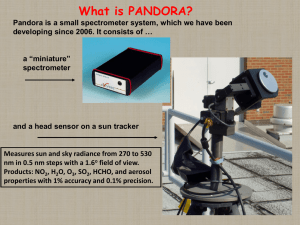

PANDORA ADVERTISING CAMPAIGN

advertisement