Church Extension Committee - Reformed Churches of New Zealand

advertisement

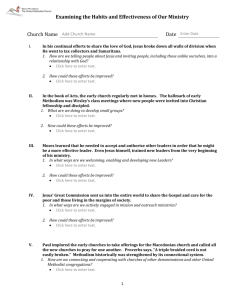

Report 12 Church Extension Committee Report of the Church Extension Committee Dear Brethren Our mandate encompasses serving the churches in administering the national Home Missionary Fund, Vicariate Fund, Needy Churches Fund, and a Building Fund (for loans), with the additional task of advising the stipend and allowances of ministers. Our Committee has changed during the inter-synodical period with John van Garderen retiring and Derrick Watson joining. A. Funds The Church Extension Committee (CEC) administers the following four funds: 1. Home Missionary Fund Funds are sourced from quotas from the churches. Consideration is given upon an annual application, budget and plan being received with the written concurrence of a sending/supervising church and that church’s local Presbytery. Funds are raised and then released as there is no capital fund held. During the inter-synodical period no application has been made upon this fund. 2. Vicariate Fund The funds provided for a vicariate are sourced through quotas to the churches for subsequent distribution to the church where the vicar is placed. A budget is provided by that church prior to any payment, with the payment made (normally or ordinarily) in two instalments. Currently the account cap is $180,000 and churches are levied a quota payment when the fund is low. The available funds is approximately $84000. In the upcoming inter-synodical period it is possible that up to five vicars will need to draw on this fund. This will mean that a levy will probably be levied beyond September 2016. The average amount for the past two vicariates is $47500 so it is possible that in the intersynodical period up to $120000 may be levied upon the churches. Recommendations: 1. That no quota be levied upon the churches till this fund falls below the $60,000 cap. 3. Needy Churches Fund The purpose of this fund is to provide assistance towards the stipend and other working expenses (excluding capital payments) of “needy churches”. For the purpose of the administration of the Fund, Synod, acting upon the recommendation of the Church Extension Committee, will determine the minimum number of units which a church is required to have before it may extend a call and subsequently request assistance from this Fund. Currently this number is twenty (20) units. Furthermore, at each Synod the Church Extension Committee shall recommend a minimum contribution which, as an average, each unit belonging to the assisted church shall make towards their church funds. Currently this minimum contribution is $1,900 per Synod 2014 4-81 Report 12 Church Extension Committee unit per annum. This has remained unchanged since at least 2005. To keep this reflective of the economic climate we recommend that we start at $2500 in 2014 as the base year and adjust to the same index as we use for the stipend. During this past inter-synodical period no churches called upon this fund. Recommendations: 2. That the minimum number of units to remain at twenty (20). 3. That the minimum annual contribution by each unit be $2500 in 2014 4. That the minimum annual contribution by each unit be adjusted annually using the average weekly wage index using 2014 as the base year (i.e. $2500). 4. Building Fund The establishment of this fund dates back to the inception of the RCNZ in the 1950’s with funds growing from support provided by the churches in the Netherlands and the USA. We can thank God for the way that the Reformed Churches were supported through vision and gifts from those who saw to support a new Reformed Church denomination “down under”. Loans are currently provided at an interest rate of 3% per annum. In the inter-synodical period we have added to the documentation required, insurance cover and we are paying attention to the CEC’s level of exposure, due to larger amounts being lent, in proportion to total lending of each project and value of assets. Over the past couple of years we have had funds which were not called on, due to some churches opting for funding from other sources. We believe that this is partly due to the high level of repayment early on (i.e. 10% in the early part of the loan) which can cause cash flow constraints as opposed to a bank loan. As a committee we have investigated various repayment options and we believe that we can offer interest only payments for up to 3 years (see Appendix 1) and still maintain a reasonable amount of lending capacity. We believe that this could relieve the burden for churches in paying a substantial amount back in the first year after the loan has been granted. This was highlighted to us by a number of churches who queried whether this could be possible as an option Recommendations: 5. That the CEC be able to offer interest only repayment opportunities for up to 3 years in consultation with each application to the fund. B. Minister’s Stipend and Allowances At the beginning of each calendar year the committee provides the churches with information pertaining to minister’s salaries (or stipends) and allowances both taxable and non-taxable, for inclusion in their annual budget. We have sought to provide this information year to year in a timely and efficient manner to assist the church treasurer’s in getting the right information and calculations to reduce any ambiguity or error. 4-82 Synod 2014 Report 12 Church Extension Committee At Synod 2011 (Art. 49 – 6,7,8) the following was decided: “That for the next inter-synodical period: The minimum base stipend be set at $40,000 as at 1 April 2009. The minimum base stipend be adjusted annually using the average weekly wage index. The current seniority allowances be set as follows: a. For ministers who have served 2-5 years, 3% of the minimum base stipend b. For ministers who have served 6-10 years, 6% of the minimum base stipend c. For ministers who have served more than 11 years, 9% of the minimum base stipend The minimum non-taxable reimbursing allowance remain at $2,623.” Also at Synod 2011 Synod mandated us to “That the Church Extension Committee be mandated to investigate current practices for structuring remuneration of RCNZ ministers and to prepare denominational guidelines for this. That this include investigating retaining accounting advice at a denominational level.” Our starting premise as we considered this mandate was that a minister of the Word and Sacraments should be able to do the work to which he is called without ‘worldly care’. Ministers should be treated in the same way as any wage earner or professional in the congregation, would be by their employer, and shouldn’t be given any special arrangements outside the options that are normally available. In the inter-synodical period we have distributed a document (Appendix 2) prepared by H.P. Hanna & Company Limited outlining current legislation and its implications for churches. This document clearly sets out what is allowable under current legislation and makes recommendations based on this. Outlined below are some implications of this for our churches. Non-taxable allowances. As part of the stipend, we currently have a minimum non-taxable reimbursing allowance of $2623. This includes hospitality, books, clothes etc. This was based on the Presbyterian reimbursing allowance approved by the IRD some time ago. HP Hanna comments “The IRD no longer has any approved allowance rates, opting rather for a reasonableness test.” To come in line with current taxation law, we believe that we have two choices in terms of this allowance (or a combination of both): i) ii) To survey the churches/ministers every 3 years to determine an appropriate level of a non-taxable allowance. This will need to be supported with actual expenses. To reimburse actual expenses. Either option involves appropriate record keeping. If we go ahead with option (i) this would mean that the minimum allowance would be in line with the church that has the lowest expenses. It should be recognised, at this point, that this allowance is only a minimum and where expenses exceed this level ministers can also be reimbursed, as should be the current practise. Synod 2014 4-83 Report 12 Church Extension Committee If we go ahead with option (ii) then all approved expenses should be reimbursed to the minister. As we noted in the beginning of this section, “Ministers should be treated in the same way as any wage earner or professional in the congregation, would be by their employer, and shouldn’t be given any special arrangements outside the options that are normally available.” The main difference is that, because we are classified as a charity, Fringe Benefit Tax (FBT) paid by the employer does not apply (unless it exceeds 5% of the salary package:- compare with subsection CX25 (3) Tax Act). HP Hanna comments “… expense allowances are not as reliable as reimbursing actual expenditure… provided accurate records are kept.” Reimbursing actual expenditure for hospitality can prove difficult, and this is why we would recommend that this becomes a non-taxable allowance. Reimbursement for actual expenses and accurate record keeping of these reimbursements, would appear to be the best option. These tax free reimbursements can include things which relate to the Minister’s employment outside of that which is provided in the conditions of employment (phone/housing/ vehicle etc – see HP Hanna document for clarification) i.e. books, software, medical and life insurance, clothing (if a minimum standard of dress is required). We acknowledge that this could create more work for each church treasurer and therefore we recommend the following. Recommendations: 6. That the minimum base stipend be adjusted annually using the average weekly wage index continuing to use 2009 as the base year (i.e. $40,000). 7. That the current seniority allowances remains as follows: a. For ministers who have served 2-5 years, 3% of the minimum base stipend b. For ministers who have served 6-10 years, 6% of the minimum base stipend c. For ministers who have served more than 10 years, 9% of the minimum base stipend 8. That for this inter-synodical period the non-taxable allowance continues to be $2623 p.a. 9. That prior to each of the following synods, a survey of all churches is conducted to determine the minimum level of non-taxable allowance for the following subsequent intersynodical period, excluding hospitality. This will be set at the level of the church that has the lowest level of actual reimbursement. 10. That the reimbursing allowance for hospitality be separately set at each synod. Note. Option (ii) should be also under consideration if the previous motions (10-12) are not passed. Other Considerations Generally speaking Churches are exempt from paying fringe benefit tax unless the use of benefits relate to a business activity of the church. Cash remuneration to employees of charitable organisations is taxed through the PAYE system, as for other employees. Any cash conditions that are part of the letter of call should be subject to PAYE. For example the payment of airfares for a visit home, the 4-84 Synod 2014 Report 12 Church Extension Committee payment of school fees, and the payment of a mortgage on behalf of a minister should be part of the PAYE calculations. At the end of the document HP Hanna says: “Churches and ministry personnel in New Zealand have many tax issues to consider to ensure they are complying with current taxation legislation and IRD requirements. Much of the aforementioned tax issues are complex and are likely to require further assistance from a tax specialist.” We would consider that to give anymore guidelines would be unwise. HP Hanna and Company Ltd are willing to keep us informed of any changes to tax law and their implications to churches and charities. Recommendation: 11. That CEC will continue to distribute any documents relating to church remuneration of ministers and tax implications as they are published. As we have noted before, the stipend should allow a minister to be able to do his work free from ‘worldly care’. We assume that each year representatives of the session meet with the minister and his wife (whether that be part of the annual home-visit) to talk about the financial needs and ascertain whether the current stipend is meeting those needs. We recognise that there are different seasons within a minister’s life which have differing financial strains upon him and his family and it may be that for a period of time that the individual congregation needs to pay more than the minimum stipend and allowances. RECOMMENDATIONS Vicariate Fund: 1. That no quota be levied upon the churches till this fund falls below the $60,000 cap. Needy Churches Fund: 2. That the minimum number of units to remain at twenty (20). 3. That the minimum annual contribution by each unit be $2500 in 2014. 4. That the minimum annual contribution by each unit be adjusted annually using the average weekly wage index using 2014 as the base year (i.e. $2500). Synod 2014 4-85 Report 12 Church Extension Committee Building Fund: 5. That the CEC be able to offer interest only repayment opportunities for up to consultation with each application to the fund. 3 years in Stipend: 6. That the minimum base stipend be adjusted annually using the average weekly wage index continuing to use 2009 as the base year (i.e. $40,000). 7. That the current seniority allowances remains as follows: a. For ministers who have served 2-5 years, 3% of the minimum base stipend b. For ministers who have served 6-10 years, 6% of the minimum base stipend c. For ministers who have served more than 10 years, 9% of the minimum base stipend Allowances: 8. That for this inter-synodical period the non-taxable allowance continues to be $2623 p.a. 9. That prior to each of the following synods, a survey of all churches is conducted to determine the minimum level of non-taxable allowance for the following subsequent intersynodical period, excluding hospitality. This will be set at the level of the church that has the lowest level of actual reimbursement. 10. That the reimbursing allowance for hospitality be separately set at each synod. 11. That CEC will continue to distribute any documents relating to church remuneration of ministers and tax implications as they are published. Respectfully submitted, Raymond Posthuma (convenor) Martin de Ruiter (secretary) Gerald Reinders (treasurer) Derrick Watson Appendices 1. Building fund projections 2. HP Hanna Report 3. Financial Statements 4-86 Synod 2014 Report 12 Church Extension Committee Appendix 1 Repayment Scenario - Current Synod 2014 4-87 Report 12 Church Extension Committee Repayment Scenario – 3 years 4-88 Synod 2014 Report 12 Church Extension Committee Repayment Scenario – 2 years Synod 2014 4-89 Report 12 Church Extension Committee Repayment Scenario – 1 year 4-90 Synod 2014 Report 12 Church Extension Committee Appendix 2 Ref: 73175 TAX FACTS FOR CHURCHES AND MINISTRY PERSONNEL Introduction This report has been prepared for churches and associated ministry personnel. In recent years, the Inland Revenue Department has taken a reasonably firm approach to the treatment of taxation by churches and it is therefore critical that care is taken to comply with current taxation legislation. This report does not extend to every aspect of taxation compliance for churches and their ministry personnel, instead identifying key taxation issues and the proper taxation treatment relevant to this sector. Disclaimer All information in this report is based on current legislation and is to the best of the writers’ knowledge true and accurate. No liability is assumed by the writers’ for any losses suffered by any person relying directly or indirectly upon this newsletter. It is recommended that churches and ministry personnel seek separate tax and accounting advice before acting upon this information. Taxable Income of Ministry Personnel The taxable income of ministry personnel includes the following: 1) Salaries and wages paid by the church 2) Any personal expenses paid by the church for the pastor, unless separately identified later in this report. Synod 2014 4-91 Report 12 Church Extension Committee 3) Any cash gifts given, irrespective of their purpose. For Example: - Ministry gifts when preaching at other churches or conferences. - A collection to purchase a car for the pastor (unless the intention is for the car to be owned by the church). - Gifts paid to ministry personnel from their immediate family are not regarded as income and therefore exempt from taxation. Salary splitting between husband and wife in ministry Many churches employ both husband and wife as pastors. However occasionally, due to budgetary restraints, only the husband receives a salary, but his wife still remains very active in church life. In these cases, the church may look at splitting the salary between husband and wife to save tax. There is often a fine line between legitimate tax savings and a scheme to avoid tax and the Inland Revenue Department would not allow a salary to split between husband and wife purely to reduce tax. However, if the time the wife works is calculated and compared to her husband and the splitting of salaries reflects this calculation then any resulting tax savings would be legitimate. For Example: A husband in ministry receives an annual salary of $48,000. He works 40 hours a week and his wife 20 hours a week. If you maintain the same hourly pay rate between husband and wife then the church would be eligible to split the salary of $48,000 as follows: Employee Weekly hours worked Percentage Husband 40 hours $32,000 67% Wife 20 hours 33% $16,000 Total 60 hours 100% $48,000 Annual Salary Motor Vehicles We consider there are three options available to churches who wish to provide motor vehicles to ministry personnel. 1) Reimburse using IRD mileage/or an IRD approved organisation’s rate A logbook is kept by the pastor or church employee and the church reimburses the pastor for kilometres travelled for church related activities. The current rate issued by the Inland Revenue Department is 77 cents. The IRD also accepts the use of other motor vehicle running cost data published by other reputable sources, for 4-92 Synod 2014 Report 12 Church Extension Committee example the New Zealand Automobile Association Incorporated, as an alternative reasonable estimate for reimbursement of employees. 2) Reimburse actual expenditure All motor vehicle expenditure incurred for church related travel is reimbursed. An invoice is required to be kept to make a claim for Goods and Services Tax (GST). 3) Church owns and provides vehicle The church can own a vehicle and provide it to the pastor or church staff member. If an employee has the use of the car while carrying out charitable work for the church, any private benefit arising is not subject to Fringe Benefit Tax (FBT). In most cases, churches providing motor vehicles to ministry and pastoral staff would be eligible for this exemption. However, if the church also operates a business outside of its charitable purpose i.e. café, bookshop or letting of commercial property, and if a person is employed in that business, FBT must be paid on any private benefit arising from the use of church motor vehicle. Fringe Benefit Tax Churches are generally exempt from paying FBT on benefits provided to employees if they are carrying out the church’s charitable purpose. Complications arise, as mentioned above, if a church also operates a business to supplement income and employs staff who are provided benefits. It can get more complicated as often ministry and pastoral staff carry out both the charitable purpose of the church and assist in operating the business activity. We would recommend that any business activity undertaken by a church is firstly legally separated from the activities of the church for example a café is setup in its own charitable trust. Secondly, that there are clear ministry and pastoral staff duties set out in employment agreements e.g. hours of work for charitable purposes and hours of work in the business activity (which are often only a small percentage of the total hours worked). And finally, letters should be provided to all staff with church motor vehicles specifying that the motor vehicle is provided to them for carrying out the charitable purposes of the church. Other benefits the church is able to contribute to pastors and ministry personnel exempt from FBT (subject to the charitable purpose/business activity test) are: 1) Low-interest loans Synod 2014 4-93 Report 12 Church Extension Committee 2) Church contributions to superannuation 3) Church contributions to medical and life insurances Contribution to Ministry Personnel Private Expenditure If employed ministry and pastor staff use their homes as an office or frequently use their home for the charitable purposes of the church then the church can contribute to their home expenditure. This expenditure includes home rental or interest on mortgages, home rates and insurance, home phone and broadband rental. The contribution needs to be calculated based on the churches usage. For example if a pastor works from home the square metres of the office space he uses needs to be divided by the total square metres of the house. The resulting percentage can be applied to the home expenditure. Office Area 15 sqm Total House Area 150 sqm Percentage Usage 10% 50% of the home phone and broadband rental can be reimbursed to the pastor if they use their home as an office. Or alternatively, if the phone and broadband contract is owned by the church and the pastor is available after hours for church related calls/emails then the church can claim the entire amount and any private benefit the pastor derives from it would be considered exempt for FBT. As pastors usually work outside of normal business hours, it is recommended that the pastor’s employment agreement acknowledges this fact and in recognition the church provides the phone and broadband line for the pastor. Reimbursement of Expenditure and Expenses Allowances At times ministry and pastoral staff need to be reimbursed for expenditure paid personally for church related activities i.e. taking a visiting speaker out for lunch. In these cases a tax invoice should be kept by the church to support the reimbursement and enable the church to make a claim for GST. Some churches provide expenses allowances for routine expenditure such as hospitality or transport. To determine an expense allowance a record should be 4-94 Synod 2014 Report 12 Church Extension Committee kept over a period of a few months to determine the level of expenditure routinely incurred and a reasonable allowance can be therefore calculated. The IRD no longer has any approved allowance rates, opting rather for a reasonableness test. However, in our opinion, expense allowances are not as reliable as reimbursing actual expenditure as the IRD cannot dispute the reimbursement of actual church related expenditure provided accurate records are kept. Credit Cards Many churches provide ministry and pastoral staff with credit cards. Credit cards are very useful for paying church related expenditure such as hospitality. However, churches need to be careful over the control of credit cards that no personal expenditure is incurred. Occasionally, a staff member may use the card by mistake for an item of personal expenditure. In this case, the expenditure should be deducted from their net wages. Vicarage/Provision of Accommodation Accommodation provided to a pastor with a church paid salary If a house is provided by a church to the pastor, then the rental value (less area used for ministry – the IRD accepted area used for ministry is 15%) should be calculated and added to his/her salary for tax purposes. This applies to property owned or rented by the church. The IRD has set the value of the home provided to the pastor by the church at 10% of his/her salary. The formula for calculating the taxable rental value is as follows: $ 10% of Salary (for example $48,000) Less allowance for church use at 15% Value of the home 4,800 ( 720) 4,080 This is added to the salary of $48,000 to equal $52,080. The total amount of $52,080 is then taxed in the church’s monthly PAYE return. Please note the above calculations set by the IRD are currently subject to review and potentially could change. Please seek further tax advice before relying on this formula. Synod 2014 4-95 Report 12 Church Extension Committee Accommodation provided to a pastor without a church paid salary Section CW25 of the Income Tax Act 2007 states that “the value of personal board and lodging and other personal necessities received by a member of a religious society or order is exempt income if the members sole occupation is service in a religious society or order; and it is the nature of the service that the members are not paid for their work and do not receive a reward for it, other than those necessities”. Effectively this would mean if the church is unable to pay a salary it could instead pay the pastor’s rent, telephone/tolls and internet and power. All these accommodation expenses would be exempt income for the pastor. The same applies for the provision of a church owned vicarage. Care needs to be taken as to the level of “personal necessities” received by the pastor as the original intention of this section was for Roman Catholic priests who have taken a vow of poverty. Missionary Pay Historically, most missionaries haven’t paid tax on income received from their New Zealand supporter churches. Whilst in many cases this is accurate, the supporter churches and their missionaries need to be aware of circumstances that could change their tax position. For a missionary’s income to be exempt from tax in New Zealand they need to be considered a non-resident for tax purposes. If they are considered a New Zealand tax resident then they will be required to file an income tax return on all income received – if this proves to be the case they will likely have significant deductions against that income such as airfares, accommodation, ministry materials etc. There is a two part test to be considered a non-resident for tax purposes in New Zealand. 1) A person must be out of the country for 325 days in a twelve month period in the first year of leaving New Zealand. Once non-residency for tax purposes has been established a person will not be considered a tax resident again unless they are in New Zealand for more than 183 days in a twelve month period. 2) A person must also prove that they no longer have an enduring relationship with New Zealand. An enduring relationship includes owning a home, car and maintaining New Zealand bank accounts. 4-96 Synod 2014 Report 12 Church Extension Committee We advise departing missionaries to seek tax advice from a professional before leaving the country. Donation Tax Credits All churches with donee status are able to provide receipts to members to claim a donation tax credit. Donation tax credits have come under scrutiny from the IRD in recent years. To qualify for this tax credit a gift must be made in money and be over $5. Gifts of goods or property do not qualify. Gifts of property include the situation where a church member loans money to the church to purchase a building and then subsequently wishes to donate that loan – this is considered to be a forgiveness of debt and does not qualify for a tax credit. The church should also be wary of schemes for members to gain tax credits such as donating money to the church which will used to buy an airfare for the same member going on a missions trip with the church or using the above example where a church member loans money - the church repays the loan and then the member donates the money back to gain a tax credit. Missions Offerings If a church collects a separate missions offerings to use for local and foreign missions they are able to provide a receipt to the donor as long as most of a church’s funds (more than 50% of tithes and all offerings including missions) are applied within New Zealand. For Example: Annual Tithes and Offerings 200,000 Missions Offerings Received 50,000 Total 250,000 Money applied in NZ 150,000 (for wages, administration costs etc) Money Given to Local Missions 10,000 Money Given to Overseas Missions Total 40,000 200,000 In this example, the churches annual missions giving is only 25% of the total money spent and 75% of the churches funds are applied in New Zealand. Synod 2014 4-97 Report 12 Church Extension Committee Conclusion Churches and ministry personnel in New Zealand have many tax issues to consider to ensure they are complying with current taxation legislation and IRD requirements. Much of the aforementioned tax issues are complex and are likely to require further assistance from a tax specialist. Our offices are most willing to assist your church(es) if you require any further assistance. Please feel free to contact our offices and speak with either Michael Hanna or Greg Hay. Yours Sincerely, Michael Hanna and Greg Hay H P Hanna & Company Ltd mike@hphanna.co.nz, greg@hphanna.co.nz 4-98 Synod 2014 Report 12 Church Extension Committee Appendix 3 Synod 2014 4-99 Report 12 Church Extension Committee 4-100 Synod 2014 Report 12 Church Extension Committee PAGE FOR AUDITOR’S REPORT Synod 2014 4-101 Report 12 Church Extension Committee 4-102 Synod 2014