Magazine and Directory Publishing in Australia

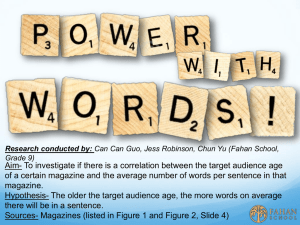

advertisement