BUILDING OPPORTUNITIES

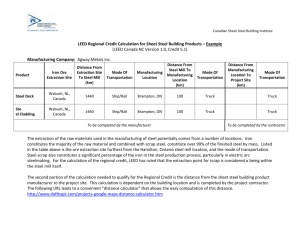

advertisement