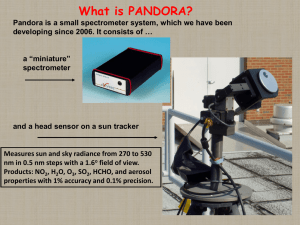

pandora - Faculty & Research

advertisement

PANDORA There are very few start-ups, or for that matter companies in general, that can boast to have a loyal customer base as passionate as Pandora’s; it is striking that such a great image has been formed through little or no advertisement. For music lovers around the globe (or at least in the U.S. at the moment), Pandora has added real value through its proprietary musicmatching algorithm. It is arguably the best venue for music discovery, and that has translated into projected ad revenues of $25 million in 2008, at a rapid growth rate of 20% per quarter. Pandora also boasts 16 million registered users, with 1 million visits to its website per day. It is featured as a top-ten most downloaded application for the iPhone. Pandora has achieved its growth while copiously complying with the rules and regulations of the music industry. It pays royalties for each song it streams, and when it became apparent that its global distribution was not in full compliance with music industry regulations, Pandora decided to withdraw from foreign markets, checking IP addresses of those who log onto its website to ensure they are located within the U.S. Pandora has been a boon to new, indie, artists, providing a mainstream venue for promotion of their artistic creations. It has also benefited established online retailers such as iTunes and amazon.com, by allowing its customers to purchase their music discoveries directly from those websites. These partnerships, along with others, have contributed to a formidable growth strategy and brand creation. Pandora is today one of the most recognizable brands of internet radio and perhaps the most admired. The most striking development in this undeniable story of value creation and growth, however, happened at the end of last summer. Pandora announced that it may be soon shutting its doors to prevent it from losing more of its investors’ money. Despite a very successful revenue strategy on a clear path to profitability, Pandora has not been able to manage its costs due to changes in the regulatory environment brought about by industry players who see the growth of internet radio as a threat to their business models. Recently instituted legislation makes it virtually impossible for independent internet webcasters to be profitable. Despite the general public outcry, it is now a real possibility that Pandora will close operations along with the 65 million personalized radio stations it has helped create. To understand how the company has come to this standstill, and what possible outcomes can arise out of this situation, it might be useful to provide some background on the music industry and the shifts that have made Pandora a viable business but that have upset incumbents. FACTORS THAT LED TO THE CREATION OF PANDORA Three key events led to the creation of Pandora, two of which were exogenous. They are: The advent of digital audio files The creation of Broadband internet The development of the Music Genome Project The first two of these events led to the introduction and development of webcasting and the internet radio. The Music Genome Project gave Pandora its edge and allowed it to take advantage of this shifting environment and to enjoy such rapid growth and loyalty from its customers. The following sections will explain each of these developments and their relevance in making it possible for Pandora to come about. DIGITAL MUSIC The music industry has undergone a drastic transformation in the past decade which has changed the balance of power among all constituents; arguably the main catalyst for this change has been the advent of digital music. The music industry has historically grown through technological disruptions: cassettes substituted LPs in the early ’80s, just like LPs had substitute monos in the ‘50s, and cassettes were replaced by CDs in the early ‘90s (see chart below for a quick timeline of major breakthroughs in the industry). Each of these technological shifts brought substantial growth to the main industry players, including the record label companies; replacement of cassettes by CDs drove sales growth for almost a decade. Technological shifts affecting the music industry 1956 1979 1988 2003 Stereo LPs become available, replacing mono as the industry standard Sony introduces Walkman, increasing sales of cassettes CDs overtake vinyl in sales volume and become driver of growth for industry iTunes created, becomes the leader in legal digital music distribution 1956 1963 1979 1981 1988 1998 2003 1963 1981 1998 Cassettes are introduced, but take 15 years to overtake LPs MTV is created, and music clips become essential in promotion Music piracy on internet becomes widespread (think MP3, Napster) Source: Wikipedia The latest of the major technological disruptions, however, along with changes in the distribution of music, has upset the main players in the industry and dramatically shifted the balance of power by rendering some of the established business models obsolete. This latest disruption is digital music, more precisely digital audio files. Digital music consists of the representation of musical sound as numerical values, in contrast with analog systems such as magnetic tape or vinyl records, which rely on physical methods to reproduce sound. According to Wikipedia, “In an analogue audio system, sounds begin as physical waveforms in the air, are transformed into an electrical representation of the waveform, via a transducer (for example, a microphone), and are stored or transmitted. To be re-created into sound, the process is reversed, through amplification and then conversion back into physical waveforms via a loudspeaker (…).All analogue audio signals are susceptible to noise and distortion, due to the inherent noise present in electronic circuits.” Digital audio consists of analog audio signals converted into binary signals. The binary signal “is then further encoded to combat any errors that might occur in the storage or transmission of the signal. This "channel coding" is essential to the ability of the digital system to recreate the analogue signal upon replay.”1 The compact disc, although a type of digital recorder of music, is not what is commonly referred to as digital music; that label is usually employed in reference to digital audio files, which consist of non-physical sources of digital audio that use various encoding formats to store audio information (e.g. MP3, WMA, WAV). Digital audio files, combined with a new method of distribution, dramatically changed the way the industry operates and created problems for the incumbents and opportunities for new entrants. BROADBAND INTERNET Another key event that, coupled with digital music, contributed to this major change in the industry was the development of broadband internet. The term broadband internet refers to high-data-rate internet access. In 1997, Nortel introduced the first 1 Mbps modem service, delivering connections over cable instead of phone dial-up. This new type of connection 1 Wikipedia worked at a speed more than 20 times faster than the 56 Kbps dial-up modem typically used by consumers up until then, and paved the way for mass adoption of cable-based broadband. By 2004, 51% of American internet users had adopted broadband technology, quickly displacing dial-up connections. According to Nielsen / Net Ratings research, the number of broadband subscribers is expected to surpass 500 million globally by 2012. Broadband internet created a new distribution channel for music files. Digital audio files could now be transferred over the web at very high speeds. This new development was initially welcomed by the music industry, as it reduced the costs of producing and distributing music recordings. However, it also allowed for very easy, cheap and fast peer-to-peer file sharing, illegal file sharing skyrocketed, culminating with the ascent (and subsequent elimination) of Napster by 2001. Broadband created a very challenging environment for industry incumbents: record label companies saw their main source of revenues threatened by peer-to-peer file sharing and unbundling of music; music retailers had to face the competition of online retailers, and several of them went bankrupt; radio stations saw the threat of online webcasters who could provide interactive programs. As an illustration of the magnitude of this problem, between 1990 and 1999, according to the RIAA, the recorded music industry sales grew by a CAGR of 7.6%, which was twice as fast as the rest of the entertainment industry as a whole. From 1999 through 2006, however, sales declined at a CAGR of 6.0% and at an accelerating rate, caused by digital and industrial piracy, the maturation and price decline of CDs, and bankruptcies of record retailers and wholesalers. Digital music and broadband distribution have been a nightmare for established players, challenging their business models and putting into question the survival of many of them. This threat is not forecasted to abate, as illustrated in the graph below. Distribution of revenues from music sales $12,000 Subscriptions Downloads CDs $10,000 $8,000 $6,000 $4,000 $2,000 $0 2006 2007 2008 2009 2010 2011 Source: Forrester Research As will turn out to be one of Pandora’s main challenges, this threat to the incumbents’ business model will result in their use of political lobbying and legislative measures to fight off new entrants and new models. Nevertheless, independent of how hard the incumbents fight to slow down the shift in business models, it seems to be irreversible at this point, and it has been welcome by consumers and to some extent by artists. It has also opened new opportunities for new entrants with creative business concepts. 2012 INTERNET RADIO One of the new business concepts that broadband internet gave rise to is internet radio. The big breakthrough happened in 1996 when RealNetworks (at the time called Progressive Networks) released its first audio player making the streaming of audio files over the Internet possible. Broadband internet allowed for the expansion of audio streaming, and with it the internet radio. Given that radio broadcasting is still the main venue for music discovery and still accounts for most music sourcing (see graph below), and radio revenues exceed $20 billion in the U.S. alone, finding a business model that brings more value to the customer than what is currently available offers very high stakes. Current sourcing of music Radio, 43% CDs, 20% Music files on PC, 12% Other, 2% Podcasts, 2 % Satellite MP3 radio, 6% player, 8% Source: Forrester Research Internet radio, 7% The main difference (and big advantage) of internet radio over conventional broadcasting is that, in addition to being able to broadcast “live” content, internet radio is able to stream recorded content at the user’s request, making their experience more interactive. Another significant advantage is that internet radio is not limited to a specific geographic location; every online station has access to a global marketplace. Internet radio is also not limited to audio. It can stream text, pictures and video, as well as links, message boards and chat rooms, making the experience more complete. An online radio station can provide various music genres, targeting several audiences. There are also cost advantages. The cost of broadcasting (at least the physical cost) is much lower than that of a traditional radio station. On the revenue side, online radio stations offer a much more interactive link between advertisers and public. Additionally, the mobility advantage of the traditional radio stations is quickly being lost as internet radio becomes wireless. Given the size of the prizes at stake, those who can craft a business concept that can provide (and therefore extract) value from the current environment generated through the advances in digital music and internet connection technologies, and who can do so at the right timing, should reap very positive results. MUSIC GENOME PROJECT AND THE ORIGINS OF PANDORA At a time when a great number of entrepreneurs were enthralled by the possibility of using the social network capabilities of the internet to establish a better connection with customers and thus offer a more targeted product through popular connections, Stanford graduate Tim Westergren came up with a concept of music delivery that did not make use of social networking but instead relied on the judgment of music specialists. Conceived in 1999 by Westergreen, in conjunction with Wil Glaser and John Kraft, and launched in January of 2000, the Music Genome Project brought about an analytical method for music discovery and matching. This project consisted of an analysis of the structure of a song down to its most basic elements, or its “genetic code”. Using over 400 attributes to describe songs, Westergren and his team created an algorithm that allowed them to organize all of these attributes and identify similar songs with similar attributes. Through this identification of similar songs, this algorithm is able to recommend new songs to a customer based on the customer’s taste. With this proprietary algorithm and ensuing database of decoded songs, Savage Beast, the predecessor to Pandora, was created. Each song in Pandora’s database is analyzed for 20 – 30 minutes by a music specialist (see below). These songs are tested for characteristics such as melody, harmony, rhythm, instrumentation, orchestration, arrangement, lyrics and vocals, among many others. The total number of characteristics depends on the musical style of the song, with rock and pop songs, on the low end of the scale, subdivided into 150 factors, and classical music with up to 500 factors. Today, Pandora has a catalog of over 600,000 songs analyzed and over 100 music analysts. This labor-intensive system was a departure from the leaner approach of other internet radio stations that used popular demand for recommendation (the amazon.com concept of recommending a product based on similar purchases by other buyers). This Music analysts at Pandora Media in Oakland, Calif., catalog the characteristics of songs. Source: New York Times is a much more costly method, but also offers customers the service of highly skilled professionals and is much better at providing music discovery. It took Pandora five years and 30 music analysts to bring the company’s database to a minimum point of usefulness. Because it does not depend on popular preferences, Pandora can be more creative and unusual in its recommendations, attracting more niche customers that are seeking more obscure songs. Despite the complexity of its algorithm, Pandora’s interface with the consumer is very simple and user-friendly. The customer simply selects a song and an artist, and Pandora will make recommendations for similar songs based on the characteristics of the original song. The system also allows for refining of preference specifications, by letting the customer rate the recommendations that the algorithm suggests. Clearly, the strength of this system depends on the quality of the analysis of the songs and therefore of the music analysts. To ensure high quality standards, Pandora’s employees are highly qualified music analysts, 99% of whom have been musicians in the past. The combination of digital music, broadband internet, and a proprietary algorithm with a catalog of over 400,000 songs by 20,000 artists, gave Westergren and his team a strong competitive edge to start marketing Pandora as an online radio station. PANDORA’S LAUNCH STRATEGY: STAGE 1 – SAVAGE BEAST Oakland-based Savage Beast, the predecessor to Pandora, started operations in January 2000, during the height of the tech boom. At that time, all you needed was a business plan that included the suffix .com and you were in a good position to secure some sort of investment. Accordingly, Tom Westergren and his team were able to obtain $1.3 million in angel financing from VC industry legend Guy Kawasaki, and that was enough money to get the company jump started. Perfecting the algorithm for the Music Genome Project, Pandora now had financial resources to start accumulating a catalog of songs, and that is what it set out to do. For five years, and with 50 musicians working as music analysts, Pandora amassed a collection of songs that amounted to 400,000 by 2005 and continued to grow at a rate of 15,000 to 20,000 songs per month. Savage Beast did not produce revenue for several years, and the founders did not see any income stream for three years. They would not be able to market their product until they achieved a critical mass of songs. The original plan was to use the Music Genome Project to create a program through which Savage Beast could make music recommendations to customers based on their taste preferences. And their algorithm would calculate a consumer’s taste preference based on samples of songs the consumer liked. This was an original idea and a departure from the then well-established concept of collaborative filtering, when a company such Amazon.com makes recommendations based on purchase patterns. This service would be sold as a B2B platform, and in 2001 Savage Beast struck a deal with Tower Records to make that service available in kiosks throughout the store, followed by another deal with Barnes & Noble to rent the Music Genome Project algorithm for use in their website. According to a study by the RIAA, “more than half of consumers who enter a music store or the music section of a retail store leave empty handed. To a large degree, they are overwhelmed by all of their choices. One of the main reasons why finding music is so difficult lies in the way in which it is categorized and presented to consumers.” It is the same with digital music. Songs get categorized (world music, alternative rock, etc.) but not always have the same characteristic and songs with matching categories will not necessarily be rated equally by a particular consumer. Savage Beast created a technology that would tailor music recommendations to consumers’ individual tastes. This concept would be particularly useful in capturing the long-tail market, those consumers who would not be attracted by collaborative filtering. It was a completely untapped market, and the confluences of technologies combined with easy financing made this business model possible at the turn of the century. All forces had aligned to make the launch of Savage Beast ripe in 2000, but once the company got started a considerable lag would have to happen to allow the company to accumulate its catalogue of songs and make its technology marketable. On the 15th of December of 2004, after the Savage Beast had analyzed a considerable list of songs, the company landed a second round of financing in a private investment in the amount of $7.7 million, led by investor WaldenVC, with participation of investor firms Labrador Ventures, Selby Ventures, and MediaWin Partners. Proceeds were to be used to refinance debt and to develop a new product. STAGE 2: CHANGE OF STRATEGY In the summer of 2005, Savage Beast reformulated its business model and changed its name to Pandora. Its new model would be a departure from the original B2B model and target consumers directly through an online interface that would become the first personalized internet radio station. Pandora would use its unique system to tap into the potentially very large internet radio market. As opposed to its very complex algorithm, Pandora’s website was very simple and user friendly. It required no installation other than that of Adobe’s Flash plug-in, which was made available at no cost on the company’s website. It was compatible with machines running Windows 2000 or Windows XP with either MS Internet Explorer 7 or 8, or with Firefox. As opposed to many other competitor services, it also ran on the MacOS X 10.3+ with either Safari or Firefox. The customer would need a minimum of 256 MB of RAM and a broadband internet connection, which by that time was the connection of choice for over half of American internet users. To get started, a customer would go to the Pandora website and enter the name of an artist or song title. Pandora’s proprietary algorithm would then play songs based on the system’s recommendation, and the customer would be able to refine those selections by giving feedback to Pandora. If the choice of song was not to the customer’s liking, Pandora would stop playing the song and recalculate the recommendation list based on the new feedback. Each original song or artist selected by the customer would form the basis of a personalized radio station, and each customer could hold up to 100 radio stations. A customer would be able to listen to up to ten selections before registering, at which point Pandora would give the customer two ways in which to register: Free version – in the free version the customer would have access to everything but would be subject to unlimited advertising; Annual subscription – for $36 per year or $12 per quarter, a customer would have access to Pandora’s services free of advertising. These two alternatives formed the basis to Pandora’s revenue model, which consisted of advertising and subscription proceeds. Pandora saw very fast growth from the start, and was on a healthy track to achieve its revenue targets. Its cost structure, however, was not as simple or predictable. There were two main sources of costs: personnel and royalties. Its personnel costs were related to its highly skilled workforce of music analysts. It constituted the basis of Pandora’s business model. Without highly qualified employees, Pandora’s algorithm would not function in the manner desired, as it needed subjective inputs to rate each song. This characteristic resulted in higher fixed costs for Pandora compared to other radio stations that relied on collaborative filtering, or that simply streamed the same content to all customers. On the other hand, having an automated recommendation system meant Pandora would not have to rely (or pay) DJs. The other important cost piece was related to royalties paid to artists and record labels. In 2002, legislation was passed defining how internet radio stations would have to compensate rights-holders of the songs they streamed. A veritable battle took place in the passage of this legislation, whose protagonists were on one side a loose coalition of online radio operators and on the other side the RIAA and SoundExchange, RIAA’s royalty collection agency formed by representatives of performance copyright holders, artists, and whose board was populated by representatives from record label companies. In 1998, the Digital Millennium Copyright Act (DMCA) became law in the U.S., establishing that royalties had to be paid by online stations. These fees should be set according to a “willing buyer/willing seller” model: “in establishing rates and terms for transmissions by eligible non-subscription services and new subscription services, the copyright arbitration royalty panel shall establish rates and terms that most clearly represent the rates and terms that would have been negotiated in the marketplace between a willing buyer and a willing seller" (DMCA, 1998, p. 37), which meant that fees would have to reflect what was customary in the digital market in general. These rates were not established by the DMCA itself, but by an independent Copyright Arbitration Royalty Panel (CARP). The rates were established at around 3% of a webcaster’s yearly revenue, but up until this ruling in 2002 no decision had been made as far as the royalties for sounds recordings to actual performers and rights-holders. Terrestrial radio stations do not have to pay such a fee, but this fee was established for online stations under the basis that it is a lot easier and cheaper for them to broadcast their songs online. This rate was set at 8/100 cents per song per listener. This was the cost structure that Pandora utilized as a basis for its business model when it got its third round of financing in November of 2005, this time for $12 million and led by new investor Crosslink Ventures on November 17, 2005. Existing investors WaldenVC, Selby Venture Partners, and Labrador Venture Partners also participated in the round. This brought the total capital raised to $22.3, and would be used to help improve Pandora’s website and to fuel its growth. Growth was not a problem for Pandora. Even without any formal advertising, relying on word of mouth and media coverage, Pandora was growing at a fast pace of 20% per quarter and well on its track to profitability projected for 2009. Pandora appears to have tapped into a market need that is not served by the traditional media or by other online versions of radio stations. It has captured market share especially from those that form the long tail of consumers that are not satisfied by the traditional collaborative filtering model; and those are the customers that currently represent the bulk of the online radio audience today (see graph below). However, Pandora also offered significant value to mainstream consumers, although not to the same degree as to long tail consumers. Podcast-using consumers skew young and male *N/A means sample size is too small to be significant Base: North American online consumers Source: Forrester Research Even though Pandora seems to have gotten a handle on the revenue side of its business model, its projections for costs were inaccurate: it had not predicted the degree to which the incumbents in the music industry would be upset nor the amount of leverage they had in Congress. In 2006, the Copyright Royalty Board passed new royalty rules that roughly tripled rates for online radio stations, from 8/100 of a cent per song per listener to 19/100 of a cent. That made achieving a profitable model extremely hard for Pandora and may still result in its going under, as will be discussed later. PANDORA’S COMPETITION Music listeners generally have one of two interrelated goals when listening to music, including listening for the sheer enjoyment of an existing artist and listening in order to identify new artists that are also pleasing. Traditional music outlets, including static web-based radio, terrestrial radio, satellite radio, and portables devices (CDs, MP3s, etc.), are most effective at meeting the needs of the former group. While Pandora also has a full library of music available, it primarily serves the latter group of listeners. Thus, the breadth of music and reliability of the recommendations are imperative for customer service and commercial success if a company is to compete against Pandora. The users that are primarily interested in Pandora’s offerings and tailored recommendations would not revert to traditional music outlets. The same enabling technologies that served as a platform from which Pandora could reach its current level of commercial success and popular following have also enabled other web-based radio stations to develop. Moreover, as a pioneer in the delivery of music tailored to the tastes of listeners according to the Music Genome Project and subsequent feedback that members have given since its inception in 2005, Pandora has served as a proof of concept so that other web 2.0 internet radio stations have been able to attract venture capital financing from top firms. These competitive threats have undermined Pandora’s core product and may lead to its rapid decline. Pandora’s competitors can be broadly classified as social networking sites with media recommendation components and other pure-play music recommendation sites. Social networking sites such as Facebook and MySpace have a rich compliment of tools and functionality that enable developers to ornament the platform to the mutual benefit of the social networking platform and developer. Given the amount of traffic that goes through these sites and the level of information that users are ready and willing to share, this makes these sites an ideal partner for add-ins such as iLike. iLike is the social music discovery service and the dominant music application for Facebook and other platforms with 30 million users. Users rate songs and then iLike generates recommendation links to iTunes, Ticketmaster, and other content providers. This practice offers a robust revenue stream for the application. This business model has received $2.5 million dollars in Series A financing from popular venture capitalist Vinod Khosla and Series B financing of $13.3 million from ticketmaster.com. Further expansion to iPhones (no relation to iLike) has further entered head to head competition with Pandora’s iPhone application. Another site that has had significant venture backing for its music recommendation services is imeem.com. With $3 million dollars in Series A financing from Morgenthaler and an unknown amount of Series B financing from Sequoia Capital (backer of Google) and Warner Music, a music industry titan, this firm has well-established partners for its product. While imeem does not yet have a robust presence on Facebook (only 80,000 monthly users) or the iPhone, it has been able to generate traffic on its own site as a result of music and video offerings. In addition to these two competitors, Last.fm is a UK-based company that seeks to match the offerings of iLike and imeem with a social networking component mapped onto a music and video recommendation services. Last.fm has a better international presence than the other offerings, but the likelihood for direct competition on a global basis in the future will create significant pressure on companies seeking to tap into a limited pool of members and advertising dollars. The pure-play music and video recommendation sites have not been nearly as successful as the companies that have incorporated a social networking component in their offering. Sites such as slacker.com and criticalmedia.com have attempted to replicate Pandora’s success but have not been widely adopted and there is no clear strategic reasoning by which they can surmount the significant hurdles that exist in this established niche market. Slacker.com had received $53.5 million dollars from venture backing yet the number of unique visitors to its website are marginal. Criticalmetrics.com only has four employees and $100,000 in seed financing. Pandora has dominated these pure play competitors. Each of these competitors utilizes an algorithm similar to the one used by NetFlix, whereby future recommendations are based on your historical preferences as they coincide with the preferences of other users. While the prediction algorithms used can be better or worse than one another, there is a risk that users will effectively “chase their own tail.” Without an outside influence to broaden the set of available music and rate it, then the recommendations will get increasingly narrow. Unlike Pandora, none of these companies have employed hundreds of musicians laboriously categorizing the music across a number of different criteria. This enables the competitor companies to run with minimal overhead and labor supplied by its customers. Depending on whether or not users notice or appreciate the marginal benefit of skilled labor in the dissection of songs, the future of the labor intensive process will be at risk. LEGISLATIVE ACTION In 2005 the Copyright Royalty Board passed a ruling that could potentially end all internet radio including Pandora. The Copyright Royalty Board, or CRB, works with industry and the public to determine the royalties that internet radio stations are required to pay in order to stream music. The royalty rates they establish are paid to a non-profit company called Sound Exchange that distributes the revenue among record companies and artists. The Board meets every 5 years and makes a royalty decision that dictates payment terms. Prior to the latest ruling, Pandora’s royalty per customer hour was approximately 1 cent. In a decision, many feel was unreasonably biased towards the interests of music content producers, the CRB raised royalty rates to approximately 2.7 cents per customer hour. In response, Pandora actively partnered with NPR and other webcasters to appeal this ruling. Their appeal failed and the rate hike became effective on July 15, 2007. With this change, most internet radio sites instantly became unprofitable. To many analysts, it looked to be the end of internet radio. Webcasters saw this latest ruling as a continuation of illogical royalty policies. If a customer listens to a song on conventional radio there is no royalty payment required. If one listens to this same song on Satellite radio there is a moderate royalty. If the song is played on internet radio there is a large royalty. In an effort to develop a more equitable policy, webcasters lobbied Congress for a bill that would allow a standardization of royalty rates between Satellite and Internet radio. In response, Senator Diane Feinstein, with the support of 100 other senators, introduced such a bill. It was named the Platform Equality and Remedies for Rights Holders in Music Act of 2007, or Perform Act 2007 for short, and is currently stuck in “The Committee on the Judiciary”. Already this bill has seen substantial pressure from music content producers. The RIAA, or Record Industry Association of America, holds considerable lobby power and has worked against the progress of this legislation. The RIAA is the organization recognized as having swayed the original vote of the CRB. Many in government feel that the RIAA’s lobby power will ultimately prevent the passing of the Performance Act 2007. So what result can we expect from these new royalty standards? It is believed that much of internet radio is comprised of small stations catering to the long tail of music interests. Because of the incredible distribution power of the internet, these players have been able to service customers in a way that regional, traditional radio never could. Visibility is generated for artists who never before had any potential for radio presence. Customers were now able to customize radio to their preferences and new artists could reach their fans. Unfortunately, with the increase in royalty rates, these small stations will likely not be able to generate sufficient ad revenue to remain solvent. The bulk of these small stations are expected to cease operations. The losers, as has been common with issues in digital rights management, are the customers and the artists. Larger webcasters have it tough also. The CRB set the royalty rates in anticipation of expected increases in ad revenue. It is unclear in today’s economic environment how long it will take for ad revenue to reach these expectations. In the interim, many internet radio stations, like Pandora, are yet to turn a profit. These new royalty rates coupled with flat and often declining ad revenue rates make profitability appear unattainable. Pandora, due to their unique business model, is especially challenged. Their philosophy of employing music experts is their differentiator and driver for success, but also their biggest weakness. The heavy fixed personnel costs this strategy imposes is a significant barrier to profit. As of October, 2008 Pandora employed 120 people. Many of their competitors, by comparison, use a music selection algorithm based on past customer song selection. These systems work much like Amazon’s recommendation system and do not require significant human management. Tied to their manpower intensive strategy, and consequently without the ability to significantly reduce their fixed costs, Pandora must bring in more revenue to survive. PANDORA’S FUTURE There are initiatives the company could undertake to improve their situation. They have already begun several and others might be viable in the future. In May of 2007 they launched “Pandora on the Go”, an application for AT&T and Sprint cell phone users that allowed customers to use Pandora on their mobile devices. To make money, the phone companies charge a monthly fee of $2.99 and forward part of this fee to Pandora. The service frees Pandora users from their computers and homes. It works essentially the same as the website using the phones data network for transmission. The phone can also be plugged into a car stereo. To compliment “Pandora on the Go” they released an iPhone application on the new 3G Apple device. Unlike the original “Pandora On the Go”, the iPhone ap is free. It is unclear whether Pandora will eventually switch to an ad based or subscription based revenue model on the iPhone. iPhone Pandora is currently the 3rd most popular iPhone ap w/ nearly 4 million unique users. Analysts have speculated that the iPhone may be the ap that lets Pandora reach critical mass for advertisers. In a period of months, iPhone Pandora has become 1/4 of Pandora’s total user base. In June of 2007 Pandora released “Pandora in the Home”. Unlike their existing service model, “Pandora in the Home” employed the use of a Pandora specific device that streamed the application. The device interacted with the Pandora site through the web, used a profile that customers had previously established on their computer, and could be stationed anywhere in the home. This device allowed Pandora radio to permanently be available in the home without the constant use of a computer. In 2008 Pandora established a deal with Clear Channel to offer Pandora services through their website. Under this deal, Clear Channel would pay the associated music royalties. Pandora simply had to make their service available to Clear Channel. Pandora founder and Chief Strategy Officer Tim Westergren regards this as the first of many distribution partners Pandora might have in the future. When larger media conglomerates, like Clear Channel, use Pandora as a compliment to their existing service portfolio they are able to create a more complete bundle for the user. The customer no longer has to switch to another site for streaming radio. This brings the media provider closer to a “one stop shop”, and creates value for the customers who now receive all their content through a single source. Pandora benefits because their customer base has the potential to dramatically increase. This could lead to increased opportunity for advertisers, a broader public acceptance of internet radio, and stronger brand recognition of Pandora. Unfortunately, even with the variety of applications, devices, and partnerships Pandora has produced, they are still losing money. With $21.3M in debt from three rounds of equity financing and 120 employees to pay, Pandora is under increasing pressure to find a business model that works. It appears that their current initiatives, iPhone Pandora and the Clear Channel partnership in particular, have the ability to greatly expand Pandora’s popularity. It is unclear how much time it will take before this popularity is enough to make Pandora a profitable business. The company has been threatening for years that they are on a path to bankruptcy. They use this threat, presumably, as a means of forcing Congress to act on the Performance Act 2007 bill. As a private company, it’s unclear what their current cash position actually is. Pandora has mentioned that their expected revenue for 2008 is $25M. The new royalty rules enacted by the CRB will consume 70% of that figure on an annual basis. The remaining 30%, or $7.5M, is insufficient to run Pandora’s business model. There are several steps Pandora can take in the future to help reverse their fortunes. They can first, greatly expand their distribution partnerships. These partnerships provide them with licensing fees without paying associated royalties. Their exceptional reputation among internet radio sites might allow them to be very valuable to large media providers looking to round out their bundled services. The downside is that this move might cannibalize their existing customer base. Additionally, it’s unclear if the revenue they generate from these partnerships is significant. The second thing Pandora can do is to continue to lobby Congress to enact legislation making webcaster royalties more reasonable. The RIAA has argued that advertising rates will increase and that they want a piece of that increase. If a law was enacted that based royalties on a portion of revenue instead of assuming a fixed advertising return, rates could be reasonable and scalable. The third thing Pandora could do is to partner with other companies struggling with digital rights fees like Apple, Amazon, and the recent crop of VOD providers. Sellers of online content, artists, and their customers are generally dissatisfied w/ royalty policies. The system is considered by many to be flawed. The dissatisfied players would together have significant negotiating power with Congress and the record labels. Pandora should continue to work with all players in the music industry to find a 21st century solution to the monetization of digital content. With a good vision, and through their combined strength, they might be able to force change. The fourth thing Pandora can do is to negotiate directly with independent artists and/or music labels. Smaller webcasters are already using this approach with artists. It’s difficult to imagine a record label consenting to voluntarily lower royalties, but it could be done as part of a branding exercise. If one of the big labels reduced Pandora’s royalty payments as a sponsorship, there record label brand could be prominently displayed on the site. As with all Venture backed start ups, Pandora will eventually need an exit strategy. For several reasons, an acquisition would be an appropriate path. Because their service is a natural fit as a component of a bundled package from a large media company, they are a good target for acquisition. Their current distribution partner, Clear Channel, or a similar media conglomerate could find value in Pandora as part of their broader offerings. These large media companies, with their expansive customer base, have the ability to reach more customers than Pandora is likely to ever touch through their own efforts. A record company could also purchase Pandora as a means of extending their distribution opportunities and promoting branding. They also have opportunity to make Pandora more profitable by biasing the playlist towards their own music and combining Pandora with their own distribution schemes for new music. Pandora could be a place where artists released new music, offered interviews, streamed live concerts, and interacted with fans. Additionally, by Pandora’s records, their website is a vehicle for music purchases. Their song selection algorithm routinely exposes customers to new music. Purchasing that new music is a click away. Record companies may find that Pandora could be a growing driver of music sales as customers become accustomed to purchase through this medium. On aggregate, being acquired by a record label could be perceived as a negative if customers see Pandora as a sellout. What we can infer is that Pandora’s future is arriving soon. They’re saddled with debt and running at a loss with no expected legislative relief to solve their royalty problems. With a host of competitors and industry becoming increasingly more aware of the power of internet radio, their fortunes are hard to predict. On one hand, their value is obvious and could lead to lucrative partnerships or an acquisition. On the other hand, they might be swallowed by intense competition from increasingly larger players in a space that media conglomerates are now fighting for. The outcome is unknown but a large and devoted Pandora fan base is hoping for the best.