Available online at

http://www.anpad.org.br/bar

BAR, Curitiba, v. 6, n. 3, art. 6,

p. 263-279, July/Sept. 2009

The Stockouts Study: an Examination of the Extent and

the Causes in the São Paulo Supermarket Sector

Luis Henrique Rigato Vasconcellos *

E-mail address: lhenrique@espm.br

Escola Superior de Propaganda e Marketing

São Paulo, SP, Brazil.

Mauro Sampaio

E-mail address: mauro.sampaio@fgv.br

Fundação Getulio Vargas

São Paulo, SP, Brazil.

ABSTRACT

Stockouts remain a significant retail problem. Progress has been limited, as estimates of stockout rates in the past

forty years have consistently averaged above 8 percent. The purpose of this study is to investigate the importance

and extent of the stockout problem in the supermarket sector in the state of São Paulo, Brazil, from the

perspective of the supermarket managers themselves. Results suggest that the level of stockouts is high.

Generally, the suppliers are mentioned as being the ones mainly responsible for stockouts. These results suggest

that managers have significant opportunities to reduce retail stockouts by taking preventative actions.

Key words: stockout; retail; logistics; supermarkets.

Received 19 October 2008; received in revised form 06 March 2009.

Copyright © 2009 Brazilian Administration Review. All rights reserved, including rights for

translation. Parts of this work may be quoted without prior knowledge on the condition that

the source is identified.

* Corresponding author: Luis Henrique Rigato Vasconcellos

Rua Itapeva, 474, 8o andar, São Paulo, SP, 01332-000, Brazil.

Luis Henrique Rigato Vasconcellos, Mauro Sampaio

264

INTRODUCTION

This study defines a stockout as a situation where an item that is regularly commercialized at a point

of sale and occupies a specific place on the shelves is not available to the consumer in the store at the

moment of purchase. A stockout is characterized by an inefficient process of refilling shelves. A

stockout rate is precisely the percentage of all the items commercialized that should be for sale, but are

not found on the shelves. A 10 % rate of stockout means, for example, that out of a total of 5,000

items catalogued and commercialized by a supermarket, 500 would not be available on the shelves for

immediate purchase by the final consumer.

Stockouts are increasingly recognized as a retail problem by both researchers and practitioners.

Estimates of stockout rates in retail stores have consistently averaged above 8 percent, the rates

reported from Peckham (1963) to Gruen, Corsten and Bharadwaj (2002) are reasonably similar. Retail

stockout problems have been studied from two major perspectives: measurement of stockout rates in

stores and consumer response to stockouts (Roland Berger, 2003; Zinn & Liu, 2001). Regardless of

the perspective guiding the research, most studies suggest that managers deal with stockouts by taking

action to reduce the number of stockouts as much as possible (Corsten & Gruen, 2003; Roland Berger,

2003).

While taking action to reduce the number of stockouts is clearly an important component of stockout

management, it is likely insufficient to solve the problem. There are two major reasons for this. First,

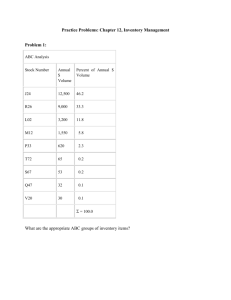

despite all efforts so far, stockout rates have remained high over a prolonged period of time, as shown

in Figure 1. The rates reported by Peckham (1963) match Roland Berger (2003), remaining around the

level of 8.0 %, while other research published within this forty-year time span reported similar rates.

Second, the stockout problem is becoming more difficult to manage due to the continued trends of

product proliferation, scrambled merchandising and shorter product life cycles. It seems evident that

stockout rates will never be zero.

Figure 1: Percent of Stockout Levels in Previous Studies

15

12,2

8,5

8,2

8,3

% Stockout

10

7,1

5

0

Peckham 1963

Progressive Grocer

1968

Andersen

Consulting 1996

Gruen et. al 2002

Roland Berger 2003

Consequently, stockouts should be managed with a combination of efforts to (1) reduce the number

of stockout instances and (2) offer remedies to manage the consumer’s response whenever the

stockout is unavoidable or is too expensive to eliminate (Anderson, Fitzsimons, & Simester, 2006;

Bhargava, Sun, & Xu, 2006). While international literature is rich in studies along these two lines,

Brazilian literature lacks information about stockouts in its market. The theme is a concern to both

retailers and manufacturers who are equally interested in stockout problems. According to Gruen and

Corsten (2007), in 45 % of the stockout cases the consumers substitute their items, in around 31 % of

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

The Stockouts Study: an Examination of the Extent and the Causes in the São Paulo Supermarket Sector

265

the cases they change stores, and in 14 % of the cases they rarely return. Stockouts were, still are, and

apparently will continue to be an important managerial problem.

The purpose of this research is to investigate the stockout rate in supermarket chains in the state of

São Paulo, Brazil, the measurement methods used and the causes from the perspective of the

supermarket managers themselves. Although some business studies about stockouts have been

conducted (Arthur Charles Nielsen [ACNielsen], 2004), there is still a great deal of room for academic

studies.

In short, the article will attempt to answer the following guiding questions:

. How important are stockouts to supermarket managers?

. What method is used for measuring stockouts?

. What is the stockout rate in supermarkets in the state of São Paulo, Brazil?

. What are the main causes and who are the ones responsible for the stockout problems?

In order to make the investigative process about retail stockouts viable, we conducted a survey with

the managers of supermarkets in the state of São Paulo which were affiliated to the Associação

Paulista de Supermercados (Paulista Supermarket Association [APAS]). The results showed that the

stockout rates are high. Supplier delivery delays are the most mentioned cause. This research suggests

that there are opportunities for reduction of stockout rates through joint actions of industry and retail.

The remainder of this article is divided into four sections. The first is a literature review. This is

followed by a description of the methodology used, including the preparation of the questionnaire and

data collection and analysis. The third section contains the results. The conclusions, limitations and

managerial implications are in the fourth and final section.

LITERATURE REVIEW

The retail stockouts literature began at least forty years ago (Peckham, 1963). During this time

frame, most publications have focused on at least one of two broad issues. One is the measurement of

stockout levels in retail stores and the other is the behavior of consumers in response to a stockout.

Consumers may respond to the stockout by either substituting the item, delaying the purchase or

leaving the store. This response set is known by the acronym SDL. The literature is summarized in

Table 1, with special emphasis on SDL behavior because it is the basis for the framework we use to

measure consumer behavior in this research. Much of this literature is also reviewed in Fitzsimons

(2000) and Zinn and Liu (2001).

The first research to investigate stockouts was Peckham’s (1963), which alerted retailers and

manufacturers to potential losses resulting from stockout. In 1968, Progressive Grocer conducted a

survey about stockouts in hypermarkets. Its main contribution was to identify the different consumer

response to stockouts. This set of attitudes is known as the SDL behavior (Substitute, Delay and

Leave) of the consumer in response to stockouts.

Walter and Grabner’s study (1975) proposed a model that charts all possible consumer responses to

stockouts. This model influenced most future studies on stockouts.

Charlton and Ehrenberg’s study (1976) conducted an experiment with traveling salesmen offering

cleaning products door to door. Stockout situations were created. The authors concluded that

consumers were willing to exchange their favorite brand for another one in a stockout situation.

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

Luis Henrique Rigato Vasconcellos, Mauro Sampaio

266

However, they returned to their favorite brands with the restoration of supplies. The weak point of the

experiment was not to have offered to the consumer the possibility of changing suppliers.

Table 1: Retail Stockouts Literature Related to SDL Behavior

Author

Description

Method

Peckham

(1963)

Measured stockout levels in grocery stores.

Measured also effects on brand loyalty and customer

satisfaction

Exit

Survey

6 17

Progressive

Grocer

(1968)

Documented stockout frequency in supermarkets and

measured SDL behavior

Exit

Survey

28

Walter and

Grabner

(1975)

Proposed a formal model that charted all possible

responses to stockouts.

Survey

Schary and

Christopher

(1979)

Measured SDL behavior with respect to store image,

brand loyalty and demographic variables.

Exit

Survey

Emmelhainz,

Emmelhainz

and Stock.

(1991)

Measured SDL behavior after removing key

products from the shelf

Measured stockout rate and SDL behavior.

Combined store audits, scanner data and personal

interviews with industry and consumers

Multiple

Verbeke,

Farris and

Thurik (1998)

SDL behavior by brand loyalty, store loyalty and

amount of purchase

Field

Experiment

30

Survey

Gruen et al.

(2002)

Measured stockout rates and SDL behavior in a

worldwide study of grocery stores

Secondary

Data

6

Roland

Berger

(2003)

Measured stockout rates and SDL behavior in a

study of European grocery stores

Survey

6

Measured SDL behavior related to brand equity and

hedonic products

Survey

66

15

31

25

42

55

30

27

40

15

21

23

22

21

24

Short-term SDL behavior in terms of consumer and

perceived store characteristics, as well as situational

and demographic variables

Delay

48

83

31

Zinn and Liu

(2001)

Leave

24

39

Survey

Did Not Buy

58

48

Examined product characteristics, consumer

characteristics and situation characteristics as

correlates of SDL behavior.

Sloot,

Verhoef and

Franses

(2005)

19

14

Field

Experiment

Andersen

Consulting

(1996)

Campo,

Gijsbrechts

and Nisol

(2000)

SDL Behavior

62

15

15

27

45

48

48

Substitute

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

The Stockouts Study: an Examination of the Extent and the Causes in the São Paulo Supermarket Sector

267

The Schary and Christopher study (1979) showed that the clients who left the store due to a stockout

were less satisfied, had a worse impression of the store and were less likely to buy there again. The

survey of Emmelhainz et al. (1991) also measured the consumer’s SDL behavior after removing key

products from the shelves.

In an attempt to explain the consumer’s SDL behavior in response to a stockout, the research

conducted by Zinn and Liu (2001) deeply investigated the influence of other variables, such as:

urgency in purchase of item, promotion, brand loyalty, surprise with stockout, pre-visit agenda and

whether or not the consumer is upset with stockout. Following the same line of reasoning, other

authors (Campo et al., 2000; Fitzsimons, 2000; Sloot et al., 2005; Verbeke et al., 1998, among others)

identified a group of new variables that influenced the consumer’s SDL behavior. According to Zinn

and Liu (2001), situational variables such as urgency and level of planning (planned purchase or

impulse purchase) greatly influence the consumer’s decision.

These findings took the theme of stockout to another level of analysis and generalization. The

reasoning now is that it is necessary to understand the variables that influence consumer behavior in

order to be able to help retail businesses discover new ways to minimize the number of consumers

leaving the store and at least encourage the consumer to substitute the item or delay the purchase.

Schary and Becker’s study (1978) investigated the long-term effect of a stockout condition. The

opportunity arose after a strike in an American national brewery that limited their supply of beer in the

Western United States. Consumers switched brands and started to consume local brands. Thirty

months after the end of the strike, the original market share of the national company had still not been

recuperated. The authors concluded that a prolonged period stockout is likely to cause loss of market

share. Straughn (1991) conducted a similar study in which she analyzed scanner data in a chain of

supermarkets. The author studied the effect of stockouts on the market share of candy bars. The effect

of short-term stockouts was considered negligible; however, the effect of a prolonged stockout

condition for a product (more than five weeks) caused losses of 10 % in market share.

Recent studies indicate stockout rates of 8.3% in supply chains for non-perishable consumer goods.

(Gruen et al., 2002; Gruen & Corsten, 2007; Roland Berger, 2003).

This literature review shows that the study of stockouts is a relevant subject, with the potential to

provide sustainable competitive advantages for those organizations that reduce the incidence of

stockouts and/or regain consumers in an effective way.

In Brazil, one of the few stockout studies was conducted by the Retail Services Division of

ACNielsen Brazil in July 2004. The research analyzed the main causes as well as the attitudes of the

consumers when they do not find the product on the shelf. They studied 528 SKUs (Stock Keeping

Units) in 587 self-service stores with 5 or more checkouts; the result was an average stockout rate of

8.0 %. The study also concluded that the stockout causes are distributed all along the supply chain, but

that the main opportunities for improvement were found between the Retail Distribution Center and

the shelves. However, because the sample was restricted to stores in the capital cities of São Paulo and

Rio de Janeiro, it was not possible to make statistical generalizations.

Despite the importance of the subject, academic research about stockouts in supermarkets of

different formats has still not been conducted, and the causes of the stockouts have not been identified.

This study seeks to fill this gap and explore these issues.

METHODOLOGY

The concept of research is a structure that specifies the details of the procedures necessary to obtain

the information that is indispensable in answering the questions being investigated. The choice of the

research schema depends on how much is already known about the problem situation. Since there is

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

Luis Henrique Rigato Vasconcellos, Mauro Sampaio

268

already previous knowledge about the issue of stockouts, although there are no convincing academic

results in the Brazilian case, a survey seems to be recommendable, and its goal is to describe the

relationship among relevant variables, such as the main causes of stockouts and the different kinds of

supermarkets. Thus, we have used a single crossing schema, i.e., the information was obtained from a

single sample (the managers of supermarkets affiliated to APAS). The objective of the study was not

to detect changes, but to extract information about the current stockout stage of the target population.

Recall that the objective of this research is to investigate four fundamental issues:

. How important are stockouts to supermarket managers?

. What method is used for measuring stockouts?

. What is the stockout rate in supermarkets in the state of São Paulo- Brazil?

. What are the main causes and who are the ones responsible for the stockout problems?

Variable Selection

The scales used to prepare the questionnaire were based on the previous literature. The list of

probable stockout causes to be investigated was drawn from Gruen et al. (2002) and the methods for

stockout measurement from Roland Berger (2003) and Andersen Consulting (1996). We also used the

scale available in Gruen and Corsten (2007) to measure stockout frequency.

To measure the importance of stockout, we asked the respondents to prepare a rank of eight

previously selected attributes that they felt were related to the final consumer’s satisfaction based on

their experience and perception (Gruen et al., 2002): clerks are friendly, polite and courteous; low

prices; promotions; variety of goods and service; low stockout levels; cleanliness and tidiness of the

facilities; easy physical access and short lines. The purpose was to identify the importance that the

managers themselves attributed to the stockout factor in relation to the other factors.

We also asked to the respondents to select which method for measuring stockouts was used. There is

no consensus in the literature about even the very definition of stockout, for there are different ways of

measuring it (Gruen et al., 2002). According to the committee of retail professionals, stockout can be

monitored by using the following methods: (a) Visual shelf auditing (b) store inventory level (c)

questions asked directly to the consumer and (d) information from the suppliers, as shown in Table 2.

Table 2: Monitoring of the Different Stockouts in the Chain

Method

Concept

Characteristics

Visual ShelfAuditing

Verification of the

availability of the

product on the

shelves.

- Expensive model

- Systematized

- Measurement

focused on items on

sale (self-audit or

outsourced)

- More effective

measurement from

the client’s

perspective

Store Inventory

Level

Calculation of the

availability of store

products based on

the entrance, exit and

store inventory

records.

- Economic model

- Systematized

- Measurement of

100% of the line

- Critical Factors for

Success:

- Accuracy

- Quick refilling of

shelves

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

Questions to the

Consumer

Questions asked

directly to the

consumer at the

checkout about their

perception of out-ofstock products.

- Economic model

- Non-systematized

- Measurement of

the consumer’s

perception of lack of

products

- Critical Factors for

Success:

- Commitment of

the cashiers

- Veracity of the

information

Information from

the Suppliers

Information reported

by the supplier’s

employees, such as

grocery clerks (shelf

stockers) and/or

salespeople.

- Economic model

- Non-systematized

- Works with

sampling

- Few suppliers have

clerks or shelf

stockers.

www.anpad.org.br/bar

The Stockouts Study: an Examination of the Extent and the Causes in the São Paulo Supermarket Sector

269

Each of these ways of measurement has advantages and disadvantages: The audit is a reliable

measurement method; however, it is expensive and uses up the scant resources of the organization.

The measurement of the levels of stock kept in the stores is easily accessed through information

systems. The problem is that the percentage of inconsistencies is high; there is a difference between

the actual physical stock and the stock found in the system, not counting the fact that the products may

be in the storeroom and not on the shelf. The information from the consumer is interesting, but is also

not very reliable, because it depends on the commitment of the cashiers to systematically ask the

consumer. Furthermore, there is the possibility that the consumer simply may not be able to find the

product in the store and may declare it to be stockout. The information given by the suppliers is

reliable, but only a small portion of the supermarket SKUs have shelf stockers paid by the

manufacturers.

Retail problems can occur all along the retail supply chain, from the retail purchaser’s contact with

the supplier’s salesperson to the placing of the product on the shelf, as can be seen in Figure 2.

Figure 2: Retail Supply Chain

The list of the stockout causes throughout this whole supply chain was based on literature, for

example, Gruen et. al., 2002; Gruen and Corsten, 2007; Roland Berger, 2003, and was also discussed

with the committee of retail professionals from the state of São Paulo.

Data Collection and Analysis

Six pre-tests of the questionnaire were conducted with a panel made up of 04 retail professionals and

02 academics. Small adjustments of the language and inclusion/exclusion of variables were made

based on their comments.

The element of the population that has the information necessary for this study is the supermarket

manager. According to the committee of retail professionals, this person is responsible for following

the stockout indicators that occur in his/her establishment. Furthermore, the manager is the one who

ends up suffering the direct consequences of stockouts, such as consumers’ complaints or

penalizations for not having reached the sales goals because the product is not available to be sold.

The team of researchers used a list of 1,000 email addresses of affiliates of the Paulista Supermarket

Association [APAS]. Initially, 54 names were eliminated from the list because they were journalists,

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

Luis Henrique Rigato Vasconcellos, Mauro Sampaio

270

consultants, professors, independent (not affiliated to a company) or retired. All the other 946 names

of supermarket managers were selected to receive the questionnaire.

The questionnaire was applied in three waves of email, as shown in Table 2. The first wave

consisted of an email in the name of APAS requesting participation in the survey and making the

questionnaire available on an Excel file to be filled out by the respondent. In this email, we spoke

about the relevance of the survey and made it clear that only the respondents would have access to the

final report as a way of encouraging the managers to answer the questionnaire and send it back to us.

After the first posting, 42 email messages were returned along with a notification saying that they

had not been received due to a change of email address. The respondents returned 33 filled-out

questionnaires. Three weeks after the first posting, a second wave of email was sent to the nonrespondents, resulting in 67 valid responses. However, in spite of the responses obtained, the

proportion of hypermarket managers was still considered low in the sample when compared to the list

of members of APAS, characterizing non-representativeness of this segment in the sample received.

Three weeks later, a third wave of email was sent to the non-respondents of hypermarkets. There were

8 responses to this posting. In short, 108 questionnaires were considered valid, resulting in a response

rate of 11.9 %, which was considered satisfactory, because it is in line with that used for other similar

studies in the past (Gruen et al., 2002).

Table 3: Survey Sample

Types

Compact Supermarket

Conventional Supermarket

Hypermarket

Total

Number

of Members

check-outs

Of APAS

1 to 4

805

5 to 19

94

20 or more

47

946

1st

wave

10

18

5

33

2nd

wave

11

47

9

67

3rd

wave

0

0

8

8

Total

21

65

22

108

Percentage

11.90%

Comparing the sample to the population, while the members of APAS have the profile of compact

supermarkets (85%), conventional supermarkets (15%) and hypermarkets (5%), the sample obtained

from the respondents was only 19% of compact supermarkets, 60% of conventional supermarkets and

21% of hypermarkets. As shown in Table 3, the group of respondents is more representative of

conventional supermarkets and hypermarkets and less representative of compact supermarkets with

respect to the total members of APAS. This fact may be explained by the strategic character of the

survey and by the fact that the level of interest in obtaining the answers to the survey is predominantly

larger in more structured organizations, such as the conventional supermarkets and hypermarkets.

The sample was made up of an experienced group of retail managers, as shown in Table 4, of which

57.4% held the positions of directors and/or owners of supermarkets, 15.7% were store managers and

17.6% were professionals in more operational levels (example: purchases). The remaining 9.3% held

positions in other categories.

Table 4: Profile of the Respondents

Position

Operational

Manager

Director

Owner

Other

Total

N

19

17

27

35

14

108

Percentage

17.6%

15.7%

25.0%

32.4%

9.3%

100.0%

The team of researchers evaluated the possibility of the existence of non-respondent bias using the

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

The Stockouts Study: an Examination of the Extent and the Causes in the São Paulo Supermarket Sector

271

extrapolation method or, in other words, comparing the answers to some key questions in the first,

second and third wave of respondents. No significant differences were observed in the averages of the

three groups.

RESULTS

In this section, we present the answers to each of the four research-guiding issues. How important

are stockouts to supermarket managers? What method is used for measuring stockouts? What is the

stockout rate in supermarkets in the state of São Paulo? What are the main causes and who are the

ones responsible for the stockout problems? First, we analyzed the questions which were asked. Next,

we evaluated the answers given by the supermarket managers. The managerial and academic

implications of the results are debated in the last section of the article.

The Importance of Stockouts

Ordinal values were assigned to the attributes so that it was not possible to compare them by

calculating the average. Instead, the median was used to compare the ranks of the eight attributes for

the selection of the supermarket. The results are given in Table 5. Each attribute was classified on a

ordinal scale from 1 to 8, with 1 = most important attribute and 8 = least important attribute. Thus, the

factor with the lower median is classified as the most important, and the factor with the higher median

is the least important.

From the perspective of the supermarket executives, the factor – quality of customer service – was

classified as the most important (median=2) and the factor – short lines – was the least important

(median 6). When the various segments of supermarkets were analyzed, some differences were

identified:

. Compact and conventional supermarkets put more emphasis on the customer service attribute.

. Hypermarkets put more emphasis on the attributes of low prices and promotions.

Table 5: Order of Importance of the Attributes for the Selection of a Supermarket

Factors for Selection

Clerks are friendly, polite and

courteous

Low Prices

Promotions

Variety of Goods and Services

Low stockout levels

Cleanliness and tidiness of the

facilities

Easy physical access

Short lines

Compact

Supermarket

1.0

Conventional

Supermarket

2.0

Hypermarket

General

Importance

5.0

2.0

1st

4.0

4.0

4.0

5.0

6.0

3.0

3.0

4.0

5.

5.0

2.0

2.5

3.0

4.5

4.5

3.0

3.0

3.0

5.0

5.0

2nd

3rd

4th

5th

6th

6.0

6.0

6.0

6.0

5.0

7.0

6.0

6.0

7th

8th

The data from Table 5 shows that the stockout factor was considered the fifth most important

attribute by the managers in all formats of supermarkets. This result is very different from that of

Fisher, Krishnan and Netessine (2006), which identified stockouts as the most important attribute to

explain customer satisfaction in a USA retail chain. It is important to point out that the manager’s

perception may be different from the customer’s perception, but still, the importance attributed to

stockout by the managers seems to be very low compared to the importance attributed to it by the

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

Luis Henrique Rigato Vasconcellos, Mauro Sampaio

272

customer. This fact in itself may explain the high retail stockout rates, for any subject that is not

prioritized by the manager will more than likely not be improved.

Methods for Measuring Stockout

Based on the data obtained in this research, it is possible to state that the method mostly used by the

managers to measure stockouts is the visual shelf auditing method – in conventional supermarkets

(62%), hypermarkets (82%) and even in compact supermarkets (38%), as shown in Table 6. However,

we have found that more than one method may be used simultaneously.

Table 6: Methods for Measuring Stockouts

Type

Compact

Supermarket

Conventional

Supermarket

Hypermarket

Total

Visual Shelf

Auditing

Level of Stock

24%

Questions to

the consumer

at checkout

33%

Information

from

Suppliers

5%

Store

doesn’t

stockouts

24%

38%

62%

52%

58%

32%

5%

82%

61%

73%

51%

64%

55%

36%

33%

0%

3%

Stockout Rate

The supermarket managers reported that the average stockout rate of supermarkets in the state of São

Paulo is 8.3, % with a standard deviation of 6.8, as demonstrated in Figure 2. This means that of every

100 items catalogued in the store, 8.3 are not on the shelves.

Figure 3: Stockout Rate of the Supermarkets of the State of São Paulo

The research revealed that the stockout rate for compact supermarkets is 9.1 %, the rate for

conventional supermarkets is 8.5 %, and for hypermarkets 7.1 %, as shown in Table 7.

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

The Stockouts Study: an Examination of the Extent and the Causes in the São Paulo Supermarket Sector

273

Table 7: Stockout Rate

Type

Responses

Average

Standard Deviation

Compact Supermarket

14

9.1

9.2

Conventional Supermarket

60

8.5

6.8

Hypermarket

21

7.1

5.2

Total

95

8.3

6.8

This result was not surprising. The stockout levels are high; nevertheless, the stockout rates are

similar to those found in supermarkets in developed countries. These levels were made possible due to

the privileged conditions of the logistics infra-structure of the state of São Paulo compared to other

Brazilian states. The news is that these numbers are similar in supermarkets of different sizes. In order

to evaluate whether there is a statistically significant difference of stockout averages from one size of

store to another, we conducted the Analysis of Variance Test [ANOVA] of one factor. The result

revealed that there is no significant difference (0.10) in the averages of the different groups. However,

it is important to note that the number of items managed by the supermarkets is also smaller, making it

easier to maintain the stockout rates at levels equivalent to those of the hypermarkets.

The result found is equivalent to the one published in the ACNielsen study (2004), the only research

conducted in Brazil about stockout rates in supermarkets. It is also important to note that the problem

is a chronic one. Managers tend to accept the problem as if 8.3 % were a normal level of occurrence.

Table 8 compares the values given by the managers (1: low; 7: high) to the stockout levels in

different categories of products in the three formats of supermarkets using the method of Analysis of

Variance [ANOVA]. The focus of the analysis was to identify the products that show significant

differences in their averages. It was nothing new to observe that the stockout rate varies according to

the stores and formats. We also noticed some other significant differences from one format to another.

The smaller supermarkets have more problems with stockout in the categories of drinks and bazaar.

However, based on this research, we are able to state that the category of items that mostly concerns

the retail managers is the one that includes hygiene, health and beauty products, because every format

of supermarket selected it as the most critical category.

Table 8: Averages of the Values Given by the Managers to the Stockout Rates in Different

Categories of Products

Category1

Hygiene, health and beauty

Bazaara

Cleaning Products

Grocery

Perishables

Alcoholic Beveragesb

Non-alcoholic Beveragesc

Compact

Supermarket

3.

2.9

2.7

2.7

3.0

2.

2.6

Type

Conventional

Supermarket

3.3

3.3

2.9

3.0

2.9

2.3

2.0

Hypermarket

Statistic F

P value

3.1

2.3

3.3

2.9

2.6

1.6

1.7

0.539

2.922

1.090

0.398

0.371

3.377

3.379

0.585

0.059

0.340

0.672

0.691

0.038

0.038

1. Averages compared by the post hoc test using the method of “least significant difference” [LSD].

a) Compact Supermarket > Hypermarket

b) Conventional Supermarket > Hypermarket

c) Compact Supermarket > Conventional Supermarket / Hypermarket

Table 9 examines the frequency of stockout occurrences related to the days of the week and weeks

of the month. According to the perspective of the supermarket managers, stockouts occur more

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

Luis Henrique Rigato Vasconcellos, Mauro Sampaio

274

frequently at the beginning of the week (on Sundays, Mondays and Tuesdays). This probably occurs

due to the growth in demand on these days, but also because of poor refilling of supermarket shelves

with products from the suppliers to the retail distribution center and/or from the distribution center to

the stores on Sundays. This information is important, for it could indicate a way to minimize retail

stockouts. The daily and continuous work of refilling shelves may minimize the stockout rates found

on the weekends.

Table 9: Stockout Frequency – Days of the Week and Weeks of the Month

Type

Compact

Supermarket

Conventional

Supermarket

Hypermarket

General

Monday

4.47

Tuesday

3.68

Wednesday

2.65

Thursday

2.21

Friday

1.89

Saturday

3.16

Sunday

4.21

4.51

3.11

2.77

2.43

2.41

2.39

3.07

4.05

4.40

2.38

3.06

2.29

2.64

1.86

2.26

1.81

2.18

2.57

2.58

3.10

3.31

2nd

2.74

2.48

2.33

2.50

3rd

2.79

2.47

2.14

2.46

4th

2.89

2.69

2.38

2.66

5th

2.42

2.82

2.7

2.72

Type

Compact Supermarket

Conventional Supermarket

Hypermarket

General

Week

1st

3.11

2.84

2.81

2.89

Main Causes of Stockouts and Those Responsible for Them

The managers’ perception of the stockout causes and those mostly responsible for them is shown in

Table 10. The impact of each cause was evaluated by posing the following question to the retail

manager: ‘In a typical month, stockout caused by factor is…’, and measured by using a seven point

scale, where 1 meant ‘occasional’ and 7 meant ‘frequent’. In this case, we admit the null hypothesis

that the average of the perception of the stockout cause isn’t different from 3 using the t sample test.

The results of the test are shown in Table 10. The items greater than 3 and which are significant are

shown on the upper part of the table, and the items of little importance and significance are shown on

the lower part of the table.

The results show that the managers of every kind of supermarket format consider the flaws in the

supplier logistics process, such as delay in delivery and/or incorrect delivery of the order, to be the

main cause of stockouts. This result was unexpected, considering that previous studies pointed to the

retailers themselves being responsible for 75% of the stockout problems (ACNielsen, 2004; Corsten &

Gruen, 2003). Compact supermarkets also pointed to insufficient shelf space as one of the main

motives for out-of-stock products, revealing a problem of planning of space occupation of the shelves.

Conventional supermarkets, in addition the problems with the suppliers, have internal problems of

refilling shelves and delay in generating the orders. Finally, it is interesting to observe that the

hypermarkets did not identify the lack of shelf stockers as one of the main reasons for the stockouts,

when most of the international literature stockout studies elected them as the main retail problem.

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

The Stockouts Study: an Examination of the Extent and the Causes in the São Paulo Supermarket Sector

275

Table 10: Causes and Those Responsible for the Stockout

Causes for Stockouts in Compact Supermarkets

Supplier delayed the delivery

Insufficient shelf space

Supplier did not deliver the order correctly

Supplier does not have the product available

Store ordered incorrectly

Shelf was not refilled by the promoter (the product is on the storage shelf)

Merchandise badly positioned on the shelf

Merchandise badly positioned in the storeroom

Store took too long to order

Inventory error (difference between the physical and the accounting)

Lack of professionals to adequately refill the shelves

Parameter errors of the shelf refilling system

Causes for Stockouts in Conventional Supermarkets

Supplier delayed the delivery

Supplier did not deliver the order correctly

Supplier does not have the product available

Shelf was not refilled by the promoter (the product is in the warehouse)

Store took too long to order

Merchandise poorly positioned on the shelf

Buying Center is negotiating with the supplier (pre/margin)

Inventory error (difference between the physical and the accounting)

Insufficient shelf space

Store took too long to order

Parameter errors of the shelf refilling system

Inventory errors in the central systems

Lack of professionals to adequately stock the shelves

Merchandise poorly positioned in the storeroom

Causes for Stockouts in Hypermarkets

Supplier delayed the delivery

Supplier did not deliver the order correctly

Inventory error (difference between the physical and the accounting)

Shelf was not refilled by the promoter (the product is in the warehouse)

Supplier does not have the product available

Parameter errors of the shelf refilling ystem

Merchandise poorly positioned in the storeroom

Inventory errors in the central systems

Store took too long to order

Store ordered incorrectly

Lack of professionals to adequately stock the shelves

Merchandise poorly positioned on the shelf

Insufficient shelf space

Buying Center is negotiating with the supplier (pre/margin)

*“In a typical month, stockout caused by factor is…” (1=occasional;

7=frequent)

**One Sample t- test (Ho : average =3)

average*

4.40

3.74

3.19

3.15

3.16

3.11

2.76

2.80

2.75

t**

3.074

1.933

0.594

0.370

0.334

0.276

-0.576

-0.698

-1.000

p-value

0.006

0.069

0.559

0.716

0.742

0.786

0.571

0.494

0.330

2.52

2.33

2.05

-1.420

-1.719

-2.557

0.171

0.104

0.020

average*

5.20

4.72

4.18

3.84

3.39

3.21

3.23

3.22

3.02

2.92

2.88

2.80

2.79

t**

8.127

6.609

4.438

3.766

2.194

1.097

1.026

0.877

0.075

-0.394

-0.477

-0.754

-1.053

p-value

0.000

0.000

0.000

0.000

0.032

0.277

0.310

0.384

0.941

0.695

0.636

0.455

0.297

2.60

-2.206

0.031

average*

4.73

4.00

3.55

3.36

3.27

3.00

2.59

2.40

2.50

2.41

2.38

2.14

2.09

2.10

t**

5.131

3.040

1.449

1.402

0.689

0.000

-1.278

-1.476

-1.755

-2.200

-2.358

-2.988

-3.360

-3.943

p-value

0.000

0.006

0.162

0.176

0.498

1.000

0.215

0.156

0.094

0.039

0.029

0.007

0.003

0.001

The implications of these results to professionals and researchers in the areas of Logistics and

Supply Chain Management are presented next.

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

Luis Henrique Rigato Vasconcellos, Mauro Sampaio

276

CONCLUSIONS, LIMITATIONS AND MANAGERIAL IMPLICATIONS

Bearing in mind that the objective of the survey was to investigate stockout rates in the supermarket

chains in the state of São Paulo-Brazil, their causes and those responsible for them from the

perspective of their own managers, the study evaluated different formats of supermarkets: compact,

conventional and hypermarkets.

Conclusions

The stockout rates in the supermarkets of the state of São Paulo are very high, but compatible to the

levels of supermarkets in more developed countries. The supermarket managers reported that the

average stockout rate is 8.3%, and no significant differences in stockouts were found in the different

supermarket formats. Shelf auditing is the measurement method that is used the most in retail. The

results show that, in the opinion of the supermarket manager, the supplier is the one mostly

responsible for stockouts. A summary of the result of the research is found in Table 11.

Table 11: Summary of the Conclusions

Format

Measurement

Compact Supermarket

Visual Shelf

Auditing

Main Causes

9.1 %

Supplier delayed the delivery

Insufficient shelf space

Conventional Supermarket

Visual Shelf

Auditing

8.5 %

Supplier delayed the delivery

Supplier did not deliver the order correctly

Supplier does not have the product available

Shelf was not replenished

Store took too long to order

Hypermarket

Visual Shelf

Auditing

7.1 %

Supplier delayed the delivery

Supplier did not deliver the order correctly

The stockout factor was considered the fifth most important factor by the managers in all kinds of

supermarket formats. Compact and conventional supermarkets focus more on the factor of customer

service. Hypermarkets focus more on the factors of low prices and promotions. This result is very

different from the one found by Fisher et al. (2006), which identified stockouts as the most important

factor in explaining customer satisfaction in an American retail chain. There is an incompatibility

between the literature and the perception of the managers of Brazilian supermarkets. Fisher et al.

(2006) state that managers should focus on improving two areas in order to attract their clients:

stockout reduction and investment in the training of their employees. If Fisher et al.’s results (2006)

are reproduced in the Brazilian culture, changes in focus will need to be made by Brazilian retail

managers.

The category of items that mostly concerns the retail managers is hygiene, health and beauty, for all

the formats of supermarkets selected this category as being the most critical. The manufacturers of

these items should also be concerned, considering that a significant percentage of consumers tend to

change brands when there is a stockout.

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

The Stockouts Study: an Examination of the Extent and the Causes in the São Paulo Supermarket Sector

277

Stockouts happen most frequently on Sundays, Mondays and Tuesdays, probably because of the

growth in demand and lack of shelf refilling on the weekends. This information is important, because

it could indicate a way to minimize retail stockouts. The continuous daily work of refilling shelves

could minimize stockout rates found on the weekends.

There are many causes of stockouts. The research shows that the supermarket managers consider the

flaws in the supplier logistics process, such as the delay in delivery and/or incorrect delivery of the

order, to be the main cause of stockouts. This result was unexpected, considering that previous studies

pointed to the retailers themselves as being responsible for the stockout problems (ACNielsen, 2004;

Corsten & Gruen, 2003). This shows that the results of international research may not correspond to

the Brazilian reality. The committee of retail professionals has said that stockouts vary a great deal

from one supplier to another and according to the region of Brazil, and that high levels of stock do not

necessarily guarantee the availability of products. As a result, the retailers and the manufacturers

should use caution in considering the results of the stockout research from other countries, and should

invest in the knowledge of their own reality.

Limitations

There are limitations in this research as in any other. The first limitation is the size of the sample of

108 respondents compared to the supermarket population of the state of São Paulo. We have only

1,000 retail professionals affiliated to the APAS; however, the number of supermarkets of the state of

São Paulo is 12,425 units (ACNielsen, 2007). Another limitation is the regional focus of the study –

the state of São Paulo – which prevents discussion and the comparison of stockout rates with those of

different states; results may be different in another region. The group of respondents is also more

representative of conventional supermarkets and hypermarkets and less representative of compact

supermarkets with respect to the total members of the APAS.

Finally, the research was done using a list of email addresses to facilitate the collection of data. The

answer rate might be higher using traditional mail with adequate incentive systems. However, the

financial resources made available to conduct this study were a determining factor in the selection of

the electronic channel for the collection of data.

Managerial Implications

This study suggests that the stockout percentages are high, but can be reduced through joint actions

of industry and retail in order to achieve more effective results.

The first step is consistent stockout measuring. An automatic system of stockout measurement needs

to be created. Visual shelf auditing is the most adopted and recommended method. Despite the high

cost it incurs for obtaining information, it is the most reliable method. It is important for the retailers to

get all their own employees and the suppliers’ employees involved in this activity, in order to not only

reduce the cost of data collection, but also to help with the solution of the problems identified.

It is essential to identify the causes to be able to generate corrective actions. One important

recommendation is the application of the concepts of the Toyota Production System [TPS] to the retail

processes for reduction of stockouts and waste, which involves managerial actions, such as:

implementing the Just in Time [JIT] philosophy to reduce inventory, using techniques of Statistical

Process Control to monitor the performance of the main items and to identify the problems,

implementing the technique of Quality Control Circles [QCC] and Plan-Do-Check-Act [PDCA] to

engage the people in the solution of the problem, exchanging information with the suppliers in order

for them to help administrate the availability of products in the store and others.

It is also important for retailers to observe stockouts and how consumers react to them. As we have

mentioned before, previous studies show that for several decades stockout rates among retailers have

not declined. We have also seen that the probability of stockouts being eliminated 100% is very small.

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

Luis Henrique Rigato Vasconcellos, Mauro Sampaio

278

Therefore, it is reasonable to accept that a certain stockout level will always exist, and that offering

remedies to keep consumers from leaving the store is another efficient way to manage retail stockouts.

Opportunities for Future Studies

One of the aspects that mostly called the attention of the researchers was the low relative importance

given to stockouts by the managers, being rated after items like customer service, low prices,

promotions and variety of goods and services, respectively. The question that arises from this

conclusion is: Would the issue of stockouts be given the same relative importance from the

consumers’ point of view as it was given in this research from the managers’ point of view? Fisher et

al. (2006) point to exactly the opposite. They cite the issue of stockouts as one of the most important

factors that affect customer satisfaction with a retail chain. Therefore, a more detailed investigation of

the theme in the Brazilian scenario would be appropriate.

Another theme that the researchers came into contact with during the study, and which they were

particularly interested in, was that of the possible consumer reactions to a stockout. Although the

possible consumer behaviors represented by the acronym SDL (substitute the item, delay the purchase

or leave the store) have been explored by international literature (Gruen et al., 2002), and have also

been considered in a case of specific/practical application by a study such as the one conducted by

ACNielsen, there is no more detailed academic investigation of the matter. Questions remain, such as:

What is the reaction of the Brazilian consumer to stockouts? Are there significant differences in

reactions depending on the categories of products? Does the social position of the consumers have any

influence on their reactions to stockouts? The unfolding of the stockout issue and its pointing to

studies that involve the consumer seem to be fertile ground for future investigations, and indicate a

possible path to be followed by researchers.

REFERENCES

Andersen Consulting. (1996). Where to look for incremental sales: the retail problem of stockout

merchandise. Atlanta, GA: Author.

Anderson, E. T., Fitzsimons, G. J., & Simester, D. (2006). Measuring and mitigating the costs of

stockouts. Management Science, 52(11), 1751-1763.

Arthur Charles Nielsen. (2004). Ruptura: causas e impactos na cadeia de abastecimento e no

comportamento do consumidor. Retrieved October 19, 2008, from http://

www.amcham.com.br/download/informativo2004-10-20h_arquivo

Arthur Charles Nielsen. (2007). Estrutura do varejo e domicílios brasileiros. Retrieved May 26, 2009,

from http://br.nielsen.com/pubs/rfid.shtml

Bhargava, H. K., Sun, D., & Xu, S. H. (2006). Stockout compensation: joint inventory and price

optimization in electronic retailing. Journal on Computing, 18(2), 255-266.

Campo, K., Gijsbrechts, E., & Nisol, P. (2000). Towards understanding consumer response to

stockouts. Journal of Retailing, 76(2), 219-242.

Charlton, P., & Ehrenberg, A. S. C. (1976). An experiment in brand choice. Journal of Marketing

Research, 13, 152-160.

Corsten, D. S., & Gruen, T. W. (2003). Desperately seeking shelf availability: an examination of the

extent, the causes, and the efforts to address retail out-of-stocks. International Journal of Retail

& Distribution Management, 31(12), 605-615.

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar

The Stockouts Study: an Examination of the Extent and the Causes in the São Paulo Supermarket Sector

279

Emmelhainz, L. W., Emmelhainz, M. A., & Stock, J. R. (1991). Logistics implications of retail

stockouts. Journal of Business Logistics, 12(2), 129-141.

Fisher, M. L., Krishnan, J., & Netessine, S. (2006). Retail store execution: an empirical study.

University of Pennsylvania, the Wharton School and Research Center: Operations and

Information

Management

Department.

Retrieved

December

1,

2006,

from

http://knowledge.wharton.upenn.edu/papers/1336.pdf

Fitzsimons, G. J. (2000). Consumer response to stockouts. Journal of Consumer Research, 27(2), 249266.

Gruen, T., & Corsten, D. S. (2007). A comprehensive guide to retail out-of-stock reduction in the fastmoving consumer goods industry. The University of Colorado and the IE Business School

Madrid.

Retrieved

January

10,

2007,

from

http://www.fmi.org/forms/uploadFiles/31E8E0000006D.toc.TOC_out_of_stock.pdf

Gruen, T. W., Corsten, D. S., & Bharadwaj, S. (2002). Retail stockouts: a worldwide examination of

extent, causes and consumer responses. University of Colorado, The Food Marketing Institute

and CIES – The Food Business Forum. Retrieved April 18, 2002, from

http://knowledge.wharton.upenn.edu/papers/1336.pdf

Peckham, J. O. (1963). The consumer speaks. Journal of Marketing, 27(4), 21-26.

Progressive Grocer. (1968). The stockout study: a crusade against stockouts. The National Association

of Food Chains and A. C. Nielsen (pp. S1-S31). Retrieved May 26, 2009, from

https://www4.infotrieve.com/neworders/Order_Cart.asp

Roland Berger. (2003). Optimal shelf availability - Increasing shopper satisfaction at the moment of

truth. Kontich. Belgium: ECR Europe and Roland Berger. Retrieved May 26, 2009, from

https://www4.infotrieve.com/neworders/Order_Cart.asp

Schary, P. B., & Becker, B. W. (1978). The impact of stock-out on market share: temporal effects.

Journal of Business Logistics, 1(1), 31-44.

Schary, P. B., & Christopher, M. (1979). The anatomy of a stock-out. Journal of Retailing, 55(2), 5967.

Sloot, L. M., Verhoef, P. C., & Franses, P. H. (2005). The impact of brand equity and the hedonic

level of products on consumer stock-out reactions. Journal of Retailing, 81(1), 15-34.

Straughn, K. (1991). The relationship between stock-outs and brand share. Unpublished doctoral

dissertation, Florida State University. Tallahassee, FL, USA.

Verbeke, W., Farris, P., & Thurik, R. (1998). Consumer response to the preferred brand stockout

situation. European Journal of Marketing, 32(11), 1008-1028.

Walter, C. K., & Grabner, J. R. (1975). Stockout models: empirical tests in a retail situation. Journal

of Marketing, 39(3), 56-68.

Zinn, W., & Liu, P. C. (2001). Consumer response to retail stockouts. Journal of Business Logistics,

22(1), 49-71.

BAR, Curitiba, v. 6, n. 3, art. 6, p. 263-279, July/Sept. 2009

www.anpad.org.br/bar