View PDF

advertisement

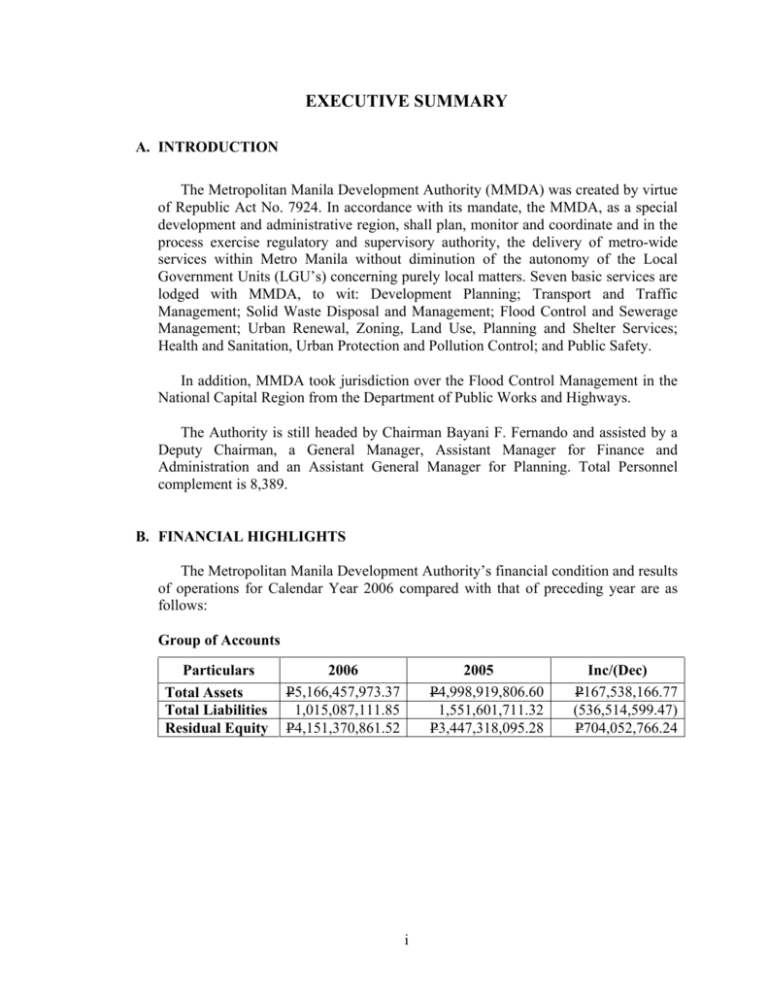

EXECUTIVE SUMMARY A. INTRODUCTION The Metropolitan Manila Development Authority (MMDA) was created by virtue of Republic Act No. 7924. In accordance with its mandate, the MMDA, as a special development and administrative region, shall plan, monitor and coordinate and in the process exercise regulatory and supervisory authority, the delivery of metro-wide services within Metro Manila without diminution of the autonomy of the Local Government Units (LGU’s) concerning purely local matters. Seven basic services are lodged with MMDA, to wit: Development Planning; Transport and Traffic Management; Solid Waste Disposal and Management; Flood Control and Sewerage Management; Urban Renewal, Zoning, Land Use, Planning and Shelter Services; Health and Sanitation, Urban Protection and Pollution Control; and Public Safety. In addition, MMDA took jurisdiction over the Flood Control Management in the National Capital Region from the Department of Public Works and Highways. The Authority is still headed by Chairman Bayani F. Fernando and assisted by a Deputy Chairman, a General Manager, Assistant Manager for Finance and Administration and an Assistant General Manager for Planning. Total Personnel complement is 8,389. B. FINANCIAL HIGHLIGHTS The Metropolitan Manila Development Authority’s financial condition and results of operations for Calendar Year 2006 compared with that of preceding year are as follows: Group of Accounts Particulars Total Assets Total Liabilities Residual Equity 2006 P5,166,457,973.37 1,015,087,111.85 P4,151,370,861.52 2005 P4,998,919,806.60 1,551,601,711.32 P3,447,318,095.28 i Inc/(Dec) P167,538,166.77 (536,514,599.47) P704,052,766.24 Sources and Application of Funds Particulars Total Allotment Current Appropriations Continuing Appropriations Total Expenditures Unexpended Balance 2006 2005 Inc/(Dec) P2,435,969,000.00 P2,454,667,886.00 P(18,698,886.00) 163,353,560.79 168,237,367.61 (4,883,806.82) 2,296,773,845.43 2,374,798,310.31 (78,024,464.88) P302,548,715.36 P248,106,943.30 P54,441,772.06 C. SCOPE OF AUDIT The audit covered the accounts and operation of the Metropolitan Manila Development Authority for the Calendar Year 2006. Likewise, the extent of compliance by the MMDA with applicable laws, rules and regulations had also been looked into. The following were some of the constraints and/or limitations in the audit of MMDA accounts and transactions for the year 2006: 1. The delayed/non-submission of financial reports/documents prevented the substantiation of the propriety of certain disbursements. 2. The failure to establish the subsidiary ledgers’ beginning balances as of January 1, 2005 in the implementation of e-NGAS also prevented the substantiation of some accounts. D. AUDITOR’S REPORT The Auditor rendered an adverse opinion on the fairness of presentation of the financial statements of the Metropolitan Manila Development Authority due to unreconciled cash balances; unliquidated cash advances; unreconciled balances of the account Due from LGUs; non-recognition of supplies and materials as Inventory; unreconciled PPE balances; non-transfer of PPE to the Registry of Public Infrastructures; negative balances of Due to GOCCs – P23,211,746.01; and unfunded obligations. ii E. OBSERVATIONS AND RECOMMENDATIONS The following are the significant observations with the corresponding recommendations: 1. Cash in Bank-Local Currency Savings/Current Account consisting of 12 bank accounts in the total amount of P402,073,285.79 does not agree with the balance per bank statement of P487,049,304.00 or a difference of P84,976,098.02 due to the failure of the Accounting Services to update the preparation of monthly bank reconciliation statements and make the necessary adjustments for various reconciling items, thus rendering the account balance inaccurate. We recommended, and management agreed, to implement the following recommendations: a. Make proper representation with concerned depository banks for the timely submission of monthly bank statements to ensure that monthly bank reconciliation statements are prepared. b. Prepare regularly monthly bank reconciliation statements and make the necessary adjustments for reconciling items to ensure that the balance of cash account at the end of each month is accurate. 2. Unliquidated cash advances remained at P12,402,370.77 as of year-end despite the liquidation of P139,116,171.28, or 92% during the year due to the non settlement thereof by the accountable officers within the prescribed period which tend to overstate Cash Disbursing Officers account and understate related expense accounts. We recommended and management agreed to implement our prior years’ recommendations such as: (a) faithfully observe the rules and regulations on the grant, utilization and liquidation of cash advances pursuant to P.D. 1445 and COA Circular No. 97-002; and (b) require the Accountant to determine which of the dormant accounts could no longer be settled even after exerting all out efforts, and thereafter, to request authority from COA for the write-off of these dormant accounts. 3. The balances of Due from LGUs account representing the 5% statutory mandatory contributions totaling P3,162,594,805.89 as of year-end do not reconcile with the LGUs’, thereby casting doubts on the accuracy and collectibility of these balances. We reiterate our prior year’s audit recommendations, to wit: a) Exert best efforts to reconcile the accounts with the concerned LGUs and collect the amounts due from them pursuant to R.A. 7924. iii b) Request from COA the authority for write-off dormant and uncollectible receivables from LGUs or request for condonation, if appropriate. 4. The balances of Inventory account was misstated due to the practice of directly charging to the expense account some supplies and materials procured and existence of dormant balances of inventories which have remained unadjusted as of year-end. We recommended and management agreed to: a. Record supplies and materials purchased under the Inventory account unless the same is procured out of petty cash fund to properly establish supply accountability and prevent possible pilferage. b. Conduct an inventory of all supplies and materials on hand; prepare an inventory report; reconcile the inventory report with accounting records; investigate variances for purposes of making the necessary adjustments. 5. Out of the total Advances to Contractors amounting to P52,654,481.98 the amount of P10,522,582.00 granted to ITP Construction, Inc. as mobilization fee for the Development of North Transport Terminal A Component of Greater Manila Area Mass Transportation System remained outstanding or unsettled as of year-end despite the indefinite deferment of the project implementation due to court injunction. We recommend that Management make proper representation or arrangement with ITP Construction, Inc. for the latter to return the advance payment of P10,522,582.00 while waiting for the resolution of the case under court injunction. 6. Comparison of the Report on the Physical Count of Property, Plant and Equipment (RPCPPE) in the amount of P922,554,513.61 with the accounting records of P922,554,513.61 showed an unreconciled difference of P4,558,066.87, thereby rendering the balances of PPE accounts inaccurate. We reiterate our prior years’ recommendation that Management should: a) Require the Chief Accountant and the Property Accountable Officer to reconcile and update their records, and to investigate the noted differences; b) Require the Chief Accountant to maintain individual SLs of all PPE and to effect adjustments for the difference noted. iv 7. Completed public infrastructure projects amounting to P141,674,436.29 have not been dropped from the Property, Plant and Equipment (PPE) account and transferred to the Registry of Public Infrastructures, thereby overstating the PPE and the Government Equity accounts. We recommend that Management require the Accounting Services to: a) draw a Journal Entry Voucher closing the completed infrastructure projects which were accounted for under the Public Infrastructure account to Government Equity account, and b) transfer said completed infrastructure projects to the Registry of Public Infrastructure Projects. 8. Environment/Sanitary services of P445,324,299.28 and other expenses amounting to P942,567.84 or a total of P446,266,867.10 incurred in prior years were only recognized as expense upon payment using current year’s allotment due to insufficient funds, contrary to Sec. 4 of the NGAS and existing budget rules and regulations. We recommended and Management agreed to strictly adhere to Sec. 4 of the NGAS and existing budget rules and regulations and also, make proper representation with the Department of Budget and Management and the Congress for approval of sufficient budget to cover all operating and maintenance expenses of the MMDA. The above findings and recommendations contained in the report were discussed with the concerned officials of the Authority. Management views and reactions were considered in the report, where appropriate. F. IMPLEMENTATION OF PRIOR YEARS’ AUDIT RECOMMENDATIONS Out of the eleven (11) audit recommendations contained in the 2005 Annual Audit Report, one (1) was fully implemented and nine (9) were partially implemented and one (1) was not implemented as of December 31, 2006. v