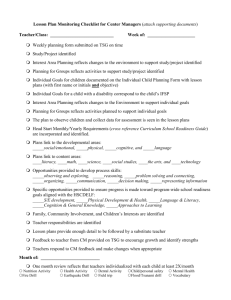

Financial Reporting Manual

advertisement