Deadweight Loss From Taxation Introduction Setup Taxation

advertisement

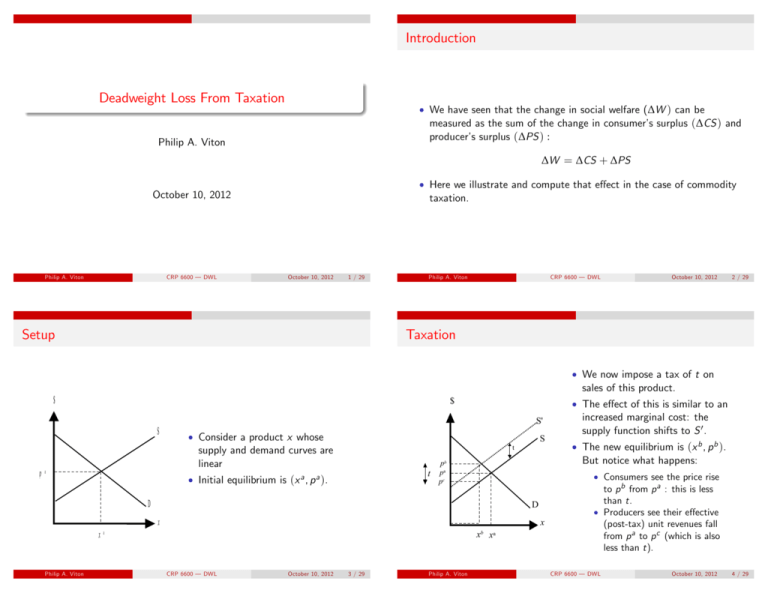

Introduction Deadweight Loss From Taxation We have seen that the change in social welfare (∆W ) can be measured as the sum of the change in consumer’s surplus (∆CS ) and producer’s surplus (∆PS ) : Philip A. Viton ∆W = ∆CS + ∆PS Here we illustrate and compute that e¤ect in the case of commodity taxation. October 10, 2012 Philip A. Viton CRP 6600 () — DWL October 10, 2012 1 / 29 Setup Philip A. Viton CRP 6600 () — DWL October 10, 2012 2 / 29 Taxation We now impose a tax of t on sales of this product. $ $ S' S pa Consider a product x whose supply and demand curves are linear S t t Initial equilibrium is (x a , p a ). pb pa pc D The new equilibrium is (x b , p b ). But notice what happens: Consumers see the price rise to p b from p a : this is less than t. Producers see their e¤ective (post-tax) unit revenues fall from p a to p c (which is also less than t). D x x xa Philip A. Viton The e¤ect of this is similar to an increased marginal cost: the supply function shifts to S 0 . xb xa CRP 6600 () — DWL October 10, 2012 3 / 29 Philip A. Viton CRP 6600 () — DWL October 10, 2012 4 / 29 Tax Incidence Consumer’s Surplus $ This is an example of a general phenomenon: most of the time, consumers do not bear the full burden of a commodity tax. Some of it is absorbed by producers. S The proportion absorbed by producers and hence the portion passed on to consumers depends on the relative elasticities of the demand and supply functions. pb pa pc As always, the change in consumer’s surplus is the area under the demand curve between the two price horizontals. In this case it is the lightly shaded area. D We now return to the main thread of our analysis. x Note that consumers see a price rise, hence ∆CS < 0. xb xa Philip A. Viton CRP 6600 () — DWL October 10, 2012 5 / 29 Producer’s Surplus Philip A. Viton October 10, 2012 6 / 29 Total Impact $ S pb pa pc $ Producer’s surplus is the area to the left of the supply function between the change in producer prices. S pb pa pc In this case this is the darker shaded area. Note that producers see a price fall, hence ∆PS < 0. D x The total impact is ∆CS + ∆PS This is shown as the shaded areas in the …gure. Note that both these areas a welfare losses, and hence the entire area has a negative sign. D x xb xa Philip A. Viton CRP 6600 () — DWL xb xa CRP 6600 () — DWL October 10, 2012 7 / 29 Philip A. Viton CRP 6600 () — DWL October 10, 2012 8 / 29 Impact of the Tax I Impact of the Tax II But what about the tax itself? Presumably we’re not just burning the money the government takes in. $ This is a bit subtle: we need to make an assumption about just what the government does with the tax receipts. For example, it would make a di¤erence (as we’ve seen) whether the government uses its tax receipts to subsidize (reduce prices on) some goods or services; of whether it simply returns income to the people. S Then tax receipts are t x b , the hatched rectangle in the …gure. This is a bene…t to the recipients, hence a positive quantity. pb t pca p The simplest assumption is that receipts are just returned to the people, for example, as an income tax rebate. Assume that tax receipts are returned to people as income. D x xb xa Philip A. Viton CRP 6600 () — DWL October 10, 2012 9 / 29 Deadweight Loss Philip A. Viton CRP 6600 () — DWL October 10, 2012 10 / 29 Numerical Analysis We now repeat our analysis with real numbers and functions. We assume: $ The net impact (∆W minus tax revenue bene…ts) is shaded. S pb pa pc D x Demand: x (p ) = 17 Note that this a negative quantity: even after considering the positive impact of the tax, there is still a net welfare loss to the community. 0.35p Total Cost: TC (x ) = 8 + 4x + 1.25x 2 Marginal Cost (=supply) is obtained by …nding the derivative of TC: MC (x ) = 4 + 2.50x This is known as the Deadweight Loss from taxation. Tax: we assume a tax of t = 1.25 per unit. xb xa Philip A. Viton CRP 6600 () — DWL October 10, 2012 11 / 29 Philip A. Viton CRP 6600 () — DWL October 10, 2012 12 / 29 Initial Equilibrium Final Equilibrium I Equate supply and demand, and solve for price and quantity. In this case we insert the demand function into the supply function: p = 4 + 2.50(17 = 46. 5 1.875p = 46.5 p = pa = The …nal equalibrium price and quantity will be where the demand curve interects the upward-shifted supply curve (S 0 in slide 5). 0.35p ) How do we …nd S 0 ? The marginal cost function takes an output x and delivers a price: we have p = MC (x ). 0.875 p 46.5 = 24.80 1.875 In this case we want it to deliver a price that is t units higher, where t is the tax. So we focus on To …nd the equilibrium quantity, plug the price into the demand function: x a = x (24.8) = 17 (0.35 p = MC (x ) + t 24.8) = 8.32 Philip A. Viton CRP 6600 () — DWL October 10, 2012 13 / 29 Final Equilibrium II Philip A. Viton CRP 6600 () — DWL October 10, 2012 14 / 29 Final Equilibrium III Then S 0 is: p = MC (x ) + t Now plug the price into the demand function to …nd = 4 + 2.50x + 1.25 = 5.25 + 2.50x xb Next, …nd the equilibrium price: equate S 0 to demand. This is parallel to what we did before: p = 5.25 + 2.50x = 5.25 + 2.50(17 = 47.75 0.875p 0.35p ) pc 1.875p = 47.75 47.75 pb = = 25. 4667 1.875 CRP 6600 () — DWL October 10, 2012 15 / 29 25.4667) Finally, the net price actually received by producers is the market price less the tax, so and solve for p (ie p b ) Philip A. Viton = 17 (0.35 = 8. 086 67 Philip A. Viton = pb t = 25.4667 1.25 = 24. 216 7 CRP 6600 () — DWL October 10, 2012 16 / 29 Equilibria Summary Change in Consumer’s Surplus The e¤ect of the tax on consumers is that they see prices change from p a = 24.80 to p b = 25.4667; their consumption of x falls from x a = 8.32 to x b = 8.08667 We have now found: So by geometry we have Post project equilibrium: p a = 24.80 x a = 8.32 Area of rectangle = (25.4657 Post-project equilibrium: p b = 25.4667 x b = 8.08667 Area of triangle = 1 (25.4667 24.80) 2 Post-project net price received by producers: p b t = 25.4667 1.25 = 24. 216 7 CRP 6600 () — DWL (8.32 8.08667 = 5. 383 296 2 8.08667) = 0.07 778 055 6 So ∆CS Philip A. Viton 24.80) October 10, 2012 17 / 29 Producer’s Surplus Three Ways = = (5. 383 296 2 + 0.07 778 055 6) 5. 471 08 Philip A. Viton CRP 6600 () — DWL October 10, 2012 18 / 29 Change in Producer’s Surplus via Geometry Producers see their price fall from x a = 24.80 to x c = 24.2167. So by geometry we have: We have three ways to compute the change in producer’s surplus: Area of rectangle = (24.80 1. By geometry, since both demand and supply are linear in own-price. 2. As an integral. Area of triangle: = 0.06 805 069 5 1 2 24.2167) (24.80 8.08667 = 4. 716 954 6 24.2167) (8.32 8.08667) = So: 3. Using the fact that ∆PS = ∆Π. ∆PS We now use our numerical example to illustrate each of these approaches. = = (4. 716 954 6 + 0.06 805 069 5) 4. 785 01 This is obviously simple, but remember that it is only available in the linear case. Philip A. Viton CRP 6600 () — DWL October 10, 2012 19 / 29 Philip A. Viton CRP 6600 () — DWL October 10, 2012 20 / 29 Change in Producer’s Surplus as an Integral I Change in Producer’s Surplus as an Integral II The solution is to invert the marginal cost curve, and make it a function of price. Solve for x: The change in producer’s surplus is the area to the left of the supply (=MC) function between the two price horizontals. p = 4 + 2.50x p So we are looking for something like: ∆PS = Z pc pa MC (p ) dp 4 = 2.50x p 4 x = 2.50 or The problem we now face is that our expression for marginal cost delivers MC (a cost, or a price) as a function of output, not price: x (p ) = = 0.4p MC (x ) = 4 + 2.50x 4 2.50 1 p 2.50 1.6 Then we have MC (p ) = 0.4p Philip A. Viton CRP 6600 () — DWL October 10, 2012 21 / 29 Change in Producer’s Surplus as an Integral III S (24.80) = (0.2 Z 24.2167 (0.4p 1.6)dp 24.80 Pre-project total revenues = TR a = 8.32 1.6p and we compute the 24.802 ) (1.6 24.2167) = 78. 542 992. (1.6 24.80) = 83. 328 = 78. 542 992 = 4. 785 01 24.80 = 206. 336. Pre-project total costs: TC a = TC (8.32) = 8 + (4 8.32) + (1.25 = 127. 808 And thus: 83. 328 8.322 ) So Πa = 206. 336 as before. Philip A. Viton 22 / 29 Pre-project: quantity supplied = x a = 8.32. Pre-project price = p a = 24.80. Then: 24.21672 ) ∆PS October 10, 2012 Finally, we can use the fact the ∆PS = ∆Π, and calculate pro…ts directly. The anti-derivative is S (p ) = 0.2p 2 limits as S (24.2167) = (0.2 CRP 6600 () — DWL Change in Producer’s Surplus via Pro…ts I We now want to evaluate: ∆PS = Philip A. Viton 1.6 127. 808 = 78. 528 CRP 6600 () — DWL October 10, 2012 23 / 29 Philip A. Viton CRP 6600 () — DWL October 10, 2012 24 / 29 Change in Producer’s Surplus via Pro…ts II Change in Producer’s Surplus via Pro…ts III Post-project quantity supplied = x b = 8.08667 ; post project (net) producer’s price = p c = 24.2167. Post-project total revenue: 832 46 TR b = 8.08667 24.2167 = RbT Then, …nally = 195. ∆PS Post-project total costs: TC b = TC (8.086) = 8 + (4 8.08667) + (1.25 = 122. 08947 8.086672 ) which once again agrees with our previous computations General remark on all these calculations: there is room for di¤erences in about the third decimal place if you round intermediate quantities too soon. So Πb Philip A. Viton = 195. 832 46 = 73. 74299 122. 08947 CRP 6600 () — DWL October 10, 2012 25 / 29 Welfare of Consumers and Producers Philip A. Viton CRP 6600 () — DWL October 10, 2012 26 / 29 Tax Receipts At the post-project equilibrium, people purchase (and suppliers produce) 8.08667 units of x. Putting all this together we have: ∆W = ∆Π = Πb Πa = 73. 74299 78. 528 = 4. 78501 The unit tax is t = 1.25 = ∆CS + ∆PS = (5. 471 08 + 4. 78501) = 10. 25609 So total tax receipts are ∆T = 8.08667 1.25 = 10. 108 34 Under our assumptions, this is a direct community bene…t. Philip A. Viton CRP 6600 () — DWL October 10, 2012 27 / 29 Philip A. Viton CRP 6600 () — DWL October 10, 2012 28 / 29 Deadweight Loss Impact in the x-market on consumers and producers is ∆W = 10. 25609 O¤-setting tax impact: ∆T = 10. 108 34 Net impact ∆W + ∆T = 10. 25609 + 10. 108 34 0.14775 The important thing to observe is that this is still a negative quantity, the deadweight loss. Philip A. Viton CRP 6600 () — DWL October 10, 2012 29 / 29