South Texas Strategic Competitiveness Study

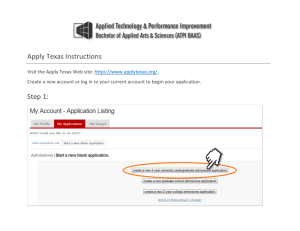

advertisement