produced within a billing system are somewhat limited. Many operators therefore output the data to another system or an outsourced company for bill production. A billing system that takes care of bill imaging is useful since customer service staff handling billing enquiries are able to see the same information their customers see. Once the bill has been imaged, it is output for presentation to the customer. Traditionally this has been in paper format, with electronic formats only for the larger corporate customer. However, there is a move towards electronic invoicing for all types of customers. Nowadays, customers demand more flexibility in the bills presented to them. Some want a summary, some want more detail, some do not want a hard copy and some even want to change the aesthetic style of the bill presented to them… Billing is expensive; it is sometimes wasteful to bill a customer with very little - 10 - Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment money. Such bills are best retained until the next billing cycle. Billing systems need to be able to accommodate these requirements to assist the competitiveness of the firm. Debt Management Unfortunately, not all customers pay their bills on time and as a result the billing system must be able to identify those in arrears and take action based on business rules (dunning). Most systems have an adequate dunning process, but with the advent of GPRS and the possibility of m-commerce transactions being debited to traditional phone accounts the demands will be greater and so dunning systems may need to be upgraded. The challenge facing operators in the future will be to develop effective debt management programs for as new services are released. IDD Tariffs The advent of fierce competition in the IDD market has necessitated change to rapidly amend rating tables and rules related to IDD charges so a firm can keep up with its competition. Marketing promises mandate the billing system to incorporate effectiveness periods and expiry dates at parameter level; whole minute charging and partial minute charging in units of seconds; initial minutes/seconds charging; and identification of destination dialling and promotion code prefixes using 12+ digits. [One new entrant] even needed to link to a bottom-price table so it could match the lowest prices of competitors at any time of the day. Product packaging and pricing Packaging and bundling services together are a compelling marketing tool, but adds an additional layer of complexity to billing processes that need to link different network elements, rating tables and rules together. Necessary improvements include: auto reversal to standard tariff upon service changes not conforming to standard package requirements and automatic switching from one plan to another based on service and spending patterns. - 11 - Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment 3.4. Analysis of billing-related customer information Throughout the evolution of the telecom industry, it is clear that many companies are aggressively moving, or have already moved from a business model based on a product strategy to one based on a customer strategy. This environment is characterized by customer relationships, product customization and profitability in response to pressures transforming the business landscape throughout the industry. Additional systems are needed by BOSSs to deliver best-of-breed business intelligence and management information to enable companies to accomplish the following: • understand the needs of their business (business intelligence) • manage actions based on those needs (business management) • run day-to-day operations effectively (business operations) The following illustrates how specific capabilities align to each of these areas. - 12 - Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment These capabilities enable companies to realize opportunities presented in a business landscape characterized by customer relationships, customised product delivery, and opportunity-driven profit. 3.4.1. Customer Relationship Management (CRM) Corporate resources must be efficiently allocated to customer care depending on a customer’s lifetime value. Those customers whose loyalty can be earned and whose lifetime value to the company is high will receive a major share of the attention compared with those whose lifetime value is low. Profits are optimised by nurturing valued customer relationships. Essential to this strategy is the ability to leverage evolving technologies to accomplish the following: • understand the customers’ needs and behaviours; • leverage this understanding to identify, develop, and deliver relevant products and services; • align CRM operations support and management in line with the above. With CRM operations support and management, the focus is on obtaining new customers, up-selling and cross-selling to existing customers. Contacts are transformed into qualified leads, which are tracked as prospects, then opportunities and ultimately customers. Prospects’ needs are matched against product portfolios and marketing literature is provided to facilitate understanding and sales closure. The same process is applicable to the sales of new or enhanced services and products to existing customers. [One new entrant quickly] recognized the importance of the above, and working with an IT-based CRM vendor with prior implementation experience with a competitive telco in the Asia region, successfully deployed the system. The core of the application system is a process and activity rules-based workflow engine with escalation management capability; supported by a graphical script builder for structuring - 13 - Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment customer interactions, and with problem resolution and product portfolio definition knowledge-based capability. (Marketing Campaign Support) (Inbound Scripts Engine with Graphical User Interface) - 14 - Billing in the Competitive Arena » Service launches in the Competitive Wireline Environment The Lead and Campaign management, hotline support and marketing literature fulfilment, and Verbal Order and Customer service requests were first implemented, followed by Sales Opportunities and Activities management as well as Faults/complaints/dispute management. These systems enjoyed great popularity because of its user-friendly graphical user interface and quick time-to-market. As a result, many other workflow-based applications were subsequently implemented using the CRM core technology-based application. 3.4.2. Data Warehousing As telecom markets become increasingly competitive, the ability to react quickly to market trends and to tailor products and services to individual customers is more critical than ever. A data warehouse is a very effective means of organizing and analyzing the complex barrage of information generated in one’s business and generating a more effective business model for keeping one’s customer base happy and profitable. The following illustrates how the data warehouse, as an enabling technology, delivers business intelligence capabilities to support business functions in the telecom industry. - 15 - Billing in the Competitive Arena » Six years into the competition; assessing options of an enhanced billing platform Data may be viewed and analyzed from the warehouse in a number of ways. One very common retrieval paradigm involves the use of an on-line analytical processing (OLAP) engine. OLAP products can offer a range of advanced analysis capabilities, such as Top N, data pivoting for multidimensional analysis, statistical functions, the ability to drill from high-level data to successive levels of detail for iterative analysis, etc. Data warehouses are used to support sophisticated operational analysis functions such as customer scoring systems and fraud detection. All these facilities may be used in concert with a separate process known as data mining. Data mining is the practice of polling data for interesting elements or anomalies without actually having to pose specific questions or queries. 4. Six years into the competition; assessing options of an enhanced billing platform As a new entrant gains market share, both its network capacity and IT operations support systems require upgrades to support the increasing number of subscribers, complex marketing schemes and new products. Towards year 2000, alternative suppliers of network and communication equipment emerged to compete with traditional suppliers from North America or Europe such as Cisco. Huawei and Chung Hing, both from the People’s Republic of China, were the two most promising vendors at that time. Being relatively new to the telecom world, they were not at the cutting edge of technology but their prices were irresistible to those needing to handle burgeoning network growth. It is not surprising to see much of the hardware purchased by new entrants sporting an alternative supplier’s label. While some problems were encountered in the initial implementation, they were quickly resolved and network quality is quickly stabilized. While hardware can be purchased at low prices, the same cannot be said of application software development costs. [One new entrant] paid out an estimated HK$10M for its Y2K patch. Further, its billing software enhancements had to be - 16 - Billing in the Competitive Arena » Six years into the competition; assessing options of an enhanced billing platform continually made because the ultra-competitive environment in Hong Kong demanded ever more capabilities from the system. To contain CAPEX costs, customer care manpower is sometimes used to handle some of the semi-automated approaches; but end-users have not been satisfied with the result. Last but not least, a licence would normally include support for a fixed number of lines but a substantial fee would be required for another number beyond that. Software costs are major issues and require top management attention. The problem is how to justify them. One new entrant identified three fundamental points: • Local application enhancements, though always needed to address the fast changing and fiercely competitive telecom market, must be justified and supported by a feasible business case; • Lines-installed based licensing and major release upgrades are common practices for the solution-vendor package business model and so is a necessary evil; • World-class solution vendors come at a price, exceptions are uncommon. Based on projected software operating costs (major release upgrades plus annual maintenance) over 3 years, the MIS department of one new entrant proffered an alternative approach. The department suggested sourcing a solution vendor with a proven billing application solution delivery capability, but with 50% costs in annual maintenance) to build a more flexible billing system to cope with the market-driven competitive environment. In essence, together will low cost, the new entrant needed an SI partner with a functional billing system, the ‘right’ telco billing experience as well as a ‘willingness’ to facilitate in-house maintenance support capability building. This was then followed through and subsequently implemented. - 17 - Billing in the Competitive Arena » Billing in the New Millennium 5. Billing in the New Millennium 5.1. Next Generation Networks The telecommunications industry in Hong Kong is undergoing a series of significant changes: fixed voice is being replaced by mobile voice; non-communication based operators are superseding communication operators; ICT is taking over from traditional information integration and communication services; and value-added services are taking the place of price services. Almost all of Hong Kong’s world’s top operators are proposing transformation strategies that exhibit a directional shift away from traditional telecommunication services towards integrated services. The ‘Next Generation Network’ (NGN) is a broad term to describe some key architectural evolutions in telecommunication core and access networks that will be deployed over the next 5-10 years. The general idea behind NGN is to have one network platform transport all information and services (voice, data, and all sorts of media such as video) by encapsulating these into packets, like how it is on the Internet. NGNs are commonly built around the Internet Protocol, and therefore the term "all-IP" is also sometimes used to describe the transformation towards NGN. - 18 - Billing in the Competitive Arena » Billing in the New Millennium 5.2. Implications for BOSS The plethora of new services such as VoIP, IPTV, broadband and mobile data have brought about greater complexity with new multi-service offers and ever-increasing competition. Business systems tomorrow must be highly reactive and inherently flexible with service and marketing innovation as key priorities. In particular, sophisticated pricing capabilities are becoming increasingly important with a requirement for greater flexibility in the face of cross product mixes, multiple payment mechanisms and more granular and targeted customer segmentation. Next-generation billing products must be far more flexible and enable companies to price data services according to new parameters. IP-based services carry data in packets rather than across a circuit that is held open for a measurable duration. It is preferable, therefore, to charge customers for each packet of information they download, rather than for every minute they are connected to the network. Other pricing parameters, based on factors such as time of day, services used, quality of service levels and subscriber class, can complicate matters still further and need to be taken into account. In addition, consumers may demand different payment options for different services. When a wireless customer signs up for a new data service, for example, they may be wary of prices associated with using the new service and thus prefer a pre-paid payment plan. They may, however, prefer a traditional post-paid plan for their voice calls. Operators that are able to offer flexible payment options will improve subscriber retention in a highly competitive market. In a traditional voice model, only two constituents are usually involved. With data services, the billing process needs to be re-engineered to reflect the fact that a ‘revenue web’ of both service delivery and content providers is involved in the - 19 - Billing in the Competitive Arena » Billing in the New Millennium provision of a specific service, whether they are based on commissions, sponsorship or interconnect settlements. 5.2.1. Specific Enhancements Required for BOSSs Traditional billing systems are not equipped to cope with the complexity of IP networks and services. While operators cope with these changes, many still rely on existing legacy billing systems to support NGN services. This has resulted in: • The costly, complicated and lengthy process of trying to adapt the existing billing system to do the job; • Delays in the introduction of new services; • Revenue leakage and liability risks due to inaccurate charging; • System instability due to an unsuitable system architecture. As changes become more profound, a substantial investment in specialist IP billing technology is inevitable for most communications service providers (Giga Group research). Following are but two (of many hundreds) significant BOSS requirements in the NGN era: One, Personalised Bill In the new era, customers will no longer accept several bills for different services from a service provider. Instead, ‘convergent bills’ will become commonplace with a single bill listing all products with various business rules applied. Converging telecommunications billing into a single system such that rating and charging is organized around the subscriber rather than the network eliminates vertical rating engines that fragment a subscriber’s record around different networks. A converged system can also allow operators to manage all its products and services with centralized real-time capabilities. Such a system evolves charging from hot billing to event-based rating capable of processing against various appropriate measures, e.g. streamed music purchases could be billed per transaction and a video-conferencing session can be billed by duration. - 20 - Billing in the Competitive Arena » Conclusion Flexi-billing One improvement would be a system that converges all provisioning, transaction, charging, rating and billing for supported services (voice, data, SMS, mCommerce) into a single application in the most comprehensive fashion and most importantly, in real-time. Real time billing is essential from a competitive perspective because subscribers have been found to be 73% more willing to pay more for pay-as-you-go convenience versus annual contracts (Redknee). 6. Conclusion Throughout the evolving competitive landscape of Hong Kong’s telecommunications market, telco billing systems have been pressured to change with the times to accommodate more sophisticated products, services and marketing promises. The changes have been traditionally brought forth by competition as telcos vie for a relatively static market in a densely populated economy. So far, Hong Kong has led the way for adopting and enhancing world-class billing and customer care systems that can support high growth and dynamic firms in a fiercely competitive market. Being technological in nature, the emergence of next generation networks provides yet another novel pressure on billing and operational support systems. Telecommunications service providers now have to weave their products into a single billing platform in order to compete in terms of convenience, flexibility and cost. Telcos have a number of options for creating the billing systems they need to tackle the NGN future requirements: upgrade, rip and replace, integrate, or turn to an application service provider or business process outsourcer. Each option has its advantages and disadvantages and decisions must be based on individual customer’s specific business requirements, existing systems, available budget and timescales. - 21 - Billing in the Competitive Arena » Conclusion Some big vendors of NGN-BOSSs including: Amdocs, CBIS (Cincinnati Bell Information Systems), IBM, Oracle… and new entrants including: Redknee, Highdeal and Huawei… will benefit from the extended requirements of NGN-BOSSs, but the ultimate benefactor will be the consumer, who will be able to enjoy the richness and diversity of a continuously widening array of voice, data and multimedia applications and services, delivered seamlessly, irrespective of access technology or platform, and a newfound convenience of flexible and personalised billing services. __________ - 22 - Billing in the Competitive Arena » References 7. References 1. 資訊 路 上的 契機 (Opportunities on the Path of Telecommunications) Anthony S.K. Wong, former Director-General of Telecommunications http://www.ofta.gov.hk/zh/dg_article/chi_dg_article_0313.htm – accessed April 2007 2. Telecommunications in Hong Kong Dr John Ure, Director of the Telecommunications Research Project Hong Kong University Press, May 1995 http://www.trp.hku.hk/papers/1995/TELEINT.DOC – accessed February 2007 3. The Groundbreaking Decade, Major developments in the Hong Kong telecom industry in the past 10 years Anthony S.K. Wong, former Director-General of Telecommunications and General Manager, OFTA Trading Fund www.ofta.gov.hk/en/trade-fund-report/0203/html/eng/03.htm – accessed May 2007 4. Update on the HK Telecommunications Market Presentation by Anthony S.K. Wong, former Director-General at IIC Telecommunications Forum 20 April 1998 http://www.ofta.gov.hk/en/speech-presentation/main.html – accessed April 2007 5. Pricing for Profits Roger Steele & Karl Wermig, Telecom World 03 Online News http://itudaily.com/home.asp?articleid=3103091 – accessed March 2007 6. The NGN Age has arrived Gao Xianrui & Zhou Yanqing, Huawei http://www.huawei.com/publications/view.do?id=325&cid=121&pid=61 – accessed March 2007 7. NGN of HK Broadband Network A CISCO Case Study http://www.cisco.com/application/pdf/en/us/guest/products/ps5320/c1042/c dccont_0900aecd801e6acc.pdf – accessed April 2007 8. Pricing, billing and interconnection in an NGN environment Dr Tim Kelly Head, Strategy and Policy Unit, International Telecommunication Union LIRNEasia, Executive Course on Telecom Regulation, Singapore 9. Redknee’s converged Rating and Charging Billing Solution http://www.redknee.com//solutions/monetization/converged_charging/ – accessed March 2007 - 23 - Billing in the Competitive Arena » References 10. OSS Essentials K. Terplan, 2001 Wiley Computer Publishing 11. The Essential Guide to Telecommunications A. Z. Dodd, 2002, 3rd ed. Prentice Hall 12. Telecom Management Crash Course P.J. Louis, 2002 McGraw Hill - 24 -