(November 1994) - Law Reform Commission of Western

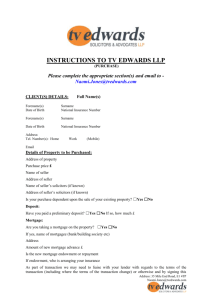

advertisement