SIC Code List

advertisement

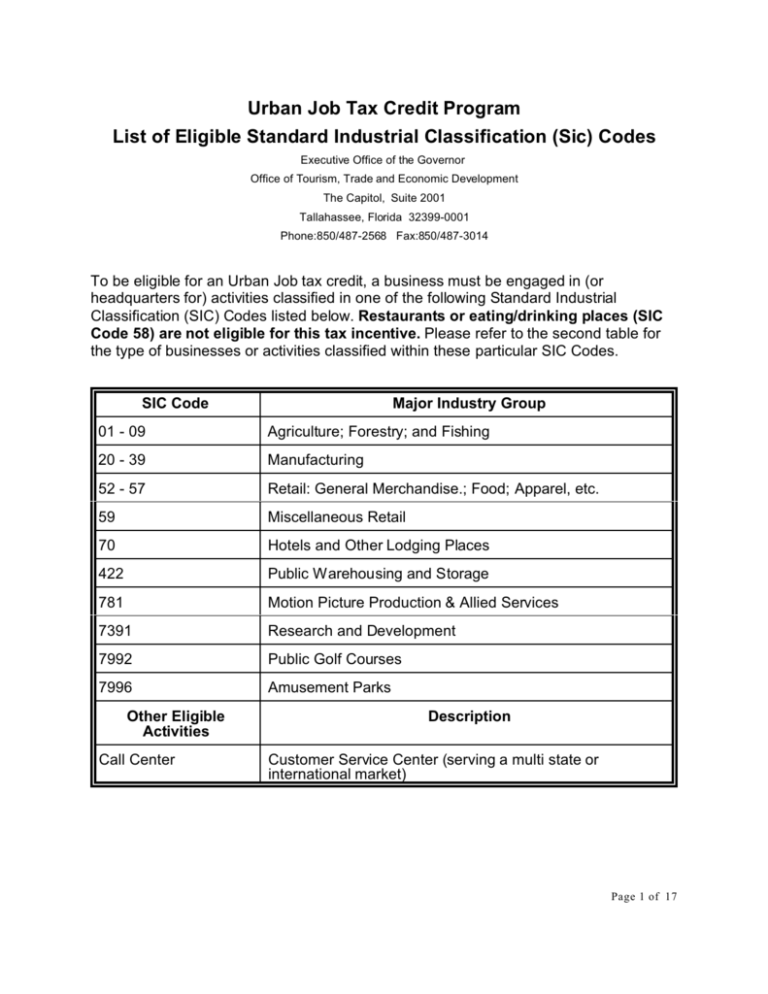

Urban Job Tax Credit Program List of Eligible Standard Industrial Classification (Sic) Codes Executive Office of the Governor Office of Tourism, Trade and Economic Development The Capitol, Suite 2001 Tallahassee, Florida 32399-0001 Phone:850/487-2568 Fax:850/487-3014 To be eligible for an Urban Job tax credit, a business must be engaged in (or headquarters for) activities classified in one of the following Standard Industrial Classification (SIC) Codes listed below. Restaurants or eating/drinking places (SIC Code 58) are not eligible for this tax incentive. Please refer to the second table for the type of businesses or activities classified within these particular SIC Codes. SIC Code Major Industry Group 01 - 09 Agriculture; Forestry; and Fishing 20 - 39 Manufacturing 52 - 57 Retail: General Merchandise.; Food; Apparel, etc. 59 Miscellaneous Retail 70 Hotels and Other Lodging Places 422 Public Warehousing and Storage 781 Motion Picture Production & Allied Services 7391 Research and Development 7992 Public Golf Courses 7996 Amusement Parks Other Eligible Activities Call Center Description Customer Service Center (serving a multi state or international market) Page 1 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 01 - Agricultural Production Crops Cash Grains 0214 W heat 0219 Rice 024 Corn 0241 Soybeans 025 Cash grains, nec 0251 Field Crops, Except Cash Grains 0252 Cotton 0253 Tobacco 0254 Sugarc ane and sug ar be ets 0259 Irish potatoes 027 Field crops, except cash grains, not 0271 elsewhere classified Vegetables and Melons 0272 Vegetables and melons 0279 Fruits and Tree N uts 029 Berry crops 0291 011 0111 0112 0115 0116 0119 013 0131 0132 0133 0134 0139 016 0161 017 0171 0172 0173 0174 0175 0179 018 0181 0182 019 0191 0211 0212 0273 Hogs Sheep and goa ts General livestock, nec D airy Farm s Dairy farms Poultry and Eggs Broiler, fryer, and roaster chickens Chicken eggs Turkeys and turkey eggs Poultry hatcheries Poultry and eggs, nec Animal Specialties Fur-bearing anim als an d rab bits Horses and other equines Anim al aquaculture Animal specialties, nec General Farms, Primarily Animal General farms, primarily animal Grapes Tree n uts Citrus fruits De ciduous tree fruits Fruits and tree nuts, not elsewhere classified Horticultural Specialties Ornam enta l nursery pro duc ts Food crops grown under cover General Farms, Primarily Crop General farms, primarily crop 07 - Agricultural Services 071 0711 072 0721 0722 0723 0724 074 0741 02 - Agricultural Production Livestock 021 0213 Live stoc k, Exc ept D airy and Pou ltry Beef ca ttle feed lots Beef ca ttle, exc ept fe edlots 0742 075 0751 0752 Soil Preparation Services Soil preparation services Crop Services Crop planting and protecting Crop harvesting Crop preparation services for market Cotton ginning Veterinary Services Veterinary services for livestock Veterinary services, specialties Anim al Serv ices, Ex cep t Veterinary Livestock se rvices, except veterinary Animal specialty services Page 2 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor Farm Labor and Management 076 Services Farm labor contractors 0761 Farm m anagement services 0762 Landscape and Ho rticultural Services 078 Landscape counseling and planning 0781 Lawn and garden services 0782 Ornam ental shrub and tree services 0783 08 - Fo restry Tim ber Tra cts 081 Tim ber tra cts 0811 Fores t Produ cts 083 Forest prod ucts 0831 Forestry Services 085 Forestry services 0851 09 - Fishing, Hunting, and Trapping 091 0912 0913 0919 092 0921 Commercial Fishing Finfish Shellfish Miscellan eou s m arine prod ucts Fish Hatcheries and Preserves Fish hatcheries and preserves Hu ntin g, T ra pp in g, Gam e 097 Propagation Hunting, trapping, game propagation 0971 2021 2022 2023 2024 2026 203 2032 2033 2034 2035 2037 2038 204 2041 2043 2044 2045 2046 2047 2048 205 2051 2052 2053 206 2061 20 - Foo d and Kindred Produ cts 201 2011 2013 2015 202 2062 M eat Prod ucts 2063 Me at packing plants 2064 Sausa ges and other prepare d m eats 2066 Poultry slaughtering and processing 2067 Dairy Prod ucts 2068 207 Creamery butter Cheese, natural and processed Dry, cond ens ed, evaporate d pro duc ts Ice c ream and frozen de sse rts Flu id m ilk Preserved Fruits and Vegetables Canned specialties Canned fruits and vegetables Dehydrated fruits, vegetables, soups Pickles, sauces, and salad dressings Frozen fruits and vegetables Frozen spe cialties, not elsewhere classified Grain M ill Produ cts Flou r and other grain m ill produc ts Cereal breakfast foods Rice milling Prepared flour mixes and dough W et corn milling Dog and cat food Prepared feeds, not elsewhere classified Bake ry Produ cts Bread, cake, and related produ cts Cook ies and crack ers Frozen bakery products, except bread Sug ar and C onfec tionery Prod ucts Raw cane sugar Cane sugar refining Beet sugar Ca ndy & other con fectionery products Ch oco late an d co coa prod ucts Chewing gum Salted and roasted nuts and seeds Fats an d O ils Page 3 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 2074 2075 2076 2077 2079 208 2082 2083 2084 2085 2086 2087 209 2091 2092 2095 2096 2097 2098 2099 Cotto nseed oil m ills Vegetable oil mills, not elsewhe re classified An im al and m arine fats and oils 212 2121 213 2131 214 2141 2211 222 2221 classified Beverages 223 Malt beverages Malt W ines, bran dy, and bran dy spirits Distilled and blended liquors Bottled and canned soft drinks Flavoring extracts and syrups, not elsewhere classified M isc. Food and K indred P rodu cts Canned and cured fish and seafoods Fresh or frozen prepared fish Roasted coffee Potato chips and similar snacks Manufactured ice Ma caroni an d sp agh etti Food p reparations, not elsewhere 21 - To bacco Produ cts 2111 221 Edible fats and oils, not elsewhe re classified 211 22 - Tex tile Mill Produc ts So ybean oil m ills 2231 224 2241 225 2251 2252 2253 2254 2257 2258 2259 226 2261 2262 2269 227 2273 Cigarettes 228 Cigarettes 2281 Cigars 2282 Cigars 2284 Chew ing and Smoking To bacco 229 Chewing and smoking tobacco 2295 Tobacco Stemming and Redrying 2296 Tobacco stemm ing and redrying 2297 2298 Broadwoven Fabric Mills, Cotton Broadwoven fabric mills, cotton Broadwoven Fabric Mills, Manmade Broadwoven fabric mills, manm ade Broadwoven Fabric Mills, Wool Broadwoven fabric mills, wool Na rrow Fab ric M ills Narrow fabric m ills Kn itting M ills W omen's hosiery, except socks Hosiery, not elsewhere classified Kn it outerwe ar m ills Kn it underwear m ills W eft knit fabric m ills Lace & w arp k nit fabric m ills Knitting mills, not elsewhere classified Textile Finishing, Except Wool Finishing plants, cotton Finishing plants, manm ade Finishing plants, not elsewhe re classified Carpets and Rugs Carpets and rugs Ya rn and Th read M ills Yarn spinning m ills Throw ing and winding m ills Thread m ills Miscellaneous Textile Goods Coated fabrics, not rubberized Tire cord and fabrics Nonwoven fabrics Cordage and twine Page 4 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 2299 Textile goods, not elsewhere classified 2385 2386 23 - Apparel an d O ther Te xtile Produc ts 231 2311 232 2321 2322 2323 2325 2326 2329 233 2331 2335 2337 2339 M en's and Boys ' Suits and Coa ts 2387 2389 Me n's and b oys' su its and coa ts Men's and Boys' Furnishings 239 Me n's and b oys' sh irts 2391 Men's & boys' underwear and nightwear 2392 Men's and boys' neckwear Men's and boys' trousers and slacks Men's and boys' work clothing Men 's and boys' clothing, not elsewhe re classified Wo men's and M isses' Outerwear W om en's & m isses' blouses & shirts 2393 2394 2395 2396 2397 2399 Appare l belts Appare l and access ories, not elsewhere classified M isc. Fabricated Textile Prod ucts Curtains and draperies Hous e furnishings, not elsewhere classified Textile bags Ca nvas an d related produ cts Pleating and stitching Automotive and apparel trimm ings Schiffli machine embroideries Fabricated textile products, not 24 - Lum ber and W ood Produ cts W om en's and m isses' outerwear, not 241 elsewhere classified W om en's an d C hildren's 2411 234 Und ergarm ents W omen's and children's underwear 2341 Bras, girdles, an d allied garm ents 2342 Hats, Caps, an d M illinery 235 Hats, caps , and m illinery 2353 Girls' and Children's Outerwear 236 Girls' & children's dresses, blouses 2361 Girls' and children's outerwear, not 2369 elsewhere classified Fur Goods 237 Fur goods 2371 Miscellaneous Apparel and 238 Accessories Fabric dress and work gloves 2381 Robes and dressing gowns 2384 Leather and sheep-lined clothing elsewhere classified W omen's, junior's, & misses' dresses W om en's and m isses' suits and coa ts W aterproof outerwear 242 2421 2426 2429 Logging Logging Saw mills and Planin g M ills Sawm ills and planing mills, general Hardw ood dim ension & floo ring m ills Special product saw m ills, not elsewhe re classified Millwork, Plywood & Structural 243 M em bers Millwork 2431 W ood kitchen c abinets 2434 Hardwood veneer and plywood 2435 Softwood veneer and plywood 2436 Structural wood mem bers, not 2439 elsewhere classified W ood C ontainers 244 Nailed and lock corner wood boxes and 2441 shook Page 5 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 2448 W ood pallets and skids W ood con tainers, not elsewhere 2449 classified Wo od Buildings and Mobile Homes 245 Mobile homes 2451 Prefabricated wood buildings 2452 M iscellaneou s W ood Produ cts 249 W ood preserving 2491 Re con stituted woo d pro duc ts 2493 W ood products, not elsewhere classified 2499 25 - Furniture and Fixtures 251 2511 2512 2514 2515 2517 2519 252 2521 2522 253 2531 254 2541 2542 259 2591 2599 2611 262 2621 263 2631 265 2652 2653 2655 2656 2657 Ho use hold Fu rniture 267 W ood hou sehold furniture 2671 Upho lstered househo ld furniture 2672 Metal hous ehold furniture Mattresses and bedsprings W ood TV and radio cab inets Hous ehold furniture, not elsewhere classified Office Furn iture W ood office furniture Office furniture, except wood 2673 2674 2675 2676 2677 2678 2679 Partitions and fixtures, except wood Miscellaneous Furniture and Fixtures Drapery hardware & blinds & shades Furniture and fixtures, not elsewhere classified 271 2711 272 2721 273 2731 2732 26 - Pap er and Allied Prod ucts 274 261 2741 Pu lp M ills Pa per m ills Paperbo ard M ills Pa perboard m ills Paperboard Containers and Boxes Setup paperboard boxes Corrugated and solid fiber boxes Fibe r can s, dru m s & s imilar prod ucts Sanitary food containers Folding paperboard boxes M isc. Con verted P aper Pro ducts Paper coated & laminated, packaging Paper coated and laminated, not elsewhere classified Bags: plastics, laminated, & coated Ba gs: uncoate d paper & m ulti w all Die-cut paper an d board Sanitary paper p rodu cts Envelopes Stationery produ cts Converted paper products, not 27 - Printing and Publishing Partitions and Fixtures W ood partitions and fixtures Paper M ills elsewhere classified Pub lic Building & Related F urniture Public building & related furniture Pu lp m ills New spa pers New spape rs Period icals Pe riodicals Books Book publishing Book printing Miscellaneous Publishing Miscellaneous publishing Page 6 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 275 2752 2754 2759 276 2761 277 2771 278 2782 2789 279 2791 2796 Commercial Printing 2842 Com m ercial prin ting , litho graphic 2843 Com m ercial printing, gravure 2844 Com mercial printing, nec 285 M anifo ld Bu sin es s F orm s 2851 Man ifold business form s 286 Greeting Cards 2861 Greeting cards 2865 Blank books and Bookbinding 2869 Blank bo oks a nd looseleaf binders Book binding and related work 287 Printing Trade Services 2873 Typesetting 2874 Plate mak ing services 2875 2879 28 - Ch em icals and allied pro ducts 281 2812 2813 2816 2819 282 2821 2822 2823 2824 283 2833 2834 2835 2836 284 2841 Ind ustrial Ino rganic C hemicals 289 Alkalies and chlorine 2891 Industrial gases 2892 Inorg anic pigm ents 2893 Industrial inorganic chemicals, not 2895 elsewhere classified Plastics Materials and Synthetics 2899 Plastics materials and resins Organic fib ers, n oncellulosic Drugs Medicinals and botanical Pharmaceutical preparations Diagnostic substances Bio logical pro ducts excluding diagnostic Soap, Cleaners, and Toilet Goods Surface ac tive agents Toilet preparations Paints an d Allied Produ cts Paints an d allied produ cts Industrial O rganic C hemicals Gum and wood chem icals Cyclic crudes and intermediates Industrial organic chemicals, not elsewhere classified Agricultu ral Chemicals Nitrogenous fertilizers Phosp hatic fertilizers Fe rtilizers, m ixing only Agricultural chem icals, not elsewhe re classified M iscellaneou s Ch em ical Produ cts Adhes ives a nd s ealants Explosives Printing ink Carbon black Chem ical preparations, not elsewhere classified 29 - Petroleu m a nd C oal Prod ucts Synthetic rubber Cellulosic man m ade fibers Polishes and sanitation goods 291 2911 295 2951 2952 299 2992 2999 Petroleum Refining Petroleum refining Asphalt Pav ing and Ro ofin g M aterials Asphalt paving mixtures and blocks Asphalt felts and coatings M isc. Petroleum and C oal Prod ucts Lubricating oils and greases Petroleum and coal products, not elsewhere classified Soap a nd o ther d eterg ents Page 7 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 30 - Rubber and M iscellaneous Plastics Produ cts 3149 301 Tires and Inner Tubes Tires and inner tubes 315 3011 302 3021 305 3052 3053 306 3061 3069 308 NEC 3081 3082 3083 3084 3085 3086 3087 3088 3089 Rubber and Plastics Footwear Rubber and plastics footwear Hose & Belting & Gaskets & Packing 3111 313 3131 314 3142 3143 3144 316 3161 Rubber & plastics hose & belting 317 Goods Gaskets, packing and sealing devices 3171 Fabricated Rubber Products, NEC 3172 Mechanical rubber goods Fabricated rubber products, not 319 elsewhere classified Miscellaneous Plastics Products, 3199 classified Leather Gloves and Mittens Leather gloves and mittens Luggage Luggage Handbags and Personal Leather W omen's handbags and purses Person al leather goods, not elsewhere classified Leather Goods, NEC Leather goods, not elsewhere classified 32 - Ston e, Clay and Glass P rodu cts Unsupported plastics film & sheet Unsupported plastics profile shapes Laminated plastics plate & sheet Plastics pipe Plastics bottles Plas tics foam prod ucts 321 3211 322 B lo w n 3221 3229 Custom com pound purchased resins Plastics plumbing fixtures 323 Plastics products, not elsewhe re 3231 classified 324 31 - Leath er and L eather Pro ducts 311 3151 Footwea r, except rubber, not elsewhe re Leather Tanning and Finishing Leather tanning and finishing Footwear Cut Stock Footwear cut stock Footwear, Except Rubber Hous e slippers Men's footwe ar, ex cept athle tic W om en's footwe ar, ex cept athle tic 3241 325 3251 3253 3255 3259 326 3261 3262 Flat Glass Flat glass Glass and Glassware, Pressed or Glass c ontainers Presse d and blown g lass, not elsewhere classified Products of Purchased Glass Products of purchased glass Ce ment, Hyd raulic Cem ent, hyd raulic Structural C lay Produ cts Brick and structu ral clay tile Ceram ic wall and floo r tile Clay refractories Structural clay products, not elsewhere classified Pottery an d Re lated Prod ucts Vitreous plumbing fixtures Vitreous china table & kitchenw are Page 8 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 3263 3264 3269 Sem ivitreous table & kitchenwa re Porcelain electrical supplies Pottery products, not elsewhere classified Concrete, Gypsum, and Plaster 327 Produ cts Concrete block and brick 3271 Conc rete products, not elsewhe re 3272 classified Re ady-m ixed con crete 3273 Lim e 3274 Gypsum prod ucts 3275 Cut S tone an d Ston e Prod ucts 328 Cu t stone an d stone p rodu cts 3281 M isc. Non me tallic Mineral Prod ucts 329 Abrasive pro duc ts 3291 Asbes tos produ cts 3292 Minerals, ground or treated 3295 Mineral wool 3296 Nonclay refractories 3297 Nonm etallic mineral products, not 3299 elsewhere classified 33 - Primary Metal Industries Blast Furnace and Basic Steel 331 Produ cts Bla st furnaces and ste el m ills 3312 Elec tro m etallurgical pro duc ts 3313 Stee l wire an d related produ cts 3315 Cold finishing of steel shapes 3316 Steel pipe and tubes 3317 Iron and Steel Foundries 332 Gray and ductile iron foundries 3321 Malleable iron foundries 3322 Steel investment foundries 3324 3325 333 3331 3334 3339 334 3341 335 3351 3353 3354 3355 3356 3357 336 3363 3364 3365 3366 3369 Steel foundries, not elsewhere classified Prim ary N on ferro us M etals Primary copper Primary aluminum Primary nonferrous metals, not elsewhere classified Second ary N on ferro us M etals Se condary nonferrous m eta ls Nonferrous Rolling and Drawing Copper rolling and drawing Alu m inum sheet, pla te, a nd foil Alum inum extru ded prod ucts Aluminum rolling and drawing, not elsewhere classified Nonferrous rolling and drawing, not elsewhere classified Nonferrous wiredrawing & insulating Nonferrous Foundries (Castings) Aluminum die-castings Nonferrous die-casting exc. aluminum Aluminum foundries Copper foundries Nonfe rrous foundries, not elsewhe re classified Miscellaneous Primary Metal 339 Produ cts Metal heat treating 3398 Prima ry metal products, not elsewhe re 3399 classified 34 - Fab ricated M etal Produ cts 341 3411 3412 342 M etal Cans and Ship ping Co ntain ers Metal cans Meta l barrels, drum s, a nd pails Cu tlery, Han d too ls, and Hard w are Page 9 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 3421 3423 3425 3429 343 Elec tric 3431 3432 3433 344 3441 3442 3443 3444 3446 3448 3449 345 3451 3452 346 3462 3463 3465 3466 Cutlery 3483 Hand and edge tools, not elsewhe re classified Saw blades and handsaws 3484 3489 Hardware, not elsewhere classified Plumbing and Heating, Except 349 3491 Metal sanitary ware 3492 Plu m bing fix ture fitting s and trim 3493 Heating equipm ent, ex cept electric 3494 Fabricated Structural M etal Produ cts Am munition, exc. for small arms, not elsewhere classified Sm all arms Ordnance and accessories, not elsewhere classified M isc. Fabricated M etal Produ cts Industrial valves Fluid power valves & hose fittings Steel springs, except wire Valves and p ipe fittings, not elsewhere classified W ire springs Fabricated structural metal 3495 Meta l doors, s ash, and trim 3496 Fabricated plate work (boiler shops) 3497 Sheet m etalwork 3498 Architectural me tal work 3499 Prefabricated metal buildings elsewhere classified 35 - Industrial Machinery and Equipment Miscellaneous m etal work Screw M achine Products, Bolts, Etc. Screw m ach ine produ cts 351 3511 3519 Bolts, nuts, rivets, and wash ers Metal Forgings and Stampings 352 Iron and steel forgings 3523 Nonferrous forgings 3524 Automotive stampings 353 Crowns and closures 3531 Metal stam pings, not elsewhere 3469 classified M etal Se rvices , Not E lsesh ere 347 Classified Plating and polishing 3471 Metal coating and allied services 3479 Ordnance and Accessories, Not 348 Elseshere Classified Sm all arms am munition 3482 3532 3533 3534 3535 3536 3537 354 3541 Misc. fab ricated wire prod ucts Metal foil and leaf Fabricated pipe and fittings Fabricated metal products, not Engines and Turbines Tu rbines an d turb ine ge nera tor se ts Internal combustion engines, not elsewhere classified Farm and Ga rden M ach inery Farm m achinery and equipment Lawn and garden equipment Co nstru ction and Related M ach inery Cons truction mac hinery Mining m achinery Oil and gas field m achinery Ele vators and m oving sta irways Conveyors and conveying equipment Hoists, cranes, and m onorails Industrial trucks and tractors M etalw orkin g M ach inery Machine tools, metal cutting types Page 10 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 3542 3543 3544 3545 3546 3547 3548 3549 355 3552 3553 3554 3555 3556 3559 356 3561 3562 3563 3564 3565 3566 3567 3568 3569 357 3571 3572 3575 3577 Calculating and accounting equipment Machine tools, metal forming types 3578 Industrial patterns Office m achines, not elsewhe re 3579 classified Refrigeratio n an d Se rvice M ach inery 358 Automatic vending machines 3581 Com mercial laundry equipment 3582 Refrigeration and heating equipment 3585 Measuring and dispensing pumps 3586 Service industry machinery, not 3589 elsewhere classified Industrial Machinery, NEC 359 Carburetors, pistons, rings, valves 3592 Fluid power cylinders & actuators 3593 Fluid power pum ps and m otors 3594 Scales an d balances , exc. laboratory 3596 Industrial machinery, not elsewhere 3599 classified Special dies, tools, jigs & fixtures Machine tool accessories Po we r-drive n hand tools Rolling mill machinery W elding apparatus Metalwork ing ma chinery, not elsewhe re classified Spe cial Indu stry M ach inery Tex tile m achinery W oodwo rking m achinery Paper indus tries mac hinery Printing trades m achinery Food p roducts m achinery Special industry machinery, not elsewhere classified Ge nera l Industrial M ach inery 36 - Electronic And Other Electrical Equipment And Components, Except Computer Equipment Air and gas co m pressors 361 Blowers and fans 3612 Electric Distribution Equipment Transform ers, e xcept electronic Pack aging m achinery 3613 Speed change rs, drives, and gears 362 Industrial furnaces and ovens 3621 Power transmission equipment, not 3624 elsewhere classified General industrial machinery, not 3625 Pum ps and pumping equipment Ball and roller bearings 3629 elsewhere classified Computer and Office Equipment 363 Electronic com puters 3631 Com puter storage devices 3632 Com puter term inals 3633 Com puter peripheral equipment, not 3634 elsewhere classified 3635 Switchgear and switchboard apparatus Electrical Industrial Apparatus Motors a nd gene rators Ca rbon and grap hite pro duc ts Relays and industrial controls Electrical industrial apparatus, not elsewhere classified Household Appliances Household cooking equipment Hous ehold refrigerators and freezers Household laundry equipment Electric housewares and fans Hous ehold vacuum cleaners Page 11 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 3639 364 3641 3643 3644 3645 3646 3647 3648 365 3651 3652 366 3661 3663 3669 Hous ehold appliances, not elsewhe re 3699 elsewhere classified classified Electric Lighting and Wiring Equipment Electric lamps 37 - Transportation Equipment Current-carrying wiring devices 371 Noncurrent-carrying wiring devices 3711 Residential lighting fixtures 3713 Com mercial lighting fixtures 3714 Vehicular lighting equipment 3715 Lighting equipme nt, not elsewhere 3716 classified Household Audio and Video Equipment 372 Household audio and video equipment 3724 Prerecorded records and tapes 3728 3721 Communications Equipment Telephone and telegraph apparatus 373 Radio & TV comm unications equipment 3731 Com munications equipment, not 3732 elsewhere classified Electronic Components and 374 367 Accessories Electron tubes 3671 Printed circuit boards 3672 Sem iconductors and related devices 3674 Electronic capacitors 3675 Electronic resistors 3676 Electronic coils and transform ers 3677 Electronic connec tors 3678 Electronic com ponents, not elsewh ere 3679 classified Misc. Electrical Equipment & Supplies 369 Storage batteries 3691 Primary batteries, dry and wet 3692 Engine electrical equipment 3694 Magnetic and optica l rec ording m edia 3695 Electrical equipment & supplies, not 3743 375 3751 376 3761 3764 3769 Motor Vehicles and Equipment Motor vehicles and car bodies Truck and bus bodies Motor vehicle parts and accessories Truck trailers Motor homes Aircraft and Parts Aircraft Aircraft en gines an d en gine parts Aircraft parts and equipment, not elsewhere classified Ship and Boat Building and Repairing Ship building and repairing Boat building and repairing Railroad Equipment Railroad equipment M otorcycles, B icycles, and Pa rts Mo torcycles, bicycles, and p arts Gu ided M issiles, Space Ve hicles, Parts Guided missiles and space vehicles Space prop ulsion units a nd p arts Space vehicle equipm ent, not elsewhere classified Miscellaneous Transportation 379 Equipment Travel trailers and cam pers 3792 Ta nks an d tank com pon ents 3795 Trans portation equipm ent, not elsewhere 3799 classified Page 12 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 38 - Instrum ents an d Re lated Prod ucts 381 3812 382 3821 3822 3823 3824 3825 3826 3827 3829 384 3841 3842 3843 3844 3845 385 3851 386 3861 387 3873 Search and Navigation Equipment Search and navigation equipment Measuring and Con trolling Devices Laboratory apparatus a nd furniture En viro nm ental controls Proces s co ntrol instrum ents Fluid meters and counting devices Instru m ents to m eas ure e lectricity Analytical instru m ents Optical instruments and lenses Measuring & controlling devices, not elsewhere classified Med ical Instruments and Sup plies Surgical and m edical instrum ents Surgical appliances and supplies Dental equipment and supplies X-ray apparatus and tubes Electro medical equipment Ophthalmic Goods Ophthalmic goods Photographic Equipment and Supplies Photographic equipment and supplies W atches , Clocks, W atch cas es & P arts W atch es, c lock s, wa tch c ase s & p arts 39 - Miscellaneous M anufacturing Industries 391 3911 3914 3915 393 3931 394 3942 Jew elry, Silverw are, an d Plated W are Jewelry, precious metal Silverware and plated ware Jewelers' m aterials & lapidary work M usical Instrum ents Mu sical instrum ents Toys and Sporting Goods Dolls and stuffed toys Page 13 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 3944 3949 395 3951 3952 3953 3955 396 3961 3965 399 3991 3993 3995 3996 3999 Gam es, toys, and children's vehicles Sporting and athletic goods, not elsewhe re classified Pens, Pencils, Office, & Art Supplies Pe ns and m echanical pencils Lead pencils and art goods Marking devices Carbon paper and inked ribbons 525 5251 526 5261 527 5271 Fasteners, buttons, needles, & pins Miscellaneous Manufactures Brooms and brushes Signs and advertising specialities Burial cas kets Hardware stores Retail Nurseries and Garden Stores Retail nurseries and garden stores M obile Home De alers Mob ile hom e dealers 53 - General Merchandise Stores Costume Jewelry and Notions Costum e jewelry Hardware Stores 531 5311 533 5331 Department Stores Department stores Variety Stores Variety stores Miscelleneous General Merchandise 539 Stores Miselleneous. general merchandise stores 5399 Hard surface floor coverings, not elsewhere classified Man ufacturing industries, not elsewhere classified 54 - Food Stores 541 5411 42 - Trucking and Warehousing 542 5421 422 Public Warehousing and Storage 543 4221 Farm product warehousing and storage 5431 4222 Refrigerated warehousing and storage 544 5441 4225 General warehousing and storage 545 4226 Special warehousing and storage, not elsewhere classified 5451 52 - Building Materials & Garden Supplies Lu mber and O the r Bu ilding M aterials 521 Lum ber an d othe r bu ilding m ate rials 5211 Paint, Glass, and Wallpaper Stores 523 Paint, glass, and wallpaper stores 5231 5461 546 549 5499 Grocery Stores Grocery stores M eat and Fish M arkets Me at and fish m ark ets Fruit and Vege table M arkets Fruit and vege table m ark ets Candy, Nut, and Confectionery Stores Candy, nut, and confectionery stores Dairy Products Stores Dairy products stores Retail Bakeries Retail bakeries Miscellaneous Food Stores Miscellaneous food stores Page 14 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 55 - Automotive Dealers & Service Stations 551 5511 552 5521 553 5531 554 5541 555 5551 556 5561 557 5571 559 5599 New and Use d C ar De alers New and use d car dealers Use d C ar De alers Used car dealers Auto and Home Sup ply Stores Auto and home supply stores Gasoline Service Stations Gasoline service stations Bo at De alers Boat dealers Rec reation al Veh icle De alers Recre ational vehicle dealers M otorcycle D ealers Motorcycle dealers Automotive Dealers, NEC Autom otive dealers, not elsewhere classified 56 - Apparel and accessory Stores 561 5611 562 5621 563 5632 564 5641 565 5651 566 5661 569 5699 Men 's & Boys' Clothing Stores Men's & boys' clothing stores Wo men's Clothing Stores W omen's clothing stores Wo men's Accessory & Specialty Stores W omen's accessory & specialty stores Children's and Infants' Wear Stores Children's and infants' wear stores Family Clothing Stores Fam ily clothing stores Shoe Stores Shoe stores Misc. Apparel & Accessory Stores Miscellaneous apparel & accessory stores Page 15 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 57 - Furniture and Home Furnishing Stores 571 5712 5713 5714 5719 572 5722 573 5731 5734 5735 5736 5962 Furniture and Hom e furnishings Stores 5963 Furniture stores 598 Floor covering stores 5983 Drapery and upholstery stores 5984 Misc. home furnishing stores 5989 Household Appliance Stores 599 Household appliance stores 5992 Radio, Television, & Computer Stores 5993 Radio, TV, & electronic stores 5994 Com puter and software stores 5995 Record & prerecorded tape stores 5999 Merc handising m achine opera tors Direct se lling esta blishm ents Fuel Dealers Fuel oil dealers Liquefied petroleum gas dea lers Fuel dealers, not elsewhere classified Retail Stores, Not Elsewhere Classified Florists Tobacco stores and stands News dealers and newsstands Optical goods stores Miscellaneous retail stores, not elsewhere classified Musical instrument stores 70 - Hotels and Other Lodging Places 59 - M isce llane ou s Retail 591 5912 592 5921 593 5932 594 5941 5942 5943 5944 5945 5946 5947 5948 5949 596 5961 Drug Stores and Proprietary Stores Drug stores and proprietary stores Liquor Stores Liquor stores Used M erchandise Stores Used m erchandise stores Miscellaneous Shopping Goods Stores Sporting goods and bicycle shops Book stores 701 7011 702 7021 703 7032 7033 704 7041 Ho tels a nd M otels Hote ls and m ote ls Room ing and Boarding Houses Room ing and boarding houses Camp s and Recreational Vehicle Parks Sporting and recreational camps Trailer parks and campsites M em bership-B asis Org anizatio n H otels Mem bership-basis organization hotels Stationery stores Jewelry stores Hobby, toy, and game shops Cam era & photographic supply stores 78 - Motion Pictures 7812 Motion Picture & Video Production 7819 Services Allied to Motion Pictures Gift, novelty, and souvenir shops Luggage and leather goods stores 7391 Research and Development Sewing, needlework, and piece goods No nsto re Re tailers Catalog and mail-order houses 799 - Miscellaneous Amusement And Recreation Page 16 of 17 Eligible Standard Industrial Classification (SIC) Codes For the Florida Urban Job Tax Credit Program Source: Department of Labor 7992 Public Golf Courses Establishm ents prim arily engaged in the operation of golf courses open to the general public on a contract or fee basis. Mem bership golf and cou ntry clubs are classified in Industry 7997. Miniature golf courses and golf driving ran ges are classified in Indu stry 7999. 7996 Amusem ent Parks Establishm ents of the type known as amusem ent parks and kiddie parks which group together and ope rate in who le or in part a number of attractions, such as mechanical rides, amusem ent devices, refreshment stands, and picnic grounds. Am usement concessionaires operating within the park are g ene rally class ified in Ind ustry 7999 . Page 17 of 17