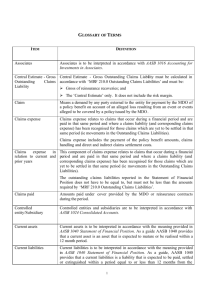

Instructions MRF 310.0 Statement of Financial Performance FINAL

advertisement

June 2007 Reporting Form MRF 310.0 Statement of Financial Performance Instruction Guide Introduction This form requires Medical Defence Organisations (MDOs) to report information about their operating income. Reporting Obligations MDOs are required to report on a half-yearly basis (that is, six monthly intervals), based on their financial year. For annual reporting, MDOs must lodge a form within four months of the end of their financial year. The information required on an annual basis must be reported as at the last day of the reporting period on a financial year-to-date basis of the MDO. For half-yearly reporting (that is, the half-year that does not correspond with the MDO’s financial year end), MDOs must lodge a form within 20 business days of the end of that six month period. Audit Requirements This form must be subject to audit review and testing on an annual basis or more frequently if necessary to enable the auditor to form an opinion on the accuracy and reliability of the data. The auditor must provide a certificate to the MDO specifying whether, in their opinion, the data provided by the MDO are reliable. The MDO must submit this certificate to APRA on an annual basis. The scope and nature of audit testing required is outlined in the applicable Auditing and Assurance Guidance Statement issued by the Auditing and Assurance Standards Board. Definitions Definitions for data reporting items required by this form have been provided where possible in the instructions under the section headed ‘Specific Instructions’. Basis of Preparation For the purpose of this form, MDOs are required to follow Australian Accounting Standards regarding the recognition and measurement of items of income and expense (profit or loss) with the exception of the following items: • Premium revenue • Commission revenue MRF 310.0 Instructions - 1 June 2007 • Subscription and membership income The interpretation and required measurement and recognition basis for these items are specified in these instructions below and under the appropriate item heading. (1). • Regulatory reporting items with different measurement basis to AASB 118 Revenue (AASB 118): Premium revenue Premium revenue is to be recognised fully upfront on a prospective basis. Any outstanding premium revenue not yet recognised should not be deferred and amortised. • Commission revenue Commission revenue is to be recognised fully upfront on a prospective basis. Any outstanding commission revenue not yet recognised should not be deferred and amortised. • Subscription and membership income Subscription and membership revenue is to be recognised fully upfront on a prospective basis. that is, recognised 100 percent at the date of payment to the MDO. Any subscription and membership revenue received in advance should not be accounted for as a liability. (2). The non-recognition of items for regulatory reporting purposes that are recognised under AASB 118 : • Subscription and membership received in advance. This item is not recognised for prudential reporting as the income is recognised fully from date of acceptance of subscription or membership. Unit of Measurement This form is to be prepared in thousands of Australian dollars (AUD). Amounts denominated in a currency other than Australian currency are to be converted to AUD in accordance with AASB 121 The Effects of Changes in Foreign Exchange Rates (AASB 121).. Assets Fair value of assets Assets other than land and building and other assets that are not normally relied on to meet outstanding claims liabilities or not generally of significance in assessing the performance of a MDO should be reported at fair value. Fair value has the same meaning as defined in AASB 139 Financial Instruments: Recognition and Measurement (AASB 139). MRF 310.0 Instructions - 2 June 2007 Reinsurance Limited Risk Transfer Arrangements typically do not involve significant transfer of risk over the life of the arrangement between the MDO and the reinsurer. An arrangement may involve one contract, or a combination of two or more individual contracts and/or side letters. Such arrangements are often characterised by requirements placed on the MDO to mitigate any loss experienced by the reinsurer to this arrangement over a future period of time. While the main purpose of such arrangements is usually financing, Limited Risk Transfer Arrangements can be used to affect the presentation of financial results. This can lead to a misrepresentation of the true prudential position of the MDO. Where a reinsurance contract does not, despite its form, provide for the transfer of risk against loss or liability from the MDO to the reinsurer, it must not be accounted for as reinsurance, but as a form of financing. The premium paid by the ceding MDO must be recognised as an asset by the MDO and a liability by the reinsurer. Liabilities Outstanding claims liabilities (OCL) are to be reported in accordance with MRF 210.0 Outstanding Claims Liabilities (MRF 210.0). All other liabilities are to be reported in accordance with applicable Australian Accounting Standards. Netting Unless otherwise specifically stated, MDOs can take advantage of netting agreements in relation to disclosure of data items in this form. MDOs are to comply with the prerequisite for netting outlined in Australian accounting standards notably AASB 7 Financial Instruments: Disclosures (AASB 7), AASB 139 and AASB 132 Financial Instruments: Presentation (AASB 132).. Term to Maturity Reference to term to maturity refers to residual term to maturity not original term to maturity. Related party/entity Related parties/entities are to be interpreted in accordance with AASB 124 Related Party Disclosures (AASB 124). MRF 310.0 Instructions - 3 June 2007 Specific Instructions 1. Premium revenue Premium revenue is to be recognised in line with the following: • Revenue is to be recognised fully upfront as soon as the amount can be reliably measured. • Revenue excludes cash flows from future contracts and investment returns from current or future investments. • Revenue excludes amounts collected on behalf of third parties i.e. government stamp duty and taxes. • Refunds and rebates are to be deducted from revenue. 2. Outwards reinsurance expense Reinsurance expense is to be discounted using similar discount rates as are required in measuring OCL in accordance with MRF 210.0. Reinsurance expense is relating to prior years. 3. Net Premium revenue 4. Gross claims expense The claims expense is to be reported in relation to business written and assumed by the MDO. This reflects the claims expense relating to claims that occur and are paid in the same financial period and and also movements in the OCL). NOTE: Claims expense that relates to movements in the OCL is to be based on the OCL that is reported in MRF 300.0 Statement of Financial Position (MRF 300.0). The OCL reported in MRF 300.0 does not have to be equal to, but must not be less than the OCL reported in MRF 210.0. 4.1 Gross claims expense which is due to changes in valuation assumptions/ model (not included in underwriting result) Disclose in this field that component of gross claims expense which is due to changes in modelling assumptions applied to the OCL. This is not added into the calculation of net incurred claims. MRF 310.0 Instructions - 4 June 2007 5. Reinsurance recoveries revenue Reinsurance recoveries revenue for the reporting period is to be reported in relation to prior years. This will reflect recoveries received or receivable that are associated with claims expense recognised for business written and assumed by the MDO. Include amounts that the MDO has recovered or is entitled to recover from reinsurers on claim expense during the reporting period. Some estimates previously made in the context of reinsurance recoverables will have been revised in the course of the year’s business. Such adjustments are to be reflected in the next reporting period as appropriate. 6. Other recoveries revenue This is the revenue from claims recoveries other than reinsurance recoveries, in respect of claims. Where appropriate it is to be reported after deducting the reinsurer’s share of the ‘other recoveries revenue’. Also include any recoveries revenue due from Government under schemes and arrangements established in relation to medical indemnity matters where relevant. 7. Total Recoveries 8. Net incurred claims This represents the difference between “Gross claims expense” and “Total recoveries”. 9. Levies and charges Report all levies and charges. 10. Commission revenue Report all commission revenue. 11. Total Underwriting Expenses 12. Underwriting Result 13. Subscription and membership income Report all income received from members in relation to subscription and membership fees. 14. Investment income Report total investment income (this will equal the totals disclosed in MRF 310.3 Investment and Operating Income and Expense (MRF 310.3)). MRF 310.0 Instructions - 5 June 2007 15. Other operating income Report income earned, which does not ordinarily come within the specific terms used above. The total will agree to the totals disclosed in MRF 310.3. 16. Other operating expenses Report the operating expenses of the business in accordance with applicable accounting standards. The total will agree to the totals disclosed in MRF 310.3. 17. Profit or loss from continuing activities before income tax expense (benefit) Derived from: • Revenue Less: • Expenses 18. Income tax expense (or benefit) Represents the income tax expense or benefit. This item must be completed in accordance with the requirements of AASB 112 Income Taxes (AASB 112). 19. Profit or loss from continuing activities after income tax Derived from: • Profit or loss from continuing activities before income tax expense (benefit) Less: • Income tax expense (or benefit) 20. Profit (loss) from discontinued operations after income tax Profit (loss) after income tax from discontinued operations is to be classified and recorded in accordance with the Australian accounting standards. 21. Net profit or loss after tax attributable to members of the MDO Derived from: • Profit or loss from continuing activities after income tax Plus • Profit or loss from discontinued activities after income tax. MRF 310.0 Instructions - 6 June 2007 22. Retained profits (losses) at beginning of the financial year Report here the relevant retained profit (loss) amount from the previous financial year concerned. Use the retained profits figure per the statutory accounts prepared in accordance with Australian accounting standards. 23. Adjustments to retained profits due to change in accounting policies/standards Include the value of aggregate adjustments to retained earnings due to changes in accounting treatment required by an accounting standard. Any IFRS related adjustments on first time adoption can be reported here. 24. Amounts transferred from reserves Disclose the amount of funds transferred from other reserves to retained earnings during the reporting period. 25. Total available for appropriations This is derived from: • Net profit or loss after income tax attributable to members of the MDO Plus: • Retained profits (or losses) at beginning of financial year Plus / less: • Adjustments to retained profits due to change in accounting policies/ standards Plus: • Amounts transferred from reserves 26. Other distributions of the MDO Include any distributions paid back to the members of the company or other distributions not reported elsewhere. 27. Aggregate amounts transferred to reserves Disclose appropriations to reserves from retained earnings. MRF 310.0 Instructions - 7 June 2007 28. Retained profits or accumulated losses at end of reporting period This is derived from: Total available for appropriations Less: • Other distributions, and • Aggregate amounts transferred to reserves. MRF 310.0 Instructions - 8