APR DRG - Connecticut Medical Assistance Program

advertisement

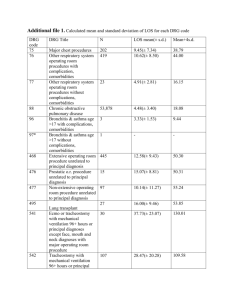

Hospital Modernization Implementation/ APR DRG Workshop Presented by The Department of Social Services & HP Enterprise Services 1 Training Topics • Hospital Modernization Overview • Inpatient Payment Methodology • Hospital Billing Changes – Interim Claims • 3M APR DRG Assignment Tool • DRG Pricing Calculator • Transfer Claims • Interim Claims • Partial Eligibility Claims • Outlier Claims • Organ Acquisition Cost RCC 81X • Claims Paid at Per Diem Rate • Health Care Acquired Condition (HCAC) / Present on Admission (POA) • Ungroupable Diagnosis Codes • Remittance Advice / Health Care X12 835 • Explanation of Benefit (EOB) Codes • Hospital Modernization Web Page CT interChange MMIS 2 Hospital Modernization Overview The purpose of this workshop is to educate hospitals that, as required by section 17b-239 of the Connecticut General Statues, the Department of Social Services (DSS) is changing inpatient hospital reimbursement for general acute care hospitals and children’s hospitals from the current model of interim per diem rates and case rate settlements to an APR DRG system where hospital payments will be established prospectively for inpatient stays with a date of admission on or after January 1, 2015. CT interChange MMIS 3 Hospital Modernization Overview • These changes do not apply to chronic disease hospitals, psychiatric hospitals or free-standing birth centers. • These changes do not apply to inpatient admissions prior to January 1, 2015 even if the client is discharged after January 1, 2015. They will continue to processing using the current methodology. • APR DRG will apply to out-of-state and border hospitals enrolled in the Connecticut Medical Assistance Program (CMAP). CT interChange MMIS 4 Hospital Modernization Overview • What is APR DRG? –In general, every complete inpatient stay is assigned to a single diagnosis related group (DRG) using a computerized algorithm that takes into account the patient’s diagnoses, age, procedures performed, and discharge status. –Each DRG has a relative weight that reflects the typical hospital resources needed to care for a patient in that DRG relative to the hospital resources needed to take care of the average patient. • DSS has selected 3M's APR DRG methodology. HP will integrate 3M's grouper software into its interChange claims processing system. –Version 31 of APR DRGs will be implemented January 1, 2015. There are approximately 1,200 groups or APR DRG values. CT interChange MMIS 5 Inpatient Payment Methodology • Base DRG payment is calculated by [Hospital Base Rate * DRG Weight]. • DRG Weight, Average Length of Stay (ALOS), and Outlier Threshold for the DRG code will be located on the DRG pricing calculator spreadsheet on a tab titled DRG Table CT. This will be posted to the Web site www.ctdssmap.com on the Hospital Modernization page under the “DRG Calculator”. The DRG weight and ALOS are national standards. The outlier thresholds were developed specifically for CT through the rate setting process. • Hospital Base Rate were sent to the hospitals separately. CT interChange MMIS 6 Inpatient Payment Methodology • Hospital’s payment will not exceed the total amount billed on inpatient claims with an admission or after January 1, 2015. • Hospitals are not required to submit the DRG code on the inpatient claim. The Connecticut Medical Assistance Program (CMAP) claims processing system assigns the APR DRG to the claim and calculates the payment. CT interChange MMIS 7 Hospital Billing Changes – Interim Claims • Historically hospitals would submit interim claims for the following reasons: –If the inpatient stay overlaps the hospital’s fiscal period. –If the inpatient stay overlaps a calendar year. –If the inpatient stay overlaps a hospital rate change. For inpatient claims that overlap a hospital rate change, the inpatient claim will be priced based on the DRG rates on file based on the date of discharge. –If the client is only covered for part of the inpatient stay. The hospital will be required to submit for the entire admission with all charges and services related to the admission. CT interChange MMIS 8 Hospital Billing Changes – Interim Claims • For inpatient claims with an admission date prior to January 1, 2015, interim billing, sometimes referred to as split-bills or interim claims, may continue to be billed. • Effective with inpatient hospital admissions on or after January 1, 2015, interim claims can no longer be billed by the hospital, with one exception. –One interim claim may be billed when the actual length of stay reaches 29 days. –For example, if the hospital stay spanned 1/1/2015 – 2/25/2015, the hospital can bill one interim claim with a date span of 1/1/15 – 1/29/15 (29 days) or greater with a patient status 30 “Still a Patient” and Type of Bill (TOB) 112 “Inpatient – First Claim”. CT interChange MMIS 9 Hospital Billing Changes – Interim Claims • Newly created Explanation of Benefit (EOB) codes have been created to deny the following inpatient claims: –EOB code 0674 “DRG Interim Claims not Allowed” If an inpatient claim is submitted with a patient discharge status of 30 “Still Patient”, indicating the patient is still in the hospital, it will be denied with EOB code 674 “DRG interim claims not allowed” if the number of days submitted is less than 29 days for admission on or after January 1, 2015. –EOB code 5075 “Only One Interim Claim Allowed Per Stay” If a second interim bill is submitted and there is a paid interim claim for the same admit date in history. • Hospitals can adjust an interim claim, replacing it with an extended interim claim. CT interChange MMIS 10 Hospital Billing Changes – Interim Claims • Newly created Explanation of Benefit (EOB) codes have been created to deny the following inpatient claims: –EOB code 5076 “Paid Interim and Final Claim For Same Admission Not Allowed” If the final inpatient claim is submitted with an interim claim still paid in history, the claim will be denied with EOB code 5076. • Once the client is discharged, the interim claim must be either adjusted, or recouped and resubmitted, for the entire stay. CT interChange MMIS 11 DRG Pricing Calculator • DRG Pricing Calculator – A calculator spreadsheet is available to assist hospitals in calculating payment for a single inpatient claim with the input of only a few data elements. –Elements include, but are not limited to, the following: DRG and Severity of Illness (SOI) code, hospital base rate, hospital cost-to-charge ratio, and submitted charges. –Hospitals might need to include additional information such as; if the client was only eligible for part of an inpatient admission or if the client was a transfer from one hospital to another. • The DRG pricing calculator is ready for use and has been posted to the Hospital Modernization Web page under DRG Calculator. CT interChange MMIS 12 DRG Pricing Calculator • The DRG Pricing Calculator includes the following tabs: –Cover - The "Cover" worksheet contains an introduction to the APR DRG Calculator and offers Web sites where stakeholders can learn more about the Connecticut Medical Assistance Program's (CMAP) inpatient APR DRG pricing method. –Structure - The "Structure" worksheet contains a synopsis of the information provided in the DRG Calculator spreadsheet. –Calculator Instructions - The "Calculator Instructions" worksheet contains a description of the data that must be entered to estimate the CMAP payment amount for an inpatient hospital stay. The instructions also describe the calculations being made to determine the payment amount. CT interChange MMIS 13 DRG Pricing Calculator • The DRG Pricing Calculator includes the following tabs: cont. –Interactive Calculator - The "Interactive Calculator" worksheet is the primary worksheet in the APR DRG Pricing Calculator spreadsheet. All other worksheets exist to support the "Interactive Calculator”. The user can enter just a few data elements describing an individual hospital admission at the top of the "Interactive Calculator" and an estimate of the CMAP payment for that admission will be displayed at the bottom of the Calculator. • One of the fields to enter in the interactive calculator is the APR DRG code. Hospitals are not required to submit the APR DRG code on their inpatient claims. However, we do offer a way for the hospitals to identify the appropriate APR DRG code using 3M Health Information Systems software. CT interChange MMIS 14 3M APR DRG Assignment Tool • 3M Health Information Systems has made a tool available to the hospitals to determine the APR DRG based on input of several data elements. –The tool is available on the Web site www.aprdrgassign.com. In order to access this Web site, users will be required to enter a User ID and Password. To obtain this User ID and Password, please send a request via e-mail to ctxixhosppay@hp.com. • Once you receive the User ID and Password, you will need to read the terms and conditions and enter the User ID and Password to accept the agreement and log into the site. CT interChange MMIS 15 3M APR DRG Assignment Tool • 3M Health Information Systems • Click on the APR DRG Assignment Report. CT interChange MMIS 16 3M APR DRG Assignment Tool • 3M Health Information Systems • Click on APR Calculator. CT interChange MMIS 17 3M APR DRG Assignment Tool • 3M Health Information Systems –Data Entry Tab - Demographics CT interChange MMIS 18 3M APR DRG Assignment Tool • 3M Health Information Systems –Data Entry Tab - Demographics 1. Grouper Version – Select from drop down “APR DRG Grouper” v31.0 (10/01/13) ICD-9 2. Grouping Type – There are two options for the grouping type: Discharge DRG and Admission/Discharge DRG. The grouping type determines if the report will include both Admission and Discharge information, or just Discharge information. − Select: Admission/Discharge DRG (Excludes non-POA (Present on Admission) Complication of Care codes). CT interChange MMIS 19 3M APR DRG Assignment Tool • 3M Health Information Systems - Data Entry Tab - Demographics 3. Case ID – User can enter any alphanumeric code to identify their case. 4. Sex – Select Male, Female, or Unknown. 5. Discharge Status – Select the patient status on the claim from the drop down selection. 6. Admission Age – Enter the age of the client at the time of admission in days or years. 7. Admission Date and Discharge Date – Enter the date of admission and discharge date of the inpatient stay. 8. Birth Weight Option – Select 7 “Entered or coded w/default, X-chk”. 9. Birth Weight (Grams) – Enter weight of newborn in grams. 10. Days on Mech. Vent. – Leave Blank CT interChange MMIS 20 DRG Pricing Calculator • 3M Health Information Systems - Data Entry Tab – Codes – Diagnoses • Enter the diagnosis on the claim beginning with the Principal Diagnosis (PDX). • Enter the corresponding Present on Admission (POA) indicator for each diagnosis. CT interChange MMIS 21 3M APR DRG Assignment Tool • 3M Health Information Systems - Data Entry Tab – Codes – Procedures • Enter all the procedure codes with their corresponding dates from the inpatient claim. CT interChange MMIS 22 3M APR DRG Assignment Tool • 3M Health Information Systems – Output Report • Once all information has been entered, under the output report tab, click on “Click here to see output report” to get the report on your request which will include the APR DRG and SOI code for the inpatient stay. CT interChange MMIS 23 3M APR DRG Assignment Tool • Example 1 – Inpatient stay admitted on January 11, 2015 and discharged on January 21, 2015 with a discharge status 01 for a female client 34 years old. CT interChange MMIS 24 3M APR DRG Assignment Tool • Example 1 – Enter Diagnosis and ICD Surgical Procedure codes. CT interChange MMIS 25 3M APR DRG Assignment Tool • Example 1 – Output Report – Identifying DRG and SOI code as 139-3. CT interChange MMIS 26 DRG Pricing Calculator • Interactive Calculator • Each field is defined under the Calculator Instructions, but the fields highlighted in green are required to be entered by the user. –Submitted Charges – UB-04 field locator 47. –Non-covered Charges – UB-04 field locator 48. This would include charges for non-covered days. –Length of Stay – This is used in pricing transfer stays or partial eligibility. The length of stay equals discharge date minus admit date, unless the discharge date equals the admit date, in which case length of stay is 1. Inpatient stay admitted on January 11, 2015 and discharged on January 21, 2015, the hospital would enter 10. CT interChange MMIS 27 DRG Pricing Calculator the stay is for a transfer claim, the length of stay will equal discharge date minus admit date plus one day. If Inpatient stay admitted on January 11, 2015 and transferred on January 21, 2015, the hospital would enter 11. –Client Eligible Days – Used for non-covered days adjustments. Enter the number of days the client is eligible during the stay, In most cases this will equal the full length of stay including transfer claims. –Was patient transferred with discharge status = 02 or 05? - Enter Yes or No from the drop down box. –Organ Acquisition Costs – If billing RCC 81X, enter billed amount. –Practitioners Costs – If the hospital’s bills 96X, 97X, 98X on the institutional claims instead of CMS-1500 the service will be denied on the claim and the hospital needs to enter the billed amount in this field. CT interChange MMIS 28 DRG Pricing Calculator –Third Party Liability (TPL) – Enter TPL payment. –Provider AVRS ID and Name – Fields are optional and do not affect the DRG calculations. –Hospital Base Rate – Enter the individual hospital’s base rate. • Hospital Base Rates were sent to the hospitals separately. –Hospital cost-to-charge ratio – Enter the individual hospital’s cost-to-charge ratio which was included with the hospital’s base rate from DSS. • Once you entered all the information, the DRG pricing calculator will estimate the APR DRG allowed amount (E45) and payment amount (E48). CT interChange MMIS 29 DRG Pricing Calculator • Example 1 – Inpatient stay admitted on January 11, 2015 and discharged on January 21, 2015 with a discharge status 01 for a female client 34 years old. Total charges $25,000, APR DRG 1393, APR DRG weight 0.9394, Average Length of Stay (ALOS) of 4.51, and DRG Outlier Threshold of $30,251.98. The Hospital base rate is $4,750.00 and Hospital cost-to-charge ratio is 0.42826. • APR DRG weight, ALOS and DRG Outlier Threshold amounts are found under the DRG Table CT on the DRG Pricing Calculator. CT interChange MMIS 30 DRG Pricing Calculator • DRG Table CT - The "DRG Table CT" is the final tab under the DRG calculator that contains a list of the APR DRG codes and parameters used in pricing individual hospital inpatient stays. APR DRG codes, descriptions, national relative weights, and Average Lengths of Stay (ALOS) are determined by 3M Health Information Systems. The DRG Outlier Thresholds were developed specifically for CT through a rate setting process. CT interChange MMIS 31 DRG Pricing Calculator CT interChange MMIS 32 DRG Pricing Calculator • Payment amount is $4462.15. • EOB code 8600 “Reimbursed via DRG Pricing” will post to claims that pay at DRG pricing. CT interChange MMIS 33 DRG Pricing Calculator • Example 2 – Inpatient stay admitted on January 28, 2015 and discharged on January 30, 2015 with a discharge status 06 for a female client 47 years old with a TPL payment of $300. Total charges $16,491.77, APR DRG 1973, APR DRG weight 0.9773 with a DRS Outlier Threshold of $32,434.45. Hospital base rate is $5,178.56 and Hospital cost-to-charge ratio is 0.28484. • TPL amount needs to be entered on the interactive calculator to calculate the correct payment amount. CT interChange MMIS 34 DRG Pricing Calculator • Third Party Liability entered as $300.00. CT interChange MMIS 35 DRG Pricing Calculator • APR DRG allowed amount was $5,061.01 minus TPL payment $300.00, actual payment amount is $4,761.01. CT interChange MMIS 36 Transfer Claims • Transfer claims are identified with a patient status 02 “Discharged/transferred to another short-term general hospital for inpatient care” or 05 “Discharged/Transferred to a Designated Cancer Center or Children's Hospital”. All other transfer related discharge statuses are paid at the full DRG rate. • If the claim is a transfer claim, the transferring hospital receives a prorated payment based on the number of days on the claim compared to the average length of stay for the assigned DRG. –The Length of Stay (LOS) on the transferring hospital claim is increased by one to reflect that a larger percent of the cost is incurred on the first day of an inpatient stay. • Transfer claim payment is based on a Prorated payment calculated by the following formula not to exceed the pretransfer APR DRG base payment: (Base DRG Payment /ALOS ) * (LOS +1) CT interChange MMIS 37 Inpatient Payment Methodology – Transfer Claims • If the transfer claim assigns DRG 580X or 581X, it will pay the full DRG rate and will not be paid a transfer rate even if the discharge value is a transfer value of 02 or 05. • Transfer Claim – Example 1 −Inpatient stay admitted on January 6, 2015 and discharged on January 9, 2015 with a patient status 02 for a male client 22 years old. Total charges $15,000 APR DRG 3512, APR DRG weight 0.5584, ALOS 2.71 and a DRG Outlier Threshold as $30,000. Hospital base rate is $5178.56 and Hospital cost-tocharge ratio is 0.28484. CT interChange MMIS 38 Transfer Claims • Length of stay and client eligible days should be entered as 4 days (LOS +1). In the field “Was patient transferred with discharge status = 02 or 05?” select “Yes” from the drop down. CT interChange MMIS 39 Transfer Claims • Transfer base payment $4,268.21 is greater than APR DRG base payment $2,891.71 so the payment amount will be $2,891.71. • EOB code 8604 “Reimbursed with DRG Transfer Rate” will post to transfer claims. CT interChange MMIS 40 Transfer Claims • Transfer Claim – Example 2 −Inpatient stay admitted on January 12, 2015 and discharged on January 14, 2015 with a patient status 02 for a male client 22 years old. Total charges $17,500, APR DRG 2803, APR DRG weight 1.0089, ALOS 4.04, and a DRG Outlier Threshold is $32,710.92. Hospital base rate is $5178.56 and Hospital cost-to-charge ratio is 0.28484. CT interChange MMIS 41 Transfer Claims • Length of stay entered as 3 days (LOS +1). CT interChange MMIS 42 Transfer Claims • Transfer base payment is $3879.69 is less than APR DRG base payment of $5,224.65 so the payment amount will be $3,879.69. CT interChange MMIS 43 Interim Claims • Interim claims are calculated based on the following formula: Length of Stay (admission date to through date) * (Base DRG payment/ALOS) Payment example of an interim claim • Inpatient claim with a date span of 1/1/2015 – 2/25/2015 and the hospital chooses to bill for the first 30 days of the admission as an interim bill. The Base DRG payment of $37,961.85 and the Average Length of Stay (ALOS) for DRG 6022 is 42.49. Length of Stay (admission date to through date) * (Base DRG payment/ALOS) 30 * ($37,961.85/42.49) = 30 * ($893.43) = $26,802.91 • The DRG pricing for the interim bill is $26,802.91. CT interChange MMIS 44 Interim Claims • Average Length of Stay (ALOS) for DRG 6022 is 42.49 CT interChange MMIS 45 Interim Claims • Base DRG payment of $37,961.85 • Interim claims do not pay out using the DRG calculator, it is based on the formula so in this example the payment amount would be $26,802.91, not based on the calculator $37,961.85. CT interChange MMIS 46 Partial Eligibility Claims • Partial Eligibility claims are calculated on a prorated payment using the following formula: –Base DRG Payment * [number of days eligible/LOS of claim (through date – admit date)]. • Example of a Partial Eligible Inpatient Claim Payment • Client is only eligible for 2 days out of a 4 day inpatient admission. Base DRG Payment for is $10,389.74 and the client was admitted to the hospital on January 6, 2015 and discharged on January 10, 2015, but only eligible from January 8, 2015 to January 10, 2015 for 2 days. $10,389.74 * (2/4) = $10,389.74 * (.50) = $5,194.87 CT interChange MMIS 47 Partial Eligibility Claims • DOS (Admit – through) of claim is 1/6 – 1/10 – length of stay is 4. Eligibility is 1/8 – 1/10, client was eligible the night of the 8th and the 9th, client eligible days are entered as 2. CT interChange MMIS 48 Partial Eligibility Claims • The DRG pricing for the partially eligible claim is $5,625.92. • EOB code 8605 “Reimbursed with Prorated Eligibility Adjustment” will set to partial eligible claims that pay at a prorated rate. CT interChange MMIS 49 Partial Eligibility Claims • Example of a Partial Eligible Inpatient Claim Payment • Client is only eligible for 2 days out of a 6 day inpatient admission. −Base DRG Payment for is $9,426.53 and the client was admitted to the hospital on January 1, 2015 and discharged on January 7, 2015, but only eligible from January 1, 2015 to January 3, 2015 for 2 days. $9,426.53 * (2/6) = $9,426.53 * (.333333) = $3,142.17 CT interChange MMIS 50 Partial Eligibility Claims • DOS (Admit – through) of claim is 1/1 – 1/7 – length of stay is 6. Eligibility is 1/1 – 1/3, client was eligible the night of the 1st and the 2nd, client eligible days are entered as 2. CT interChange MMIS 51 Partial Eligibility Claims • The DRG pricing for the partially eligible claim is $2,946.25. CT interChange MMIS 52 Outlier Claims • The Department recognizes that, due to the complexity of the illness or other complicating conditions, there are stays that are costly in relation to other stays within the same APR DRG assignment. APR DRG methodology’s implementation includes a provision to pay additional amounts for these cases that have significant outliers where costs are far above those envisioned in the development of the DRG rates. • Outlier methodology will be based on a cost outlier threshold established through a statistical formula based with a minimum threshold per DRG. CT interChange MMIS 53 Outlier Claims • Outlier Payments are calculated based on the following formula: −(Hospital Specific estimated cost of the stay – APR DRG base payment) – DRG Outlier Threshold * 75% = Cost Outlier Payment. Hospital specific estimated cost of the stay is calculated based on the following formula: Allowed Charges * Hospital Cost-to-Charge Ratio (were sent to the hospitals separately) = Hospital specific estimated cost of the stay. Allowed charges = Total Charges (claim) – non-covered charges (claim) – organ acquisition costs- practitioner costs. • The Cost Outlier Payment will be added to the APR DRG base payment to calculate the payment amount on the claim. CT interChange MMIS 54 Outlier Claims • Allowed Charges $75,000 – $1,000 - $8,725 - $500 = $64,775.00. CT interChange MMIS 55 Outlier Claims • Allowed Charges $64,775.00 * Hospital cost-to-charge ratio 0.21484 = Hospital specific estimated cost of the stay $13,916.26. CT interChange MMIS 56 Outlier Claims • Example of an Outlier Payment • Inpatient stay admitted on January 9, 2015 and discharged on February 25, 2015 with a patient status 01 for a female client 53 years old. Total charges $90,366.00, APR DRG 0422, APR DRG weight 0.6838, ALOS 5.78, and a DRG Outlier Threshold as $30,000 at an outlier percentage of 75%. Hospital base rate is $5,772.93 and Hospital cost-to-charge ratio is 0.47008. CT interChange MMIS 57 Outlier Claims CT interChange MMIS 58 Outlier Claims Cost Outlier Payment = [(Hospital Specific estimated cost of the stay – APR DRG base payment) – DRG Outlier Threshold] * 75% −Cost Outlier Payment =[($42,479.25 - $3,947.53) - $30,000] * 75% −Cost Outlier Payment =($38,531.72 - $30,000) * 75% −Cost Outlier payment =$8,531,72 * 75% −Cost Outlier payment =$6,398.79 will be added to the payment CT interChange MMIS 59 Outlier Claims • Cost Outlier Payment + APR DRG base payment = Payment Amount. –$6,398.79 + $3,947.53 = Payment Amount of $10,346.32. • EOB code 8603 “DRG Outlier Amount Applied” will post to claims that hit a DRG Outlier Threshold adjustment. • Organ Acquisition Cost Revenue Center Code (RCC) 81X, Practitioner Costs RCC 96X, 97X, 98X and non-covered charges are excluded from calculation of outliers. If the hospital bills for these services, they must enter it on the DRG calculator to ensure the DRG calculator payment amount is correct. CT interChange MMIS 60 Outlier Claims • Organ Acquisition Cost Revenue Center Code (RCC) 81X, Practitioner Costs RCC 96X, 97X, 98X and non-covered charges are excluded from calculation of outliers and should be entered in the fields below on the DRG calculator. CT interChange MMIS 61 Organ Acquisition Cost RCC 81X • Organ Acquisition costs (RCC 81X) will be reimbursed outside of the APR DRG payment methodology effective with admissions on or after January 1, 2015. Claims that contain organ acquisition charges will be suspended to allow the claim to be manually priced. Once finalized, these claims will contain both a DRG payment and an organ acquisition payment and will include EOB 6000 “Claim was Manually Priced or Denied for Missing Information”. • Prior authorization for the hospital stay covers the authorization for the organ acquisition cost. CT interChange MMIS 62 Claims Paid at Per Diem Rate • APR DRG payment will be applied to all inpatient claims from acute care hospitals except the following: –Inpatient Behavioral Health Claims DRG range 740 – 776 –Inpatient Rehabilitation Claims DRG 860 • The DRG calculator should not be used to price claims that are exempt from the inpatient payment methodology. CT interChange MMIS 63 Claims Paid at Per Diem Rate • The following EOB codes will post to claims paying at per diem rate: –EOB code 8606 “Reimbursed via General BH Pricing” will post to inpatient behavioral health claims DRG range 740 – 776. –EOB code 8607 “Reimbursed via Rehab Pricing” will post to inpatient rehab claims DRG 860. CT interChange MMIS 64 Health Care Acquired Condition (HCAC) / Present on Admission (POA) • Health Care Acquired Condition (HCAC) is an undesirable situation, or condition that affects a patient, that arose during a stay in a hospital or medical facility. • The Patient Protection and Affordable Care Act (PPACA) requires that states not pay for provider preventable conditions including health care acquired conditions (HCACs) and other providerpreventable conditions (OPPCs). • Providers currently report health care acquired conditions using Present on Admission (POA) indicators on inpatient claims. However, they are only validated for presence and validity. CT interChange MMIS 65 Health Care Acquired Condition (HCAC) / Present on Admission (POA) • Present on Admission Indicator – Y - Diagnosis was present at the time of inpatient admission. – N - Diagnosis was not present at the time of inpatient admission. – U - Documentation insufficient to determine if the condition was present at the time of inpatient admission. – W - Clinically undetermined. Provider unable to clinically determine whether the condition was present at the time of inpatient admission. – Blank - As long as the corresponding diagnosis is on the POA exempt list. http://www.cms.gov/HospitalAcqCond/Downloads/POA_Exem pt_Diagnosis_Codes.zip CT interChange MMIS 66 Health Care Acquired Condition (HCAC) / Present on Admission (POA) • HCAC is identified by POA indicator = N (Diagnosis was not present at the time of inpatient admission) or U (Documentation insufficient to determine if condition was present at the time of inpatient admission). • The implementation of DRGs for inpatient admissions on or after January 1, 2015 will enable Connecticut to change the administration of how claims with a HCAC are reimbursed. • While the OPPC and HCAC portion of this policy was previously handled through the cost settlement process, going forward, this policy will be administered in claims processing. CT interChange MMIS 67 Health Care Acquired Condition (HCAC) / Present on Admission (POA) • For inpatient claims with dates of admission 1/1/2015 and after, hospitals will not receive the higher DRG payment for cases when one of the selected conditions (see table 1 and 2) is acquired during hospitalization (i.e., was not present on admission). • EOB 8601 “Claim Contained HCAC - Priced at a Lower Rate” will post to a claim if the HCAC code caused the claim to pay at a lower rate • EOB 8602 “Claim Contained HCAC – No Impact to Pricing” will post to claims that include a HCAC code and had no impact to pricing. CT interChange MMIS 68 Health Care Acquired Condition (HCAC) / Present on Admission (POA) • Table 1 and 2 can be viewed on the Hospital Modernization Web page under the Health Care Acquired Condition (HCAC) / Present on Admission (POA) link. • Table 1 is a list of diagnosis codes that will impact the DRG payment when the POA indicator is either “N” or “U”. • Table 2 is a list of both diagnosis and surgical procedure codes that when billed on the claim with a POA indicator of “N” or “U” will impact the DRG payment. CT interChange MMIS 69 Ungroupable Diagnosis Codes • Effective with dates of admission on or after January 1, 2015, diagnosis codes identified by ICD-9-CM to “Use Additional Digits” will no longer be accepted as valid diagnosis codes on an inpatient claim. These diagnosis codes are considered ungroupable in 3M's grouper software. • As an example, diagnosis code 250 Diabetes Mellitus requires the use of additional digits. If a claim is submitted with this diagnosis code, the claim will deny with a newly created EOB code. CT interChange MMIS 70 Ungroupable Diagnosis Codes • If a claim is submitted with one of these diagnosis codes, the claim will be assigned DRG code 955 and deny with a newly created EOB code 0690 “Principal Diagnosis Invalid as Discharge”. • If the inpatient claim returns with DRG 956 “Ungroupable”, it means the DRG could not be determined based on the information on the inpatient claim. –The inpatient claim will deny with EOB code 0691 “DRG 956 – Ungroupable”. • Additional EOB codes 0920-0927 will deny the claim if invalid information is submitted on the claim and a DRG code cannot be returned. CT interChange MMIS 71 Ungroupable DRG Codes • If the inpatient claim returns with DRG 956 “Ungroupable”, it means the DRG could not be determined based on the information on the inpatient claim. • The inpatient claim will deny with EOB code 0691 “DRG 956 – Ungroupable”. • Additional EOB codes 0920-0927 will deny the claim if invalid information is submitted on the claim and a DRG code cannot be returned. CT interChange MMIS 72 Remittance Advice and ASC X12N 835 • The DRG and severity code will be added to the hospital’s Remittance Advice (RA) in 2015. • DRG and SOI code – DRG 197 and SOI 3. • EOB code 8600 “Reimbursed via DRG Pricing”. CT interChange MMIS 73 Remittance Advice and ASC X12N 835 • An updated copy of the new RA will be posted to Provider Manual Chapter 5 “Claim Submission Information”. • The ASC X12N 835 Health Care Claim Payment/Advice, which is an electronic RA will be updated to include additional DRG related fields. Once the new fields are confirmed, the Hospital FAQs will be updated. CT interChange MMIS 74 Explanation of Benefit (EOB) Codes • A full list of new EOBs codes once finalized and approved will be posted to Provider Manual Chapter 12 “Claim Resolution Guide”. The provider manuals can be downloaded by going to the www.ctdssmap.com Web site. Go to Information, click on Publications and scroll down to Provider Manual Chapter 12 “Claim Resolution Guide”. CT interChange MMIS 75 Hospital Modernization Web Page • Where to go for more information: www.ctdssmap.com • Hospital Modernization Web Page –The Web page includes Quick links, DRG Provider Publications, Hospital FAQs, Hospital Important Messages, DRG Calculator, Provider Manual updates, Provider Training, and Contact Information. CT interChange MMIS 76 Hospital Modernization Web Page CT interChange MMIS 77 Hospital Modernization Web Page CT interChange MMIS 78 Training Session Wrap Up • Where to go for more information: www.ctdssmap.com –Provider Bulletins • 2014-79 IP Hospital Payment Modernization/APR DRG • DSS Reimbursement Home Page http://www.ct.gov/dss/cwp/view.asp?a=4598&q=538256 • HP has also made available an email address, ctxixhosppay@hp.com, that can be used to submit questions related to APR DRG reimbursement. • Provider Manual Chapter 7 Update – To access the updated provider manual go to “Publications,” then scroll to “Provider Manual Chapter 7,” and then choose “Hospital Inpatient: New Requirements Eff. 1-1-15” from the drop down menu. CT interChange MMIS 79 Training Session Wrap Up • HP Provider Assistance Center (PAC): Monday through Friday, 8 a.m. to 5 p.m. (EST), excluding holidays: –1-800-842-8440 –1-800-688-0503 (EDI Help Desk) CT interChange MMIS 80 Time for Questions • Questions & Answers CT interChange MMIS 81