Peru: Opportunities for U.S. Exporters May 2009

advertisement

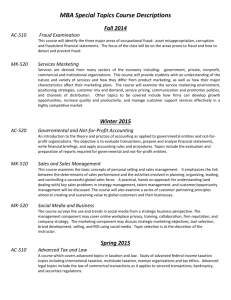

Peru: Opportunities for U.S. Exporters May 2009 Peru at a Glance 496,226 square miles (three times larger than California) Geography: desert coast, central mountains and eastern Amazon rainforest Rainforest “selva” 1/3 of the country, or the size of California 25 regions & 1 province 27 million people Spanish language, with Quechua & Aymara spoken in the highlands 90% literacy rate Life expectancy: 70 yrs. Map courtesy of www.theodora.com/maps, used with permission. Peru: One of Fastest Growing U.S. Export Markets • U.S. Exports have more than doubled in the past 2 years: --$2.9 Billion in 2006 --$6.2 Billion in 2008 Exports increased by: --25% in 2006 --41% in 2007 --50% in 2008. Bilateral Trade: 2004-2008 7 6 5 4 U.S. Exports U.S. Imports 3 2 1 0 2004 2005 2006 2007 2008 Factors Driving Demand for U.S. Products: 1. Strong Economic Growth: 9% last 2 years. Over 90 consecutive months of economic growth. The size of the Peruvian Economy will more than double this decade. 2. Market Reforms and Tariff Reductions 3. Exchange Rate: Dollar had depreciated by about 20%, but is now appreciating. Peruvian Economic Trends 1985-2007 GDP Growth (%) Per Capita GDP 10 3,800 Asian Crisis & El Niño 3,300 5 2,800 0 2,300 -5 ATPDEA Hyperinflation -10 -15 Garcia Fujimori 1,800 1,300 Toledo Per Capita GDP (current US$) Market Reforms& ATPA Garcia 800 19 8 19 5 8 19 6 8 19 7 8 19 8 8 19 9 9 19 0 9 19 1 9 19 2 9 19 3 9 19 4 9 19 5 9 19 6 9 19 7 9 19 8 9 20 9 0 20 0 0 20 1 0 20 2 0 20 3 0 20 4 0 20 5 0 20 6 07 Percent Annual GDP Growth 15 Sources: BCRP, IMF 4 Peruvian Market: Heavy Concentration Geographically: Sectorally: Lima Mining Market is Heavily Concentrated in Lima • Almost one-third of population (9 million) -- second largest city has pop. of only 800,000. • Produces 50% of GDP • 55% of cell phone users • Home to 2/3 of Peru’s manufacturing • Over 80% of new car sales Mining Sector • Accounted for 59% of Peru’s Exports in 2008, totaling $18 billion • Major Purchaser of U.S. exports, probably above 50% • $20 Billion in additional Mining Investments have been proposed – although many are being delayed due to global financial crisis. Signs of Diversification are Appearing • Consumer goods sales are now split evenly between Lima and the rest of the country. --Five years ago closer to 70% of such sales occurred in Lima. • New industries are showing strong growth and attracting foreign investment. --Oil and Gas (Hunt Oil: $3.5 billion LNG facility and large number of new oil and gas leases) --Telecommunications (Telefonica, America Mobil, Nextel) --Retail (major Chilean presence) --Strong agricultural export sector Sectors Leading Economic Growth in Peru (2008) • Overall Economy 9.8% • Construction 16.5% • Mining and Energy 7.6 • Manufacturing 8.5% • Electricity and Water 7.7% Leading U.S. Exports to Peru: 2008 • Industrial/Power Generating Equip. 26% • Refined Petroleum Products 19% • Electrical Machinery 9% • Plastics 8% • Transportation Equipment 4% Leading Peruvian Exports to U.S.: 2008 • Petroleum Products 21% • Precious Metals (Gold, Silver) 18% • Copper 16% • Knit Apparel 13% • Tin 6% Foreign Competition: Sources of Peruvian Imports 2008 • United States 18% • China 14% • Brazil 8% • Ecuador 6% • Argentina 5% Impact of Global Economic Crisis: • Decelerating growth: Down from 9% in 2008 to 2.3% in March 2009 • Sharp decline in Trade Flows in Q1 2009: --Exports down 33% (to U.S. -40%) --Imports down 23% (from U.S. 21%) • Still, Peru’s economy performing better than most. • Business and consumer confidence is still strong. -- Foreign Competition: Pending Peruvian Trade Agreements Peru is reaching out to many of its key trade partners, having recently concluded or negotiating FTAs or other trade accords • Canada: Concluded agreement in May 2008 • China: Concluded April 2009 • Singapore: Signed agreement in May 2008 • EU: Trade agreement under negotiation • Korea Seeking to conclude an agreement in 2009 • Japan: Seeking to conclude an agreement in 2010 Best Prospects for U.S. Firms • Mining Equipment: Over $20 billion in proposals for new or expanded mining projects. • Construction and Transport Equipment: Continued strong housing construction sector and infrastructure projects (roads, ports, water projects). • Power Generation Equipment: Shortfall of generating capacity. Major gas fired, hydro and wind projects proposed. • Oil and Gas Equipment: New exploration leases, major pipelines and down-stream projects under development. U.S. Peru Trade Promotion Agreement (FTA) •Approved by U.S. Congress in December 2007 •Entry into Force February 1, 2009 •FTA will make it easier to sell to and do business in Peru. FTA: Key Provisions •80% of U.S. exports of consumer and industrial products become duty-free immediately. --Remaining tariffs phased-out over 10 years •Two-thirds of U.S. farm exports become duty-free immediately. --All tariffs eliminated in 17 years. •Facilitates Trade by improving transparency and efficiency in customs procedures. FTA: Key Provisions (cont.) •Improved labor rights commitments •Obligations regarding environmental protections. •Expanded Access to services markets Market Challenges •Peru’s Infrastructure deficit is estimated at $20 billion. Roads and ports are in particular need of upgrading. •Government capacity to implement infrastructure projects or social welfare programs is constrained and marked by frequent delays. •Judicial system does not offer an effective remedy for commercial disputes. --Commercial contracts should include strong arbitration provisions. •Peruvian public identifies corruption as a leading concern in recent polls. Public Perception of Main Problems “Currently the main problems of the country?” (Asked to pick top three from a list; most often mentioned) – – – – – – – Corruption Unemployment Poverty Lack of security Cost of Living Increases Abuse of authority Inadequate education 43% 38% 36% 28% 24% 23% 23% APOYO national poll taken April 15-17, 2008 8 Marketing Products in Peru •Pricing is critical. -- Despite reductions in import duties, goods in Peru are expensive owing to a 19% VAT. •Most goods are costlier than in the United States, in a country with a per capita GDP of only about $3,700. •40% of the population lives below the poverty line Market Issues •Local representative is often important •Most firms with ongoing commercial activities in Peru engage a local attorney. •Customs valuation of imports is sometimes an issue, becoming less so as import duties are reduced. • Certificate of Origin documentation can be a source of customs clearance delays. Useful Web Sites • www.buyUSA.gov/peru/en • ustr.gov/Trade_Agreements/Bilateral/Peru_TPA/Secti on_Index.html • www.proinversion.gov.pe • www.doingbusiness.org/ExploreEconomies/?econom yid=152 • www.aduanet.gob.pe/aduanas/informai/tra_ar.htm