COE EE Handbk HR1033G Cvr

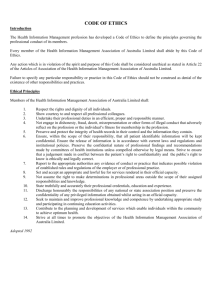

advertisement