BEFORE THE BOARD OF DIRECTORS EXPORT

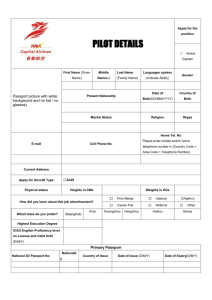

advertisement

BEFORE THE BOARD OF DIRECTORS EXPORT-IMPORT BANK OF THE UNITED STATES WASHINGTON, D.C. ) ) ) APPLICATION NUMBER AP087801XX FOR A FINAL COMMITMENT FOR THE EXPORT OF ) BOEING 777 AND BOEING 737 AIRCRAFT TO ) ) CHINA ) In the matter of EIB–2013–0024 JOINT COMMENTS OF DELTA AIR LINES, INC., HAWAIIAN AIRLINES, INC., AND AIR LINE PILOTS ASSOCIATION, INTERNATIONAL Communications with respect to this document should be addressed to: MICHAEL K. KELLOGG Counsel for Delta Air Lines, Inc. Kellogg, Huber, Hansen, Todd, Evans & Figel, P.L.L.C. Sumner Square 1615 M Street, N.W., Suite 400 Washington, D.C. 20036 (202) 326-7900 mkellogg@khhte.com ANDREA FISCHER NEWMAN Senior Vice President – Government Affairs Delta Air Lines, Inc. 1212 New York Avenue, N.W. Washington, D.C. 20005 (202) 216-0700 andrea.newman@delta.com JONATHAN B. HILL Counsel for Hawaiian Airlines, Inc. Dow Lohnes, P.L.L.C. 1200 New Hampshire Avenue, N.W. Suite 800 Washington, D.C. 20036-6802 (202) 776-2725 jhill@dowlohnes.com RUSSELL BAILEY Senior Attorney Air Line Pilots Association, International 1625 Massachusetts Avenue, N.W., 8th Floor Washington, D.C. 20036 (202) 797-4086 russell.bailey@alpa.org BEFORE THE BOARD OF DIRECTORS EXPORT-IMPORT BANK OF THE UNITED STATES WASHINGTON, D.C. ) ) ) APPLICATION NUMBER AP087801XX FOR A FINAL COMMITMENT FOR THE EXPORT OF ) BOEING 777 AND BOEING 737 AIRCRAFT TO ) ) CHINA ) In the matter of EIB–2013–0024 JOINT COMMENTS OF DELTA AIR LINES, INC., HAWAIIAN AIRLINES, INC., AND AIR LINE PILOTS ASSOCIATION, INTERNATIONAL Delta Air Lines, Inc. (“Delta”), Hawaiian Airlines, Inc. (“Hawaiian”), and the Air Line Pilots Association, International (“ALPA”) submit these comments in response to the recent Notice by the Export-Import Bank of the United States (“Bank”) of an application for final commitment for a loan guarantee supporting the purchase of Boeing 777 and Boeing 737 aircraft by Air China (the “Guarantee”).1 I. Introduction Air China seeks final approval for a loan guarantee in excess of $100 million to purchase Boeing 777 aircraft to “provide long-haul airline service between China and various international destinations.”2 The Bank acknowledges that Air China may use the aircraft purchased with the aid of the Guarantee to “provide services in competition with the exportation of goods or provision of services by a United States industry.” Indeed, Air China is Asia’s largest carrier, a 1 See Export-Import Bank of the United States, Application for Final Commitment for a Long-Term Loan or Financial Guarantee in Excess of $100 million: AP087801XX, Public Notice 2013-0024, 78 Fed. Reg. 20,913 (Apr. 8, 2013) (“Notice”), attached hereto as Exhibit A. Although the Notice concerns financing for both Boeing 777 and Boeing 737 aircraft, this Comment only addresses the financing for the 777s because those aircraft will compete directly with domestic airlines, resulting in significant harm to the U.S. airline industry and lost jobs for its employees. 2 Id. serious competitor to U.S. airlines, and a major recipient of Bank support. Air China already competes with U.S. airlines on flights between 70 different international city-pairs, which account for approximately $2.4 billion in annual U.S. airline revenues. Air China recently announced plans to increase service to the United States, including the addition of flights to a new destination (Houston) and an increase of flights to existing destinations (New York City and Los Angeles). That will cause additional significant harm to U.S. airlines. For example, if Air China uses the Bank’s support to add just one daily flight between Beijing and another U.S. destination, such as Washington, D.C., it would likely result in estimated lost annual revenues of at least $11 million to $41 million for U.S. airlines. It is therefore clear that the Bank’s Guarantee will provide a competitive advantage for Air China against U.S. airlines, and that advantage to Air China will result in lost opportunities for U.S. airlines and lost jobs for their employees. Even apart from Air China’s direct – and increasing – competition with U.S. airlines, the Guarantee comes at a time when there is already structural oversupply in the airline industry. The Bank should not contribute to that oversupply at the expense of U.S. airlines and their employees. The Bank should reject Air China’s application.3 Part II of this Comment explains why the Bank must evaluate the harm that the Air China transaction will have on U.S. airlines and their employees under the statutes passed by Congress. Part III explains why the Bank should 3 At a minimum, under the Bank’s newly effective economic impact procedures, the Bank should perform a detailed economic analysis of the transaction to determine whether there is a net benefit to U.S. industry. See Part IV, infra; see also Export-Import Bank of the United States, Economic Impact Procedures and Methodological Guidelines (effective Apr. 1, 2013) [hereinafter “New EIPs”], available at http://www.exim.gov/generalbankpolicies/economicimpact/upload/Final-April-2013Procedures.pdf. 2 accurately measure and evaluate that harm to U.S. industry under the Bank’s new Economic Impact Procedures. Part IV details the substantial harm to U.S. industry that the Bank’s approval of the Air China Guarantee would cause. II. The Bank’s Charter Requires the Bank To Consider the Adverse Economic Effects of the Guarantee in Detail In the Export-Import Bank Reauthorization Act of 2012,4 Congress made clear that the Bank must consider the potential adverse effect of all transactions it subsidizes through loans and guarantees, with no exception for aircraft. Congress required the Bank to provide advance notice of all applications for financing above $100 million and an opportunity for the public to comment. See Pub. L. No. 112-122, § 9(a) (codified at 12 U.S.C. § 635a(c)(10)(C)(i)). The notice must provide “a brief non-proprietary description of the purposes of the transaction and the anticipated use of any item being exported, including, to the extent the Bank is reasonably aware, whether the item may be used to produce exports or provide services in competition with the exportation of goods or the provision of services by a United States industry.” 12 U.S.C. § 635a(c)(10)(C)(ii)(I). The statute also requires the Bank to “seek comments on the application from the Department of Commerce and the Office of Management and Budget,” id. § 635a(c)(10)(C)(i)(III); provide any comments to the Bank’s Board of Directors before the Board takes final action, id. § 635a(c)(10)(E); and to provide to requesting commenters a “nonconfidential summary of the facts found and conclusions reached in any detailed analysis or similar study” conducted for the application, id. § 635a(c)(10)(F).5 These new requirements, which were added to the Bank’s pre-existing obligations to consider the potential adverse 4 Export-Import Bank Reauthorization Act of 2012, Pub. L. No. 112-122, 126 Stat. 350 (“2012 Reauthorization Act” or “Act”). 5 Congress also requires the Bank to “consider and address in writing the views of parties or persons who may be substantially adversely affected by the loan or guarantee prior to taking final action on the loan or guarantee.” 12 U.S.C. § 635a-2. 3 economic effects of all transactions,6 make clear that the Bank must consider the specific adverse economic impact resulting from its decision to finance aircraft exports. The 2012 Reauthorization Act further requires the Bank to “develop and make publicly available methodological guidelines to be used by the Bank in conducting economic impact analyses or similar studies under section 2(e)” of its Charter. Pub. L. No. 112-122, § 12(a). On September 27, 2012, the Bank published a notice seeking comments on a new set of economic impact procedures and methodological guidelines. See Export-Import Bank of the United States, Economic Impact Policy, 77 Fed. Reg. 59,397 (Sept. 27, 2012). The Bank adopted these proposed procedures and guidelines (with minor changes) to take effect beginning in April 2013.7 The new procedures acknowledge that the Bank can no longer ignore the adverse economic impact of its aircraft financings. As the commenters have explained through prior objections, there are serious flaws in the Bank’s new approach to aircraft transactions, and this comment incorporates those objections in full.8 Even under the New EIPs, however, the Bank 6 See id. § 635(b)(1)(B) (requiring the Bank to “take into account any serious adverse effect of such loan or guarantee on the competitive position of United States industry . . . and employment in the United States”); id. § 635a-2 (the Bank must “implement such regulations and procedures as may be appropriate to insure that full consideration is given to the extent to which any loan or financial guarantee is likely to have an adverse effect on industries . . . and employment in the United States” (emphasis added)); id. § 635(e) (prohibiting the Bank from approving applications that would cause “substantial injury” to U.S. industries). 7 See New EIPs at 1. 8 See, e.g., Joint Comments of Delta Air Lines, Inc., and Air Line Pilots Association, International, in Exp.-Imp. Bank of United States, Public Comments on the 2012 Proposed Economic Impact Procedures (Nov. 5, 2012) [hereinafter “Public EIP Comments”], available at http://www.exim.gov/generalbankpolicies/economicimpact/upload/Public-Comment-Nov-52012.pdf; Joint Comments of Delta Air Lines, Inc., Hawaiian Airlines, Inc., and Air Line Pilots Association, International, Comment on Application Numbers AP087595XX, AP087595XA, AP087595XB For a Final Commitment for the Export of Boeing 777 and 747 Aircraft to South Korea (Feb. 8, 2013) (explaining that Korean Air competes directly with Delta and Hawaiian and that ExIm subsidies to the foreign carrier greatly disadvantage the competing U.S. carriers); see also Delta Air Lines, Inc., v. Exp.-Imp. Bank of United States, No. 1:13-cv-00424-RC (D.D.C. filed. Apr. 3, 2013). Additionally, the New EIPs are the subject of a legal challenge brought by 4 should not approve the Air China Guarantee. Because of the substantial injury to U.S. airlines detailed in Part IV below, the Bank should conduct a detailed economic impact analysis of the Air China Guarantees to confirm whether the benefits of this transaction in fact outweigh its profound costs to U.S. industry and employment. III. The Bank’s New Economic Impact Procedures Should Lead The Bank To Conduct a “Detailed Economic Impact Analysis” of the Guarantee A. The New Procedures The Bank’s New EIP procedures describe a four-stage process. Stage I examines the overall state of the global airline industry and aims to determine whether it suffers from long term structural oversupply. If so, any financing transaction for a foreign airline can be approved only under “exceptional circumstances.” If the Bank determines that there is no structural oversupply, it will run the transaction through three additional stages. Stage II consists of three threshold tests: (1) whether the “evaluated transaction” exceeds $200 million; (2) whether the transaction will cause “substantial injury”; and (3) whether the airline will use a “significant number” of flights from the “evaluated transaction” to “direct[ly]” compete with U.S. airlines. All three threshold tests must be satisfied for a transaction to pass this stage. If the transaction in question clears Stage II, the Bank will conduct a detailed economic impact analysis of the transaction, which is described in Stages III and IV of the New EIPs. Stage III of the analysis consists of determining (1) whether Export Credit Agency (ECA) support provides a price advantage to the foreign airline and (2) whether any price advantage translates into a calculable direct loss. The second step of Stage III entails “evaluat[ing] the nature and extent of direct competition [and] quantify[ing] the likely impact of the price Delta, Hawaiian and ALPA, which is currently pending in federal court. See Delta Air Lines, Inc. v. Exp.-Imp. Bank of United States, No. 1:13-cv-00192-RC (D.D.C. filed Feb. 13, 2013). 5 difference on relative market share and total income potentially lost by the U.S. airline.”9 Following these determinations, Stage IV consists of comparing the “export value of the ‘evaluated transaction’ under review (and any future spares/replacements of the order package)” to the direct loss to determine “whether there [is] likely to be a net economic benefit to the order package.”10 As a part of Stage IV, the Bank must consider public comments made regarding the transaction. B. There Is Long Term Structural Oversupply in the Airline Industry The Air China transaction should not proceed past Stage I because of the long-term structural oversupply in the airline industry.11 As previously explained, the focus of this inquiry must be the international routes flown to and from the United States, not the capacity of the global airline industry in general.12 But even looking at the global airline industry, it is evident that long-run structural oversupply exists. As industry expert Daniel Kasper and economist Eric Amel explain in the attached declaration, an industry can be said to be in a state of long-term structural oversupply when profits consistently fail to justify the industry’s investments.13 A standard measure of an 9 New EIPs at 15. 10 Id. 11 The new EIPs state that the Bank’s Stage I analysis will be conducted “annually by an independent, external source recognized as an expert (and neutral party) in the airline field.” Id. at 13. The Bank has not publicly released any further information about its annual study. To the extent the Bank has already conducted its analysis for the coming year, the commenters maintain their objection that they were not able to participate in the process, see Public EIP Comments at 41-42, and they request a copy of the any conclusions reached, pursuant to § 635a(c)(10)(F). 12 See Public EIP Comments at 41 (“Most importantly, any evaluation of structural oversupply must focus on international routes to and from the United States, not on the airline industry generally. Those international routes are the areas in which the Bank’s subsidies have the most significant effect on U.S. airlines and their employees.”). 13 See Declaration of Daniel Kasper and Eric Amel at 6-8 [hereinafter “Kasper-Amel Decl.”], attached hereto as Exhibit B. 6 industry’s investment returns is its return on invested capital (ROIC).14 If an industry’s capital costs of investments—often estimated using a Weighted Average Cost of Capital (WACC)— exceed its returns on invested capital, ROIC, then it is in a state of structural oversupply.15 As the following graph shows, the airline industry has suffered from structural oversupply since at least 1993; at no point since that time have returns on invested capital been sufficient to cover the cost of the capital invested:16 Return on invested capital in airlines and their WACC 10.0 9.0 WACC 8.0 7.0 6.0 Investor value losses 5.0 4.0 3.0 ROIC 2.0 1.0 0.0 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013F Source: IATA, “Downward pressures may ease but risks to outlook remain high, Industry Outlook – September 2012.” Other commentators have recognized this problem as well.17 In an article entitled “Why does the airline industry over-invest,” the Journal of Air Transport Management published a conclusion similar to the one reached by Kasper and Amel: 14 Id. 15 Id. at 7. 16 Id. at 8, Exhibit 1; see also Declaration of Igor Helman Ex. 1 [hereinafter “Helman Decl.”], ROIC Analysis, attached hereto as Exhibit C. 17 See Helman Decl. Ex. 32, IATA Industry Outlook Presentation (Sept. 2012). 7 Since 1981, the listed airline industry earned meaningful economic profits only in 1984. For a further five years, the industry approximately covered its cost of capital (1985, 1988, 1997, 1998 and 1999). During the remaining years, and since 2000, the industry has failed to cover its cost of capital. In cyclical industries, to cover the cost of capital over a cycle, a company has to earn sufficient economic profits in good times in order to compensate the economic loss during downturns. The airline industry failed to achieve this over the last two decades.18 No exceptional circumstances justify supporting this transaction in the face of such overcapacity. Air China is a financially healthy and growing airline that, with the Bank’s substantial support in years past, has already contributed heavily to the industry’s endemic supply problems. The airline has grown its fleet to 289 passenger aircraft with an average age of just 6.58 years.19 In the past two years alone, Air China has taken delivery of eleven 777-300s compared only to two 777s (and eight widebody aircraft total) added to the entire U.S. fleet during that time. This is the second notice for financing exceeding $100 million the Bank has issued for Air China in as many months.20 During its recent rapid expansion, Air China has enjoyed a six-fold increase in the number of passengers it carries to and from the United States (from 47,000 annual passengers in 1997 to 316,000 annual passengers in 2012).21 The Bank should not reward Air China for planning to increase this capacity even further. Nor does anything suggest that Boeing especially needs the Bank’s help in this instance. Given Air China’s previous purchases and existing commitments to purchase additional Boeing aircraft,22 18 Helman Decl. Ex. 30, Oliver W. Wojahn, Why Does the Airline Industry Over-Invest? J. of Air Transport Mgmt. 19 (2012). 19 Id. Ex. 11, Air China 2012 Interim Report at 7; Kasper-Amel Decl. at 2. 20 See Export-Import Bank of the United States, Application for Final Commitment for a Long-Term Loan or Financial Guarantee in Excess of $100 million: AP087801XX, Public Notice 2013-0024, 78 Fed. Reg. 16,852 (Mar. 19, 2013). 21 Kasper-Amel Decl. at 11-12 & Ex. 3. 22 See, e.g., Helman Decl. Ex. 26, Press Release, Air China, Air China Orders 15 Boeing 787 Dreamliner Aircraft (Nov. 20, 2007) (noting that the “Boeing 787 is the optimal aircraft to support Air China’s strategy for continued international growth”). 8 any competition Boeing may face from Airbus in this case is purely speculative, and certainly does not amount to an exceptional case. C. The Air China Transaction Satisfies All Three Stage II Threshold Tests If the Bank proceeds to Stage II of its new EIPs (which it should not do, as set forth above), it should conclude that the Air China transaction satisfies all three threshold tests of that stage. The first test of Stage II requires the Bank to determine whether the “evaluated transaction” exceeds $200 million. The Bank defines “evaluated transaction” as “the total number/value of Ex-Im Bank supported aircraft to be (or has been) delivered in the greater of: (a) the authorization upon which the Detailed Economic Impact Analysis is based, or (b) 12 months of such deliveries after/around/preceding the date of the authorization.” 23 The Air China transaction almost certainly exceeds the $200 million threshold. A single Boeing 777 has a list price of $315 million.24 Moreover, a number of 777 aircraft are involved in the “evaluated transaction”: publicly available information indicates that Air China plans to receive nine Boeing 777-300ERs within the next two years.25 The Bank’s historical support for Air China likewise confirms that the first test will be easily satisfied. Over the past two years, Air China has received over $1.2 billion in ExIm financing, amounting to more than $600 million per year, and this is the Bank’s second notice of 777 financing to Air China exceeding $100 million issued 23 New EIPs at 13, n.26. 24 Helman Decl. Ex. 31, Boeing, Commercial Airplanes—Jet Prices, http://www.boeing.com/boeing/commercial/prices/ (last visited May 1, 2013). 25 See Kasper-Amel Decl. at 9; Helman Decl. Ex. 2, Air China Turns Attention to International Markets, But its Profits Are Regional and Domestic, CAPA Centre for Aviation (Apr. 5, 2013) (showing Air China as scheduled for delivery of five 777 aircraft in 2013 and four more in 2014). 9 in the past two months.26 There is no indication that the financing for Air China’s proposed purchases of Boeing 777s in this Guarantee will be any less substantial than it has been in previous years.27 The Air China transaction is also likely to meet the second threshold test of Stage II: whether the “evaluated transaction” meets the threshold for “substantial injury.”28 The Bank has not released sufficient information to ascertain the total number of airplane seats implicated by its Guarantee. Using publicly available information, however, Kasper and Amel estimate that that current capacity of U.S. carriers’ widebody aircraft is approximately 122,000 seats,29 and that Air China currently configures its 777-300ER aircraft to have 311 seats. Plugging these numbers into the Bank’s “substantial injury” formula, it would take four aircraft to exceed the 1% threshold.30 It appears that Air China seeks to finance at least four 777 aircraft within the year, which would exceed that threshold. Specifically, Air China currently has nine 777-300ER aircraft 26 See Kasper-Amel Decl. at 9; see also Helman Decl. Ex. 3, Exp.-Imp. Bank of United States, 2012 Annual Report, at 35 (showing loan guarantees to Air China totaling over $830 million); Helman Decl. Ex. 4, Exp.-Imp. Bank of United States, 2011 Annual Report, at 31 (showing Air China loan guarantees amounting to over $420 million); 78 Fed. Reg. at 16,852; 12 U.S.C. § 635(e)(6) (“For purposes of determining whether a proposed transaction exceeds a financial threshold . . . under the procedures or rules of the Bank, the Bank shall aggregate the dollar amount of the proposed transaction and the dollar amounts of all . . . guarantees, approved by the Bank in the preceding 24-month period, that involved the same foreign entity and substantially the same product to be produced.”). 27 Transaction amounts below $200 million may suggest that Air China’s loan guarantees are being structured in an unnatural way simply to avoid being subject to ExIm Bank’s detailed economic analysis. See Public EIP Comments at 43-44 (explaining why the “extraordinarily high threshold of $200 million” is not an appropriate amount to use). 28 “Substantial injury” is found where the evaluated transaction divided by the number of seats in similar aircraft (i.e., widebody or narrowbody) owned by U.S. airlines exceeds 1%. New EIPs at 2, n.3. 29 Kasper-Amel Decl. at 9-10 & Ex. 2. 30 Id. at 10. 10 ordered and set to be delivered within the next two years, with five of those planes scheduled to be delivered in 2013.31 Air China has already sought Bank financing exceeding $100 million for 777s in March of this year.32 In the previous two years, Air China has taken delivery of eleven 777-300ER aircraft, with six of those financed by ExIm Bank and delivered in the last year alone.33 Consequently, the Guarantee is likely to meet the Bank’s “substantial injury” test of Stage II.34 Finally, the proposed transaction is “virtually certain” to meet the third threshold test of Stage II,35 which requires that the carrier seeking the financing in question fly a “significant number” of flights “in direct competition” with U.S. carriers.36 For example, Air China currently 31 See Helman Decl. Ex. 2, CAPA Centre for Aviation, Air China Turns Attention to International Markets (Apr. 5, 2013); see also id. Ex. 5, Boeing Orders & Deliveries (showing 19 777-300ERs ordered since 2007 and only 11 aircraft delivered through February 2013). 32 See Kasper-Amel Decl. at 2; 78 Fed. Reg. at 16,852. 33 See Helman Decl. Ex. 6, Air China Mandates for Two 777s, Air Finance Journal (Aug. 16. 2012); id. Ex. 7, Air China Closes 777 Financing , Air Finance Journal (July 31, 2012); id. Ex. 8, Exclusive: Air China Closes U.S. Ex-Im Bond, Air Finance Journal (June 7, 2012); id. Ex. 9, Air China Closes Ex-Im Financing , Air Finance Journal (May 31, 2012); id. Ex. 10, Air China Closes 777-300ER Financing , Air Finance Journal (Feb. 8, 2012). 34 Even if the aircraft covered by the “evaluated transaction” are insufficient to meet the strict letter of the Bank’s current formulation of the substantial injury threshold, the Bank should still perform a detailed economic impact analysis. The bottom line is that Air China expects to receive at least nine 777 aircraft over the next two years – an average of 4.5 per year. It should not be permitted to evade review simply by pushing off one delivery by a few weeks or days. See Public EIP Comments at 45 (suggesting that artificially limiting the numerator to insufficient length of time “ignores the accretive effect of the Bank’s financings”). Moreover, as previously explained, “including the total daily capacity offered by U.S. airlines [as the denominator] makes no economic sense and would be a totally inappropriate and erroneous base against which to apply the 1% standard for measuring harm.” See id. at 45, 67. It is inappropriate to include U.S. capacity on routes and in markets which Air China does not and cannot serve. Including irrelevant capacity in the denominator of the formula artificially dilutes the impact that this transaction will have on international routes of U.S. carriers. See id. 35 Id. at 4. 36 The commenters maintain their objection to this threshold test on several grounds. First, the new procedures fail to define what number of flights is considered “significant.” Id. at 11 operates nonstop flights from San Francisco and New York to Beijing, and from Tokyo to Beijing and Shanghai.37 U.S. carriers operate these same nonstop routes—which account for $275 million in annual revenue to U.S. carriers—in competition with Air China.38 Air China also competes with U.S. carriers for passengers flying Los Angeles-Beijing and Houston-Beijing routes (which U.S. carriers service through hubs in cities such as San Francisco, Seattle, and Detroit),39 which account for an additional $161 million in annual revenue to U.S. carriers.40 In addition, Hawaiian just announced that it will begin its Beijing-Honolulu service, connecting Beijing to the 11 U.S. cities Hawaiian services from Honolulu.41 Hawaiian will then compete with Air China for passengers flying to at least three of these U.S. cities (San Francisco, Los Angeles, and New York). Finally, Air China serves 26 international destinations from its hub in 46. Second, the focus on direct (defined as “non-stop or one-stop/same plane”) competition is based “on a fundamental misunderstanding of the nature of airline competition” and is contrary to the current understanding of the nature of competition in the airline industry. Id. Modern airlines—including Air China and U.S. carriers—rely on a hub model, particularly for international flying, which connects passengers through hubs to their ultimate destinations. See Kasper-Amel Decl. at 11; Helman Decl. Ex. 11, Air China 2012 Interim Report at 6 (“We continued to develop our hub and network strategy.”). The hub system means that U.S. airlines compete with foreign carriers on both a nonstop and a connecting basis. Therefore, examining only direct competition drastically underestimates the impact that ExIm financing of foreign carriers has on their U.S. competitors. See Kasper-Amel Decl. at 11, 13. Third, the Bank’s apparent focus on existing competition improperly fails to consider the preclusive effect of the Bank’s support. As Air China adds additional routes with Bank-backed planes, U.S. airlines will find it more difficult to expand into similar markets. See Public EIP Comments at 47-48. 37 Kasper-Amel Decl. at 13 & Ex. 4. 38 Id. 39 Id. at 14 & Ex. 5. 40 Id. 41 See id. at 16 n.32; see also Helman Decl. Ex. 35, Press Release, Hawaiian Airlines, Hawaiian Airlines to Begin Service to China in 2014 (Apr. 10, 2013). 12 Beijing with travel times and distances that are competitive to routings offered by U.S. carriers for those same destinations.42 In sum, Air China competes with U.S. carriers on flights between 70 city pairs that generate approximately $2.4 billion in revenue each year for the U.S. carriers and their joint venture partners.43 By any measure, these figures represent significant revenues for U.S. carriers put at risk by this transaction. IV. The Guarantee Will Harm U.S. Airlines and Their Employees The Air China Guarantee will significantly harm U.S. airlines and their employees.44 If approved, the Guarantee will give Air China a significant competitive advantage over U.S. airlines, which must finance their aircraft acquisitions with private capital at market prices. As the Bank recognizes, Air China may deploy Bank-financed aircraft on international routes to and from the United States. The cost savings and other advantages provided by Bank financing to Air China will thus translate into direct competitive harm to U.S. airlines and their employees. A. As Air China Has Received Greater Bank Financing, It Has Significantly Increased its Service to the United States in Competition with U.S. Airlines This Guarantee is the latest in a series of Bank financings that Air China has used to support its rapid growth on international routes, to the detriment of U.S. carriers. Air China has received over $2.6 billion in Bank loans and loan guarantees since 1997, and this is the second notice of a 777 financing exceeding $100 million that the Bank has issued in as many months.45 42 Kasper-Amel Decl. at 14-15, Ex. 6. 43 Id. at 16. 44 As explained in Part III.A, supra, the Bank has set forth how it will conduct its detailed economic impact analysis of aircraft transactions in Stages III and IV of its new EIPs. The commenters have elsewhere explained the many problems with these Stages and maintain those objections here. See, e.g., Public EIP Comments at 49-56. 45 See Kasper-Amel Decl. at 2; 78 Fed. Reg. at 16,852. 13 The airline has used those below-market financings to dramatically increase the size of its fleet and its global network. In the past two years alone, Air China has taken delivery of eleven Boeing 777-300s.46 As of February 2013, Air China has received 134 Boeing aircraft and has orders for 62 more, including nine more 777s and other widebody Boeing aircraft.47 This unprecedented expansion has allowed Air China to grow its fleet to 289 aircraft, with an average age of just 6.58 years, one of the youngest fleets in the world.48 In the next two years alone, the nine 777s that Air China plans to purchase will likely be financed in part by ExIm guarantees. This is in addition to the 30 other Boeing aircraft Air China is set to order for deliveries through 2015.49 In contrast, all U.S. carriers combined are forecasted to take delivery of 55 wide-body aircraft through 2015. And unlike Air China’s rapid expansion, most of these deliveries to U.S. carriers (48 out of 55) will replace retiring aircraft, not provide additional new capacity.50 During this period of massive expansion, Air China has dramatically increased the number of passengers it carries to and from the United States: from 47,000 annual passengers in 1997 to 316,000 annual passengers in 2012 – an increase of 572%.51 Air China has also expanded the number of cities it serves in the United States; it currently serves three cities and is 46 See Helman Decl. Ex. 11, Air China 2012 Interim Report at 7; id. Ex. 2, Air China Turns Attention to International Markets. 47 See id. Ex. 5, Boeing Orders and Deliveries; id. Ex 2, Air China Turns Attention to International Markets. 48 See id. Ex. 11, Air China 2012 Interim Report. By comparison, the average age of the U.S. fleet is 13.8 years. See id. Ex. 12, Boston Consulting Group, Winning the Future: The Case for a U.S. National Airline Policy at 227-28 (May 11, 2011). 49 See id. Ex. 33, Air China to Order 31 Boeing Jets, Air Finance Journal (Mar. 1, 2013); see also id. Ex. 2, Air China Turns Attention to International Markets (Air China’s net gain of 13 widebody aircraft in 2012 “made the year the largest for widebody deliveries in Air China's history, according to the carrier”). 50 Id. Ex. 12, Winning the Future at 227-28 (May 11, 2011). 51 Kasper-Amel Decl. at 11-12 & Ex. 3. 14 adding a fourth (Houston) in July of this year.52 Among other overlaps, Air China competes directly with U.S. carriers on nonstop New York-Beijing and San Francisco-Beijing flights. Air China also provides direct flights between Tokyo and both Beijing and Shanghai, in direct competition with Delta.53 As Kasper and Amel’s data demonstrate, Air China’s rapid expansion in the United States is closely correlated with the increasing financial support it receives from the Bank.54 Air China’s competitive impact is not limited to flights between the United States and Beijing. Air China currently provides competing connecting service to 26 destinations from its U.S. gateway cities via its major hub in Beijing, which is well-positioned to allow the airline to provide connecting service to numerous destinations in competition with U.S. airlines.55 Such competing destinations include not only the domestic China market, but also other parts of Asia, Australia, and the Middle East.56 Overall, Air China competes with U.S. airlines on international routes between 70 different city pairs, which generate approximately $2.4 billion in annual revenue for U.S. airlines and their joint-venture partners.57 Air China’s rapid expansion, fueled by the availability of favorable ExIm financing, has increasingly allowed Air China to grow its business at the expense of U.S. carriers.58 52 Id. at 11. In addition to Houston, Air China also serves San Francisco, Los Angeles, and New York. Id. 53 Id. at 13 & Ex. 4. 54 Id. at 2. 55 Id. at 14-15 & Ex. 6. 56 Id. at 15 & Ex. 6. For example, a passenger flying from San Francisco, California to Delhi, India can take a 22-hour Delta flight with a connection in Amsterdam or a 22-hour Air China flight with a connection in Beijing. See Helman Decl. Ex. 13, Cheaptickets.com Search Results (Apr. 10, 2013). 57 Kasper-Amel Decl. at 15-16. 58 Id. at 12 & Ex. 3. 15 B. The Guarantee Would Give Air China Significant Competitive Advantages Over U.S. Airlines Because the Bank has not released the details about the financing terms that its guarantee would offer to Air China, it is impossible to calculate the exact price advantage that Air China would reap from the Guarantee.59 It is plain, however, that a price advantage exists. As the Kasper-Amel Declaration explains, Bank financing enables Air China to finance its aircraft purchases at below-market rates, making new Boeing 777 aircraft an even more attractive investment for Air China, and giving it a substantial cost advantage over competing U.S. airlines.60 Indeed, Air China’s desire for such financing makes clear that the Bank’s support provides Air China—a growing and profitable airline—with a significant competitive advantage. The availability of below-market financing makes it advantageous for Air China to deploy these aircraft on routes that compete directly with unsubsidized U.S. carriers.61 The effect on Air China’s expansion plans is clear. Since 2011, it has received 11 Boeing 777-300ER aircraft with the aid of Bank financing (and has ordered nine additional Boeing 777 passenger aircraft). Air China has added those aircraft to its international routes in direct competition with U.S. airlines, using the Bank-financed planes to add new U.S. destinations and increase both the frequency and capacity of flights to existing U.S. destinations.62 59 Id. at 16. 60 Id. at 10-11. 61 See id. at 17 (explaining that when “Air China deploys additional capacity on international routes to and from the United States, it increases the supply of seats thereby putting downward pressure on the fares on those routes”). 62 See, e.g., Helman Decl. Ex. 14, ‘Smiling China’ Kick-starts Service Upgrade, Global Travel Industry News (Apr. 2, 2013) (noting that Air China used the new Boeing 777-300ER to increase service on its “Beijing-New York route–the most important and busiest between China and the United States–. . . from seven to 11 times a week” and that to “further cement its North American foothold, Air China also plans to start direct Beijing–Houston flights on July 11, 2013, the first service ever to link Beijing with the southern region of the United States”); id. Ex. 15, 16 Bank financing thus has provided (and would provide) Air China a substantial and unjustified cost advantage over U.S. airlines. As Kasper and Amel explain, the competitive nature of the airline industry coupled with low profit margins means that even minor cost savings can translate into significant competitive advantages.63 This advantage is exacerbated by the significantly lower fuel and maintenance costs that come with Air China’s new, Bank-backed aircraft. The average age of Air China’s fleet is 6.58 years.64 By comparison, the average age of U.S. airlines’ aircraft is 13.8 years.65 This disparity also encourages Air China to squeeze out U.S. airlines in additional international routes to and from the United States by charging lower fares for flights on newer, more appealing aircraft. For example, Air China uses its Bank financed 777s to offer first class cabin service between New York and Beijing, and it is the only airline to do so.66 The real world effect of these Bank-sponsored benefits is to help Air China attract customers away from U.S. carriers. Press Release, Air China, Fly Air China to North America (Mar. 20, 2013) (noting that the Beijing-Los Angeles service will be expanded to twice daily, the “Beijing-Houston service will start in July, and the flights will be operated with the B777-300ER”); id. Ex. 16, Air China 2011 Annual Report at 15 (stating that in 2011, North American passengers accounted for over 7% of Air China’s revenue, a 16% increase over the prior year); see also id. Ex. 23, Air China Builds its N. American Network While Hainan Air to Use A330 Instead of 787 to Chicago, CAPA Centre for Aviation (Feb. 4, 2013) (“The North American market continues to outperform for Chinese airlines, a result of high demand and more limited competition than on European routes. . . . A decade ago Air China had only a three times weekly Beijing-New York service, reflecting the rise of China as both a country and aviation market. Air China’s 2013 capacity to North America will be 183% greater than in 2003 and is quickly closing in on United Airlines’ position as the largest carrier between North America and China.”). 63 Kasper-Amel Decl. at 17-18. 64 Helman Dec. Ex. 11, Air China 2012 Interim Report at 7. 65 Id. Ex. 12, Boston Consulting Group, Winning the Future, at 46. 66 See id. Ex. 17, Air China to Upgrade Aircraft, Increase Frequency for NYC Nonstops, Airline Industry Information (Feb. 7, 2013); see also id. Ex. 18, Zhang Yuwei, Air China Expands Service Across US, China Daily USA (Apr. 1, 2013) (quoting an Air China executive as saying that the focus is on “upgrading and expanding service” and that the new 777-300s bought 17 The Bank’s support is also unwarranted because Air China does not need the U.S. government’s largesse to acquire Boeing aircraft. Air China is state-owned and supported, and is financially successful and growing steadily, enjoying year-over-year profit increases from 2001 to 2007.67 The airline’s chief financial officer described the financial status of the company as “very healthy.”68 Last year, Air China’s operating profit was up over 30%.69 Air China’s strong domestic industry buoyed the airline during the recession of the late 2000s, and it is one of the few airlines to post a profit during the first quarter of 2009.70 Air China’s strong financials give it access to other sources of capital: for instance, it recently announced plans to issue 10-year bonds valued anywhere from $804 million to $1.6 billion.71 with Bank financing has a cabin that “is wider, and coach-class seats [that] have individual monitors and consoles with audio and video on demand”). 67 See id. Ex. 19, Air China, About Air China (explaining that the number of passengers carried by Air China, as well as its passenger load factor have both increased in 2011, by 18.34% and 2.77%, respectively); id. Ex. 16, Air China 2011 Annual Report at 7; see also id. Ex. 20 Jasmine Wang, Air China, China Southern Profits Decline on Currency, Fuel, Bloomberg (Mar. 27, 2013) (describing Air China as Asia’s biggest airline by market value). 68 Id. Ex. 21, Beijing Municipal Government: Air China Shows Strain of Large Airline Debt, Hong Kong Gov’t News (Sept. 4, 2013). 69 Id. Ex. 22, Air China Operating Profit Up 31% in 2012, CAPA Centre for Aviation (Mar. 27, 2013). 70 Id. Ex. 24, China Bucks the Downturn at Home, Airline Business (June 15, 2009) (explaining that Chinese “domestic traffic is surprisingly healthy and has defied the downturn with double-digit growth since October [2008]. . . . While international traffic has been badly hit and is still down on last year, there are indications that China’s airlines are slowly recovering. During the first quarter . . . Air China . . . posted profits. The domestic activity of Chinese carriers is much bigger than their international business so domestic RPK [Revenue Passenger Kilometer] growth has been enough to boost total RPKs.”). 71 Id. Ex. 26, Air China to Issue Bonds, Air Finance Journal (Jan. 18, 2013). Earlier reports indicated that Air China’s bond offering may be as large as $1.6 billion of securities. Id. Ex. 21, Beijing Municipal Government: Air China Shows Strain of Large Airline Debt, Hong Kong Gov’t News. Air China has also received government support at times. See id. Ex. 25, Joanne Chiu, China’s Top Airlines Post Sharp Profit Fall, Wall St. J. (Mar. 26, 2013)(observing that Air China has “in recent years fared better than [its] international rivals thanks to government financial support and growing domestic air travel”); id. Ex. 24, China Bucks the 18 In addition to its strong financial position, Air China is not likely to choose Airbus over Boeing, regardless of ECA support. The Boeing 777-300ER aircraft is “Air China's preferred long-haul airliner” because it is efficient, reliable, and offers exclusive business class features.72 Air China values Boeing as a supplier in part because it provides aircraft without a current direct competitor, such as the Boeing Dreamliner 787 aircraft that Air China has purchased and has committed to keep purchasing in the future irrespective of the Bank’s financing.73 The Bank’s assumption that Air China would choose Airbus over Boeing absent Bank support is pure speculation. C. The Guarantee Would Substantially Injure U.S. Airlines and Their Employees Even on very conservative assumptions, the Guarantee would result in substantial revenue loss to U.S. carriers. Air China has recently announced that it is adding new and expanded service to the United States. It plans to increase the frequency of its service to New York from seven to 11 flights a week using a Boeing 777-300ER.74 It will also resume its double daily flights from Los Angeles to Beijing, also using the 777-300ER, and will replace a Boeing 747-400 that it uses on its San Francisco-Beijing route with a new 777-300ER aircraft, resulting in an increase in seat capacity of 20%.75 Air China is adding Houston as a fourth U.S. Downturn at Home, Airline Business (“In response to the [economic] crisis, the government axed its tax on fuel surcharge revenue, opened China’s airspace further to allow more direct routings and stepped in to bail out struggling state-controlled airlines.”). 72 Id. Ex. 14, ‘Smiling China’ Kick-starts Service Upgrade, Global Travel Industry News. 73 See, e.g., id. Ex. 26, Press Release, Air China, Air China Orders 15 Boeing 787 Dreamliner Aircraft (noting that the “Boeing 787 is the optimal aircraft to support Air China’s strategy for continued international growth”). 74 See id. Ex. 27, Ben Mutzabaugh, Houston Lands Beijing Flights on Air China, USA Today (Jan. 16, 2013). 75 E.g., id. Ex. 2, Air China Turns Attention to International Markets, CAPA Centre for Aviation. 19 destination.76 With this expansion, Air China is on track to becoming the largest carrier between China and North America, displacing a U.S. airline (United Airlines) that currently holds that distinction.77 The Bank should decline to subsidize Air China’s expansion efforts, particularly when they come at the expense of competing U.S. airlines and their employees. In addition to these carefully planned and publicized expansions by Air China, Bank financing will likely permit Air China to add even more destinations in the United States, including major destinations such as Washington, D.C. Air China has continually pursued a strategy of expansion in the United States, and Washington would be a logical city to add to Air China’s growing list of U.S. destinations.78 Air China is already the largest Asian carrier and the only Asian airline to fly nonstop from Beijing to U.S. destinations.79 Kasper and Amel also 76 See id. Ex. 27, Mutzabaugh, Houston Lands Beijing Flights on Air China (“Air China has tabbed Houston Bush Intercontinental as its newest U.S. Gateway. The carrier plans to begin nonstop service to Beijing on July 11, pending regulatory approval. . . . Air China plans to fly four flights a week on Boeing 777-300ER jets.”). 77 Id. Ex. 23, Air China Builds its N. American Network, CAPA Centre for Aviation. 78 See, e.g., id. Ex. 28, Air China to Buy 31 Boeing Planes, Associated Free Press (Mar. 1, 2013) (“China’s leading airline, which last year partnered with US JetBlue Airways, is seeking to expand its business in the United States.”); id. Ex. 18, Yuwei, Air China Expands Service Across US (quoting Chi Zhihang, Air China's vice-president and general manager for North America, as saying “The sky is the limit” when introducing Air China’s plans for the U.S. market. Chi additionally “said the airline is focused on upgrading and expanding service. For example, he said service between Beijing and the Canadian city of Vancouver is being increased to 11 round-trip flights a week in mid-May and nonstop service between Beijing and Houston will begin in July.”); id. Ex. 29, Press Release, Air China, Air China Flies a Million Seats per Week and Launches Daily Service to San Francisco (Mar. 29, 2007) (quoting Mrs. Zhang Lan, a Senior Vice President of Air China, as saying that “As the only airline with daily Beijing nonstops from both San Francisco and Los Angeles, Air China is showing its commitment to service the growing demand for travel to and from China”). 79 See id. Ex. 34, Press Release, Air China, Air China Continues Expansion in North America with New Nonstop Houston-Beijing Service (Jan. 15, 2013) (“Air China is the world’s largest airline by market capitalization, according to the International Air Transport Association (IATA).”); id. Ex. 29, Press Release, Air China, Air China Flies a Million Seats per Week; id. Ex. 17, Air China to Upgrade Aircraft, Airline Industry Information. 20 explain that no Chinese carrier currently offers nonstop service between Beijing and Washington, D.C. and there may be demand for adding this international service.80 As Kasper and Amel detail in their declaration, the impact of Air China adding a single daily Boeing 777 flight between Washington, D.C., and Beijing would be substantial. This flight would compete not only with connecting service by U.S. airlines to Beijing from Washington, D.C., but also with connecting service by U.S. airlines to numerous other destinations that Air China would serve from Washington, D.C., through its Beijing hub.81 Relying on conservative estimates, Kasper and Amel project that Washington-based expansion by Air China would likely cause U.S. airlines to lose between 9,521 and 24,850 passengers per year.82 These lost passengers would account for 4.7% to 12.3% of total passengers carried by U.S. airlines on competing routes, vastly exceeding the 1% statutory test for substantial injury. See 12 U.S.C. § 635(e)(1), (4). Moreover, Air China’s increase in capacity and aggressive pricing (subsidized by the Bank’s below-market financing) would likely force U.S. carriers to lower prices, reducing their revenues even further.83 Kasper and Amel estimate that U.S. airlines would lose between $10.4 million and $29.6 million in annual revenue from just one additional Beijing-Washington, D.C., flight.84 As past experience has shows, lost profits from subsidized foreign competition translate directly into reduced routes for U.S. airlines and reduced wages and lost jobs for U.S. 80 Kasper-Amel Decl. at 18-19; see Helman Decl. Ex. 23, Air China Builds its N. American Network, CAPA Center for Aviation (speculating that Air China may add “another San Francisco service, up-gaug[e] Houston to daily, or introduc[e] a new city”). 81 Kasper-Amel Decl. at 18-20, 24. 82 Id. at 23. 83 Id. at 22-23. 84 Id. Kasper and Amel show that their estimated revenue losses understate the full impact on U.S. airlines since the estimates do not account for the likely price decreases on overlapping routes that would result from the influx of additional capacity that Air China flights would provide. Accounting for these further losses, Kasper and Amel estimate that U.S. carriers stand to lose anywhere between $14 million and $39 million in annual revenue. Id. at 23. 21 airline employees.85 This impact would be multiplied if Air China expands to additional U.S. cities or increases capacity in the cities that it currently serves.86 Thus, the impact of the Guarantee on U.S. carriers will be substantial by any measure.87 V. Conclusion For all of the reasons given above and in the attached declarations and exhibits, the Bank should deny Air China’s application for financing. At a minimum, the Bank should perform a detailed economic analysis of this transaction and make the results available to the commenters in this case. Delta, Hawaiian, and ALPA request that the Bank’s Board of Directors consider this comment before reaching a decision on Air China’s application as required by 12 U.S.C. § 635a(c)(10)(E), and that the Bank respond in writing to this comment and the attached declarations within 30 days of making a final decision on the Guarantee, as required by § 635a(c)(10)(F). 85 See, e.g., Air Transp. Ass’n of Am. v. Exp.-Imp. Bank of United States, 878 F. Supp. 2d 42, 57 (D.D.C. 2012) (detailing Delta’s discontinuation of New York-to-Mumbai service due to Bank-backed competition from Air India). 86 Kasper-Amel Decl. at 23-24. 87 Because the Bank has not provided financial information about Boeing’s costs of building the aircraft at the heart of this transaction, the commenters are unable to evaluate whether there is a net economic benefit to the transaction. However, in conducting this Stage IV analysis, the Bank must be mindful that a large amount of Boeing’s aircraft parts are outsourced to other countries, and do not result in an economic benefit for the U.S. workforce. See Public EIP Comments at 54. 22